The most important financial concept in the world is the concept of compound interest. Even an urban rumour claims that Albert Einstein said that compound interest is the Eighth Wonder of the World.

If I can invest a lump sum of money PV for a return r over a period t, my resulting future wealth, FV, will grow exponentially based on the following equation :

This equation shows that our money can grow in many ways. We can set aside more savings and increase PV; we can find ways to improve our returns r or patiently invest our money for a more extended period and increase t. As t is an exponent, time in the markets will make the most significant difference in our lives.

People can get rich around the idea of compound interest.

But until today, no one has ever spoken about which concept comes a close second in importance to compound interest.

In my opinion, the second most important financial concept in the world is the idea that someone can invest a lump sum of assets to create an infinite stream of income.

A tragedy that befouls humanity is that we can’t eat 21 meals over a weekend to remain sated for the rest of the week. Some of our needs are periodic. Humans cannot save their food in ancient hunter-gatherer societies, so any excess food not eaten will rot away.

Fast forward to today, not only has science provided the means to make refrigeration possible, financial markets allow society to invest their assets by taking ownership of businesses in such a way as to convert a lump sum of money into a continuous stream of income that can be used to feed investors.

Thanks to these modern developments, humanity has a reason to delay gratification and save their excess assets for a rainy day.

So…what is a reasonable baseline of conversion from a lump sum to a continuous stream of income?

a) A safe rate of withdrawal

The first concept to understand is the safe rate of withdrawal by Bill Bengen. Bill Bengen discovered that withdrawing 3% annually from a well-diversified portfolio is very safe. Spending 4% each year will allow most portfolios to last about 33 years, which is why 4% is often the safe rate of withdrawal.

Local data from the Lee Kuan Yew School of Public Policy projects that a single 55-year-old retiree needs $1,721 a month to live a dignified existence. We can deduce that the lump sum of wealth required that generate that amount of income would be:

The target wealth that makes retirement safe would be along the baseline of $500,000.

b) Singapore Blue Chips

If you find a better way to invest, you will need a lower lump sum to attain the income you need to retire successfully. If you are a dividends investor, you will find the local STI index a fertile ground to find counters that can provide a yield higher than the safe rate of withdrawal. Investing this way is low risk and results in a reasonably stable portfolio.

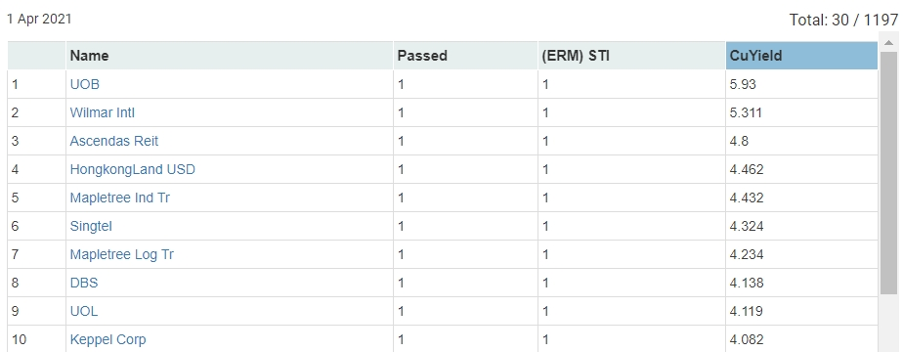

Using Stocks Café, I could filter out the top 10 yielding blue chips in the STI.

Averaging the top 10 yielding blue-chips in the STI, you can build an equally-weighted portfolio that yields 4.43%.

Investing in such a portfolio will reduce the portfolio size required to generate an income of $1,271 a month, easing your journey towards financial independence.

c) Real Estate Investment Trusts

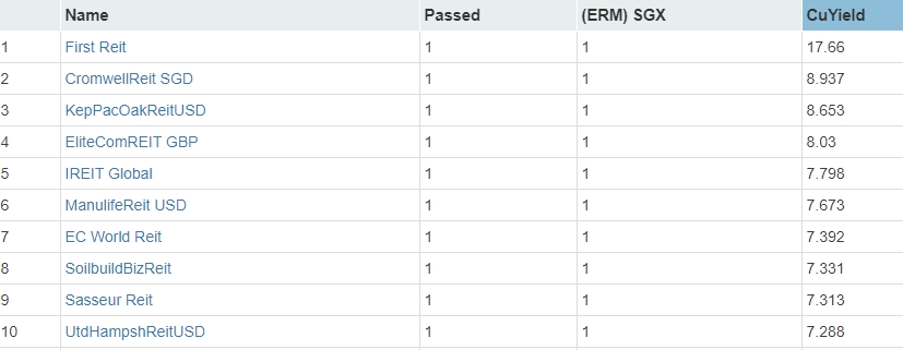

You can obtain higher yields by investing in real estate investment trusts or REITs. Risking your capital on the top 10 yielding REITs will result in dividend yields above that of Singapore blue chips.

The average yield of 10 of the highest yielding REITs is 8.8%.

Using successive strategies to seek a higher yield can reduce the target portfolio size to generate a comfortable income for retirement.

Do note that investing exclusively for high-dividends in the S-REITs universe is a risky proposition with a history of sub-optimal performance. In all cases, it is safer to examine each investment individually in a qualitative manner before deciding to put the REITs into your portfolio.

Nope.

I would say that the 2nd most important financial concept is that compounding in real life does not occur in a nice upward sloping line. It goes up and it goes down. And if it goes down big early on (or even later on), most people will be out permanently or for a long time, either financially or emotionally.

You need to build in anti-fragility or redundancies & cultivate a resilient and flexible mindset. This is usually more art than hard scientific formulae, and often involves some level of inefficiencies i.e. not yield-maximisation or returns-maximisation.