A premium EV company with an asset light business model that rides on the infrastructure of existing car manufacturers, Polestar is a Swedish automobile brand with manufacturing capabilities in China.

With a forecasted 92% revenue CAGR up to 2025, this EV company is due to start listing via a SPAC. Let’s take a look at the company to see if it can become the next Tesla:

Polestar’s SPAC listing Overview

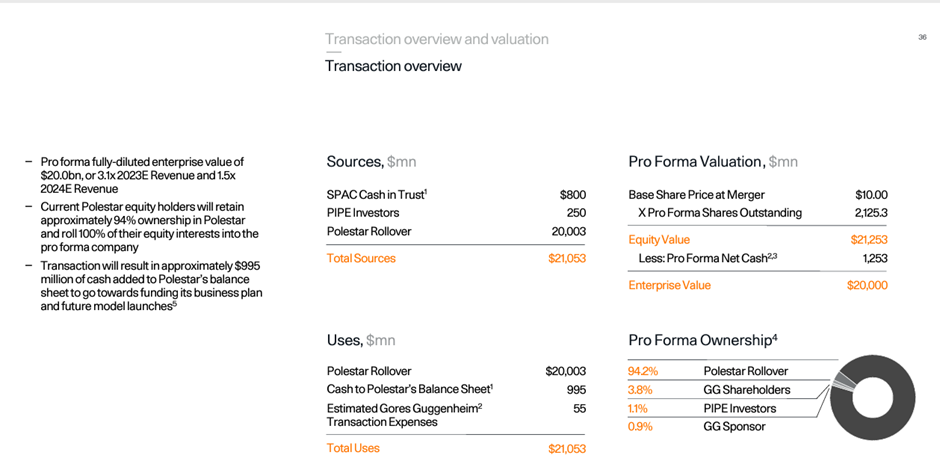

Here is a brief overview of the indicative details from Polestar’s SPAC listing with Gores Guggenheim, Inc (Nasdaq: GGPI):

- The SPAC Price will be $10

- SPAC Merger approval to be on 22nd June 2022 and likely to commence trading shortly after

- Combined SPAC market capitalisation of around $21.3 billion

- Total capital raised: $995 million (after deducting $55 million in fees)

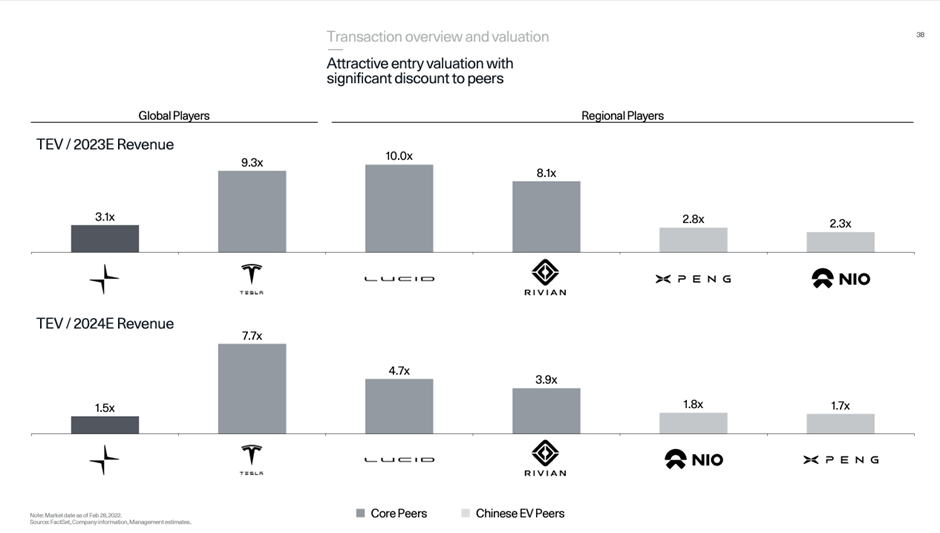

- Enterprise value of $20 billion implies a FY23 EV/Revenue of 3.1x and FY24 1.5x

What is Polestar?

Founded in 1996, initially focused on racing cars, it has since evolved into an electric vehicle (EV) company, backed by Volvo and Geely with a post-transaction ownership of just under 50% and 39% respectively.

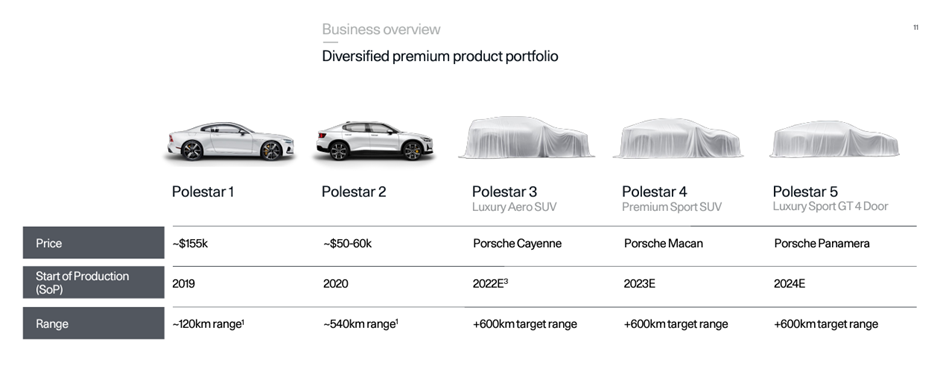

Being backed by Volvo and Geely, Polestar itself is an asset light business model, leveraging on Volvo’s and Geely’s industrial infrastructure. Polestar positions itself as a premium car company and has commercialised two car models so far, the Polestar 1, a plug-in hybrid 2-door sports car and Polestar 2, a 5-door liftback EV. Polestar also has the models Polestar 3 to 5 in the pipeline, with Polestar 3, an EV SUV expected to debut late in 2022 and with production slated to commence in 2023. The Polestar 3 will be built both at Volvo’s US plant and in China.

Based on the chart below, the company is looking to price the Polestar 3 similar to a Porsche Cayenne, which is in the range of US$70k and up. This price point is comparable to the Tesla model Y at $63k and up but lower than the Model S that goes for $100k and up.

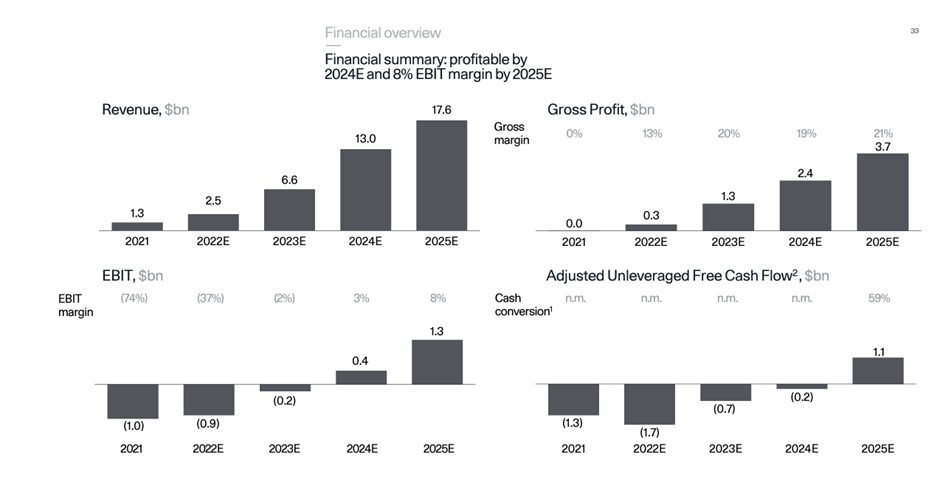

The company delivered approximately 29,677 Polestar 2 in 2021, which was a total vehicle sales growth of 185% from 2020. Note that the 29.7k vehicles delivered included 2.8k vehicles which had buy-back agreements. FY21 Revenue was $1.3 billion with a gross profit of $1 million.

As see in the chart below, Polestar has forecasted a 92% revenue CAGR up to 2025, setting a 2025 revenue goal of $17.6 billion, a 2025 gross profit goal of $3.7 billion on a 21% margin and a 2025 EBIT profit of $1.3 billion on an 8% margin.

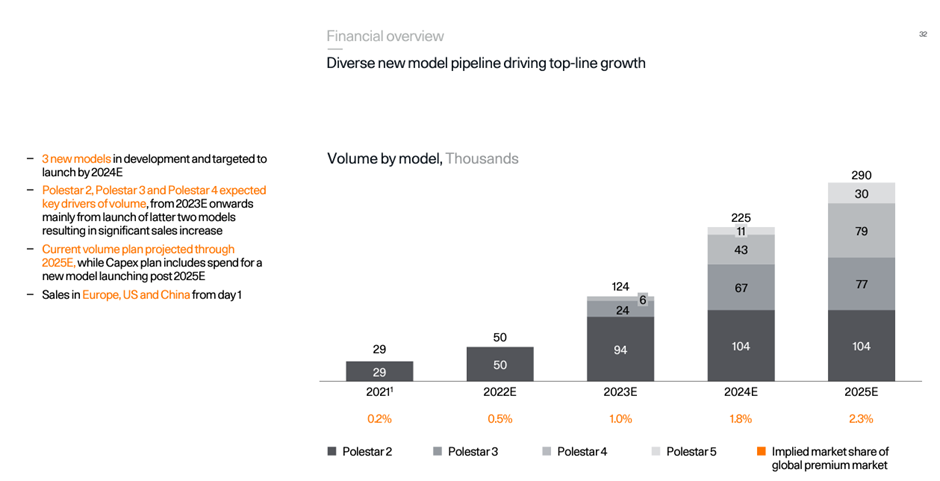

Based on the chart below, Polestar currently has a market share of 0.2% of the global premium car market.

To achieve its revenue growth targets, it targets to sell 290k vehicles a year by 2025, which implies for a market share of 2.3%. This means that Polestar does not expect the global premium market to grow significantly in the next 4 years but expects itself to gain market share.

As seen in the chart below, Polestar is able to use Volvo and Geely’s factory capacity of 750k cars across 5 factories (excludes Europe facility presented below). Polestar currently only owns the Chengdu factory with a production capacity of merely 750 cars and expects to rely on Volvo and Geely’s production capacity strength.

To achieve its goals, Polestar has forecasted to spend a total of $4.6 billion in the next four years, with $2.8 billion on capital expenditure and $1.8 billion on research & development(R&D). The spending is evenly spreaded out with forecast spend of $2.3 billion in the next two years.

Polestar’s big names investors

Polestar is seeking to raise $1.05 billion, with $800 million through the SPAC’s existing cash and $250 million via PIPE investors. With an estimated $55 million in transaction costs, Polestar will receive a net amount of $995 million in cash should there be no withdrawals by any PIPE investors.

As at Dec 2021, Polestar had a net cash position of approximately $293 million. The fundraising will increase its cash holding to nearly $1.3 billion which would cover its capital expenditure and R&D costs for 2022 and some of 2023.

It is backed by Volvo and Geely and Gores Guggenheim will come on board as an investor through the SPAC merger.

Why do a SPAC listing now?!

The post combination equity value would be $21 billion with a $20 billion enterprise value.

Most SPACs have fallen significantly in recent times and Goldman Sachs is shrinking its SPAC business amidst regulatory crackdown and the current market turmoil. Hence, it does beg the question as to why Polestar chose to list via a SPAC as new amounts to be raised of $1.05 billion is merely 5% of the enterprise value and current Polestar equity holders are not cashing out.

The two plausible reasons are:

- The ease of listing via a SPAC rather than a traditional listing; and more importantly

- Listing at a valuation which has been in place since September 2021 rather than bookbuilding via an IPO at the weak prevailing market conditions

Valuation: Peer comparison

Polestar has also provided a chart comparing its EV/estimated revenue ratios to peers such as Tesla, Lucid, Rivian, Xpeng and NIO which indicates that the entry valuation is at a significant discount to its peers.

We note that these are all highly subjective valuations as it was based on share prices as at the end of Feb 2022. Only Lucid has provided longer term forecasts as part of its SPAC listing where it forecasted for $10 billion revenue by 2024 and $14 billion by 2025.

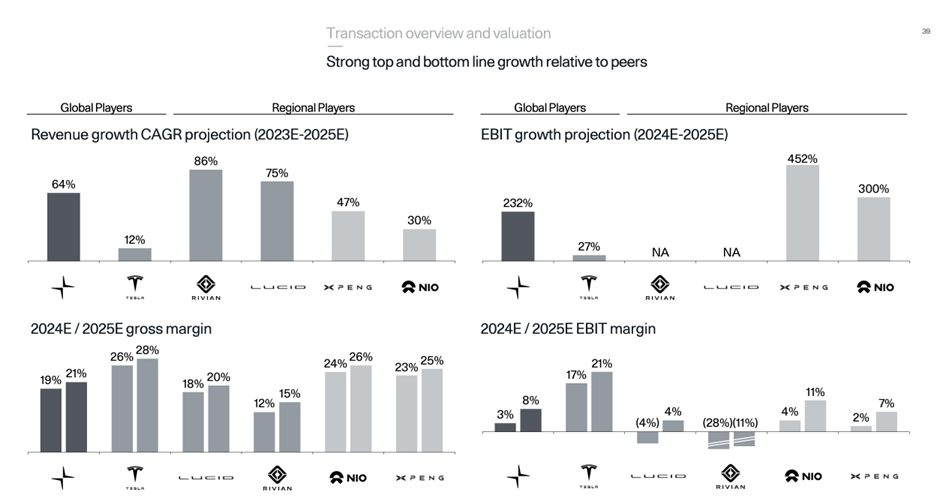

Polestar also expects strong top and bottomline growth relative to its peers as shown in the chart below.

We also looked at the current market capitalisation of each company for reference.

| EV Company | Current market capitalisation ($’billion) |

| Polestar | 21.3 |

| Lucid | 25.9 |

| Rivian | 23.8 |

| Tesla | 662 |

| Nio | 29.6 |

| Xpeng | 22.0 |

What the current market capitalisation serves to tell us is that aside from Tesla who is the clear current market leader, all other companies are in a growth stage with a similar market capitalisation size as the market would likely have priced the other stocks potential growth fairly.

So…does Polestar deserve a spot in your portfolio?

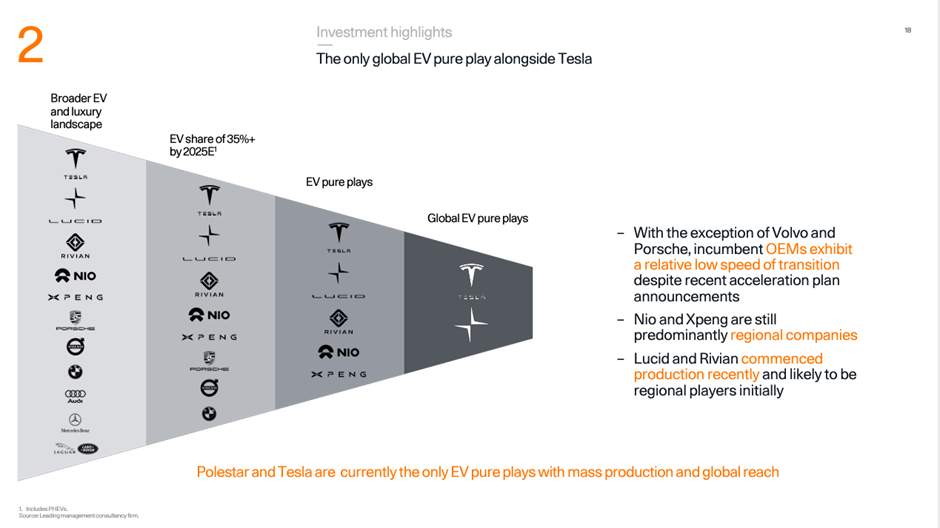

Polestar views itself, together with Tesla as the only two EV pure plays with mass production and global reach. Comparing themselves to Tesla has been the playbook of many growth tech companies and we would treat this with a huge pinch of salt.

It presents itself as a compelling investment relative to its peers, however it has raised very little money, probably due to the current weak market sentiments and has less cash on hand compared to its peers. Consequently, it may have to carry out an equity raising in the next 1-2 years or pursue debt funding at prevailing interest rates, which is unlikely to be at palatable levels for a growth stage company.

Unlike other EV companies, it pursues an asset lite model, backed by the industrial infrastructure and also the financial power of its two major shareholders, Volvo and Geely, who themselves are large traditional automotive manufacturers with significant production and financial capacity.

Similar to other SPACs, there is strong alignment of interests between the existing investors and minority shareholders due to the significant stake in the SPAC. However, the biggest risk is the current market sentiments surrounding SPACs. When comparing Polestar’s valuation to its EV peers, it also does not seem all that cheap.