SPH (SGX:T39) is going to be replaced by Mapletree Industrial Trust as a Straits Times Index (STI) constituent on 22 Jun 2020.

Two years ago, I speculated that SPH could be kicked out of the STI,

As the index is weighted by traded market-cap, a declining share price would reduce the market cap further. Dropping out of the Index is a possibility and with its recent fluctuations, that seems more likely now than ever before.

Currently at 30th place is Starhub. It has $4.5 billion market capitalisation.

After the recent price decline, SPH’s market cap is about $4.3 billion. It would be interesting to see what happens in the next STI review in end Sep 2017.

I was expecting it to be earlier but it took almost 2 years for this to happen. Most people could see it coming as the writing was already on the wall.

Yue Sin has previously analysed the situation at SPH and it wasn’t pretty.

It is clear that their core media business is becoming less relevant and financial performance is deteriorating. To offset losses from media, they made a pivot into the property segment to generate a stable and recurring source of cash flow.

If you look at the history of many companies, a capital outflow to other non-core business is a sign of a crumbling business. They are pumping air into a lifebuoy now and this lifebuoy is property. But are all these properties doing well? That is a crucial question to ask since this lifebuoy determines whether SPH survives or drowns.

Enough of bashing. I wanted to see if the market is too pessimistic about SPH because of all these known bad news. Could SPH be beaten down too much that it becomes an undervalued play?

Index Funds Have To Sell S$63.5m Worth of SPH Shares

SPDR STI ETF (SGX:ES3) and Nikko AM STI ETF (SGX:G3B) held S$51.6m (on 16 Jun 2020) and S$11.9m (15 Jun 2020) worth of SPH shares respectively.

As index trackers, the funds are obliged to sell SPH when it gets off the STI list.

In fact, SPH had a similar event on 29 May 2020. You can see the spike in transaction volume from the chart below. This was due to the removal of SPH from MSCI Singapore on that day. The share price tanked 12% from the previous day, which I assumed some institutions had to sell SPH and had to dump the shares cheaper to draw the buyers in.

The transacted value on 29 May 2020 was at least $263m. And if we do a simple proportionate calculation, SPH share price might drop another 2.9% on 22 Jun 2020 when the index funds make their exits.

What’s the fate of the stocks after they exited STI

Let’s look at the performance of some stocks that were removed from the STI.

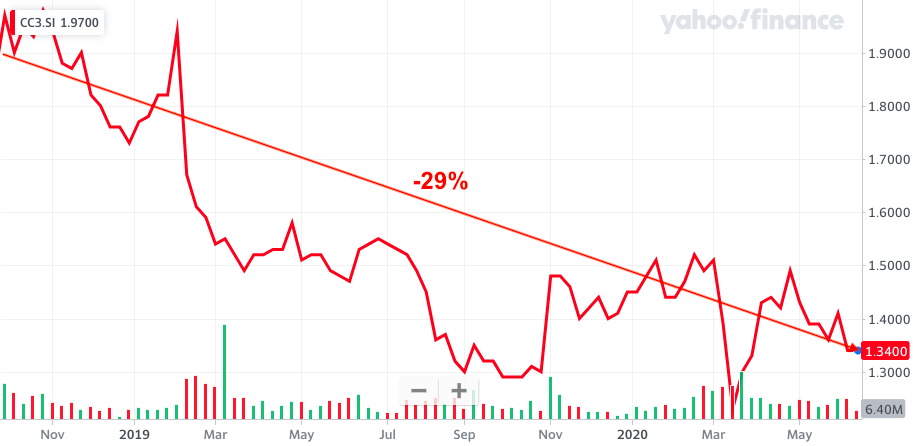

Starhub (SGX:CC3) was removed from the STI on 28 Sep 2018 and the share price has declined by 29% since then.

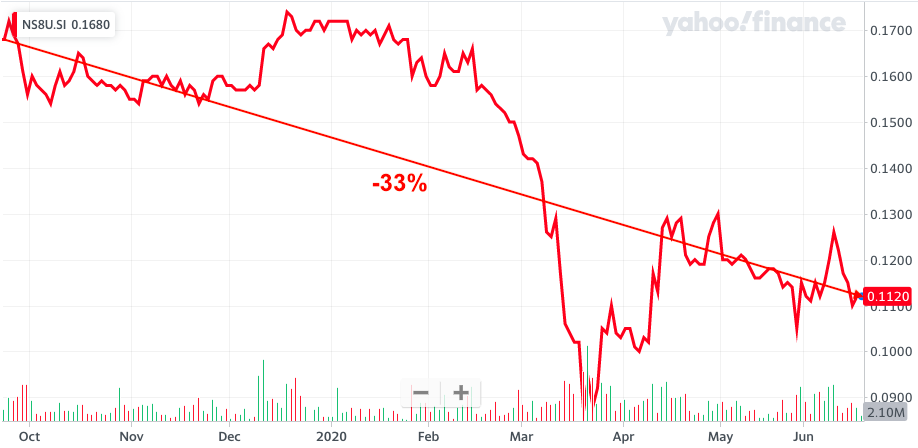

Hutchison Port Holdings Trust (SGX:NS8U) was removed from the STI on 23 Sep 2019 and the share price has declined 33% since then.

Golden Agri (SGX:E5H) was removed from the STI on 23 Dec 2019 and the share price has declined 28% since then.

The odds don’t look good for SPH but we have to understand that each business has its own set of problems. Hence, their performance may not be reflective of the fate of SPH after it exited STI. One core difference is that SPH’s property business is doing fine while these businesses had nothing else to rely upon once their core business underperformed.

SPH is priced at its property values, media business is free

72% of SPH assets are in properties. Singapore Property Holdings would be an apt name.

The media business is the declining segment while other investments (not properties) contribute relatively small revenue to SPH.

Hence, let’s strip out these business assets and just focus on the properties and cash to adjust for SPH’s book value.

| SPH | Value ($’000) |

| Investment Properties | 5,014,896 |

| + Land & Building | 131,971 |

| + Cash | 554,435 |

| – Total Liabilities | 2,400,242 |

| – Non-controlling Interest | 1,068,180 |

| – Perpetual securities | 150,512 |

| = Adjusted Book Value | 2,082,368 |

| / number of shares | 1,611,865 |

| Adjusted Book Value per share | $1.29 |

| Share price | $1.37 |

| Price / Adjusted Book Value | 1.1 |

With a price/adjusted book value of 1.1, we can say that SPH is priced closed to the valuation of the properties they own.

The media business is actually making profits (S$55m) although it has declined over the years. Hence, it should worth more than zero.

In other words, you pay for the properties at fair value and get the media business for free.

What I think would happen to SPH

I expect the market to exhibit more pessimism for SPH and the share price may go down further. But at the same time I believe that there is limited room for the downside because the property values are acting as an anchor to its valuation. If we discount the value of the properties by 30%, SPH should still trade around $0.90. I would think that this price would make SPH an undervalued play due to an overextended pessimism.

I don’t think SPH will shed the media business because it is still profitable and journalism plays an important role in society. But I am not confident they can turn it around. It would operate like a public good with breakeven revenue.

The dividend yield of SPH should still be decent at 5% (share price ~$1) even from the property business alone. This is because SPH REIT provides a DPU of 5.6 cents and moreover, SPH has properties other than those held by the REIT that could generate rental yields too.

SPH would be a value stock but not a growth stock. Investors who like to buy future growth would give this a miss. Value stocks require catalysts to realise their value. Earnings turnaround is possible but very remote for SPH case. Special situations such as spinning off another REIT (nursing homes) or large merger and acquisition events are more likely to be value unlocking catalysts.

You need to strip out the S$452m in perpetual securities before arriving at your final adjusted book value.

Thanks for pointing out! But I see $150.512m only. not $452m

Hi

Is it also good to consider the amount of %SPH Reit it owns + Cash it has to conclude whether SPH is undervalued?

i.e

SPH owns 65% of SPH Reit (think is 69%-70% but let’s take 65% as it is more conservative)

SPH Reit current market capitalisation – 2.4bil

SPH own 65% so in theory if it liquidate SPH Reit, it gets 1.56bil

SPH also has 0.55bil cash in hand

SPH issued 1.616bil shares

The ownership of SPH Reit + Cash = 1.30 per share

That’s to say, lessing off liabilities.. the balance PBSA, nursing home, media, telco investment etc. are free at current share price 1.33

If any of the above assumption/evaluation is wrong please correct me..

The thinking is largely there but i would prefer to look at the balance sheet to do up the calculation. The major missing item is the total liabilities you need to deduct.

The profits of SPH media dept can improve provided the management is willing to cut cost. The media business simply has too many staffs and high overhead that is based on the old business model where the media business was very big, now the media business has shrunk, SPH should cut cost…