Our Government has taken pains to assure us that changes to the statutory retirement age do not affect the time Singaporeans can withdraw their CPF monies.

This does not always mean that Singaporeans who have been conscientious with their retirement planning would be totally unaffected by these reforms.

Changes in the statutory retirement age affect the Supplementary Retirement Scheme (or SRS) account holders.

As the statutory retirement age will increase from 62 to 63 years old, tax-free withdrawal of SRS can be pushed back by one year if your SRS account is created after 2022. We want to avoid this by preemptively opening our SRS account before 2022.

The primary advantage of having an SRS account is tax relief. You can deduct up to $15,300 from your annual tax bill depending on your income.

For folks in the higher tax brackets, this can be a huge source of savings, but it comes with a caveat; if you withdraw your SRS before the statutory retirement age, withdrawn sums are factored into income tax for that year and you suffer an additional 5% penalty.

- Suppose you earn $140,000 per year now. Your tax bracket is 15%.

- Setting aside the maximum $15,300 this year will save you 15% x $15,300 or $2,295.

- If you withdraw the same amount one day after getting retrenched before you are 62 years old, you incur no income taxes because you are no longer working.

- You need to pay a 5% penalty or $765 when you use this to offset your emergency expenses.

- This $765 is small change compared to your tax benefits throughout the years.

- This tax relief is also consistent with trends for PMET salaries as reported by the Ministry of Manpower with degree holders reaching their peak earning years at age 45 and then dropping off after that.

Students in the Early Retirement Masterclass learn how to create a cash cushion to address “sequence of return” risks in the early phases of retirement – when hapless retirees are forced to draw down on their retirement portfolio when suddenly faced in a crippling recession.

The SRS is a great way to build such a cash cushion proactively because the only time you will call upon it is when you have no income and are faced with a recession. However, the construction of an SRS based cash cushion looks slightly different from other SRS accounts.

A suitable candidate for the SRS cash cushion is an investment that, ideally, has fixed-income yields because you are assumed to already have a separate account for investment purchases where you take on greater market risk.

It should also have a mild counter-cyclical effect – doing mildly better when things in the economy begin to turn south but underperforming otherwise. This precludes REITs from consideration as rent collections may drop in a bad downturn.

Suitable candidates for an SRS cash cushion include:

#1 – Retail bonds

A retail bond like Astrea V A1 bond has a yield to worst of 3.122% taken from bondsupermart.com is an example of what can go into your cash cushion. A good trait to look for in retail bonds is a healthy bond rating from S&P or Fitch.

#2 – Bond ETFs

For investors would prefer greater diversification, the two bond ETFs traded in SGX are ABF Singapore Bond fund that provides around 2% yields and the Nikko AM SGD Investment Grade Corporate Bond Fund ETF that yields around 3%.

#3 – Singapore Savings Bonds

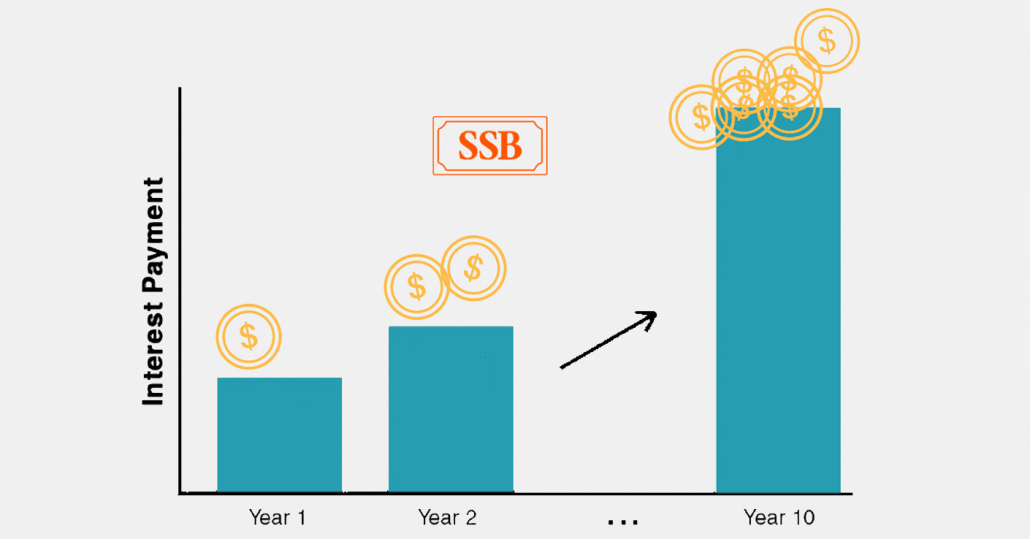

Investors tend pile in Singapore Savings Bonds when they anticipate bad times. These are the most stable investments that you can possibly buy, but they yield only about 1.68% over the first three years of investment.

#4 – Gold

The SPDR Gold Shares ETF does not generate a dividend but has a tendency to increase its value on a downturn.

Some correlational studies show that Gold may have a negative correlation to bonds making this a useful diversifier of a cash cushion.

You may wish to keep this within 10% of your SRS allocation as over the long term Gold tends to lose about 1-2% due to expensive storage costs.

The great thing about the National Day Rally 2019 is that our government is signalling their intentions to raise the statutory retirement age early so that we can start planning to react to these changes before they begin taking place.

For investors who are seeking an early retirement well below this statutory age, it is now a good time to open an SRS account to lock down your statutory retirement age to 62 so that it will be pushed back to age 63 in 2022 and age 65 in 2030.

This will provide greater security in the form of a cash cushion to handle your first economic recession post early retirement, the government is dedicated to assisting you in creating this cushion by lucrative tax benefits.

Since I started working, I had worked to put as much of my paycheck into the markets to build a dividend portfolio that could one day replace my salary. I did it by 39, and retired then. I’ll be sharing how I build my portfolio and pick the most suitable stocks here.