There is a social justice component that the Financial Independence and Retire Early (FIRE) movement may have yet to address systemically – the question of whether an average man of the streets can save enough money to retire on time credibly.

The situation was more glaring when I had the honour of speaking to Secondary Four students of Raffles Institution last week, when I was pointedly asked how much can an average Singapore save?

How much can a Singapore student save?

When you are asked a question from the brightest 16-year-olds in the country, there is a reason to hesitate.

Without national statistics, it may be insensitive just to parrot the response from popular financial planning guides from the US, which recommends a flat 10% as best practice.

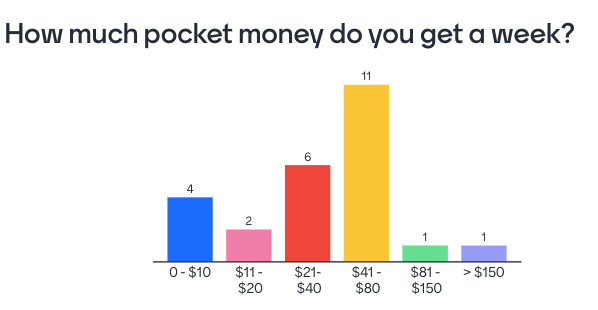

Another reason is that before my talk, I did a survey to find out how much pocket money these students received from their parents.

I am happy to reproduce the results here:

Like a mirror that reflects the rest of Singapore society, RI boys receive very different stipends from their parents.

That single student gets paid over $150 per week would easily be able to set aside 50% of his pocket money, maybe even open a brokerage account when he reaches 18 years old. However, I cannot give the same advice to the four students who have to survive on less than $10 a week.

The implication for working adults is that making a higher income would be easier for you to save money. So our parents’ advice to study hard and get a good job is sound and these RI students have the potential to be high income earners.

But it would be naïve to assume that savings happen automatically – we all have heard stories of those who made $20,000 a month but still ended up broke and in debt.

Having access to higher income does makes it easier to save money but the act of saving, is not a given.

How much does an average Singaporean save?

It is easier to answer that question for the rest of the country.

But instead of the average, we’ll use the median or 50th percentile. In a society with great inequality, using the mathematical average would skewed income and expenses data upwards as compared to a median score.

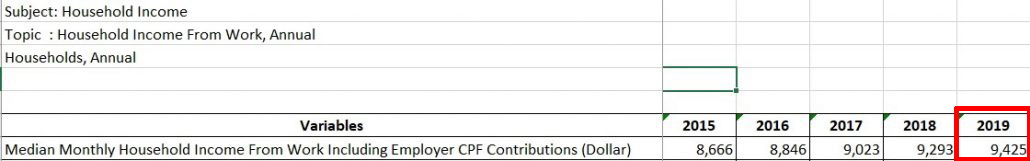

If you look at data from the Department of Statistics, in 2019, the median monthly income that includes CPF showed that families can earn about $9,425 a month. Assuming that 20% goes into CPF contribution, the take-home pay would be about $7,540 a month.

Not too bad, even when compared to our peers in First World Countries.

So let’s review the median household expenses from the Department of Statistics:

In 2018, the median household expenses were $5,904.50. We do not need to adjust the numbers to 2020 because inflation has been negative thanks to the pandemic.

So we already have all the numbers that we seek.

The median family can set aside ($7,540 – $5,904) or about $1,636 every month, which is about 20% of their take-home pay.

Some of you may even feel that 20% savings rate is challenging in Singapore. The truth is, I have seen many Singaporeans achieved an even higher savings rate than this and personally I have bettered it for years.

I shall repeat some tips from my book, Growing Your Tree of Prosperity, to help you save better.

How to save more money

Consumerism is the enemy of savings.

We buy things to level up our status and signal to others that we have arrived. This mindset has to shift for high saving rates to begin. Instead of buying a car, you could have invested the $100,000 and generate endless streams of dividends.

You are buying confidence, security, hope and a firm handshake which are more priceless than a piece of metal that depreciates.

There are four categories of expenses and the ones you must ruthlessly cut are the frivolous and decadent expenses. You would be able to see your savings rate skyrocket when you are able to say no to these;

- Mandatory – small and compulsory expenses like basic food and clothes.

- Investments – large and compulsory expenses like basic shelter or academic course to enhance career.

- Frivolous – small and nice to have expenses like branded clothes.

- Decadent – large and nice to have expenses like luxury cars.

But you can’t stop at saving

The median family save about $1,636 every month. That would be $19,632 per year and it would take 26 years to save $510,432.

Not forgetting this amount has to cater for the couple to retire, instead of just an individual. This is hardly enough. Though I have stressed the importance of saving, relying solely on it isn’t going to work either. You NEED to invest your savings.

And this insight has some implication for the Early Retirement Masterclass.

In my previews, we assume that a single person can save aggressively at $2,000 per month. Even at such a high rate, he or she would need to be able to attain a return of 13-14% if he wishes to have half a million within ten years so he or she can avoid the endless cycle of getting retrenched and retraining for a new career.

Let’s face it. A return of 13-14% annualised return is a difficult target to achieve. And no product sold by financial institutions is able to meet this objective.

This is the key reason why I decided to invest in stocks directly and adopting rigorous continuous backtesting of investing strategies to meet my target return.

In a nutshell, a person needs a combination of strong career earnings, the ability to save a significant portion of salary, and better than average insight than the average retail investor in order to retire early.

It takes sacrifice but it achievable and definitely a worthwhile dream to pursue.

But it is absolutely achievable.

I’ll share how investors can build a portfolio that allows them to retire early here.