We know that many of our blue-chip stocks are partially owned by the Singapore Government sovereign wealth fund, Temasek Holdings. In fact, there are plenty of investors who find comfort in investing in Temasek-backed companies.

I was curious to find how many of 30 Straits Times Index (STI) stocks had Temasek as a major shareholder.

How much of these blue chip stocks did they own and how did they perform?

The purpose of this article is to highlight some of my findings which you could find useful or interesting.

Temasek owns 12 out of 30 STI stocks

I downloaded every STI stock’s annual report to find out the largest shareholders of the companies.

There are 30 stocks representing the STI and out of which 12 are owned by Temasek. They are

- SIA – 55.71%

- SingTel – 52.35%

- ST Engineering – 50.97%

- Sembcorp Ind – 49.4%

- SATS – 40.01%

- CapitaLand – 39.99%

- CapitaComm – 31.96%

- CapitaMall – 29.57%

- DBS – 29.27%

- Ascendas REIT – 20.7%

- Keppel – 20.48%

- Hutchison Port – 11%

Temasek’s top 3 holdings in STI are SingTel, DBS and SIA

The top 3 holdings in STI are

- SingTel – S$26 billion

- DBS – S$18 billion

- SIA – S$6 billion

The bottom 3 holdings in STI are

- Hutchison Port – S$0.4 billion

- Ascendas REIT – S$2 billion

- SATS – S$2 billion

Here’s a pictorial view of the STI stocks by value in Temasek’s portfolio.

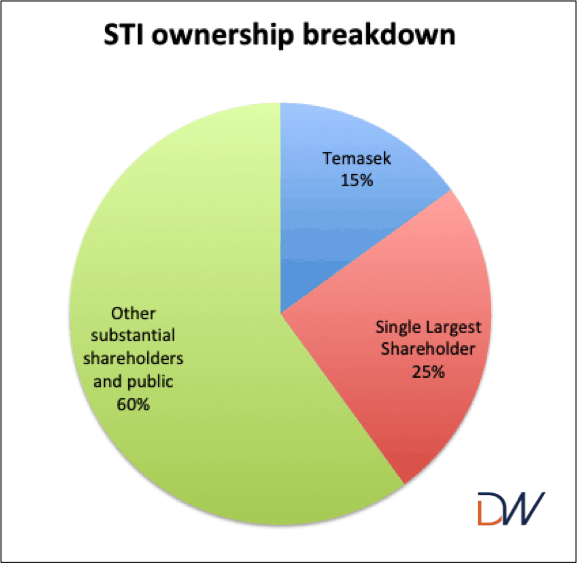

Temasek owns 15% of STI

I was expecting Temasek to have a bigger proportion of the ownership among the STI but 15% isn’t really that excessive.

In comparison, the other key shareholders had a bigger share of 25% of STI.

This shows that there is a healthy dose of private enterprises driving the economy and the business environment is friendly.

Below is the list of STI stocks and the corresponding shareholders and ownership levels.

| Company | Ticker | Temasek / Largest Shareholder | % Ownership | Ownership Value (in millions) | Market Cap (in milions, as of 17 Dec 18) |

| Singapore Airlines | C6L | Temasek | 55.71% | S$6,231.52 | $11,185.64 |

| SingTel | Z74 | Temasek | 52.35% | S$26,149.74 | S$49,951.75 |

| ST Engineering | S63 | Temasek | 50.97% | S$5,597.26 | S$10,981.47 |

| Sembcorp Ind | S63 | Temasek | 49.48% | S$2,313.58 | S$4,675.78 |

| SATS | S58 | Temasek | 40.01% | S$2,065.05 | S$5,161.33 |

| CapitaLand | C31 | Temasek | 39.99% | S5,206.84 | S$13,155.39 |

| CapitaLand Comm Tr | C61U | Temasek | 31.96% | S$2,142.13 | S$6,702.53 |

| CapitaLand Mall Tr | C38U | Temasek | 29.57% | S$2,507.50 | S$8,479.88 |

| DBS | D05 | Temasek | 29.27% | S$17,879.78 | S$61,085.69 |

| Ascendas REIT | A17U | Temasek | 20.7% | S$1,685.83 | S$8,144.11 |

| Keppel | BN4 | Temasek | 20.48% | S$2,264.25 | S$11,055.93 |

| Hutchison Port Tr | NS8U | Temasek | 11% | S$368.98 | S$3,354.37 |

| Jardine Strategic | J37 | Jardine Matheson | 83.96% | S$24,603.05 | S$29,303.30 |

| Jardine Matheson | J36 | Jardine Strategic | 57.66% | $17,309.99 | $30,020.80 |

| Dairy Farm | D01 | Jardine Strategic | 77.6% | $13,375.27 | $17,236.17 |

| Hongkong Land | H78 | Jardine Strategic | 50.01% | S$10,950.29 | S$21,896.20 |

| Jardine C & C | C07 | Jardine Strategic | 75% | S$10,609.13 | S$14,145.50 |

| Thai Bev | Y92 | Charoen Sirivadhanabhakdi | 65.89% | S$9,762.05 | S$14,815.68 |

| UOB | U11 | Wee Cho Yaw | 18.17% | S$7,543.57 | S$41,516.60 |

| Genting Singapore | G13 | Tan Sri Lim Kok Thay | 52.75% | S$6,353.73 | S$12,044.99 |

| OCBC | O39 | Selat (Pte) Ltd | 11.51% | S$5,548.05 | S$48,202.03 |

| Wilmar | F34 | Archer Daniels Midland | 24.89% | S$4,991.86 | S$20,055.70 |

| CityDev | C09 | Kwek Holdings | 48.42% | S$3,640.61 | S$7,518.20 |

| UOL | U14 | Wee Cho Yaw | 35.84% | S$1,860.40 | S$5,190.85 |

| Golden Agri | E5H | Widjaja Family | 50.35% | S$1,667.09 | S$3,311 |

| Yangzijiang | BS6 | Ren Yuanlin | 25.35% | S$1,210.31 | S$4,774.40 |

| Venture | V03 | Wong Ngit Liong | 7.08% | S$296.33 | S$4,185.40 |

| ComfortDelGro | C52 | Blackrock | 6% | S$278.04 | S$4,633.96 |

| SGX | S68 | Public | – | – | S$7,748.12 |

| SPH | T39 | Public | – | – | $3,920.43 |

What if you just invest in Temasek-backed STI stocks?

I used stocks.cafe to do a backtesting on a Temasek-backed portfolio. Here are the rules I used

- Buy all 12 stocks/counters at 100 shares each (min 1 lot rule)

- Buy on 23 Dec 2013 and held till 17 Dec 2018 (approx 5 years)

- No commissions

Below is the portfolio returns vis-a-vis the STI itself. The portfolio outperformed slightly, doing 21% over five years (average 4% per year) compared to STI return of 14%.

Digging deeper into the portfolio components we can draw further insights

- 9 out of 12 made money

- SATS, DBS, Ascendas REIT, CapitaCom, and CapitaMall returned more than 50% (inclusive of dividends) in the past 5 years

- Portfolio did well mainly because of the overweight in DBS (because buying 100 shares of DBS is a large amount) which returned 66%. Underweighting DBS would yield very different results

- The portfolio is yielding a healthy 6.45% per year with stocks in diverse industries

Here’s a screenshot of the portfolio details:

Would you invest in Temasek-backed STI stocks? Share with us!