Today we are going to cover an asset class that not many Singaporean knows about.

They are not stocks, not REITs, and definitely not your typical savings accounts that pay 0.5% interest rate -.-.

They are bonds.

Today you will learn what retail bonds are about, and how you could use it to diversify your investment and achieve a stress-free predictable return.

Previously, we have also wrote about Singapore Government Securities and Singapore Savings Bonds.

So let’s begin!

What Are Bonds

#1. Bonds Are Debt

Companies can raise capital in a number of ways.

They could go to the market to sell more shares and use the new capital to fund expansion. Imagine I am a farmer raising pigs for Parma ham, and I need capital to expand and to buy a thousand more hogs.

I could approach interested parties Mario and Luigi and say to them if you were to invest some money, I would make you a shareholder and together we would own a much larger company that would conquer the market for ham and share out the profits.

On the other hand, I could also approach both of them and say that I am selling bonds that pay a 5% coupon rate. Essentially what I am doing is borrowing money from them and paying out five percent per annum in interest. I will repay the principal amount at a predetermined maturity date. It is a debt that I am taking on, very much like going to the banks for a loan.

Unlike companies, governments are not able to sell shares in their country hence they take to the bond market to raise money. In fact, and no surprises here, the US government is the biggest issuer of bonds in the world, while the Chinese government is the biggest foreign purchaser of US debt.

Once again, when someone purchases a bond, he is in fact lending money to the issuer.

#2. Bonds are tradeable

Assuming Mario and Luigi both purchased $10000 worth of the bonds I’ve issued. One day, Mario decides he needs his money back to buy a new car. What he could do is to sell this bond to Luigi, or anyone who is willing to purchase the bond, for that matter. Effectively now, I no longer owe Mario a debt but this obligation is transferred to the purchaser of the bond from Mario, and upon maturity I would have to repay the principal amount to the new lender.

In the local context, retails bonds are traded over SGX and most brokers should be able to facilitate your buying and selling. Alvin has written an excellent article on how to purchase Singapore Government Securities here. However, for both instruments, liquidity and volume can be found wanting.

Bonds are traded much more in the US markets, and the easiest way to be exposed to bonds would be to purchase it through an exchange traded fund. These funds, through their basket of holdings attempt to replicate the performance of actual bonds.

A fund that we like and have been following for a while is the ishares Barclay 20+ years treasury bond fund (ticker TLT). The fund tracks US treasury bonds that have more than twenty years to expiry and is a good bond proxy for your portfolio. Once again, a brokerage account that allows you to trade the US market will suffice and allow you to trade TLT like any other counter.

#3. Bonds Have Yield

Stocks pay dividends and bonds pay coupon. Unlike stocks where the dividend depends on the company’s performance over the past year and is decided by the board, bond coupon rates are a percentage of face value and are fixed. What changes is the yield. Imagine Mario having a tough time selling his bond or finding someone to take over his loan at his purchase price of $10000. The only interested buyer is willing to pay $8000 for it and Mario caves in.

Consequently he receives a coupon rate of $500 ($10000 x 5%) yearly and that for him, equates to a 6.25% return on his purchase price.

Bond price is a function of creditworthiness. An organisation that is deemed safe and able to repay its obligations would be able to finance its debt at a lower cost than one that is doubtful or even on the verge of a default. Hence, the Greek government, in the face of the country’s woes, would have to promise lenders a substantial amount before they are willing to part with their money. At the height of the crisis, Greek government 10Y bonds were trading at 41.8% yield!

Price is also a function of interest rates. If I had purchased bonds at 5% coupon, my returns would be 5% per annum fixed. Assuming interest rates have skyrocketed to 10% since then and the public can now easily achieve that amount through a fixed deposit investment. The only way for me to interest others to purchase my holdings would be to match the yield. ie. lower the price. Hence, bond prices decrease when interest rates increase.

#4. Bond Prices Move

A popular misconception is that bonds prices move as much and as fast as one’s nails can grow – not very much at all. To dispel that, here is the chart of TLT over the past five years. The returns are hardly to be sniffed at.

#5. Bonds Balance Out Your Portfolio

Followers of Dr Wealth would know that we are firm advocators of the Permanent Portfolio. One of the basic tenets of PP is that money flows around in a closed loop around the financial markets, and the asset class that sees the most inflow of capital will see the greatest price increase.

Over the past five years, TLT has returned 34% as opposed to the S&P500’s negative four percent. And interestingly, during the financial crisis in 08/09, bond prices spiked and increased by more than 25% as the equity market crashed. If you had a portion of your portfolio in bonds, you would have weathered out the storm and still be out ahead.

Why Invest In Corporate Bonds?

Pros | Cons |

|---|---|

Fixed coupon rate | Illiquid |

Low volatility | Interest rate risks |

Low risk | |

Credit rating |

Pros

Fixed coupon rate — Bonds pay a fixed interest, also known as coupon to investors during the holding period. Upon maturity holders can redeem the full principal amount. This is unlike stocks whereby dividends are not guaranteed and stock prices can fall below what the investors initially invested.

Low volatility — Bonds are also known for their low volatility as compared to stocks. Investors should not expect to profit through bonds trading since the price movement is limited.

Low risk — Unlike stockholders, bondholders have higher priority to the claim on assets in the event of insolvency. They are also less risky because investors can redeem at par value even when the bond prices collapse.

Credit rating — Before a company issues a bond they will be required to be assessed by a credit rating agency to determine their creditworthiness. The credit rating gives investors a barometer to know the investment risks they are taking.

Cons

Illiquid — Bonds are not popular among Singaporean as compared to stock and property, and hence investors have to keep in mind of time horizontal because short term selling can be a difficult.

Interest rate risks — Bonds prices are susceptible to the government interest rate. They move inversely. When interest rate goes up, bond prices will go down to compensate for the lower yield. Likewise when the interest rate goes down, bond prices will increase to recognise the higher yield of existing bonds.

How To Read Bond Quotation on SGX

Here we will discuss how to decode the bond names.

Quotation for Corporate Bonds

Example: CapMallTrb3.08%210220

- CapMallTrb -> Issuer CapitaMall Trust Management

- 3.08% -> Coupon rate is 3.08%

- 210220 -> Maturity Date is 20/02/2021

1 lot = 1000 units, hence price = $1.03 x 1000 units = $1030 for 1 lot

Singapore Average Retail Bonds Coupon Rate

Singapore’s retail bond market is rather small. At the point of writing, there are only 14 bonds trading. You can view the latest on SGX here.

Refer to ‘Board Lot’ to determine the minimum lot size of each retail bond. For example, in the table above buying one lot of Astrea IV (6AZB) bonds would cost $1,026 (1,000 * $1.026).

The coupon rate ranges between 3% and 6%.

Take note that KrisEnergy is a zero coupon bond. That means it does not pay annual interest to bondholders. However, it is traded below the par value of $1,000 and bond holders are rewarded by the difference between purchasing price and par value upon maturity.

How To Buy Corporate & Retail Bonds On SGX

Not many people know that retail government and corporate bonds have been available on the Singapore Stock Exchange (SGX) since July 2011.

Purchasing bonds is easy, the process is just like how you normally buy any other stocks though a stock brokerage platform, and your SGX CDP will reflect the numbers of bonds you purchase. Here are two main types of bonds you have to know before starting your bond investment.

#1 Government Issued Bonds

Singapore Government Securities (SGS) is issued by Monetary Authority of Singapore (MAS) on behalf of the Singapore Government. They come in the form of:

- Treasury Bills (T-Bills) which mature in less than one year

- SGS Bonds with maturities of 2, 5, 10, 15 and 20 years or

- Singapore Savings Bonds (SSBs) which can be bought in smaller quantities and come with a maturity of 10 years.

T bills and SSBs can be bought through ATM, while you can trade SGS bonds of 2 years and above maturity on SGX. SGS bonds at this moment are AAA rated by S&P, the highest rating available. All SGS bonds pay coupons semi-annually.

#2 Corporate Issued Bonds

Are bonds issued by either statutory boards like Jurong Town Corporation (JTC) or companies such as SIA. Statutory board bonds can be considered almost similar grade to government bonds as the boards are actually government bodies.

Companies such as SIA and F&N though are private/public listed companies which have to evaluated on their business performance and ability to service debt.

3 Singapore Bond ETFs

You can invest in bond ETFs to gain exposure to the fixed income market, and benefit from the diversification, cost-effective and passive income. Something which many retail investors are unable to achieve given the resources needed.

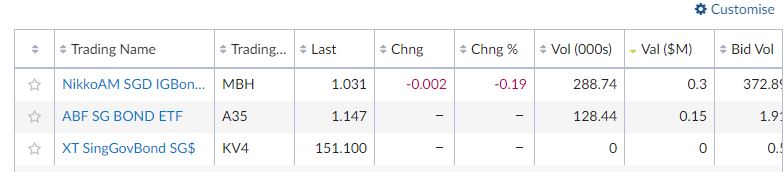

There are 3 Singapore bond ETFs trading on the SGX as of Nov 2021:

Source taken from SGX

ABF Singapore Bond Index Fund — This ETF was created by NikkoAM, the same company that created by Nikko AM STI ETF. The ETF holds a basket of bonds issued by Singapore government and quasi-Singapore government entities. Their 5-year annualised return is 2% and they have the highest credit rating of triple-A signifying high creditworthiness i.e risk low, low reward.

NikkoAM SGD Investment Grade Corporate Bond ETF — Another ETF managed by NikkoAM, this ETF holds high quality Singapore dollar investment grade corporate bonds. It aims to replicate the performance of the iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index. This is relatively new having listed in Aug 2018, its 3 year annualised return is 3.86%.

XT SingGovBond SG$ ETF — Managed by Deutsche Asset Management Limited, this ETF holds a basket of Singapore government bonds, it aims to reflect the performance of Singapore government bonds in the long run. Their 5-year annualised return is 1.68%

Singapore Bonds Essential Terms

Government bonds: bonds that are issued by government. The securities with 1 year maturity are usually known as treasury bills. Most government bonds are rated by credit rating agencies. Not all government bonds are investment grades.

Corporate bonds: bonds that are issued by corporations or companies to raise funds for their business operations. These usually carry more risks and hence their interest rates are usually higher. Some of the corporate bonds are not rated and bond investors would need to carry out their own assessments.

Perpetual bonds: bonds with no maturity date. The issuer does not have to redeem the bond, investors can choose to sell these bonds in the secondary market.

Callable Bonds: type of bond that can be redeemed by its issuer before its maturity date. Issuers are more likely to call their bonds when the bank interest rates are low in order to refinance their debt at a lower rate of interest.

Bond prices: Bond prices are used in the secondary market, they can be affected many factors such as interest rates, credit rating of the issuer, accrued interest, and demand and supply.

Secondary market: where bonds can be traded – a bondholder can sell it to another buyer before the maturity.

Face value or par value: underlying value of a bond. Upon maturity, bondholders are paid the face value of the bond.

Coupon rate: interest rate payout of the bond, usually presented as a percentage of the face or par value.

Yield to maturity (YTM) is used interchangeably with ‘book yield’ or ‘redemption yield’. It refers to the annual returns for the investor from the point of purchase to the maturity date of the bond. This happens when the bond price you have paid for is different from the par value. Your yield is not equivalent to the coupon rate anymore.

Current yield: annual income of the bond divided by the current price of the bond. It is used to calculate the return of a bond in the condition that the investor buys and sells the bond before its maturity.

Yield to Call: Only applicable to callable bonds. Refers to the yield of a callable bond on the call date.

Clean Price: reflects the current price of the bond with the discounted future cash flows taken into account.

Dirty Price: reflects the clean price of a bond plus accrued interest, which is interest that has been accumulated since the last coupon payout. Bond prices in Singapore’s secondary market are reflected as dirty price. Dirty price of a bond increases as the next coupon payout date draws near.

Conclusion

We hope this guide has given you a fundamental understanding of Singapore Retail Bonds, and Singapore Government Bonds.

Although most investors do not talk about bonds, you should know that they can play an important role in building a balanced portfolio. Bond prices tend to surge when inflation is low (or when it feels like the stock markets are crashing), hence they could cushion your portfolio from major fluctuations in the stock market.

To learn more about building a balanced portfolio that lets you sleep soundly at night, join us at our Personal Finance Masterclass.

Hi,

Understood from your online article that you are able to achieve 10 to 15% annual return on bond investment. I am not sure how can this be done based on today’s environment.

Would you be please elaborate?

Looking forward to hearing from you.

Rgds,

Oliver

You have been mistaken. We were referring to stocks using factor based investing methods.

Hi admin,

I have a question, could you please enlighten me.

Mr X purchased bond A at issue price of $1 face value for 10,000 units (total invested amount is $10,000), if the interest rate increases from 5% to 10% and the bonds price drops. And Mr X sells his bonds to Mr Y on exchange for $0.80 (total $8,000) loosing $2,000. And when the bonds matured. Will Mr Y gets back $8,000 or $10,000 (which Mr Y pays initially)?

Best Regards

Chee Leong

He gets back $10,000 at maturity

Can you recommend 1 to 2 good yield and stable corporate bond? what are the charges?

How do I know the par value of a bond and whether coupon is annual or semi-annual?

I find that bondsupermart provides quite useful information. For examples of a retail bond listed on the SGX: https://www.bondsupermart.com/main/bond-info/bond-factsheet/SG31A4000007

Do all bonds issued in SG described as non cumulative? Are there coporate issuers who were not able to pay bond interest income for a period or several periods? How reliable are the bond issued on a non cumulative basis when they pay the semi annual interest?

Do we pay commission on the repayment of principal (at maturity) for retail bonds bought on SGX?

Successfully subscribed to SIA 3.03% bond in March 2019. Coupons (interest earned) not due till 28 Sept 2019. If I were to sell now, can I still earn the 3.03% at a pro rated rate on the time I held the bonds before selling?

i have unrated bonds, they are on Bloomberg and available they have a insurance wrap that is A rated, to cover principal and interest, I want to sell the bonds maturity is 2022