Ah, Donald Trump. What can I say? I honestly cannot remember a more controversial sitting US President if there ever was one. If you remotely follow the US news cycle, it is almost an endless barrage of controversies about President Trump.

As you can imagine, with the US Presidential Election just around the corner, things have really kicked up a notch of late. As I was going through my daily digest of news, I revisited an article by the New York Times that was published a few weeks ago on President Trump’s tax returns. This got me thinking, about quite a few things that I can relate to as an investor – specifically on the US taxation system (and loopholes) and also the business psyche of US companies.

I believe, there are several insights that we can glean, which may prove to be informative for aspiring investors in the US stock markets.

I will illustrate these learnings by drawing comparisons with ZScaler Inc. (Ticker: ZS), a high growth tech company.

Lesson 1: Operational Losses as a means of Tax Optimization

The very first thing that caught everyone’s attention about President Trump’s tax bill was the eye-popping miniscule amount of taxes that he is liable for. How in the world could a (supposedly) billionaire get away with a tax bill that is likely to be much lower than yours or mine?

As it turns out, the solution is to lose a lot of money in the first place. This article from Business Insider provides a pretty comprehensive explanation on how that works. Without going too far into the weeds, here are some key points to takeaway:

- A business, when not profitable is not required to pay taxes

- Losses for an accounting period (typically a year) can be carried forward to offset future tax liabilities

The way that the US tax code is set up, it provides incentives for companies (especially high growth companies) to run their business in a certain way.

To put it in perspective, we need to understand that the primary reason companies become publicly listed, is to raise capital. That capital should then be deployed by the company in the best way possible.

To a growth company, this generally means taking that capital and investing it aggressively (on hiring people, acquiring assets, etc). Such investments are recorded as operating expenses and drives operating losses.

This approach allows the company to avoid tax liabilities and also potentially accumulating those losses to offset future tax bills. Hence, if the company has expansion ambitions, one would rather spend the money and incur a loss than to be reporting profit prematurely and be taxed.

Let’s take a look at a practical example of this in action:

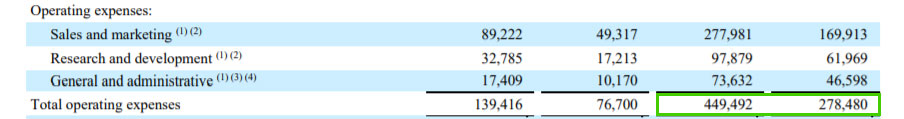

From their FY2020 Q4 results, we can see that ZScaler’s Operating Loss and Net Loss have widened significantly in FY2020 vs. FY2019 from US$7.9 billion to US$ 44.8 billion.

However, if we took a closer look we should see that the reason for the widening loss is not due to massive decrease revenue or massively decreasing gross profit, but rather the huge jump in operating expenses. This is an indicator of aggressive investment at the expense of being profitable.

This phenomenon is very common place especially in tech sector growth investing.

Lesson 2: Cash (Flow) is King

Given President Trump’s massive losses across multiple years, how in the world is he still able to live like a boss, invest in a lot of stuff and not be broke?

Well, as it turns out, the secret lies not so much in profitability of his businesses, but rather how much cash he is able to get his hands on, that in turn improves his cash flow position and keeps things afloat on a day-to-day basis. There are many ways to generate cash including taking on debt, which according to the New York Times, was how President Trump allegedly went about it.

As in the case of President Trump, often times, profitability and cash flow, while inter-related can paint a very different picture. An unprofitable entity with strong cash flows can thrive. The key question then is the source of cash that in turn gives an idea of sustainability and survivability.

Observing the cash flow statement of ZScaler, we can see that in spite of the company reporting losses, the business is actually generating positive (and growing) operating cash flow (highlighted in orange) In fact, the company has also been Free Cash Flow positive.

We can also observe here, that ZScaler has taken on a large debt position in the form of convertible notes (highlighted in red). However, that cash has largely been used to purchase short-term investments (highlighted in green).

From what I can see, this is a company that is taking on debt that it arguably does not need and is parked in the form of liquid assets. This smells like they are getting ready to continue aggressive investments (perhaps an acquisition coming round the corner?) and is probably taking advantage of the currently low interest rate environment to beef up their balance sheet.

Not something I would necessarily worry about at this point.

Lesson 3: Expenses Matter (A Lot!)

One of the key controversies from the reporting on President Trump’s taxes is on the nature of what he declared as business expenses. It would seem like certain expenses (such as what he spends on hair care!) is super contentious.

While we have learnt, that there are incentives for companies in the US to avoid being profitable prematurely, we should not take it for granted! It is always worthwhile to investigate, make sense of the expenditures and make sure the story lines up.

How does this look like in the case of ZScaler?

First turning to the corresponding transcript for ZScaler’s quarterly conference call, they have iterated that they are investing aggressively by building out their organization (i.e. hire more people) and capabilities (i.e. adding to capital expenditure).

As human resource is a fixed cost component (operating expense), we can look at how this has sized up:

We can observe here that there has been a pretty big jump (north of 60% increase) across the board, which is pretty consistent with what the company mentions on the call.

Further clarity can be obtained from the cash flow statement:

Stock-based compensation (paying employees in stock rather than cash) is recorded on an adjusted cash basis in the cash flow statement and provides insight on just how aggressive they are in building up their organization, while preserving cash.

As we can observe, they have paid out nearly 3X more in 2020 than they have in 2019. The amount in stock-based compensation here accounts for a sizeable chunk of total operating expense for the year (around 27%).

Aside to that, we can also observe:

Capital expenditures have also increased significantly (by around 68%) indicating investment dollars being put into enhancement of their technical capabilities.

Overall, the story looks in line with what management of the company has put forth and capital is allocated in order to grow the business, which is exactly what we want the company to do as an investor.

Wrapping It Up

To be clear, investing in unprofitable growth companies is a risky affair where plenty of things could go wrong. However, in exchange for the “higher risk” (perceived or otherwise), the returns can be very rewarding.

Since its initial public offering in March 2018, ZScaler has returned 344% over the span of a little less than 3 years (so a CAGR of about 64%)!

In sharing these lessons, I hope to shed some insight that not all “losses” are necessarily equal. Would-be investors should not pass up an opportunity simply because a company is “unprofitable”, especially in the tech sector.

There is some method to the madness. The key then is in understanding the methods to provide context to interpret how our investments is progressing, beyond the simplistic view of profitability.

Disclosure: The author owns shares of ZScaler Inc. (Ticker: ZS). Investors should conduct their own due diligence before engaging in any buying/selling of any of the shares mentioned.