Disclaimer: You are responsible for what you buy. I may control shares in stocks & indexes mentioned.

Broadly speaking, when a recession happens, patterns emerge. These are some of them.

- Mortgage delinquency rates pick up.

- Middle income luxury good consumption spending goes down.

- As wages are cut and as jobs get slashed, people retool, reskill, retrain and hope to attain new employment.

- Off-price discount retailer selling household items for $1 shoots up in sales. Pawn Brokers also experience shoot up in sales.

- Passive Investing cash flows heading into the indexes reverse as wages are slashed, jobs are cut, and as people pull OUT of the index versus investing more heavily. This means major price moments in the markets which also means volatility goes through the roof. This is exacerbated by Price Discovery being erased from the market.

A common answer to the question of how to invest during a recession seems to always come up. Retail investors seem to think that they will simply have to buckle down and stay defensive while the markets take a hammer to their guts.

This could not be further from the truth.

When markets swing down, there are stocks that swing up. You only need to know start asking yourself – “what went up in the last recession?”

Buy Companies That Clean Up Loan Delinquency

How to Invest: Buy Companies That Clean Up Loan Delinquency $ASPS

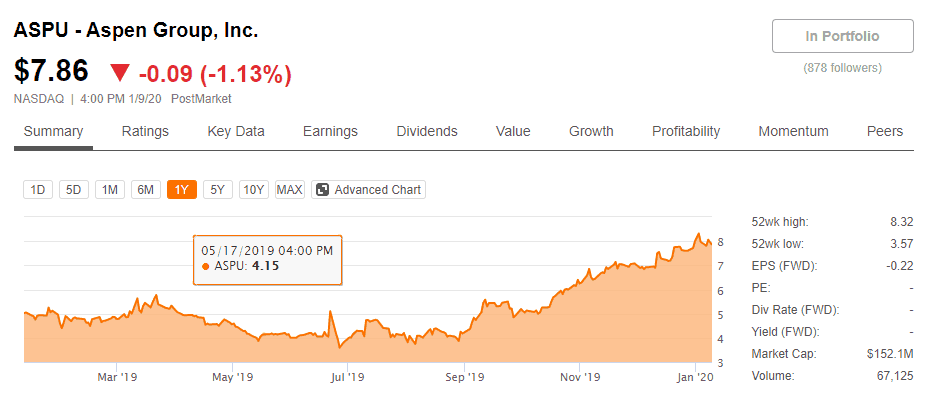

Observe the huge spike in 2008 through to 2011. Next, observe the share price of a companies that dealt in the processing and reclaiming of housing defaults.

Note the time delay between a recession and the pick up in earnings and share prices.

When the 08/09 recession hits, panic first ensues ann delinquency rates skyrocket before the repo men is called in. The whole conveyor belt of processing, detailing, documenting, reclaiming, reselling the loans takes between months to years to complete. Only then does the profits reflect in the share price as it rockets upwards.

These companies also have the nasty habit of tending to do below average as long as the economy is churning along. Their profits will never really pop and their earnings might never really sky rocket. To whit, I’m not too concerned. Look out for the revenues they generate based on the capital employed and you should be able to see if they can just chug along. That’s the key to being invested in these companies.

They have to be able to stay alive and maybe deliver a slow but steady upwards march as they expand their businesses while you wait for the inevitable market cycle to swing down and conversely allow them to profit.

This is a cyclical crisis play, not a long term Buffet long term kind of investment. If you take offense to that, don’t buy in. It’s not your religion, I get it.

Buy Put Options on Middle Income Luxury Companies As Spending by Consumers Fall

When purses get tightened a whole chain of events unfolds. Luxury goods spending dips. Discount spending goes up. Stocks surpluses for luxury goods go up as interest rates balloon and what were cash generating storefronts quickly become cash burning storefronts even as debts balloon in size. This forces either consolidation of stores into a sustainable number or unloading of luxury goods at discounted prices. Both actions smack share prices downwards.

I told you not to short previously, so why am I putting forward a downward play? The answer is simple. The risk:reward ratio is not attractive when you short. But when you use options as a synthetic leverage to up the potential gains and reduce the cost, your risk:reward goes through the roof. The simple idea here is to buy Put Options (which is the right to sell a share at a certain price, by a certain date) on luxury goods which have heavier middle income consumption.

Which brands have those? Walk around a local mall and check out who Look at the price tags and you should find out. The more “affordable” they are in price, the more likely they are to eat a bunch of damage from tightening wallets and purses. You can expect them to report lower quarter on quarter earnings and the downward selling pressure to pile on and drive share price into the ground.

What’s the evidence? Here’s one example.

Tiffany went from $41.59 to $19.68. A 52% drop.

There are probably many more I haven’t covered which went to zero and flat-lined. The key here is to focus on the industries most affected by a recession which the most unhealthy, debt burdened balance sheets with adjustable loan rates and to buy put options against all of them.

These guys can all go to zero even without a recession, your upside is higher compared to what you risk, and the recession is the kick in the chest for many of these companies to close shop. Look for insider selling. Look for high debt burdens. Look for how their profits get cut off as the economy turns. Look at their loan agreements and whether rising interest rates can be serviced.

All of these guys are likely dead or left crippled. Anyone that survives gets to devour market share wholesale and reap massive rewards. Start finding the winners and the losers.

For that matter, the S&P500 allows Options too. If you run out of ideas, look that way. I plan to stay long on the S&P500 for as long as the Feds print money and as long as Trump stays in office (coupled w elections being in Nov 2020). It’s a mistake to do otherwise when the Fed has clearly indicated with their actions what they plan to do along with Trump putting his weight on them to stay in power longer. Guys I know working in funds made a killing being long Call Options when everyone else was nervous. The guys shorting the market got crushed with the upward explosion in prices.

Remember the rule of the jungle – always be able to earn more than you risk. And remember – you are responsible for what you buy, so don’t be lazy and do the homework.

Buy For Profit Education Companies That Retrain & Reskill Workers

When you lose a job in the USA, the same thing happens to you as a person who loses his job in Singapore.

We retrain, retool, reskill, and go back into the workforce to make a living.

What else are you going to do?

Lose the house and rot? Obviously not.

A recession is this ongoing pattern scaled up and out a thousand fold. On top of encouraging retooling, reskilling and retraining, the government is likely to hand out stimulus packages subsidising or discounting training fees.

Remember, they want workers back in the workforce asap and as productive as possible so that the economy recovers more quickly.

Naturally, the beneficiaries of these patterns are the for profit education centres that carry out all the training. These are counter cyclical companies with strong inflections in earnings whenever job loss rates and unemployment rates pick up. In a bull market, these guys make money selling courses on how to up your skill sets and maybe even turn a profit if its well run. Think data analytics courses, digital marketing, machine learning, cfa programs and hard skills such as welding, plumbing, nursing. These are all in demand industries always ready and willing to hire with manpower shortages because the work isn’t glamorous or the pay just isn’t there or the skill sets just aren’t easily acquired.

For profit education places that can deliver good earnings in good times and even better earnings in recession times are the targets here.

Who am I looking at to play this out?

Here’s another name.

These guys are already starting to turn positive. Look at UTI. These guys specialise in training students to become technicians in automotive, diesel, & motorcycle repair. A necessary service whether or not you’re in a recession. Worse. In a recession, people hold vehicles longer and repair/maintain it more. Auto sales drop. Business picks up for car maintenance and repair workshops. Oh. Look. Another investment idea. Go run that one down.

As for UTI’s business?

In 2018, the first sign of life appeared when new student starts ticked up 1.2%. This was the first positive number for new student starts the company posted in 8 years. And more recently, for the first 9 months of 2019, new student starts have exploded upward to the tune of 13%, and average student enrollment comped positive 4% in Q3’19.

Source

Buy what goes up when markets come down. If you’re confident, sell shitty companies that go down too. Use options to game the downside swings. Control risks. Expose smaller percentages of your capital.

Buy Discount Retailers and Value Stores

I don’t have to explain the reasoning behind this I hope. When jobs get cut, spending power goes down and everyone wants to stretch their dollars. Guess what happens at the local thrift stores and $1 value stores?

Sales explode upwards. With sales comes earnings and with earnings profits.

Check out what happened for these guys the last time.

Again. Allow me to reiterate.

There is no reason in the world you cannot look for solid companies with solid economics doing great businesses that experience exponential upside when markets collapse and everyone tries to stretch their dollar.

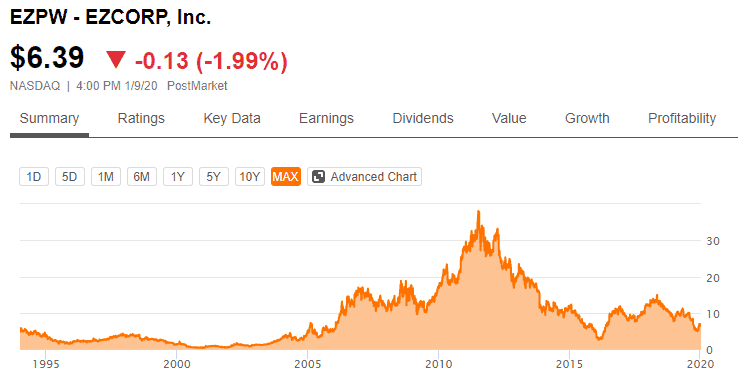

Buy Pawnbrokers

The same thing that drives business up for mortgage delinquency servicing, as it does for dollar discount and off price retailers also drives up sales for Pawn Brokers. These pawnbrokers were all monsters in the last recession even if some experienced a temporary decline in share price before earnings that lagged the real world got reported and dragged share prices upwards. Remember, people aren’t always in a rush to sell family jewels. Those are last resorts and I expect that to happen only 3-6 months down a recession so the upward inflection in earnings is about as expected.

These pawnbrokers were all multi-baggers last time and I don’t expect things to be different this time. If anything, given the propensity of passive investing, I expect many more people to be pawning items and a heavier flow of funds to dump into stocks that go up as the recession kicks into high gear.

And another one.

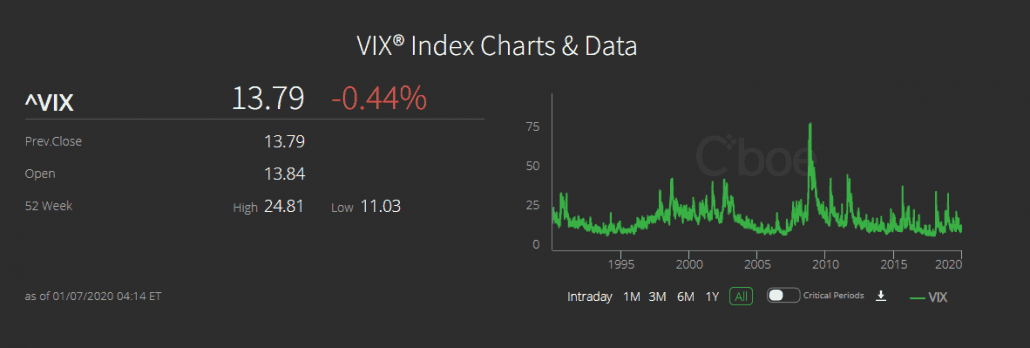

Long Short 2 – Being Long Volatility

Method: Backward Call Spread

Note the spike in 08′.

That’s what you’re looking for when you are long volatility.

Volatility is best defined as the amount of movement present in a market whether upwards or downwards over a period of time. Standard deviation, bollinger band, call it what you want to call it.

I call volatility human emotion (since volatility can be both bullish and bearish).

When there’s a recession, and the markets meltdown, people sell off stocks en masse when they should really hold on, average down and ride out the storm.

The problem here is this next crash might completely destroy retail investors leaving many in shambles. This is largely because of the pervasiveness of passive funds because passive funds have completely destroyed price discovery as a mechanic.

What do I mean?

Price discovery is present in any stock.

You want to buy a cow for between $50 – $52. I’m only willing to sell for $55. Let’s say we meet in the middle at $53.50. The share price will gap up to reflect the “last done” at $53.50.

Why does passive investing destroy this mechanism? Because right now, the instructions funds have is that whenever they get new cash, they issue a buy order.

There’s no price discovery here. It’s buy.

I don’t care what price it is. Buy.

Those are standing instructions present in all passive funds.

This goes on every month since most passive plans are funded by salary deposits.

You get paid, you slot that chunk of your salary you set aside into the markets, pushing it to your fund manager, and he goes on to put it into whatever you bought. Probably the S&P500. Or the DJI. Or the NASDAQ.

There’s just no price discovery because these funds are mandated to stay 100% invested and to mimic the index they’re trying to follow. Why will this grossly exacerbate the crash that is coming and drive volatility even higher therefore delivering bigger profits for those who are long volatility?

Well, the absence of price discovery works both ways.

When investors get scared and sell, they don’t care what the price is either.

The fund will keep liquidating as is at whatever the price is and this exerts even greater downward movement on share prices.

The degree to which this is a problem can be understood better if you simply look at the size of the passive investing market currently. Back in 1998, passive equity funds accounted for only 11.2% of all U.S. equity funds, and the rest was made up of actively managed funds.

In 2019, passively invested assets account for 49.9% of total U.S. equity funds, with the rest invested in actively managed funds. When the stampede for the door happens, you can expect equities to drop. And hard. All that will do is add to volatility and drive gains up even higher.

The mechanisms of executing this strategy is more complicated to explain. Most funds call this Crisis Alpha. It sounds cool and exotic but its really just how to make a lot more money than the rest of the suckers in the market when shit goes sideways.

What they do is they execute a 2x backward call spread on the Volatility Index. A call option is basically a right to buy something at a certain price in the future at a certain time. Using the cow analogy, you buy the “right” to buy the cow at $51 from your neighbour. He sells you that “right” and earns a premium which you pay to him in exchange for the right. You profit if that cow appreciates to a price that is above what you paid for the premiums and the agreed price of $51.

This is where things get tricky. A backward call spread is selling out-the-money(OTM) call option to buy two out-the-money call options. You use that premium you gained to buy not one, but two OTM call options on the VIX.

If you want greater detail, I highly encourage you to check out TRADING OPTIONS FOR EDGE by Mark Sebastian. Google is handy as well.

The primary benefit to this set up is that it can be credit neutral to credit positive, which means that executing this trade either costs you nothing or makes you a bit of money. This is crucial since we A) already sacrificed any return on equities we could make with money in a stock and B) we want to mitigate insurance costs on our portfolio just as we want to lower insurance cost in real life.

Importantly, this position delivers truly spectacular returns when volatility goes through the roof as it does during market meltdowns.

Note the risks however. This is a strategy that basically makes you very little money if nothing happens, loses you money if something small happens, and makes you a lot of money if something big happens. When you sell an Option, you need margin to offset the likelihood of being assigned. So please don’t skip due dilligence. Excute this trade only if you have done the homework and can explain the risk-reward and costs in such a way that is understandable to a 5 year old.

Keep Both Feet On The Ground, Don’t Forget the Basics

I’ve talked a lot about how I expect things to play out. I want to take this chance to come to ground. Here is a list of pointers to close out handling a recession while staying invested.

- Investors can stay invested in a recession. You just need to be able to pick the right stocks.

- It is not only possible to handle a recession well, it is possible to find stocks that deliver truly massive gains especially because of a recession.

- The investor best able to utilise all the tools in the arsenal of the investment world reaps the profits and reduce the risk. Options are one such tool I have actively used to give a boost to my returns. The drawbacks are dividends risk and when you’re selling an option, your risk is technically infinite. Try to be a net buyer of options with a deep, laser like focus on why the share price will go in a certain direction. If you cannot find such a reason, just don’t buy the option. Better to save your bullets for other things.

- We cannot predict the market. There are no edges in predicting where the markets will go. Having said, you must still have an understanding of where things stand and how badly things can fall out. This means baking a margin of safety into your ideas. This should translate into your portfolio and stock positioning. Of all the positions above, I like the discount retailer option of playing the recession out the best. The business model is relatively easy to understand and plays a straight up game even without a recession. Cheap capital only allows them to expand faster. Recessions only make things better. This is a heads I win big, tails I win small kind of situation. The usual rules apply. Look for strong insider ownership/insider buying, good balance sheets, low debt levels, high free cash flow generative companies in the discount store world. Some of those guys might be overvalued as heck. The examples I have given are companies that have now grown too big and might not enjoy cost of scales anymore. You need to investigate deeper into smaller listed stores who can represent outsized earnings comparable to their market capitalisation. This is what truly makes a share price pop. One of them is Stage Stores Incorporated. I’ll leave you to figure out why.

- Figuring out what goes up in a recession is just as good as figuring out what is good that went down. You can buy good things cheap both ways.

- Locally, MAXICASH, VALUEMAX, MONEYMAX are all listed. Yes, we want counter-cyclical plays but we also want clean balance sheets. You can’t just buy any old shelter because a storm is coming. What if the shelter collapses before the storm hits? What covers your ass then? Nothing. Remember your fundamentals.

I hope this piece has been informative for retail investors on how to invest even during a recessions. Remember basics matter. Remember you can profit off smaller counter cyclical stocks with sold balance sheets.

If all else fails, just keep buying good assets cheap. That’s what our factor investing course is for, buying good companies at dirt cheap prices and buying growing, profitable companies at great prices. If you want to know how we do it, click here for a seat, listen, and truly understand it. We’ll welcome any questions.

Investing is a lonely road but it doesn’t always have to be lonely. You don’t always have to do it alone. You don’t always have to do it yourself. Stand on the shoulders of those who’s fallen into the traps before you. Profit from their experience.

We’ll see you there if you’re interested. If not, remember the basics.

Investing needs to be done in a systematic and a planned way. You need to figure out different ways and ideas for your profit from an investment. The details and points mentioned in this article were helpful and to keep this points in mind before investing. Thank you for putting it together. Keep sharing.