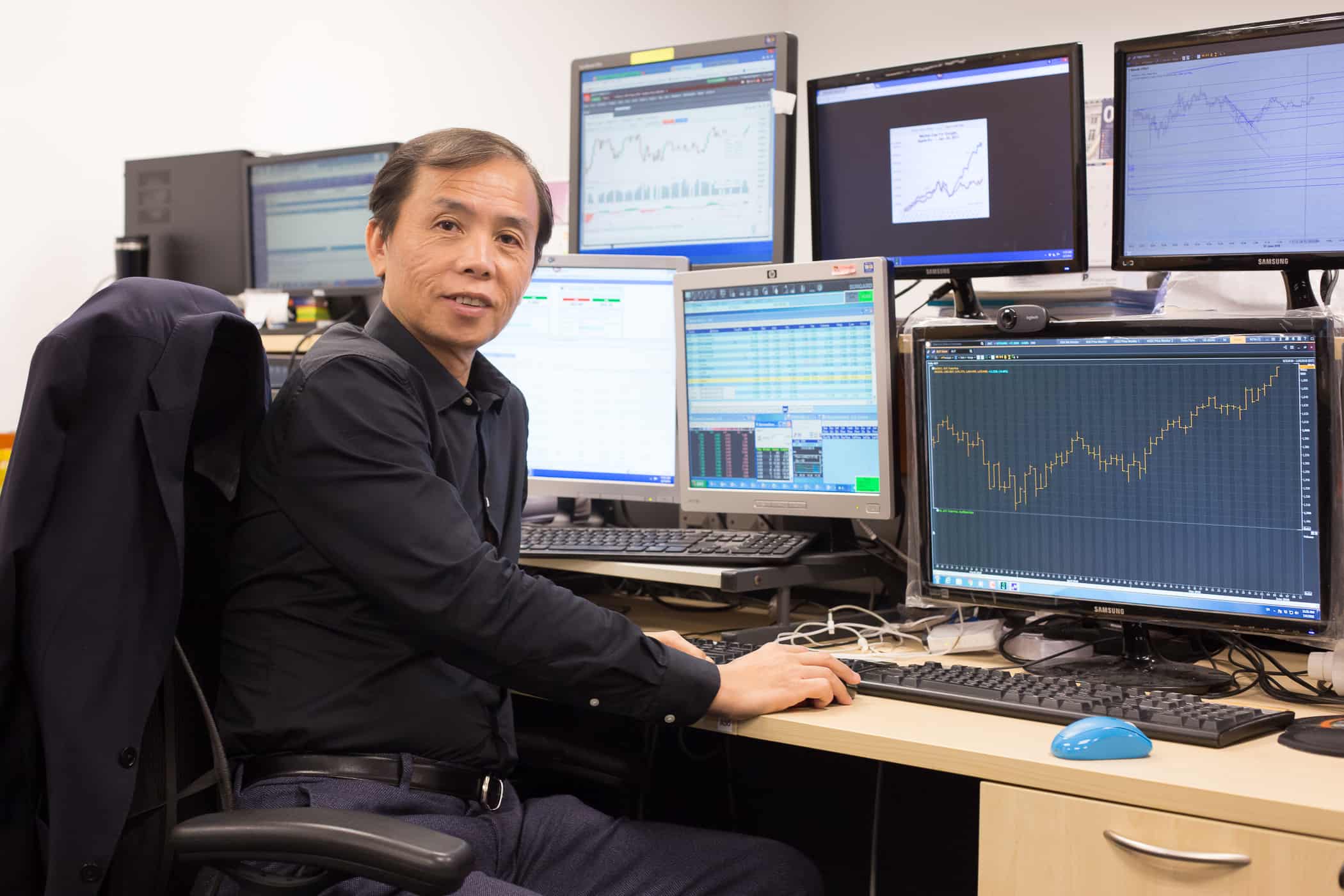

Many of us dream of becoming a full time trader. We dream of being in command behind the numerous computer monitors. We dream of making lots of money with nothing but our wits and guts. We dream of never needing to report to a boss.

In reality, trading is an extremely difficult game. Only the top few traders are able to stay long enough and make good profits in the long run. For the rest, it remains a dream.

Recently, I had a chance to shadow one of the top traders in Singapore, Robin Ho. I was able to peek over his shoulder and observe how he trades the market in a typical day.

7 AM – Preparation

6 Jun 2018, 7am. Robin was already up and checking on the performance of the futures and stock indices in the U.S. The U.S. capital markets are still the leaders in the world and they would provide direction for the Asian markets. The U.S. markets did well yesterday. This suggested that the Asian markets are likely to go up when they open later.

Robin was in the office at 8.30am. He opened his trade plans and looked through them to prepare his trade execution when the markets open. He had two types of trade plans – one for the macro view and another the micro view. The macro view had several trendlines drawn on stock charts with a daily timeframe. This would guide his swing trades or trades that he would hold for a few days. The micro view was based on the minute charts and would be used for intraday trading where trades are opened and closed within the day.

He also used the macro charts to determine the highs and lows for the today’s intraday trades. Thereafter he would zoom in into the micro charts to draw the trend lines according to the highs and lows like this:

This means that he will only buy near the low and sell near the high.

Robin has decided to focus on trading the Hang Seng Index Daily Leverage Certificates (DLCs) today as he noticed that the volatility was low. A quiet market made stock trading difficult. However, DLCs offer as high as 7 times leverage and that provided the volatility that Robin needed to trade.

He also decided to trade intraday. This was because the market did not show any strong trend in the macro view such that he would be convinced to hold the DLCs over a few days. The DLCs have a compounding effect if held over many days and he could make more money if the trend is strong and the price moves in one direction over consecutive days. But today is not the day to do swing trades.

9:15 AM – Ding, ding, ding! Market Opens!

The Hang Seng futures opened at 9.15am. Robin fired the trade and by 9.18am he had 40,000 units of CPRW-DLC SG7xLongHSI210114 at prices between $1.20 and $1.205. The total amount traded was about $48,000.

Robin began monitoring the position with full concentration. He started selling as soon as the price ticked up. He sold 5,000 units at $1.210 and another 10,000 units at $1.215. He kept selling and by 9.45am, he has sold his entire position.

In fact, he noticed that the price has hit the predetermined day high and has begun to show weakness. So he reversed his trade and went short with 10,000 units of CPRW-DLC SG7xLongHSI210114 at a price range of $1.24 to $1.235.

He was right! The price rejected the day’s high and started to retreat. Robin was able to buy back the entire short position at $1.22 by 10am.

Robin was decisive and acted according to his trade plans. It was an amazing and profitable 40mins.

He then turned to me and told me that he usually stops trading the Hang Seng Index before 10.30am. This is because the Hong Kongers have a habit of going for “Yum Cha” (tea break) at 10.30am and the market would become quiet.

He also let me in on a secret – he does not only look for for prices hitting the high and low according to his trade plans, he would also look out for high transacted volume at these price points as a validation of his high and low predictions. He would wait for such ‘confirmations’ before keying in the orders.

For the next hour or so, there was not much action to be had and the market stopped trading at 12pm. Robin went for lunch.

1 PM – Market reopens after lunch

Robin was back at his terminal at 1pm. He was getting ready for the next opportunity.

Unfortunately there was no trade signals as prices did not hit the predetermined high and low. He said it was not wise to trade for the sake of trading. In fact, he makes more money by trading lesser because he could focus on the best set-ups and not settle for ambiguous signals that does not offer an edge to the trader.

Market closed and he tallied his profits. He has made $900 before commissions charges!

He also shared with me that he conducts a monthly gathering for DLC traders where he shares his views about the market. He would also report his previous month’s DLC trade results. During the last DLC meet up in Apr 2018, he shared his Mar 2018 results which was a gain of $8,915. He added that it was a trendy market in that month and he had quite a number of swing trades done on DLCs, taking advantage of the compounding effect. Moreover, he trades them within the contra period and he does not even need to come up with the full capital for his trades.

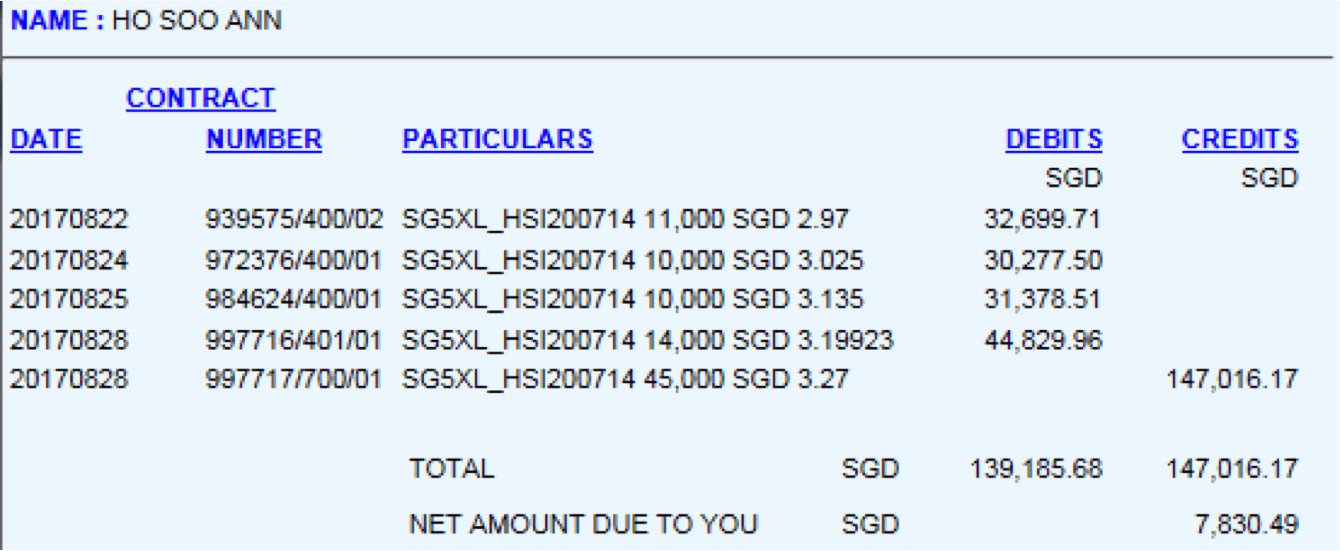

His best trading month was in August 2017 where he made a whopping $28,298 profits trading DLCs! Here’s a snapshot of one of the best trades he had in the month of August, $7,830.49 in a few days without putting up the capital:

5:30 PM – The day is not over yet

The Asian markets were closed but Robin was not done with the day. He began preparing the trade plan for tomorrow at 5.30pm. He looked through major indices and stocks to scout for opportunities. The major trend lines were established on the daily chart and he was updating the 1-min charts with more trend lines.

Robin headed home for dinner after the trade plans were done. He would still trade the U.S. markets if anything interesting showed up. But he would make more swing trades and avoid intraday trades as he would not want to stay up beyond 11.30pm. He would go to bed and the next day repeats.

Who wants to be a full time trader?

Contrary to most people’s impression that trading is carefree and flexible, Robin has showed that a lot of work is required to prepare for his trades. He puts in more hours than a 9-to-5 job. It would be very difficult to sustain if he does not have a passion for the financial markets.

You must really have the necessary skills and experience like Robin in order to trade profitably. Although it sounded easy, I am certain that the road to his proficiency was not all rosy. Sacrifices were made, losses were incurred and lessons were learned. The bottom line is, one must pay the dues in order to be successful.

I hope you would be able to have a better understanding of a full time trader’s routine and decide whether it is your cup of tea!

P.S. You can follow Robin’s trades on his website: www.robinhosmartrade.com and you can also join the Singapore DLC Traders group and be informed of the next gathering!

Hi,

I am keen to retire early, but now coming to end of 2nd quarter of the year 2020. How can your ensure the economic will slowly recover in the latest 6 months? Whole world was in mess. Possible for your to explain more detail through email or meet personally if you are so knowlegeable. Your guideness are much appreciated.