It is no secret that Singapore has one of the lowest income tax rate countries in the world.

But wouldn’t it be better if you could pay even less taxes and save more for the future? After all, a dollar saved is a dollar earned.

“So how?” you might wonder.

Today you will learn a government tax savings program called Supplementary Retirement Scheme. Here, we will cover what is SRS about, how to set it up, how much tax savings can you get and whether is it worth considering it.

So without further ado let’s start!

What is SRS Singapore?

The Supplementary Retirement Scheme (SRS) is a voluntary saving scheme that complements Singaporean’s CPF savings for retirement.

The Scheme is open to everyone living in Singapore. This means that Citizens, Permanent Residents and Foreigners are all allowed to open an SRS account. Other than to increase one’s retirement nest egg, contributing to the SRS account also allows you to reduce your income tax bill.The SRS provides two key tax saving benefits.

- Tax saving benefit on contribution

- Tax saving benefit on withdrawal

How You Can Benefit From Tax Savings Through Contribution & Withdrawal of SRS Funds

#1 Contribution

When you contribute to your SRS account, your chargeable income will be reduced by the amount of your contribution.For example, if you have racked up $120,000 in chargeable income, your income tax bill will be $7,950 based on the progressive income tax rate by IRAS. If you choose to contribute $12,750 to your SRS account, your chargeable income will be reduced to $107,250 ($120,000 – $12,750) and your income tax payable will become $6483.75.

Here are how the numbers look like:

| Without SRS contribution | With $12,750 SRS contribution | |

|---|---|---|

| Chargeable Income | $120,000 | $107,250 |

| Income Tax | $7,950 | $6,483.75 |

| Tax saving | – | $1,466.25 |

Simply by contributing $12,750 to your SRS account, you will be able to reduce your income tax by $1466.25. That is the equivalent to a brand new laptop!

Although it sounds very enticing but please do note that there is a yearly contribution limit to your SRS account.

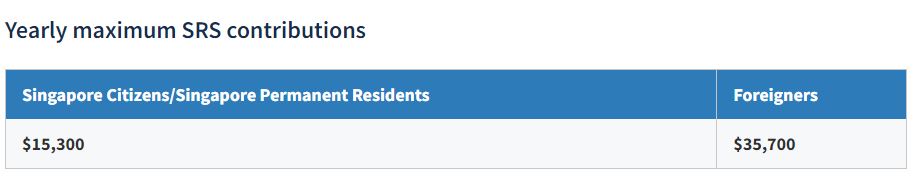

The latest Yearly Maximum SRS contributions are capped at $15,300 per year for Singapore Citizens and Permanent Residents and $35,700 for foreigners:

Image source

#2 Withdrawal

The second tax saving benefit for SRS occurs when you withdraw your money from the SRS account. Only 50% of the amount that you withdraw from your SRS account is taxable if the withdrawal is made after the retirement age (62 years old at the point of writing).

It is also important to take note that the SRS withdrawal can be spread across a maximum of 10 years to enjoy maximum tax saving benefit. (unless you have invested in an Annuity or Endowment Plan, you will then be able to withdraw for more than 10 years)

Below is the example given by IRAS. If you have $400,000 balance in your SRS account, the withdrawal plan and tax payable is as below:

How to Open an SRS Account?

Requirements: What do you need to open your SRS account?

The requirement is straightforward.

- Eligible to all Singaporeans, Permanent Residents (PRs) and foreigners

- At least 18 years old

- Not an undischarged bankrupt, not suffering from mental disorders

- Capable of managing your own affairs.

Who are the SRS operators?

An SRS operator is a bank that’s been approved by the Ministry of Finance to operate SRS accounts for Singaporeans.

You can open an SRS with any of these 3 bank operators:

- DBS Group Holdings (DBS) apply here

- Overseas Chinese Banking Corporation (OCBC) apply here

- United Overseas Bank (UOB) apply here

You can register an account with any of them. It has little difference which bank you choose because you can invest in SRS approved assets from any institutions.

However, do note that you can only have 1 SRS account at any time. Opening an SRS account with multiple bank operators is an offence. You can however, choose to change your bank operator by requesting for a “transfer of account” form from your current bank operator.

Documents to prepare when opening an SRS account

When opening your SRS account, you’ll need to have your Identity Card or Passport on hand. If you’re a foreigner, you’ll need to complete a declaration form which will be provided.

How To Invest Your SRS Funds?

Investing in SGX listed securities like shares, STI ETF and REITs using your SRS funds is easy.

After you have created your SRS account, you just need to approach your stock brokerage to link up your accounts. Buying and selling stocks will be the same as what you would normally do on the online trading platform, except you have to tick the SRS checkbox to indicate your interest.

Additionally, there are a wide range of assets you can invest in.

- Bonds, including Singapore Savings Bonds and Singapore Government Securities

- Stocks and REITs listed on the Singapore Exchange (SGX)

- Unit trusts

- Fixed deposits including foreign currency fixed deposits

- Insurance

- Roboadvisors

- Regular Share Savings (RSS) plans

Remember, you are not restricted to assets or products under your SRS operator. This means you can invest in UOB bonds, even when your SRS account is under DBS.

You can find more details of the above assets at the following SRS Operator’s websites too.

However, do note that the criteria for insurance is more complex. The following restrictions on insurance purchase via SRS were taken from the MOF’s SRS handbook:

- Only single premium products are allowed (including recurrent single premiumproducts, encompassing both annuity and non-annuity plans).

- Life cover (including total and permanent disability benefits) will be capped at 3 times the single premium.

- Plans can allow for a contribution continuation feature/benefit upon disability.

- Other types of life insurance e.g. critical illness, health and long-term care are excluded

- Trust nomination is not allowed for life insurance products purchased using SRS funds

You may find the full details here.

Should You Have a Supplementary Retirement Scheme (SRS) account?

The benefits of an SRS account sounds great right? So should you open a SRS account immediately?

Hold up, there’re a few key considerations you should make before opening your SRS account. Some of these could result in financial drawbacks too:

3 Things To Consider Before Contributing To Your SRS Account

#1. 5% Penalty On Withdrawal Before Retirement Age

The Supplementary Retirement Scheme (SRS) savings are for retirement purposes. You should withdraw the money only after the retirement age. However, if you wish to withdraw the money before retirement age, 100% of the withdrawal amount will be taxable.

In addition, a 5% penalty charge will be imposed to your withdrawal. For instance, if you withdraw your SRS account by $40,000 when you are 61 years old, you will be subjected to additional taxable income of $40,000 and also a $2,000 penalty charge.

Therefore, you must ensure that you have planned for your finances properly before you deciding to contribute to the SRS account.

There are specific circumstances where you are allowed to withdraw your money from the SRS account before retirement age with no penalty charge. Here are some of the common types of withdrawal, table taken from IRAS.

| Type of withdrawal | Amount subject to tax | 5% penalty imposed? |

|---|---|---|

| Withdrawal on or after prescribed retirement age (withdrawal can be spread over 10 years from the date of first penalty-free withdrawal) | 50% of withdrawal sum | No |

| Withdrawal in the form of annuities | 50% of annual stream | No |

| Withdrawal on medical ground (e.g. physical/mental incapacity and partial withdrawal on grounds of terminal illness) | 50% of withdrawal sum | No |

| Withdrawal in full on terminal illness | 50% of full withdrawal sum less exemption* | No |

| In the event of bankruptcy | 100% of withdrawal sum | No |

| Withdrawal in one lump sum by a foreigner (excluding PR)^ | 50% of lump sum | No |

| Early withdrawals before retirement age | 100% of withdrawal sum | Yes |

* From Year of Assessment 2016, a specified amount of SRS funds withdrawn in full on the grounds of terminal illness would be exempt from tax.

^ He/She must have maintained the SRS account for at least 10 years from the date of first contribution and have been a non-Singaporean for a continuous period of 10 years before date of withdrawal.

#2. Direct property investment is not allowed

Currently, IRAS does not provide a list of approved investment products. You will need to check with your SRS operator for the investment instruments that is allowed. Generally, there are not many restrictions on the use of money in the SRS account; you are free to invest in almost any instrument of your choice.

However, direct property investment is strictly not allowed using your SRS funds. If you are planning to purchase a property in the near future, you should not open an SRS account.

#3. You might potentially pay more tax on withdrawal…

The last but the most important point to take note is that you may end up paying more tax if you contribute to your SRS account at wrong time! The concept is pretty easy to comprehend but the calculation can be tedious and complex.

It goes like this.

If you contribute to your SRS account at your early age, your SRS account will grow to a big amount when you are retired. You will receive tax saving benefit from your contribution to SRS account.

However, during the withdrawal period after retirement, you may ended up withdrawing a large amount of money and hence be required to pay the correspondingly high income tax. Even though only 50% of the withdrawal amount is taxable, large sum withdrawals will still put you in an expensive tax bracket.

Therefore, even though the SRS can potentially allow you to save tax, the timing of when you should contribute to SRS account is critical. There is an optimum age when you will benefit the most for contributing to your SRS account. Generally, the optimum age will be around 40-45 years old.

Do note however, that this optimum age vary from person to person. The following factors will affect your optimum age:

- Your age

- Your estimated income growth rate

- Your income tax bracket

- Your estimated investment return

- Your estimated inflation rate

To compute the optimum age is rather difficult, I have developed a calculator just for that. You can download my calculators below.

Quick Conclusion

The Supplementary Retirement Scheme (SRS) will definitely provide you with tax saving benefits. However, it is crucial to know when you should contribute to your account. If not, you might end up paying more tax in the future.

Lastly, you may like to consider the investment options available, after you have deposited money into your SRS account since most cash balance account offer scant interest rates which would not be sufficient to meet the inflation rate.

You definitely would not want your money to lose its value due to inflation after holding it for considerable period.

We hope you find this guide informative, do share it with you friends!

If you need a personalised and trusted financial advice, you can register your interest here.

Hi Louis, thanks for this write up. Clarified quite a few of my doubts but there is one final one that I hope you can shed some light on. If a single premium that I’ve purchased matures (Mature when I’m 80) only after I finished my 10 years drawdown period (start drawdown at 63 till 73) for that matter and it is an amount that is larger than $400,000 , will I still be taxed? By that time, I think the SRS would have already closed. Or the general rule of thumb is that in order to enjoy tax free status, I just have to be sure that my srs account should not exceed $400k in totality regardless of what I invest or buy into.

Hi Adrian,

If not mistaken, you will be taxed as lump sum withdrawal at age 73. The amount of tax will be the equivalent amount of the balance value in your annuity plan.

Hi

is possible to fund my SRS account by cash for tax relief and then use SRS account to purchase regular savings plan ?

Hi Jackson,

Yes. You can either use the SRS savings to purchase Mutual fund for the RSP or use OCBC blue chip investment plan to invest your SRS savings.

https://www.ocbc.com/personal-banking/investments/bluechip.html

Hi, is it possible for me to start saving small amounts like $100 yearly into my SRS, (im 23 this year) so that the eventual sum won’t be so large that I’ll be taxed heavily upon withdrawal?

Hi Louis,

Your article does not factor in the fact that foreigners also have to pay a withholding tax of 22% on the balance in the SRS account upon withdrawal. This piece of information is buried in all the advertising to lure foreigners to open up SRS accounts. I am trying to crunch the math and see if it is still worth using an SRS account but it seems like you would be taxed at 22% on your balance and then also 50% on your withdrawal which makes an SRS account seem pointless despite the claims of operators. Thoughts?

Hi DK,

Your 22% tax is based on 50% of the withdrawal amount. Assuming you have no other income at withdrawal, the effective tax is 11% only on the full withdrawal amount. Do take note that you need to park the SRS amount for 10 years period to qualified for this penalty-free withdrawal.

Refer to here if you need more information: https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Special-tax-schemes/Supplementary-Retirement-Scheme–SRS-/Tax-on-SRS-withdrawal/

Hi Louis,

What is the tax situation for a foreigner who becomes a Singapore tax resident again after a 10 year period, prior to which this foreigner made SRS contributions? Is it right that 50% of the withdrawn amount will be taxed at his now applicable personal income tax rate, which could be lower than the 11%? The withdrawal is also penalty free, I assume, as the 10 year period has passed.

Thank you

Hi Christian,

My understanding is as long as the person is still a foreigner status, and 10 years period has passed since first contribution, the withdrawal is penalty free and based on the personal tax rate at the time of withdrawal.

This is the same as SPR or SC, tax rate is the personal tax rate at the time of withdrawal.

Regards

Louis

I have a friend,sole propritor currently still working.He only contribute cpf medisave. Turning 63 yr old this year .Average annal chargeable income 80k.He hopes to work till 75 yrs so is it good to suggest to him to open srs account for tax saving purpose and also acts an retirement reserve for him? Tks.

Hi Sf,

if your friend is purely looking for tax savings, can consider to top up to SRS. he can withdraw anytime from SRS if need to.

Louis Koay

Hi Louis,

Only 50% of the amount that you withdraw from your SRS account is taxable if the withdrawal is after the retirement age — the tax referred here is only a with holding tax?

Thanks!

Hi Kelly,

the tax here is referring to the withdrawal amount from SRS. the amount that you wihdraw from SRS, 50% of the amount will be added to your income tax. you will then pay the tax according to your income tax rules

Regards

Louis Koay

https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Special-tax-schemes/Supplementary-Retirement-Scheme–SRS-/Tax-on-SRS-withdrawal/

It says:

You can withdraw funds from your SRS account any time. Withdrawals can be made:

a) in cash;

b) in the form of investments (effective 1 Jul 2015).

When you withdraw money or investment from your SRS Account, the withdrawal is subject to tax.

Then

Example 4: Early Withdrawal

Does it mean, if I contribute $15K to SRS at age 40. I have a $15K tax relief.

But, if I also use the same $15K from SRS to invest in a insurance policy, that $15K is now 100% taxable and I need to pay a 5% penalty for early withdrawal?

Hi Michael,

the 15k withdrawal from your insurance is taxable based on your income tax bracket. Example, if you are paying 17% tax on your income, the taxable amount will be 15k x 17%. If you withdraw after age 62, taxable amount is on 50% of the withdrawal amount, in this cash is 15k x 50% x 17%. 5% penalty is only if you withdraw prior to age 62.

Regards

Louis

Hi Louis,

Im a foreigner, if I put my money in to SRS for 10 years, while during these period of times I use them to subscribe unit trust.

If I make some money from this unit trust can I redeem it out? Do I need to pay penalty or tax?

Understand that SRS contribution part need to redeem after 10 years, and 50% of the lump sum will be taxed at the rate of 11%

Hi Kitty,

You have to pay tax and penalty if you withdraw the unit trust gain from SRS account within 10 years. All capital gain, dividend will pay to your SRS account, you should withdraw after 10 years to avoid the 100% tax and penalty.

Thanks

Regards

Louis

Hello Kitty,

Maybe just to clarify your doubts, a foreigner can only enjoy the tax concession of subjecting only 50% of your one time lump-sum withdrawnal to tax at the applicable tax rate provided that you met the following conditions:

i) you are neither a Singapore Citizen nor a Singapore Permanent Residence on the date of withdrawal and for a

continuous period of 10 years preceding the date of withdrawal;

ii) you have maintained your SRS account for a period of not less than 10 years from

the date of your first contribution to your SRS account; and

iii) you make a one-time full withdrawal from your SRS account.

Otherwise, 100% of the sum withdrawn will be subjected to tax at the applicable tax. Also, there will be penalty of 5% imposed for premature withdrawal.

The tax rates will determined by your tax residency status. If you are a foreigner who is working / staying in Singapore for at least 183 days during the year of contribution; or if you continuously worked for the same employer for at least 183 days; or you stayed / worked in Singapore for at least 3 consecutive years; you will be tax progressively similar to a Singapore tax resident tax rates (more information, please refer to the link: https://www.iras.gov.sg/IRASHome/Individuals/Foreigners/Working-out-your-taxes/Tax-Rates-for-Resident-and-Non-Residents/). Otherwise, you will be tax at the Non-resident tax rate of 22% for the SRS withdrawal, and the % of sum withdrawn being chargeable to tax depends on whether you met the conditions as highlighted above.

As forr question on unit trust, the investment return that made in the SRS account is not subjected to tax since any investment return will be deposited back to the SRS account. However, it will only be subjected to tax when you commence withdrawing it. Again, the % amount being subjected to tax depends on the the period you withdraw it and whether are you withdrawing balance in full.

Hi Louis, I have a query.

Suppose I use the srs to buy local stocks or etf like sti etf.

At retirement age, I can withdraw this in the form of investment without having to sell or liquidate the investments.

The problem is between age 62 to 72,the lump sum can continue to grow even I as make withdrawals over 10 years, which means the taxes I will have to pay will also increase between age 62 – 72.

Is my understanding correct?

Thanks Louis, very insightful article. Just wondering and adding on the question that was asked before.

My my friend asked me if he contributed $53,500 to the SRS account a few years back and it grew to $66,000. If he withdraw $66,000 and is under the 14% tax bracket. The net amount that he will get back from the SRS account should he decide to withdraw in full is:

$66,000 – $66,000*5% – $66,000*14%

= $66,000 – $3000 – $9,240

= $53,760

In this case then it is not really worth for him to withdraw now because this amount narrowed the gain to $260.

Are the calculations correct?

Hi CC,

Yes. this is not worth it if your friend wants to withdraw before age 62. cause there is a 5% penalty and full withdrawal amount is taxable.

Your calculation should include tax savings on contribution as well.

Regards

Louis Koay

Hi Louis, you mentioned in the article about a calculator to find the sweet spot for SRS contribution. May I know where I can find it? thank you.

Hi Slwq,

Please get the calculator here:

https://gallery.mailchimp.com/f0a081e58cb412082ef0ebf6f/files/b9a07868-8ece-4933-a897-150df31424c1/SRS_calculator.xlsx

Hi,

Can you clarify what do you mean by total tax savings nominal vs real?

If real is lesser than nominal, means it’s not beneficial for me to contribute srs at max now?

Thanks!

Hi CJ,

If tax savings in real term is negative, then it is not worth to contribute SRS.

Regards

Louis Koay

Hi, I came across a specific situation with respect to SRS withdrwal after retirement age.

IRAS says that we can do a partial withdrawal from SRS as investment ( i.e no no need to sell the investment). So if you have unit trusts or stocks you can apply with the SRS agent bank for partial withdrawal and they will work with the brokerage to do do partial transfer transfer of the unit trust /stock to cash account. This helps when you want to continue with the investment after withdrwal from SRS.

While this is very useful, it does not look like any of the normal unit trust distributors are suppprting this form of partial withdrawal.

Any feed back or suggestion or experience from your side on SRS partial withdrawal as investment.

Rgds

Ram

Hi Ram,

Yes. you can transfer your investment holding from SRS without selling the investment.

Please check with your broker or banker for the actual transfer out procedure.

Regards

Louis Koay

Hi Louis

Is it compulsory to start the withdrawal after the retirement age?

Can one withdraw from age 70 for 10 years?

If there is no withdrawal from the srs account, the balance in the srs account will become part of estate, upon death?

Thank you

Hi Jane,

Yes. You can start the withdrawal anytime after age 62, dont have to be exactly at age 62.

yes. SRS will be part of the estate if death happen. If SRS payout on death, the first 400k payout is tax free. this is the enhancement from IRAS, to be similar to first 400k tax free withdrawal if you spread the withdrawal for 10 years.

Louis Koay

Hey Louis,

Great write up. I am an expat and put my money into SRS OCBC account. Few questions:

1. If I leave the country at some point permanently (while an expat), can SRS account still remain open or I have to compulsory withdraw it? Any penalty for not contributing SRS yearly afterwards?

2. (Assume expat case) If withdrawl is done after 10 years of holding account, what is the tax implication (amount and method – TDS?) for 1) Expat still living in country and 2) Expat left the country more than 1 year ago?

3. Regarding Investments, is Investing into Foreign Equity markets (e.g NYSE) allowed using SRS funds?

4. Regarding Investments, How can one invest in REITS using SRS? Any recommended platforms? (FSM doesnt allow yet)

Thanks,

Peeyush

Hi Peeyush

1) Yes. SRS account can remain open if you leave the country. SRS contribution is on voluntary basis. there is no penalty if you dont contribute.

2) withdrawal after 10 year parking period is taxable at 50% on the withdrawal amount without penalty. Please refer to iras website for SRS withdrawal:

https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Special-tax-schemes/Supplementary-Retirement-Scheme–SRS-/Tax-on-SRS-withdrawal/

3) SRS only can invest in Singapore listed equities or ETFs. You can invest in unit trust for global funds

4) there are many other platforms that can link your SRS to trading and invest in REIT. I am from POEMS, you can drop me a message if you want to open POEMS account and link to your SRS. my email is louis@drwealth.com

Regards

Louis Koay

Hi Louis, say in an ideal case, to avoid paying any tax on SRS withdrawals, should we be working backwards such that by the time we withdraw at age 72 or the 10th year of withdrawal, we left with just nice $40,000 or there about in our SRS account? If so, do you have a calculator for that so that we know when we should ‘stop’ contributing?

Happy to chat more.

Thanks.

Hi zs,

the withdrawal amount during the 10yrs withdrawal period should be equal amount for lower tax, not just 10th year at 40k.

I do have a calculator for projected tax savings. you can get it here. Many assumption are using in this calculator.

https://gallery.mailchimp.com/f0a081e58cb412082ef0ebf6f/files/b9a07868-8ece-4933-a897-150df31424c1/SRS_calculator.xlsx

Hi Louis

Does the three banks factor in, for approval of SRS application, one’s credit bureau rating?

Hi Addison,

According to SRS application criteria:

Who is eligible

You are a Singaporean, Permanent Resident (PR) or foreigner

At least 18 years old and not an undischarged bankrupt

Have no existing SRS Account with another bank

Have no pending SRS Account opening application with another bank

I dont think there is a need to check one’s credit bureau rating

Regards

Louis Koay

Hi Louis,

My understanding is I could start to withdraw my money in SRS account after age 62 ( at present is the retirement age for Singaporean).

If I decide to start withdraw my money at the age of 70, then I will need to withdraw it completely by 80 (maximum allowable time to spread/continually withdraw the money is 10 years).

During the above time from 70 to 80 years old, do I need to or must sell all my SRS shares investment in SGX. Could I sell after 80, and then withdraw the remaining money or pass down as an estate.

Thank you!

Hi Jack,

Yes, you can withdraw from age 70 to 80. you can withdraw as cash or transfer SRS investment to CDP as cash investment, dont have to sell your investment. the remaining amount not withdrawn or transferred by age 80 will be fully withdrawn/transferred at age 80 as the SRS account will close after 10 years.

Regards

Louis Koay

Dear Louis,

Thanks you for your helpful site and page on SRS.

I would be grateful if you could clarify the following.

If one:

1) invests 20 years before retirement age

2) and one’s SRS balance will achieve a meaningful % growth,

I struggle to see that it is a beneficial scheme for me. Spefically, if I contribute $35,700 in 2020, I will save $7,854 in tax (as a 22% tax payer). However if this investment grows to >$71,400 in the next 20 years (which I hope it would) I will be in the same or worse financial position (i.e. 50%*22% tax*$71,400 = $7,854) and I would have had a limited number of investments to choose from and illiquidity for this 20 year period. Am I correct in my understanding?

Many thanks,

Nick

Hi Nick,

Your assumption is that you will still be paying the same tax rate during SRS withdrawal period. Typically when one withdraw from SRS, they should pay lower tax rate as they will have lower income level.

I agree with you that if your investment can perform very well, then you may be better off from not contributing to SRS and do direct investment. There are too many variables here, projected return from investment, income tax bracket, inflation rate to calculate whether it is beneficial for contributing to SRS. but as mentioned above, typically income tax rate at the time of SRS withdrawal will be lower, hence most people will be benefited from SRS contribution.

Regards

Louis Koay

Hi Louis,

I wish to know how much can I withdraw from my SRS account each year in order that my children can still be entitled to claim parental relief in their income tax return for each year.

As I understand, if I have less than S$4000 income he can claim parent relief.

Pls advise.

Thanks

Hi Leong Yee Khan,

assuming no other income, you can withdraw $7999 or lesser in order for your children to claim parental relief.

Please refer to IRAS link for more details:

https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Deductions-for-Individuals/Parent-Relief-/-Handicapped-Parent-Relief/

https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Special-tax-schemes/Supplementary-Retirement-Scheme–SRS-/Tax-on-SRS-withdrawal/

Regards

Louis Koay

Hi Louis,

Great article! Thanks for putting them all together!

I have a question regarding early withdrawal. If I need urgent money and am willing to pay the 5% penalty to withdraw from SRS before the retirement age (e.g. lost of job for a few years), can I make a partial withdrawal, or do I have to withdraw all of them in one go and close the account? You know, maybe I don’t need all of the money at one go.

Thanks,

Jeremy

Hi Jeremy,

Yes. you can choose the amount that you want to withdraw, dont need to withdraw all in one lump sum.

Regards

Louis Koay

Hi Jeremy,

Yes. you can choose the amount that you want to withdraw, dont need to withdraw all in one lump sum.

Regards

Louis Koay

Dear Louis,

Bonds – do note that Singapore Savings Bonds are not allowed at the moment is incorrect. SRS can be used to purchase SSB. Refer to https://www.mas.gov.sg/bonds-and-bills/investing-in-singapore-savings-bonds/how-to-buy