Sea Ltd announced their earnings on 1st Mar 2022. Initial premarket prices rose by 9%, but minutes later, Sea’s share price fell by 20%! We explore why:

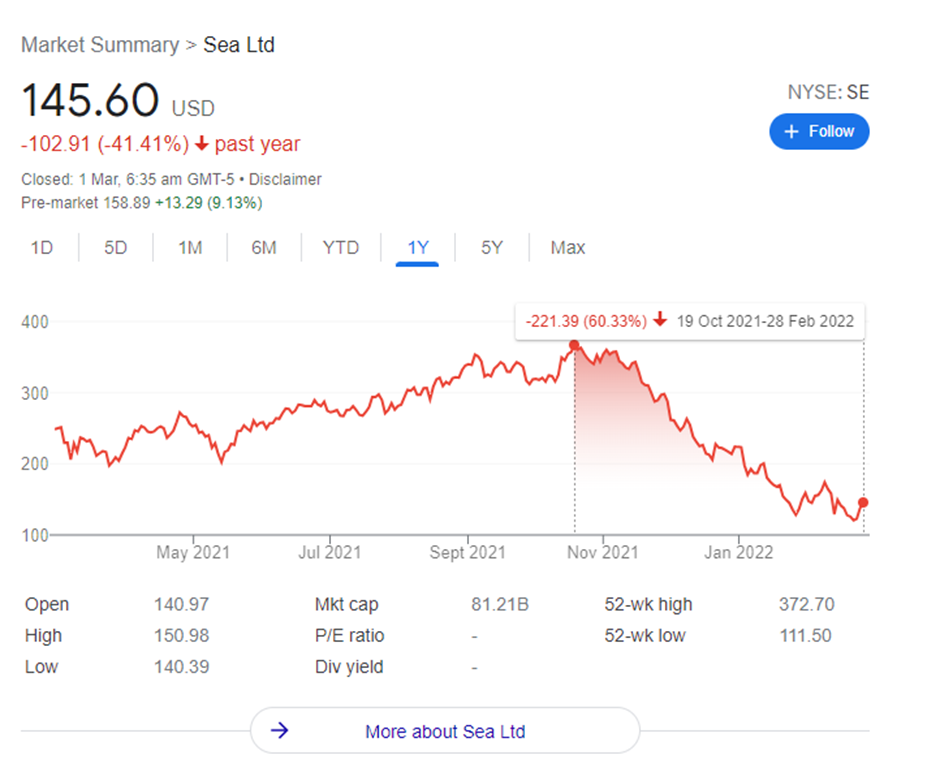

Sea Ltd (Sea) (NYSE:SE) has seen one of the most spectacular declines since it raised $6.3 billion in a share and convertible bond sale in Southeast Asia’s largest ever capital raising in September 2021. The capital raising consisted of 11 million shares priced at $318 and a $2.5 billion aggregate principal amount of convertible senior notes due 2026 at 0.25%. The conversion price of the note is approximately $477 per share.

The capital raising was done at a small discount to the last traded price and share price actually went up to a high of $372 in late October 2021 before it started its decline.

Two major events that impacted SEA

The broader tech sector faced declines due to concerns over slowing growth and a lack of profitability for some tech stocks, and with Sea fitting the bill for most of these concerns, it was clear that Sea’s share price would take a hit. In addition, Sea’s share price decline was exacerbated by the following two events that were idiosyncratic to the company:

1) On 4 January 2022, Tencent announced that it would sell 14.5 million shares in Sea Ltd at $208 each for a total of US$3 billion, reducing its stake from 21.3% to 18.7%. This was less than two weeks after Tencent distributed nearly 15% of JD.COM, reducing its take from 17.0% to 2.3% which led to market concerns that Tencent was abandoning Sea Ltd and its strategic partnership agreements. While such fears was allayed by both companies, the share price continued to decline.

2) On 14 February 2022, the Indian government announced a ban on Garena’s Free Fire along with more than 50 other apps with apparent links to China. The news of the ban came as a surprise to Garena’s team in India as the team was chasing deals with tournament organizations to further promote its game and attract more users and high-profile gamers in the country.

With the stock in the doldrums, we review its FY2021 results that was published on 1 March 2022 to identify any positives which could lead the stock into a turnaround and any negatives which may cause the stock to continue on its downtrend.

Summary of SEA’s financial results

Financials in US’m

| Dec’21 | Sep’21 | Jun’21 | Mar’21 | Dec’20 | Variance (%) | Variance (%) | |

| Earnings Per Share (EPS) in US’$ | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q’20 | 4Q21 vs 3Q21 | 4Q21 vs 4Q20 |

| Digital Entertainment revenue | 1,415 | 1,099 | 1,024 | 781 | 693 | 29% | 104% |

| E-commerce and other services revenue | 1,482 | 1,310 | 1,000 | 772 | 656 | 13% | 126% |

| Sales of goods | 324 | 280 | 256 | 210 | 217 | 16% | 49% |

| Total revenue | 3,221 | 2,689 | 2,280 | 1,763 | 1,566 | 20% | 106% |

| Net loss | (616) | (571) | (434) | (422) | (525) | (8%) | (17%) |

| EPS/(Loss per share) | (1.12) | (0.98) | (0.82) | (0.82) | (1.06) | (14%) | (6%) |

| Adjusted EBITDA for Digital entertainment | 603 | 715 | 741 | 717 | 664 | (16%) | (9%) |

| Adjusted EBITDA for E-commerce | (878) | (683) | (580) | (413) | (427) | (29%) | (106%) |

| Adjusted EBITDA for Digital financial services | (150) | (159) | (155) | (153) | (171) | 6% | 12% |

| Adjusted EBITDA for Other services | (57) | (32) | (23) | (58) | (13) | (78%) | (338%) |

Sea delivered strong 4Q21 results to close out FY21, with both 4Q21’s revenue and EPS beating analyst expectations by 7% and 3% respectively. 4Q21’s total revenue was 20% higher QoQ and 106% higher YoY.

All segments performed well with the Digital entertainment segment being the strongest segment on a QoQ basis while the E-commerce segment was the strongest segment on a YoY basis.

- The digital entertainment segment grew active users to 654 million, an increase of 7.1% YoY and average bookings per user was stable at $1.7.

- The e-commerce segment saw a GMV of $18.2 billion, a 52.7% YoY increase, with Shopee Brazil recording a 326% YoY growth in revenue to $70 million. Shopee also continued to rank first in certain categories in Southeast Asia, Taiwan and Brazil.

Due to its focus on expansion, all segments recorded poorer EBITDA results. On a YoY basis, Sales and marketing expenses increased 109.2%, This was primarily due to higher online marketing and content costs for Digital entertainment and marketing incentives and online marketing costs for E-commerce.

General and administrative expenses increased 68.2% due to higher staff compensation and increased staff to support business growth. Similarly, Research and development expenses increased 135.1% primarily due to the increase in its staff force.

2022 revenue guidance & uncertainty

Sea provided a 2022 guidance forecasting a 30% revenue growth. However the forecast is mixed with expectations of headwinds in the digital entertainment segment leading to a revenue decline due to unanticipated government actions in India over the game Free Fire and also impact from reopening leading to moderations in online activities and poorer user engagement.

Sea provided a forecasted 75.7% YoY growth for the e-commerce segment which attests to its strong performance in incumbent markets and its expected growth in Latin America.

Lastly, Sea expects a 155.4% growth for the digital financial services segment as Sea continues to leverage its flywheel effect, pulling users into its SeaMoney platform.

2022 and forward profitability guidance

Sea expects Shopee to achieve positive adjusted EBITDA before HQ costs allocation in Southeast Asia and Taiwan by 2022 and SeaMoney to achieve positive cashflow by 2023.

Sea also believes that by 2025, cash generated by Shopee and SeaMoney collectively will enable these two businesses to substantially self-fund their long-term growth.

2 Positive takeaways

1) Shopee is growing rapidly

It is deepening its engagement with users and expanding its total addressable market. It is in two of the world’s fastest growing regions, namely South East Asia and Latin America. In Latin America, it has entered countries such as Mexico, Colombia, Chile and Brazil and It has been taking market share from major competitors with the Shopee e-commerce app becoming the #1 e-commerce app in Latin America.

Its websites have also seen a meteoric rise in traffic and is on track to garner significant market share.

In Asia, Shopee already has a stronghold in countries such as Singapore, Taiwan, Vietnam, Philippines, Thailand and Indonesia and has either the number one or number two spot in most of these countries.

2) Progress in its digital financial services is going well

In Indonesia, which has the most comprehensive set of products and services among its markets, over 20% of the active users have used multiple SeaMoney products or services in the fourth quarter. This is a positive indicator of the flywheel effect as it provides new offerings to its large and fast-growing user base on the Shopee and SeaMoney platforms, which are both highly synergistic with one another and will enable in the scaling of each other’s platform.

In addition, Sea was awarded one of 2 digital full bank license in December 2020 and it is anticipated that Sea’s digital bank in Singapore will serve as a regional base for Sea’s digital banking operations. Sea also acquired Jakarta-based lender, Bank BKE as part of its expansion into this segment.

While the digital bank is expected to turn operational in 2022, they are expected to burn cash in the first 2 years. Nevertheless this could be a major catalyst for the stock as this could allow Sea to build a foundation and subsequently a foothold in a segment that is clearly its smallest but also with one of the biggest potential.

3 Negative Takeaways

1) Over dependence on Garena

Sea is still overly dependent on Garena, its only profitable business, and is expecting greater cash burn. Sea expects its e-commerce and digital financial segments to be loss making on an overall basis at least until 2024. Although Sea has about $10.8 billion of cash on hand now, with Sea aggressively expanding Shopee and expecting cash burn for its digital bank, Sea may have to find further funding in future years.

2) Digital entertainment will take a hit

The Digital entertainment segment is expect to see revenue decline YoY because of a ban on Free Fire in India and also because of reopening of many economies as countries exit the pandemic. While it has been estimated that India comprises about 10% to 15% of the global Free Fire user base, it is estimated to contribute less than 5% of Garena’s global revenue. As Garena is about 40% of Sea’s revenue, the impact on Sea’s revenue is estimated at 2%. It is also worth noting that as Garena is the only profitable segment, any hit to its revenue would mean a direct hit to the bottomline.

3) Shopee still burning cash

Shopee has been expanding aggressively and burning significant levels of cash. It has expanded into many regions outside of Southeast Asia where it does not have a stronghold, such as Latin America and countries in Europe such as Spain, Poland and France. Shopee just announced that it will shut down its operations in France on 6th March, after just expanding to the country only in October 2021 as part of its European expansion. Shopee explained that this was a short term pilot run and that the company has decided not to continue operations in France.

Closing statement

Sea’s share price has seen better days with a decline of more than 60% in 4 months. It was affected not only by broad tech sentiments over slowing growth and a lack of profitability but also by two events, namely, a major shareholder reducing its stake, potentially signalling a reduction in support and also a ban on Free Fire, which is one of its most popular games, in India.

Sea’s FY2021 results were mixed, with some positives amidst many negatives. Growth quickened across key segments but expenditure increased at an even higher rate due to its focus on investing to securing future growth.

Sea provided mixed guidance on both its 2022 revenue growth forecast and profitability forecast. Sea expects to see continued strong revenue growth in the e-commerce and digital finance services segment but expects a sequential decline in revenue for the digital entertainment segment due to the ban on Free Fire by the Indian government and an impact on online activities due to reopening of many economies after a long pandemic. There are also uncertainties over growth in Shopee Europe which may cause a larger cash burn than expected.

Looking ahead, Sea will continue its focus on all three segments, growing its user base and revenues. It will also leverage its flywheel effect, leveraging its user growth to increase revenue across its multiple platforms. With a strong cash on hand position after a blockbuster fund raising in September 2021, it is expected to have sufficient funding to continue its expansion path for Shopee and SeaMoney at least for 2022 and 2023. However, as it expects to attain profitability only in 2025, it may have to seek future funding in due course.

The mixed bag of news probably explains why the share price had such a drastic movement, increasing by 9% initially when the results were released before declining by 20% minutes after. While the share price may look attractive after a 60% decline, the stock may not see an immediate turnaround as investors may look towards a little more certainty from the management in terms of revenue growth and cashflow management before putting down their money.

p.s. looking for the best time to enter SEA? Join Alvin at his next live webinar to learn how you can do so with a simple framework.