[Updated Jan 2024. This article was first published in Nov 2021.]

Most readers are familiar with stock brokers and exchanges but can be quite clueless as to how to buy cryptocurrencies.

Cryptocurrency exchanges play the role of a broker as well as a marketplace. This is unlike stocks where you can have multiple brokers putting orders in the same exchange. This also means that you can have different price quotes on Bitcoin on different exchanges. Fees, price spreads, order types, liquidity, and the types of coins offered can differ widely too.

According to Coinmarketcap, there are over 229 crypto exchanges to choose from. With so many options, which should you choose?

To me, these are the key considerations when choosing a cryptocurrency exchange:

- Number of cryptocurrencies

- Trading fees

- Withdrawal fees

- Fund transfers

- Regulations

Alas in Singapore, we do not have access to all the crypto exchanges available due to the current regulations and a need for KYC. Hence, if you wish to get some crypto to hedge your portfolio, your choices are somewhat limited.

Here, we share the best Crypto Exchanges to use in Singapore, as of Jan 2024.

Best Crypto Exchanges in Singapore

| Cryptocurrency Exchange | Number of cryptocurrencies offered | Trading Fees | Withdrawal Fees | Fund Transfer Method | Exemption from Payment Services Act by MAS | Comments |

|---|---|---|---|---|---|---|

| Crypto.com | 523 | 0.075% | Varies with coin/token | FAST, Credit Card (3.5% fee),StraitsX (0.5% fee) | Yes (FORIS DAX ASIA PTE. LTD.) | |

| Tokenize Xchange | 90 | 0.6% | Varies with coin/token | Debit/Credit card (2.9% fee), StraitsX (0.3% fee), GrabPay (1.5% fee),Bank transfer (Only for Premium & Platinum members) | Yes (Amazingtech Pte Ltd) | |

| Coinbase | 238 | 0.6% | 1% fee + network fees | Debit/Credit card (Credit card fees apply),FAST | Yes (COINBASE SINGAPORE PTE. LTD.) | |

| Coinhako | 67 | 0.6% | Varies with coin/token | Bank Transfer,PayNow,Debit / Credit Card (Credit card fees apply),StraitsX (0.55% fee), Grabpay (2.8% fee) | Coinhako has obtained the Major Payment Institution (MPI) Licence in May 2022. | |

| Independent Reserve | 30 | 0.5% – 0.02% | From S$1.50 | FAST (S$2.5 fee for deposits under S$1,000) | Licensed under PAS Act (PS20200517) | |

| Kraken | 224 | 0.26% | Varies with coin/token | Credit Card (Credit card fees apply), SWIFT Bank Transfer (USD) | No | |

| Okcoin | 5 | 0.2% | Varies with coin/token | Bank Transfer | Yes(OKCOIN PTE. LTD.) | |

| Binance | 385 | 0.1% | Varies with coin/token | Nil | No/ Binance.sg has stopped its services in Singapore. | Binance is one of the largest exchanges and still deserves a mention. |

| Gemini | 116 | 0.4%(Active trader) | Flat fee for most coins.Dynamic fee for ETH or ERC-20 tokens. | FAST,Bank Transfer,Credit Card,Apple & Google Pay | Yes (GEMINI TRUST COMPANY, LLC) | Previously our favorite but they have been in trouble since the FTX blow up and don’t look safe at the moment. |

No longer serving Singapore | No | Kucoin no longer serves the Singapore market. |

I hope the table above has helped to narrow down your options.

To help you further, I pick 3 of the best crypto exchanges, based on select criteria:

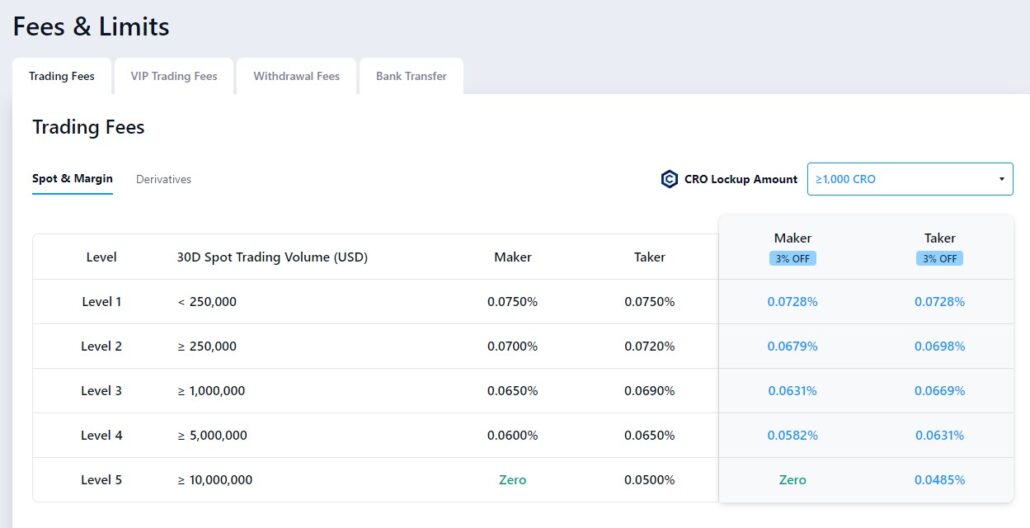

Best crypto exchange (Lowest fee): Crypto.com

As of Aug 2022, crypto.com had reduced their trading fees by 80%, down to 0.075% for Spot trades. CRO stakers and VIPs enjoy even lower fees.

Lowered fees along with the capability to deposit your fiat via FAST transfer with no fees makes crypto.com a great crypto exchange option for Singapore investors.

The crypto.com app also comes with a pretty user-friendly UI that is easy to use.

While the crypto.com card used to be hugely popular thanks to the perks offered, the latest revisions in their terms have cost them to lose their shine. However, if you’re planning to invest a substantial amount with crypto.com, you may want to consider it.

In ending, crypto.com also offers a good range of coins which makes it a good option for both beginner and existing crypto investors.

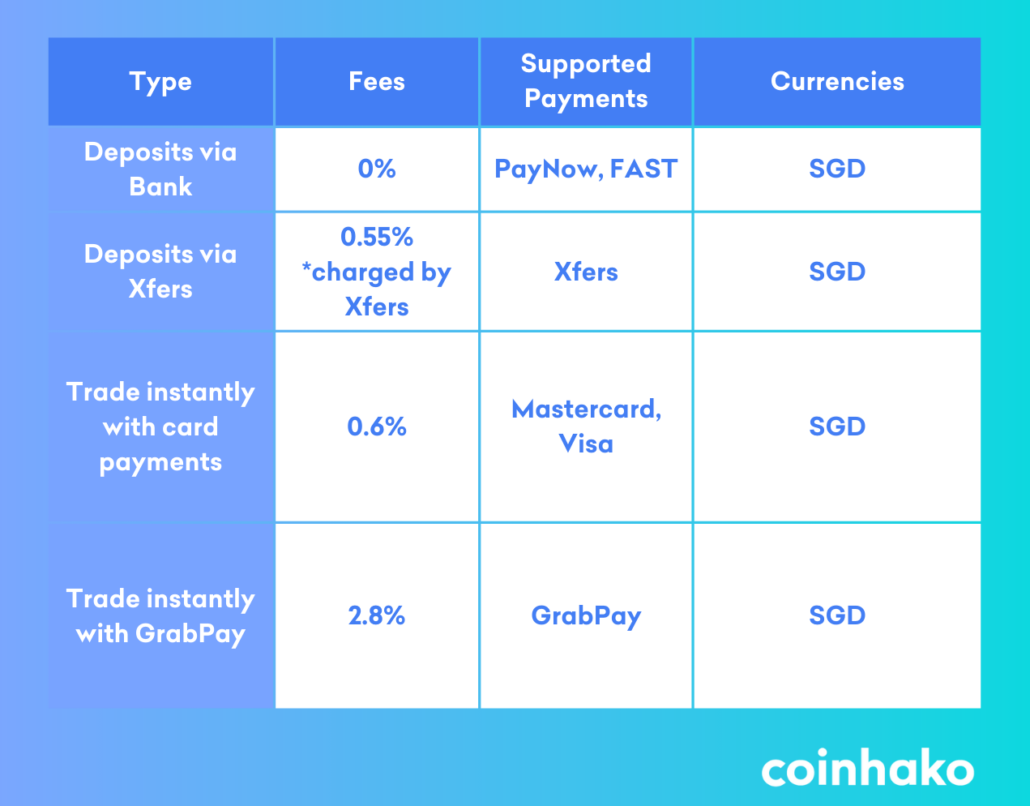

Best crypto exchange (Ease of deposit): Coinhako

I totally missed this out when this post was originally published. Thanks to the suggestions given by readers, I discovered Coinhako and have since opened an account with them. It is a Singapore startup and hence we should support it!

It only offers in-app trading and the trading fees are higher on Coinhako, at a flat 0.6% 1%. But it is easy to use and if you don’t want the hassle of using a desktop to make the trade, Coinhako would be a good choice and is cheaper than the 1.49% trading fee on Gemini app. It is pretty popular among locals.

Coinhako accepts SGD transfers and is exempted having a payment license. You can easily withdraw fiat to your bank account too.

P.S. as of May 2022, Coinhako is no longer exempted under the MAS PAS list as they have obtained the Major Payment Institution (MPI) Licence.

Worthy Mention (HQ in Singapore): Tokenize Xchange

Tokenize Xchange is a cryptocurrency exchange that is headquartered in Singapore.

Like coinhako, it offers a base trading fee of 0.6%. Premium or Platinum members get to enjoy lower fees:

Tokenize Xchange Trading Fees

| Trading Fees | Normal | Premium | Platinum | |||

| Revised fee | Revised fee | Revised fee | ||||

| Fiat-Crypto | 0.80% | 0.60% | 0.50% | 0.30% | 0.10% | 0.05% |

| Crypto-Crypto | 0.25% | 0.15% | 0.20% | 0.05% | 0.10% | 0.01% |

It also offers a couple of ways for you to deposit fiat into your account;

- Debit/Credit card (2.9% fee)

- StraitsX (0.3% fee)

- GrabPay (1.5% fee)

- Bank transfer (Only for Premium & Platinum members)

The most interesting option here is that you can use GrabPay to fund your account (although there is a 1.5% fee).

You’ll also need to note that the zero-fee bank transfer option is only valid for Premium and Platinum members.

To become a Premium member, you’ll need to pay 30 TKX* per year, while to become a Platinum member, you’ll need to pay 80 TKX and stake 720 TKX per year. Members enjoy extra perks such as lower trading fees, zero fiat transaction fees and more.

TKX is Tokenize Xchange’s token. At the point of writing, it is trading at about US$6 which means the Premium membership costs about US$180 and Platinum membership costs ~US$4,800.

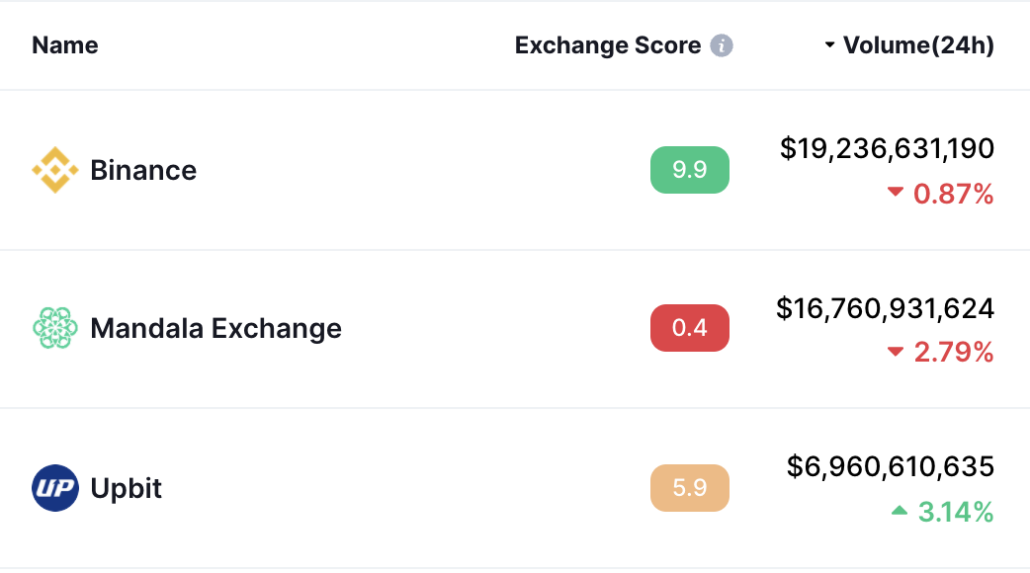

Worthy Mention: Binance

Binance is still the largest crypto exchange in the world by trading volume despite all the regulatory challenges it is facing right now.

It is known for its low fees and extensive range of coins available for trading. However, there’s a difference between Binance and Binance.sg. The former is the international version while the latter is targeted at Singapore with fewer services but accept SGD. The international version has been banned from offering its platform in Singapore.

The international site also offers many other services like lending, futures contracts, options contracts and mining pool.

I have a Binance account but have moved most of my cryptos out. I have an NFT remaining on it.

Note on use of Binance for Singapore Crypto Investors

But for those who just want the major coins and cheap commissions, Binance.sg would be good enough. It has an office in Singapore and is exempted from the Payments Services Act by (MAS).

Update: As of 13 Dec 2021, Binance Asia Services, the operator of Binance.sg, has withdrawn its application to the Monetary Authority of Singapore (MAS) to operate a regulated cryptocurrency exchange in the country. Binance.sg had stop services in Singapore by 13 Feb 2022.

If you still fancy an international Binance account especially if you are not in Singapore, you can get a 10% off the commission rate when you sign up with this link.

Update: Binance and Coinbase were sued by the SEC recently.

Worthy Mention: Coinbase

Coinbase is a publicly listed company in the U.S. and probably one of the most famous crypto exchanges in the world. Some investors would find comfort in listed companies because of better transparency and if so, Coinbase would be your choice.

Coinbase does not offer the most number of coins but 103 sounds enough for most investors.

Coinbase does not have the cheapest fees but at 0.5% with Coinbase Pro isn’t the most expensive either.

To give you even more confidence, Coinbase is exempted from the Payments Services Act (PS Act) by the Monetary Authority of Singapore (MAS).

It’s on you to protect your crypto assets!

The crypto exchange scene has evolved tremendously since this list was first published back in 2021. Since then, we’ve witness the fall of FTX (which used to make this list) and the total number of crypto exchanges listed on CoinMarketCap’s list has dwindled from 500+ to 229 at the point of update.

While you pick the best crypto exchange to start investing in crypto in Singapore, I want to reiterate the following lesson again:

Not your keys, Not your coins

While crypto exchanges are a convenient way to onboard new investors into cryptocurrency, the painful lessons from the failures of big crypto exchanges remind us time and again that you do not fully own the coins in your crypto exchange account.

These platforms can go bust quickly and you can end up losing everything you’ve invested.

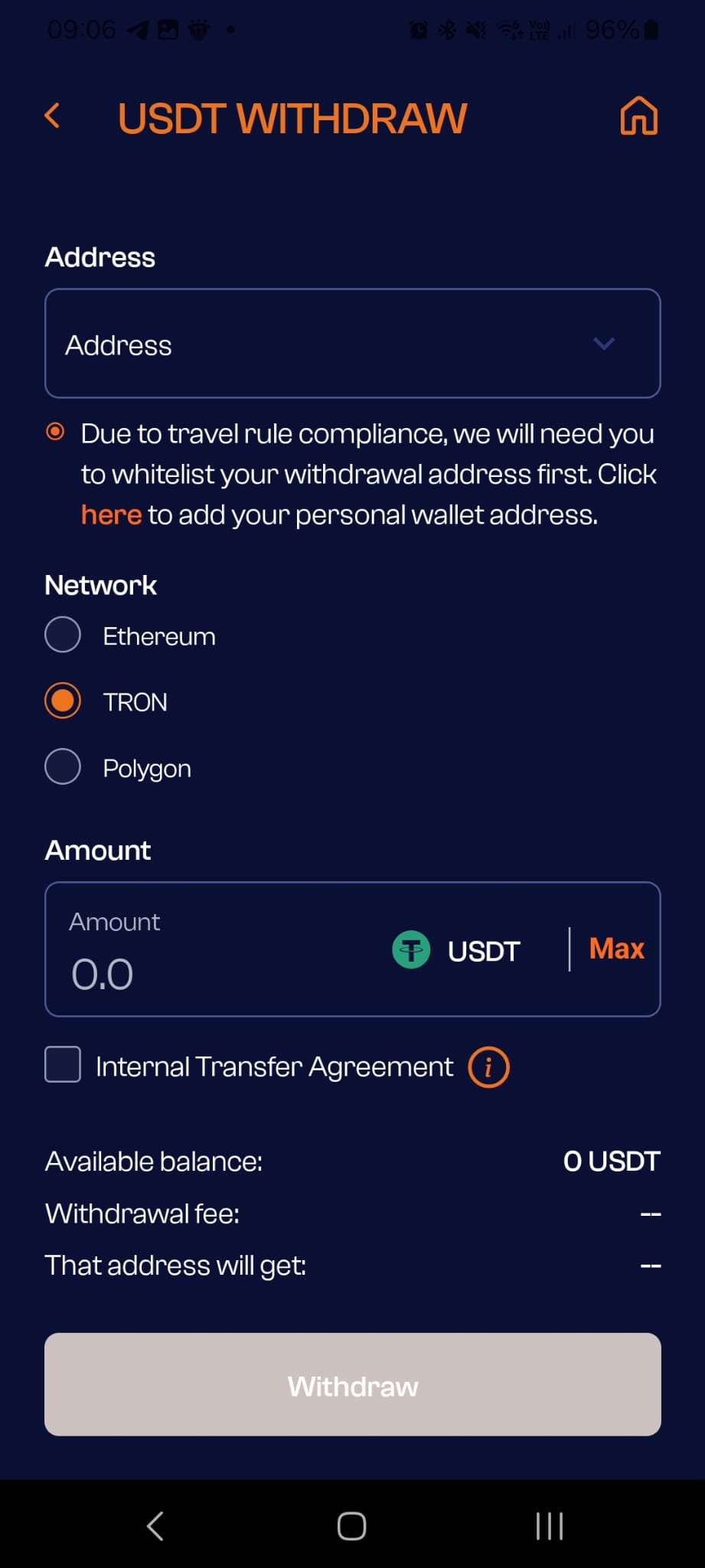

Instead of leaving your cryptocurrency in the wallets or accounts of your crypto exchange, it is prudent to move your coin onto your own crypto wallet. If you’re not sure where or how to start, read our introduction on hardware wallets and crypto security.

Remember, unlike your cash in the bank which is insured by the Singapore Deposit Insurance Corporation, up to S$75,000, your cryptocurrency is not. The onus is on you to protect your crypto assets, and the best way is to make sure you have direct access to them by holding your own keys.

Conclusion

I hope these crypto exchanges give you a good idea of where to start and for others who have traded crypto, which is your favorite exchange?

Share in the comments below!

p.s. Things move fast in the world of cryptocurrencies, do refer to MAS’ list for latest entities which have been exempted under the PS Act, as well as the list of entities that have been awarded the Major Payment Institution (MPI) Licence.

There is no Signal share option….

How about cryptoapp (crypto.com)

Are you suing Cryoto.com? How was your experience?

sorry I meant crypto.com

You should include coinhako in the list. Can sign up using singpass, and can deposit using sgd local transfer.. Fees around 1% and a good variety of coins

Yes. I just found out about coinhako!

Yup i also using Coinhako and they also accept Bank Transfer and more recently Visa and Mastercard for depositing funds in but at 3%.

You can also reduce trading fees for Coinhako by using a promo code, which reduces the trading fees by a bit.

For example, key in the promo code COINGECKO under the “Promotions” tab to lower fees from 1% to 0.8%.

thanks for the hack!

Great review!! Personally have been using Binance international app since 2017. Been breeze buying and selling. Downside is transferring the money out. Will need to have Binance.sg acct in order to link to Xfer and then you can take the money out.

Coinbase was also a good choice for starters, easy to use interface. But new traders, and don’t wish to deposit much, there’s rewards for watching videos for intro coins and earn up to 100$ usd worthy of different coins. Well, who doesn’t like free money. 🙂

BinanceSG has limitation of only SGD 30,000 annual spending limit via Xfers (don’t know whether this is MAS regulations?) and they don’t even know what’s this annual year starts and ends for your investment? I’ve asked both Xfers & BinanceSG for my case & both replied they don’t know??

Maybe should spread it out and have accounts on multiple platforms

I have been using Liquid for over 6 months now who have a direct SGD Debit/credit card to Coin swap.

I have also used others around the world including Coinbase and Nash and my experience is ok.

Binance and some others seem a little more complex to use and recently looked as Swiss Borg out of Luxemborg.

People will also tell you about Uniswap / Sushi swap and other coin swap sites however i would not recommend using them until you have confidence and understand crypto addresses, ether liquidity and GAS fees as well as other more advanced areas of the market.

The key to look at is Fee’s on in, out and transfer of currency.

Every txn incurs costs so you need to be careful.

Hardware wallet is a must have – get used to the idea of what your crypto addresses are on the chains out there (like when you fitrst got used to the idea of email addresses & URL’s…) and NEVER talk about passwords / secret phrases or any other secret information for your crypto you have with anyone else…

Scammers are everywhere waiting to take your money as this world is not as regulated as others – if its too good to be true = it is..

Always DYOR – Research everything you look at in the crypto world – flashy whitepapers and websites does not mean the projects are worth investing in – as many are just projects and have not delivered any product as yet.

So If you wanted to make an investment in SG across multiple BTC ETH and other alts for more than $30k its not possible because of the $30k/year limit (in and out) placed on the Xfers platform???? Or is there a way?

I would assume that this means there are two rules from MAS….. one for us “domestic retailers” and another for institutions like DBS who obviously have other avenues.

Perhaps that’s something you should outline in your article……

Hi Alvin and all,

I’m new to cryptocurrencies world, however, I have set-up a Coinbase account recently and for experience purposes, bought XLM with credit card, after that only found out the purchase was considered as cash advance and I was charged by the bank, which is quite costly for a small amount trade. The worse part is Coinbase doesn’t support withdrawal in Singapore and it is inconvenient for me or any investors in Sg. Now I need to find a way to withdraw the XLM when the time comes.

I found answer from Thaddeus Ong from a website:

There are actually quite a number of ways you can still do a withdrawal. You’re right that Coinbase cannot process sell orders and withdrawals in Singapore at the moment. What you should do now is to send your crypto from Coinbase to another platform where you can sell back into SGD, such as Binance SG or Coinhako.

To do that, you need to have an account at the destination exchange, get your deposit address, and then go to Coinbase and send your crypto out from Coinbase wallet to the destination deposit wallet address. You just needs to ensure you click “deposit” for the same crypto that you are trying to send, and copy and paste the wallet address instead of typing it. If you do these steps carefully, it should be a quick and easy process.

After done some homework, I found out Coinhako is a platform that is quite convenient for Sg investors, the fees also reasonable. Hereby attached the fees for deposit and withdrawal:

1. Deposit cash

– SGD / VNDT Deposits via inter-bank transfers: No fee.

– SGD Deposits via Xfers Direct Charge: No fee from Coinhako, 0.55% fee charged by Xfers.

– USD Deposits in form of USDT/USDT: No fee

2. Withdraw cash

– SGD / VNDT Withdrawals via inter-bank transfers: S$2 / VND 20,000 per transaction.

– USD Withdrawals in form of USDT/USDT: 15 USD per transaction

3. Buy, Sell, Swap cryptocurrencies

– Coinhako charges a fee of 1.0% for every transaction to buy, sell or swap cryptocurrencies.

4. Receive cryptocurrencies

– Receive cryptocurrencies on Coinhako: No fee from Coinhako.

– Do note that when you send cryptocurrencies into your Coinhako wallet from other wallets, you might incur miner’s fee that may vary according to a multitude of factors.

5. Send cryptocurrencies

– When you make a transaction to send cryptocurrencies from Coinhako, there will be a fee charged.

– The fee will be displayed on the confirmation pages and the confirmation email for you to check before confirming the transaction.

**In the event that the miner fees cost more than Coinhako fees, we will absorb the additional costs and you will incur no more than our stated Fees.

6. Store cryptocurrencies

– There is no fee charged for opening, maintaining your Coinhako account and storing your cryptocurrencies here.

Yes, i realised Coinhako is popular among Singaporeans and I went on to open an account too. I would recommend it as well and will update the post above. But Gemini still my favourite 😀

Hi Alvin, do you know the best way to change SGD to USDT or USDC while incurring the least transaction costs?

Unfortunately I don’t. Usually transfer USD directly from my bank acccount

HI Guys – I am new to this world but would like to take plunge . I was checking Coin Hako . I found the bid-ask spread too wide – almost 5% !!

Is having such wide spread normal in crypto world ? Or we have some exchange which have reasonable spread ?

i think when the market volatility is high, the spread can widen a lot

Dear Alvin Chow,

only 3 exchanges are MAS approved, which are those? are we sure the binance sg is really approved exchange not getting any sources of this information?

you can check it here. https://www.mas.gov.sg/regulation/payments/entities-that-have-notified-mas-pursuant-to-the-ps-esp-r

They are exempt from holding a license while MAS reviews their application. This is different from holding a license.

Thanks for pointing out. reworded

I started trading crypto in a small way in around February this year, before the end of the bull run in April.

I had issues with Gemini which kept prompting me to pay for my purchase with credit card, even though the fund had already been transferred my Gemini account. There was no response from Gemini when I highlighted my problem.

I also opened accounts with local exchanges, Coinhako and Tokenize.

Notwithstanding the fees and other trading/money transfer costs, the April collapse of the crypto market was a test of the robustness of the trading systems.

That night, I couldn’t log onto Coinhako, and when I managed to, there was no way to do trading as the screen was frozen. I didn’t have any issue with Tokenize.

Just thought I’d share another perspective of robustness of the trading system.

Did anyone trading with international crypto exchanges have such an issue.

I have heard many platforms having technical problems faced during periods of high volatility. it is common. I remember Binance also had the issue. It didn’t bother me because I am more of a long term HODLER of crypto. so I accumulate and leave them alone in the hardware wallet.

Would it makes more sense to on-ramp via Huobi (0.2% fee) to HUSD (ERC 20 is 1USD) or USDT (via TRC20 fee is 1USD) then transfer to FTX? Furthermore, purchases can be done via credit card, bank transfer or paynow.

Which stablecoin in Gemini can be transfered into FTX?

definitely many ways to do transfers. as long as it makes sense for your situation.

I think no similar stablecoins between Gemini and FTX. Have to do other tokens

ugh.. now you lost me Alvin. Under FTX you wrote you don’t recommend transferring fiat to FTX but rather buy stablecoin on Gemini and then use that on FTX to buy other tokens. Why don’t you recommend using SGD on FTX ? I have followed your recommendations, opened accounts with Gemini, FTX and Tokenize and wanted to use Gemini as my main hub and store the tokens on my ledger nano. But if Gemini and FTX don’t share a stablecoin then it will be more challenging. Thanks for sharing your insides !

Sorry for the confusion. Can transfer the common coins like BTC and ETH if there are no matching stablecoins.

Hi Alvin, great post first of all! Very informative and thorough. Would you know the most effective way to change SGD to USDT/USDC while incurring the least transaction costs?

I am thinking bank deposit SGD —> Gemini. Send a stablecoin to FTX or KuCoin?

Any other ideas?

That’s what i do too. I fund Gemini and buy a stablecoin and withdraw to KuCoin

Hi, Could you also explain how to trade Tokens like MANA, SAND, CUBE as I realized only able to trade bitcoin and Eth via Gemini Active Trader using my SGD currency?

Thank you

Yes. there is a limited number of tokens you can trade with SGD. USD doesnt have this restriction.

Wrong info on Gemini ActiveTrader Fees. Should be 0.35% instead of 0.25%.

.25% is for notional trading value of more than $500k. Amended. Thanks!

Hi Alvin, appreciate your article particularly on the tip not to transfer fiat money into ftx, and use an alternative approach instead.

However, could I ask for your advice on a specific example in buying a stablecoin on Gemini and sending it to FTX? Because I tried looking it up and looked into getting DAI, however I am unable to buy DAI directly using SGD on Gemini’s website. Thank you so much in advance.

I think you can only buy BTC and ETH on Gemini using SGD. You would have more options if you fund in USD. Alternatively you can transfer BTC or ETH from Gemini to FTX.

Hi there

The review of the various crypto exchanges is very useful. Besides Coinhako, for local exchanges, you may want to consider Tokenize.com, as I found it to have a more professional interface for trading cryptos.

E H Ng

Should reduce their (Coinhako) super high fees of 1% inorder to be more competitive.

Alot of their Altcoins can only buy, sell n swap but cannot send or receive. Why ? Other exchanges hv no problem .

Nexo is a good choice if one wants to earn high interest from staking them instead of just HODL. U can also take loans from them with your cryptos as collateral.

Any comments.

I will suggest to take a bigger picture when posting such articles (yours is dated fairly recently). For e.g. your recommendation to transfer SGD to Gemini, and transfer to BTX. Did you find out how much it cost to do all those transfer to and from Gemini and BTX (network fees)? What are recommended “sums” that would make it worthwhile taking into consideration prevailing MAS restrictions? More importantly, which are the exchanges that you have actually tested using your own funds? Personal experience can very different from what is touted on the website (rates and whatnot, “dynamic fees” can be minefield to negotiate for the unwary). Also, while trading fees are currently low, there is nothing stopping the exchange from revising them in future. We don’t want the audience to misinterpret and making wrong decisions.

Great articles/information – thanks. Have you ever heard of Blex or Coinfwb crypto exchanges? Any insight on their platforms?

Hey Randy, we havent used either of those before. Blex looks like a decentralized exchange, not too sure about Coinfwb.

Hi. Does anyone know of any exchanger that supports USDT TRC20? Most Singapore exchangers that I checked do not support TRC20 network.

Coinhako only supports ERC20

I am still confirming with coinbase and crypto.com support but if remember checking on their apps, they do not support TRC20.

Tokenize supports it, you can give it a try.