2020 was an exceptional year where the pandemic had accelerated digitalisation trends as people worked from home and embraced online shopping. Together with the adoption of new technologies like 5G, artificial intelligence and the Internet of Things, we experienced a surge in data and computing capacity.

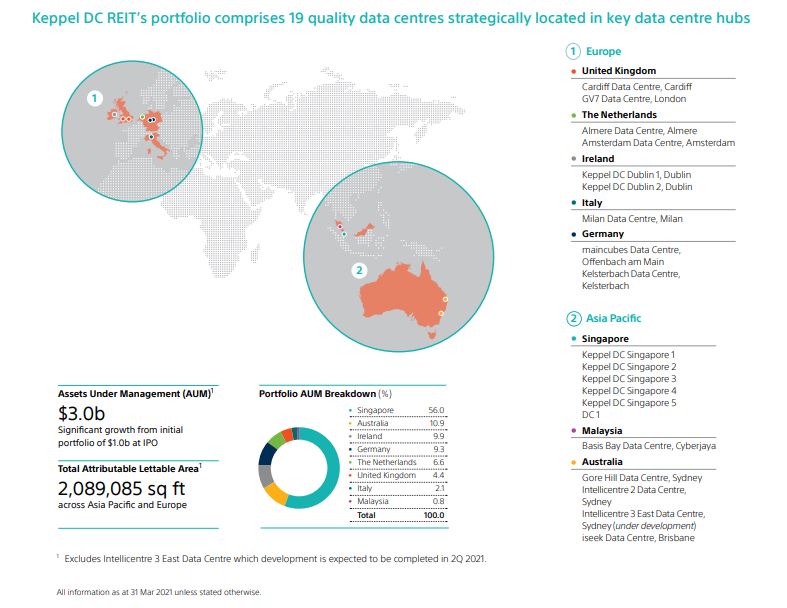

As a result, it is unsurprising that demand for data centre infrastructure has increased around the globe. Keppel DC REIT (SGX:AJBU), a pure-play data centre REIT with over 19 data centres globally, is one of the biggest winners from the pandemic, with a 60% increase in stock price since its low.

Fast forward to 2021, Keppel DC REIT share price is now on the downtrend despite delivering great financial results.

With such bright prospects, why is the share price down?

As investors, it is not recommended to speculate why a stock share price is dropping as it is hard to determine the actual cause.

However, finding possible reasons for a drop in the share price could help us in our decision-making.

For example, if it is a drop due to poor management, it may mean the company’s fundamental has turned sour and should be trimmed off from our holdings. However, if the decline is due to investors sentiment such as a ‘lack of interest’ or fear, holding the stock would be a better choice as we wait for recovery.

With that, here are five possible reasons why Keppel DC REIT’s share price is on the downtrend.

#1 Optimistism for data centres

During the Covid 19 pandemic, many ‘stay home’ stocks have done well. Companies like Zoom, Google and SEA have performed extraordinarily in terms of revenue growth. Likewise, Data centres that support the growth of this ‘stay home’ stock have done well as the demand for its infrastructures increases.

Seeing such an opportunity amid the pandemic, many investors were highly optimistic of Keppel DC Reit, which drove up its share price.

Source: TradingView

In general, it is considered healthy for a company’s share price to rise in unison with its earnings and asset value. However, for Keppel DC Reit, its share price had risen considerably faster than its book value and assets value. As a result, its PB ratio (Orange) and PE ratio (Pink) have increased above their historical averages, indicating that it has become overvalued.

Now that its stock price has tumbled by 18%, its current PB of 2.11 and PE of 24.369 have returned to their historical averages, indicating that the share price of Keppel DC Reit has simply reverted to the mean.

#2 Failure to meet investors’ expectations

If we look closely, the week when Keppel DC REIT’s share price fell coincides with the company’s Q1 2021 earning results. This could hint that its most recent result wasn’t as great as expected.

Do not be fooled; Keppel DC REIT performed admirably in the first quarter of 2021. For the first quarter of 2021, it achieved $42 million in distributable income*, up 17.5% year on year.

Similarly, its Distribution Per Unit (DPU)* has risen 18.1% to 2.462 cents year on year.

With a long Weight Average Lease Expiry (WALE) of 6.6 years, its portfolio occupancy has remained resilient at 97.8%.

* Distributable Income includes Capex Reserves. Keppel DC REIT declares distributions on a half-yearly basis. No distribution has been declared for the quarter ended 31 March 2021.

However, if you compare this performance to its FY2020 results, it will tell you a different story

In FY2020, Keppel DC REIT’s earnings recorded 38.6% growth in distributable income to $156.9 million and DPU increment of 20.5% to 9.17 cents. This growth is way higher than its Q1 2021 growth, which signifies that Keppel REIT growth has slowed down.

While its occupancy remains high at 97.8%, its WALE has seen a slight drop from 6.8 years to 6.6 years.

Adding these metrics up, we can infer that Keppel DC REIT Q1 2021 performance has failed to meet investors expectations.

#3 Expansion of mandate

After two months of no movement in its share price, Keppel DC REIT started sliding more on 28 April. Interestingly, this coincided with the announcement on the expansion of Keppel DC REIT’s investment mandate.

With this announcement, Keppel DC REIT would no longer be a pure Data REIT play as it will now include real estate and assets in the digital connectivity sector. Keppel DC REIT’s official reason was that this expansion of mandate would allow Keppel DC REIT to continue to invest in assets with stable cash flows, attractive yields, and accretive returns.

Nonetheless, I question the primary purpose of this expansion as, together with this announcement, Keppel DC made another announcement on a proposed investment in M1 network asset (more on that later). So did Keppel DC REIT expand its mandate to fit M1 into its portfolio, or was it the other way around?

I am not sure, but for your info, M1 is a subsidiary of Keppel Corporation. Likewise, Keppel DC REIT can be linked all the way back to Keppel Corporation.

Yes, Keppel DC REIT has kept its investment into M1 at 2.6% of its total portfolio and has indicated that such infrastructure investment will unlikely exceed 10% of its asset. However, with this expansion of mandate, Keppel DC REIT ceased to be a pure REIT play and therefore should not be trading at such a high premium the sector is usually at. A drop in share price could be a signal of such sentiment in the market.

#4 Proposed investment in M1 network assets

With the announcement of its expansion of investment mandate, Keppel DC REIT has signed a non-binding term sheet with Keppel DC REIT on the proposed investment in M1 network asset.

Here is how it is going to work:

- M1 will establish a Special Purpose Vehicle (SPV), and the SPV will acquire the network assets from M1 at $580 million

- The SPV will fund this acquisition of the network assets through external financing of approximately $493 million.

- Keppel DC REIT will invest around S$87 million (the equivalent of 15% stake) in return for a combination of debt securities and preference shares to be issued by the SPV.

- M1 will retain 100% of the ordinary shares in the SPV while the board of the SPV will have equal representation from M1 and Keppel DC REIT.

- The SPV is to enter into a 15-year Network Service Agreement with M1, under which the SPV will contract its network capacity to M1, and M1 will undertake the operations and maintenance of the network assets.

This deal will surely benefit M1 as it would free up its capital. However, the same cannot be said for Keppel DC REIT as I do not see much synergy between this and its current portfolio of data centres.

On the bright side, Keppel DC REIT is expected to receive a fixed return of $11 million per annum over the next 15 years. According to DBS analysis, it would give an internal rate of return of 9.3% over 15 years and also a possible increase in Keppel DC REIT Dividend per unit (DPU) by 4% to 5.2% .

Despite that, investors may not be buying it. After seeing how Singtel is doing poorly, I am sure many have doubts on M1 too.

Nonetheless, this proposed investment is still in its early stage and is subjected to regulatory approvals and may even require an EGM to seek shareholders approval.

#5 Singapore to halt new data centres development

Data centres consume a lot of energy, and as demand for this infrastructure grows, emissions issues may arise sooner or later. In fact, the International Energy Agency estimates that data centres consume about 1% of global electricity.

In Singapore, this is much worst. Data centres in Singapore used 7% of total electricity in 2020, which is a significant amount given our current power constraints. As a result, the government has temporarily halted the construction of new data centres to address the problem before it gets out of hand.

Yes, data centres will benefit in the short term due to the halt, as it has increased rental income caused by the shortage. However, it would stifle any organic growth for Keppel DC REIT in the long run, whose largest holding is still Singapore.

I believe Keppel want to continue investing in data centres in Singapore because the city-state remains an appealing data centre hub in the region, with a robust subsea cable network and low risk of natural disasters. As a result, this pause may halt any growth it is seeking.

This could be one of the reasons for the stock’s recent decline.

Keppel DC REIT Dividends

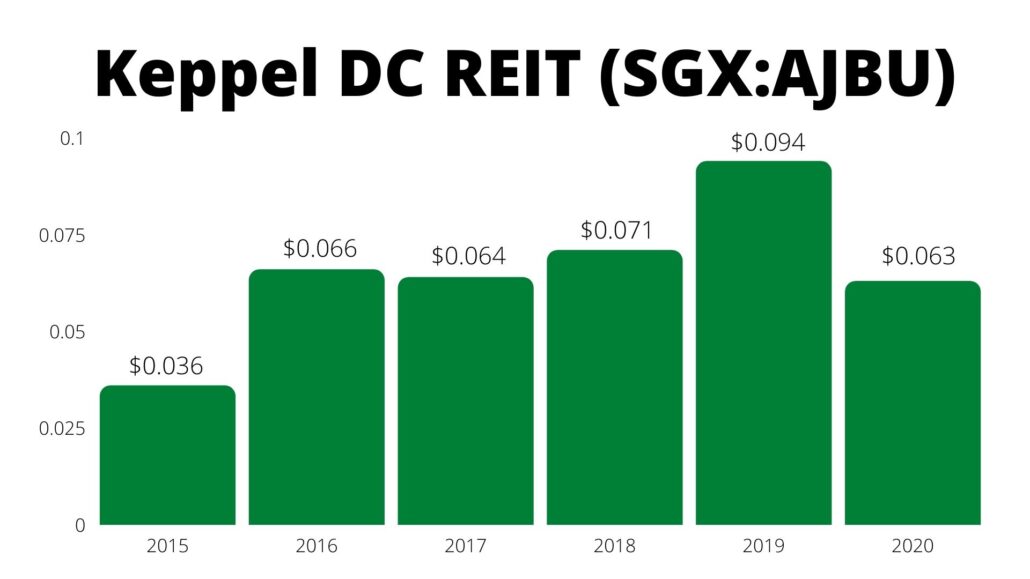

Since Keppel DC REIT listed on 12 December 2014, it has been paying dividends:

Its dividend yield has not been stable, but that is to be expected given that it is a young REIT and has had to deal with the new business world post-Covid.

Keppel DC REIT Dividend Yield

| Year | Dividend Payout (SGD) | Dividend Yield |

|---|---|---|

| 2020 | $0.063 | 2.67% |

| 2019 | $0.094 | 3.95% |

| 2018 | $0.071 | 3% |

| 2017 | $0.064 | 2.71% |

| 2016 | $0.066 | 2.79% |

| 2015 | $0.036 | 1.5% |

Conclusion

To sum it up, the above are five potential reasons why Keppel DC REIT has been falling for the past months. Of course, we cannot be 100% sure what is the real cause, but I hope you have a better understanding of Keppel DC REIT’s woes.

Should you continue to invest in Keppel DC REIT?

Up to date, Keppel DC REIT DPU has been growing consistently, and it has a high interest coverage of 13.1x. Coupled with a healthy portfolio occupancy and a long WALE, I believe this is an excellent REIT to own.

Even without the pandemic, I believe the digitalisation trend is here to stay, and Keppel DC REIT would ultimately benefit from it. At its current price, I would say it is fairly priced, and investors could consider starting an initial position if they like the stock and are not deterred by the five reasons above.

But before you do anything, ask yourself, are there better investment opportunities out there?

There are so many data centre players like Ascendas REIT and Mapletree Industrial Trust which have all grown tremendously thanks to the pandemic.

In addition, we may soon have another data centre REIT by Digital Realty (NYSE: DLR) as it is considering an IPO in Singapore. Being a global brand with over 290 data centres in its Texas-based portfolio, will this ‘newcomer’ be a better bet on data centres?

You will have to decide which is the best for you moving forward!

Or, if you prefer a strategy that’ll clarify your investing decisions, Chris shares how he retired on his dividend portfolio. You can learn more here.