The US Securities & Exchange Commission (SEC) has sued 2 major crypto exchanges this week.

They have:

- filed 13 charges against Binance which includes operating unregistered exchanges, unregistered offer and sale of securities, and others on 5 June 2023.

- and sued Coinbase for “operating as an unregistered Securities exchange, broker and clearing agency” as well as for the “unregistered offer and sale of securities in connection with its staking-as-a-service program”, on 6 June 2023.

If you are an investor in these entities, or have assets on these exchanges, I hope this article can give you an idea of what’s happening and help you decide what to do next.

First up, everything you need to know to get up to speed:

Why did the SEC sue Binance?

Among the many charges, the SEC alleges that Binance had failed to restrict US investors from accessing Binance.com, even though Binance.US publicly claimed to be a separate trading platform for US investors.

Other charges against Binance which includes:

- operating unregistered exchanges, broker-dealers, and clearing agencies,

- unregistered offer and sale of crypto assets,

- misleading investors,

- and more

How did Binance respond?

Binance has since issued an update, stating that:

While we take the SEC’s allegations seriously, they should not be the subject of an SEC enforcement action, let alone on an emergency basis. We intend to defend our platform vigorously.

Binance

Since the charges, BNB coin is down 7.2%.

Why did the SEC sue Coinbase?

The SEC has sued Coinbase for operating as an unregistered Securities exchange, broker and clearing agency as well as for the unregistered offer and sale of securities in connection with its staking-as-a-service program.

Since the charges, COIN is down 9.46%.

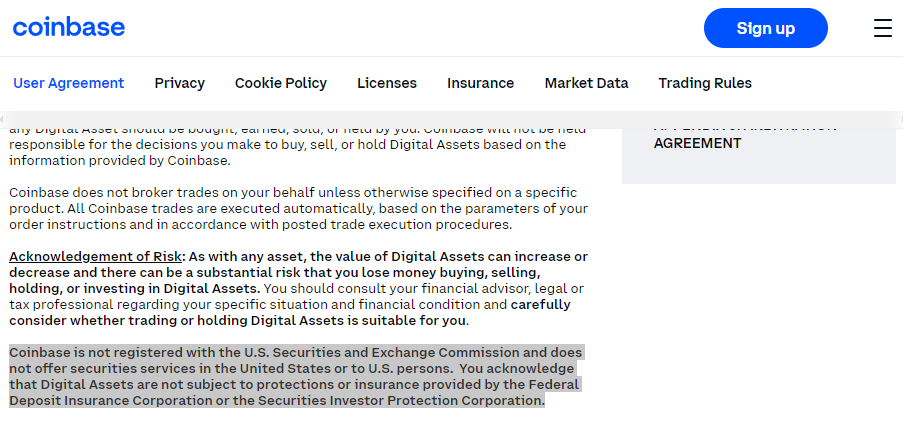

Is Coinbase registered with SEC?

No.

If you’re surprised by this, please be reminded to do your own due diligence when you’re investing in anything.

Coinbase has been quite transparent about this, they have also mentioned it on their User Agreement.

The issue here is the definition of “securities”. So…

While Coinbase maintains that they “do not list securities or offer”does not list securities or offer products to our customers that are securities”, the SEC says Coinbase “has made available for trading crypto assets that are being offered and sold as investment contracts, and thus as securities.”

Crypto Regulations are to be expected

So, first…don’t panic. Given the scale of FTX’s failure, this is to be expected. The SEC going after Binance and Coinbase has never been a matter of if, but when.

In fact early this year, there were already news that the SEC was looking into both exchanges on possible securities fraud. They were also investigating into the legitimacy of projects like Polygon (MATIC) and Cardano (ADA), although these coins are less well known compared to the two big exchanges.

What’s next for Binance & Coinbase?

Binance and Coinbase will definitely be defending their case with the SEC and perhaps try to force the SEC to come up with clear regulatory guidelines on the entire crypto industry that will be operating in the US.

Will Binance survive?

That’s the million dollar question.

Nansen shared that Binance users have withdrawn over $3B since the SEC sued Binance:

This is not the first time that Binance had endured huge mass withdrawals (and it won’t be the last). However, it has survived several rounds of FUD driven withdrawals, and I believe in the Lindy Principle.

My opinion as an investor

Binance as a company would survive this saga, but not without a scratch.

The SEC is making it more difficult for crypto companies to operate whereas their European counterparts have released a form of framework in the lines of MiCA. UK is progressing as well with the Royal Mint considering about NFTs and adopting CBDCs in the near future.

If Binance decides to not operate in the US, there are plenty of options around the world albeit speaking to a lot more players, changing and complying with a lot more different countries systems compared to a single entity. As for BNB, it did take a beating of major FUD when the news was released but the market is prepared and it only affected it’s price by 10% negatively as of today.

Should you trade BNB now?

Whether are you thinking of buying or selling BNB, I would highly suggest following the news and progress of this battle between the SEC and the exchanges.

I like to quote that “Crypto investing is a marathon with some parts of sprinting” so if you are holding BNB, you might want to consider selling some and take back your capital if the prices falls further.

There will always be another price of entry later on down the road. Your main objective should be to reduce your risk so that you can make it to the finishing line.

If you are looking to pick up BNB on the cheap, you should be prepared with a clear entry and exit, that’s your “sprint” in this marathon.

Have a clear strategy and don’t let your emotions take over, which commonly happens to investors. Don’t chase after the price, let the price come to you and execute the orders according to your strategy.

I’ll be sharing how my community and I devise our strategies to grow our crypto portfolio safely. Join me to learn more!

Should you withdraw your assets from Binance or Coinbase?

Yes.

Holding your crypto assets on centralized exchanges is not the best solution, especially if you plan to hold them for the long run. Get a hardware wallet and guard your keys fiercely.

Read this to learn how to keep your coins secured.

Will the SEC go after other crypto exchanges?

If you’re worried about your assets on other crypto exchanges, withdraw them.

Once the SEC have closed the case on Binance & Coinbase or formed up a proper regulatory framework on how exchanges are to be operated within the US, the other exchanges will either have to comply or shift their businesses elsewhere.

Decentralized exchanges (DEXes) would probably not be affected as they operate internationally. In fact, trading volumes rose among the major DEXes after Binance was sued.

In the past 24 hour, trading volumes were up on:

- Uniswap: +200%

- Pancakeswap: +75%

- Curve: +45%

Conclusion

No matter the outcome of this battle, it’s definitely going to be groundbreaking progress.

This will definitely impact how crypto will operate going forward.

I’ll be sharing how my community and I devise our strategies to grow our crypto portfolio safely. Join me to learn more!