Today, new age achievers are digital natives who prefer the convenience of accessing information and performing transactions on digital platforms in many aspects of their lives.

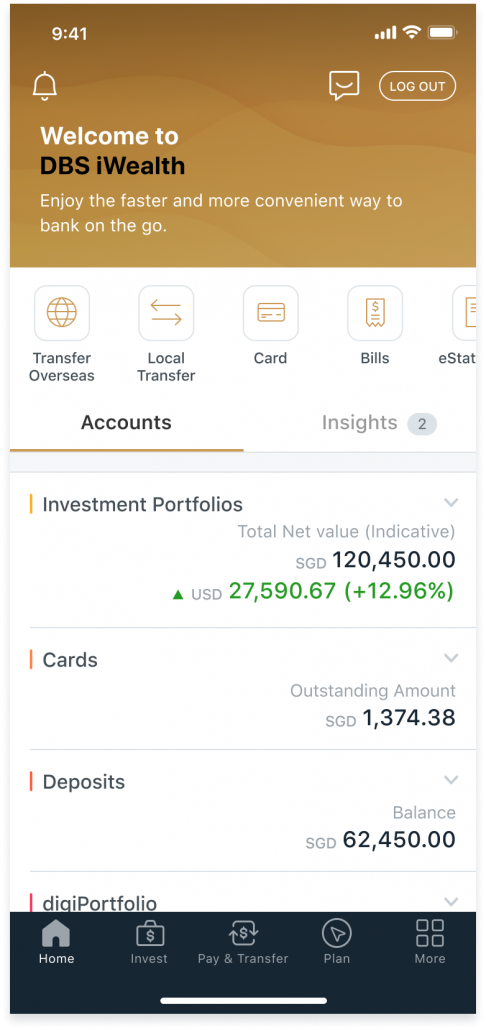

DBS has been ahead of this change in consumer preference. Instead of providing full advisory, their tech-focused solution DBS iWealth relinquish(es) control to its users – users now have the ability manage their wealth on their own terms using digital solutions.

If you are like me who likes having convenience without giving up control, be sure to read about what DBS iWealth can do for you.

Note that the DBS iWealth is offered as part of DBS Treasures and you need a minimum of S$350,000 in investible assets to qualify.

DBS iWealth is a convenient and comprehensive wealth management digital tool

After my experience with many banking apps for personal and corporate banking functions, I personally felt that DBS iWealth is one of the easiest to use.

The most impressive thing about DBS iWealth app is the ability to monitor all your wealth at a glance – cash inflows and outflows, investment portfolio value and more. This is very convenient if you are strapped of time to do up your own spreadsheet to track across multiple accounts. Not to mention you might get a headache piecing statements together. You can now be updated about your wealth at your fingertips without having to do the work!

I observed that DBS has made frequent improvements to their apps, introducing new features regularly over the years. This shows that DBS has devoted resources to keep pace in this new digital world. The DBS iWealth app has won the World’s Best Mobile App for Wealth Management by Cutters 2020 which serves as a testament of their efforts.

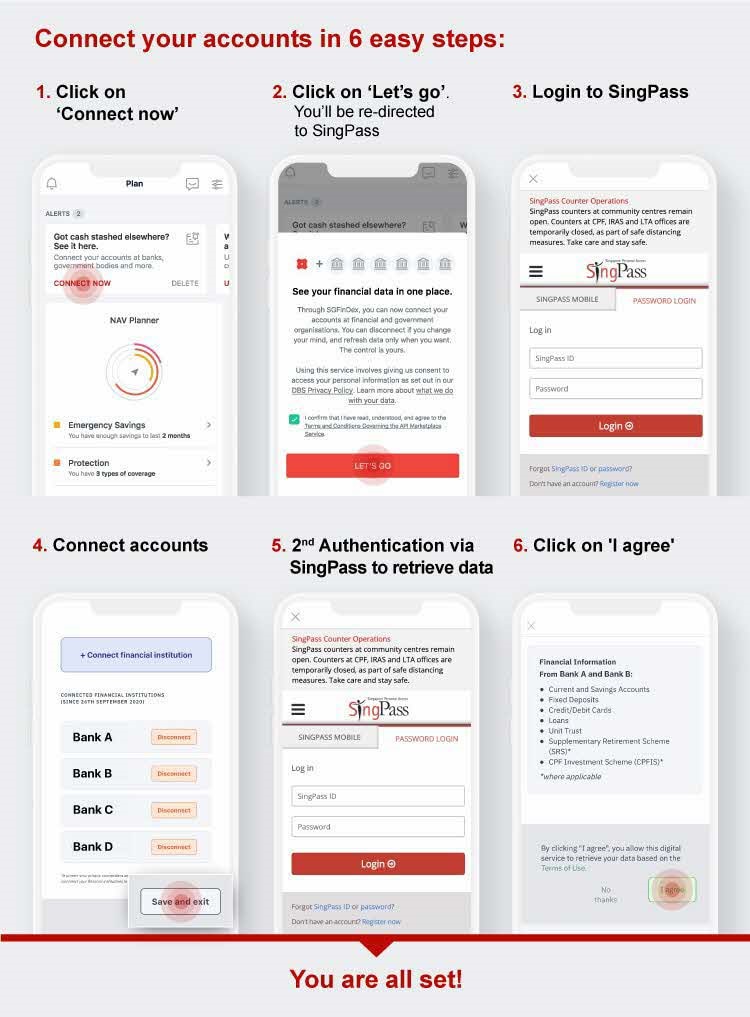

You might have heard of the launch of SGFinDEX, which is a GovTech initiative to enable you to connect all your financial information from CPF, IRAS, HDB and your bank accounts so you get a complete picture of your wealth.

You can do it conveniently via the DBS iWealth app under the NAV Planner function. Below is a simple set of instructions to enable it.

You can now ditch your spreadsheet and use the DBS iWealth app to get a full picture of your wealth without all the manual updates. Moreover, DBS NAV Planner can do more than that, helping you analyze your financial situation – do you have enough emergency savings and protection, are you on track to achieve your retirement needs, and many more. It is that powerful and I like it when the AI could flag out an unusual transaction to me. Try it if you haven’t already.

Growing your wealth with a suite of investment options

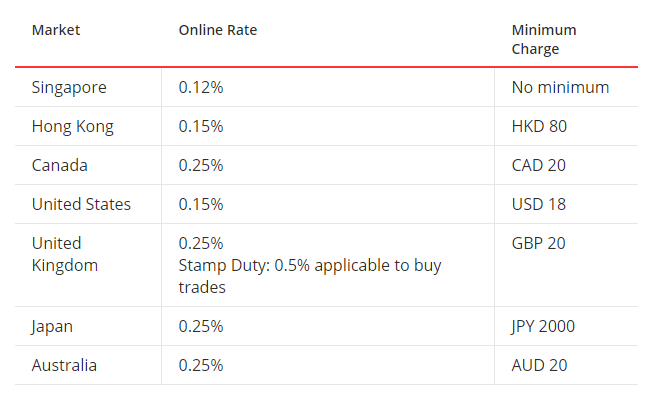

You don’t need to set up a separate brokerage account as DBS iWealth offers online trading for securities listed in 7 countries (Singapore, Hong Kong, USA, Canada, Australia, Japan and the UK).

The brokerage fees are comparable with other competitors. And, there’s no minimum charge for Singapore securities, which is a plus.

Another attractive proposition is that there are many advance order types available on the app and that gives you a lot more control over how you want the orders to be executed.

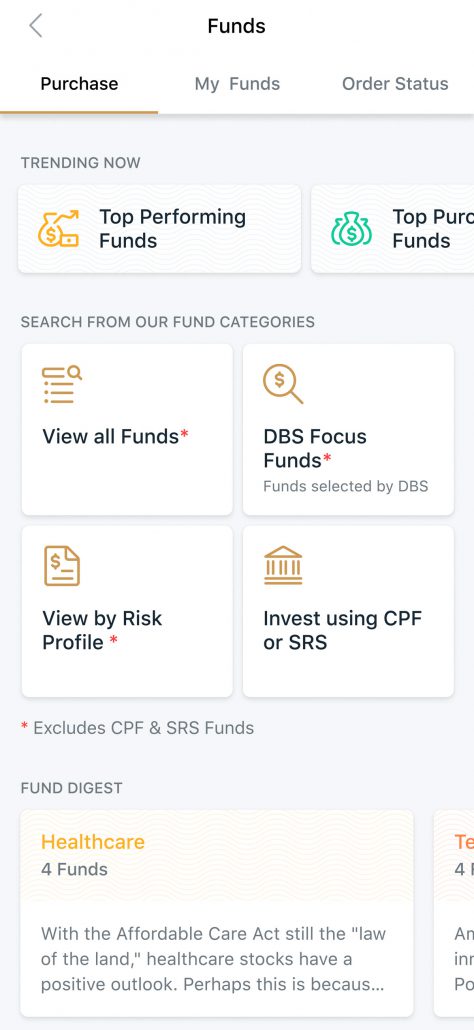

If picking stocks and managing a portfolio of individual counters is too time consuming for you, one alternative option is to invest in funds, or unit trusts, where the underlying investments are readily diversified – funds invest in a large number of securities and may even offer different asset classes. As such, your investments are readily diversified and you would not need to crack your brain to decide which stocks to buy and sell.

You can buy and sell funds easily on the DBS iWealth app. There are over 200 unit trusts available and you can search by asset class (equities, fixed income, balanced etc), geography or fund manager. You would also be able to access more funds via the DBS iWealth which may not be available to a retail customer.

Or, take a look at the DBS Focus Funds – a selection of funds based on the bank’s Chief Investment Office’s outlook for quick ideas on which funds to invest in.

Tapping on DBS’s expertise

If you need some ideas or directions, DBS iWealth provides you with market research and insights from DBS’s research team. The Chief Investment Office provides regular views and updates too.

Personally, I find the industry reports insightful as it is difficult for me to understand industries that I did not have work experience in.

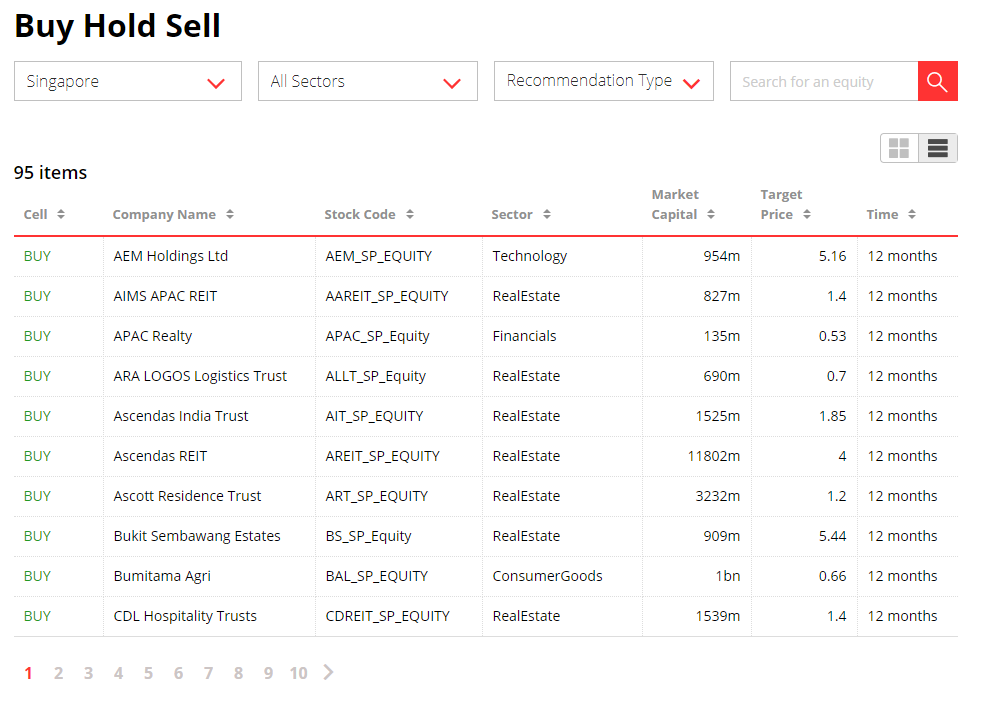

Not to forget the immense range of research on individual stocks which are available only to DBS Treasures clients:

Of course, you can still tap on the expertise and advice of the relationship managers at DBS Treasures. Gone are the days when you would have to make a trip down to meet up in person. These days, with DBS Teleadvisory, you can schedule a virtual meeting in the comfort of your home to meet a DBS Treasures Relationship Manager online. Even the documentation process can be completed conveniently online.

Managing multiple currencies on one platform

In this globalized world we live in, we would love being able to pay, receive, transact, hold and foreign currencies on one platform. DBS iWealth enables you to do just that, in nine major currencies.

In additional piece of good news is that you get preferential rates when using DBS iWealth app to do the forex conversions! That’s what most people want and it really makes a great difference when you are transacting a large amount.

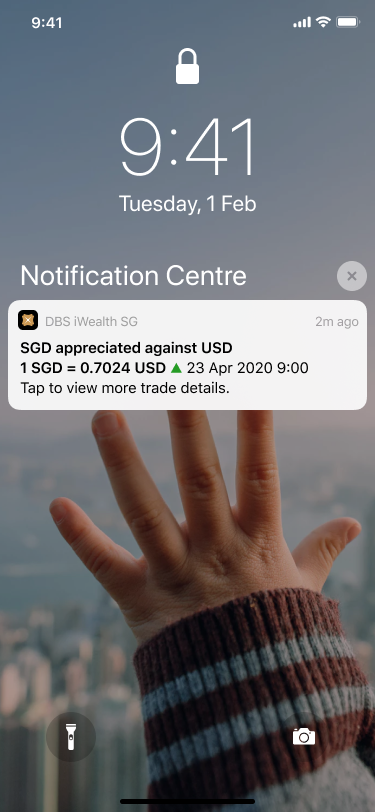

Besides that, DBS iWealth also offers alerts which can be useful for you to respond and take advantage of the volatility in the currency movements, that is based on your portfolio.

For example, if you often trade in SGD/USD, the app would alert you when there are any movements for the same currency pair.

My take

DBS has recognised the trend of digital solutions for wealth management and the DBS iWealth app has been redesigned for the 21st century.

Besides having more control over your wealth options, you also have the convenience of tracking your wealth all in one app, one bank – this is an underrated convenience. Most people have their money spread all over the place – different bank accounts, various brokerages, funds and insurance policies from different firms. More optimisation can be done if you are able to keep on top of your wealth. This problem compounds as your wealth increases. That’s where DBS iWealth comes in to offer a great solution with its comprehensive and convenient digital wealth management app. You can finally have a complete view of your wealth and make better decisions on how to grow it.

This is a sponsored article by DBS but the views belong to the author.