The football season managed to continue after it was suspended during the peak of Covid-19 outbreak. But watching the games with empty stadiums is an anti-climax. Gone were the vibes. The games went on to finish the season at the very least and long-waited Liverpool fans have seen their team lift the Premier League trophy.

The Premier League is back! Fans are allowed back in stadiums, with random spot checks of their COVID-19 status.

Being a football fan and a stock investor, I was wondering which football teams were publicly listed. Most importantly, is there a case for mixing passion and money by investing in our favourite football teams? Let’s find out.

#1 – Manchester United (NYSE:MANU) – US$2.4b Market Cap

One of the most well-known football clubs in the world. It once contemplated listing in Singapore to tap on the Asian fan base for its stocks. But it decided to list in New York in the end.

Manchester United struggled to perform after legendary manager, Alex Ferguson, left the club in 2013. It has not won the League even after changing several managers and splurging millions in the transfer market.

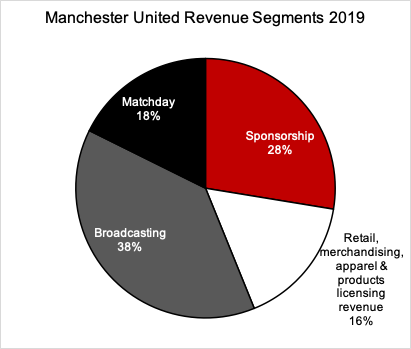

The club makes money in 3 major segments:

- Commercial

- Sponsorships: brands pays the club to get their logos in front of the fans

- Retail, Merchandising, Apparel & Product Licensing: sell sports apparel, training and leisure wear, coffee mugs, bed spreads and other merchandise featuring the Manchester United brand

- Broadcasting: Broadcasting revenue is derived from the global television rights relating to the Premier League, UEFA club competitions and other competitions. Includes MUTV and prize money.

- Matchday: Selling tickets to the 74,140 seats in the stadium, Old Trafford. It is the largest football club stadium in the UK and reported to have over 99% of attendance capacity for the Premier League matches.

Below is the breakdown of the revenue by segments. Broadcasting is the largest source of revenue and that explains the pricey sports channel subscription viewers have to pay for. Matchday revenue may be lost since fans may not be back to watch the games in the stadium for a period of time.

In terms of expenditures, it isn’t surprising that employee benefits (£332m) took up more than half of the total operating expenses (£603m) as the A players have high salaries and cost a bomb to acquire them from other clubs.

The profit margin was only a mere 3%. Revenue growth was flat too – the compound annual growth rate over the past 5 years was just 1%.

Hence, that explains the poor performance of the stock – gaining 5% after almost 8 years. That’s worse than bond returns!

📈Manchester United’s share price jumped as much as 11% on the day (27 Aug 2021) of announcing that Cristiano Ronaldo is back. Should you buy their stock now?🤔

#2 – Juventus (BIT:JUV) – €1.2B Market Cap

Juventus is the most successful Italian football club and it has won the Serie A title this season. In fact, it has won 9 consecutive titles. Cristiano Ronaldo is the star player in the team.

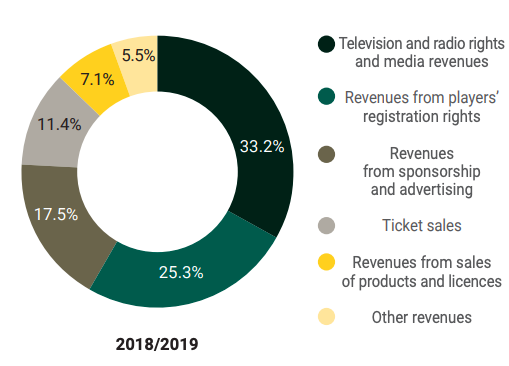

Juventus earned most of the revenue from TV and media rights. The second largest revenue was from players’ registration rights which is a bit iffy in my opinion. Juventus capitalised the transfer fees and the contract value of its players, and recognise the revenue when they make a gain in a sale.

Although revenue has been growing at 12% per year for the past 10 years, Juventus has incurred losses in most years.

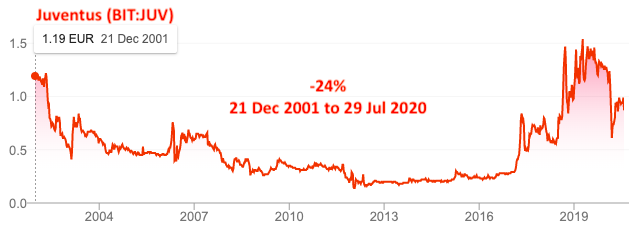

Juventus was listed on Borsa Italiana on 20 Dec 2001. Sadly, you would have lost money if you invested at IPO. The share price declined 24% over the last 19 years.

#3 – Borussia Dortmund (DB:BVB) – €525m Market Cap

Borussia Dortmund is a well-known German football club donning the bright yellow jerseys. It is listed in the Frankfurt Stock Exchange.

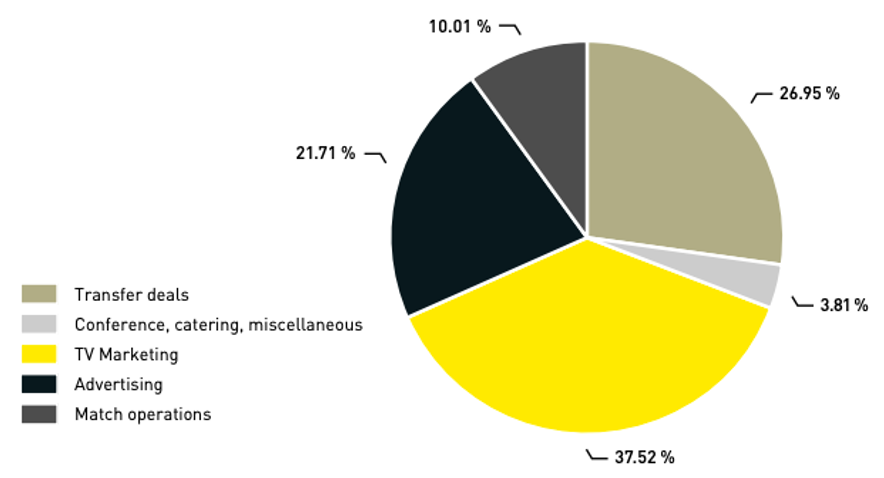

TV rights remained the biggest revenue segment and similar to Juventus, Borussia Dortmund recognised the revenue derived from player transfers. It made good money from the sale of Christian Pulisic and Ousmane Dembele.

Borussia Dortmund has been surprisingly profitable and was able to generate positive cash flow for the last 9 out of 10 years. Revenue has grown at 18% compounded annual growth rate but earnings growth was flat.

The share price has not done well too, declining 45% in the past 20 years. During this period, Borussia Dortmund has won 3 Bundesliga champions while rival Bayern Munich had 15 titles.

#4 – Ajax (AEX:AJAX) – €281m Market Cap

Ajax has won 8 Dutch league titles since its IPO in 1998.

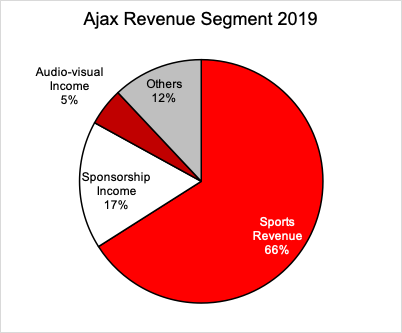

Ajax lumped the revenue from TV rights and matchday ticket sales into Sports Revenue, which represented 66% of the total revenue. Merchandise was lumped under Others.

Ajax was profitable for 8 out of the last 10 years. Revenue was hovering around €100m for most years except 2019 where the revenue was almost €200m.

The share price has gained 20% from 12 years ago. Even so, the return was disappointing. Bonds could have done better.

#5 – AS Roma (BIT:ASR) – €210m Market Cap

It is tougher to find information on the smaller clubs as they do not have English versions for their financial reports. Probably because they do not serve the international investing community but only their local investors. Hence I would just show their stock performances from here on.

AS Roma was listed in 2000 and it has seen its share price tanked by 85% in the past 20 years!

#6 – Celtic (AIM:CCP) – £112m Market Cap

A Scottish club. Celtic dominated the league and won 9 consecutive titles. It is listed in London’s AIM stock market.

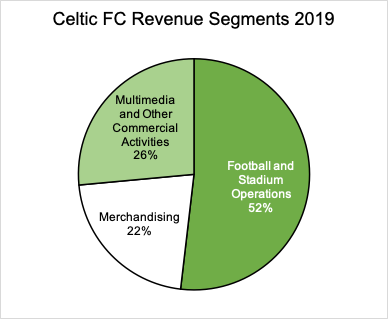

Celtic did not enjoy the lucrative TV rights as compared to the other major clubs in the English Premier League and Serie A because Scottish league isn’t well followed. Hence, most of Celtic’s revenue comes from the ticket sales.

Celtic share price isn’t doing well too – lost 43% in the last 24 years. This is despite being profitable for most years.

#7 – Lazio (BIT:SSL) – €93m Market Cap

Lazio is listed on Borsa Italiana and its most recent Serie A title was won in 2000.

It is the worst performer of the lot and its share price was down by 99% from 12 years ago!

#8 – Benfica (LS:SLBEN) – €64m Market Cap

Benfica is listed in the Euronext Lisbon stock exchange. It has won 5 out of the 10 titles in the Portuguese league.

Share price has gained 7% since 13 years ago.

#9 – Sporting CP (LS:SCP) – €51m Market Cap

Sporting CP plays in the Portuguese league but was not as successful as Benfica and FC Porto.

The share price dropped 80% in the last 18 years.

#10 – Bali United (IDX:BOLA) – IDR984b Market Cap

The only Southeast Asian football club that is listed. Bali United was recently crowned champion in Liga 1 in 2019.

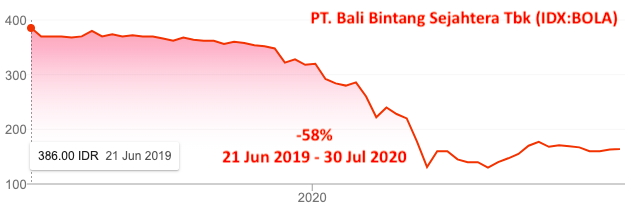

But share price performed disappointingly – losing 58% in slightly over a year.

#11 – FC Porto (LS:FCP) – €19m Market Cap

FC Porto is the main rival to Benfica and has won 5 titles in the Portuguese league in the past 10 years.

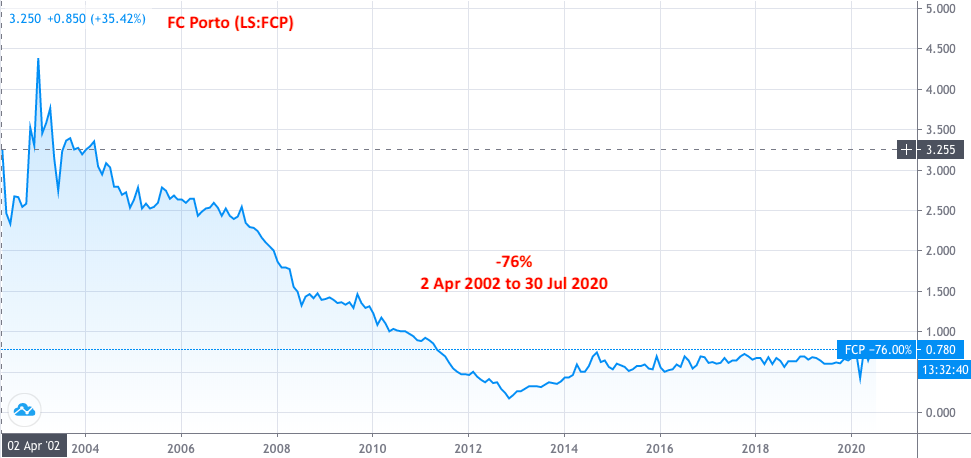

Share price has declined 76% in the past 18 years.

But wait, there’s more. A reader notified us to S.C. Braga, and it looks like the only candidate that hasn’t disappoint:

#12 – Sporting Clube De Braga (ELI:SCB) – €7.95 Market Cap

S.C. Braga is a Portuguese football club from the city of Braga. At the point of writing, it is fifth on the Primeira Liga table.

Conclusion

S.C.Braga aside, it is quite evident that we should never mix our passion and money – we can follow our favourite football clubs and support them monetarily by buying their merchandise. But we should not invest in their stocks. These 11 stocks have done poorly and a few had catastrophic losses.

Things may get worse considering that the clubs may not be able to generate ticket sales because of Covid-19. Even if they can sell tickets, they wouldn’t be able to sell their full capacities due to social distancing rules.

Love the clubs. Not their stocks.

Hi

I live in UK, How can I buy singapore stocks, e.g SIA

Thanks

Raj

You have to get a broker in UK that provides access to Singapore stocks.

Dude not sure you know anything about the stock market as to say “Celtic share price isn’t doing well too – lost 43% in the last 24 years” First off the initial shares by Fergus McCann were always going to drop that was explained. Celtic after selling to the current owners where unlike McCann would not have a single majority, there was and second share offering to create much needed funds for the club. Creating extra shares lowers the value of all other share and to base Celtic shares with the share value of 1997 is just absurd. I know very little about the stock market but clearly you appear to know less.

precisely. supporting a football club is one thing. making an investment profit is another.

I’m a Manchester United fan. I just own a few shares to have that feeling that I own a part of the club