Being an investor in the U.S. stock market, I am concerned about the consequences of US’s prolonged loose monetary easing and rising debt levels. I decided to do some research on the possible outcomes and what I would do with my investments.

Before I can carry on, you will first need to understand the background of US printing and how its reserves currency status has kept the country afloat all this while. (If you have had a grasp of it before this, you can skip to the next section)

The economics of the U.S.

In the past, the United States was known as a nation of savers. Throughout U.S. history, its citizens typically save 10 percent or more of their incomes annually. This allowed its citizens to endure unexpected hardships over the years. However, in recent years there has been a shift in economic policy where its citizens were encouraged to spend instead of save as economists believed that savings are a drag to the economy since it removes the money from circulation. This practice grew to a point whereby Americans have been living beyond their means by overconsuming. (Essentially eating for free at the expense of others.)

Over the years, this result in the U.S. having trade deficits with other countries as its citizens continues to import more goods for consumption. From the graph below which shows the U.S. balance of trade over 25 years on a month-to-month basis, we can see a clear downtrend which indicates the increasing trade deficit. In fact, in 2020, the deficit totaled around $678.8billion.

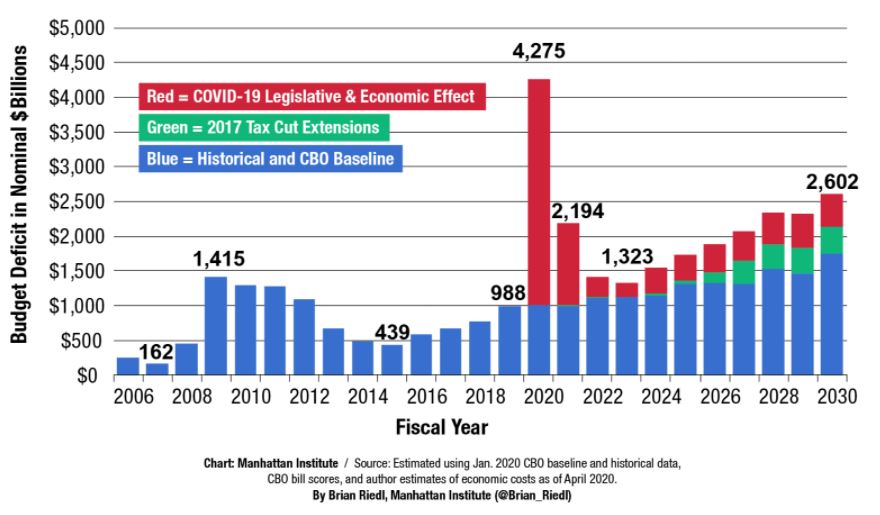

To add to this, we can see from the figure below that the U.S. federal budget has been running on a deficit over the year as its government spends more than it receives from tax.

*The data from 2020 onwards are projections. The actual budget deficit in 2020 was roughly $3.1 trillion.

So how did the US continue to spend more than it receives? Who/what is funding its budget deficit?

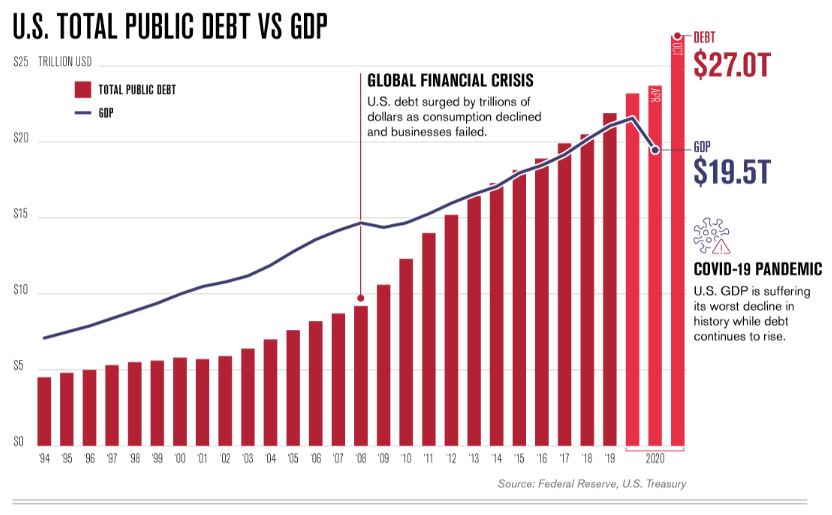

Well through borrowing. In fact, the U.S debt has been growing at an unsustainable rate over the years, even exceeding its GDP as shown below.

It is a cause of concern if you see your country having so much debt. If this happens to other countries, they would pretty much be in trouble.

However, U.S has one advantage and that is the U.S. dollar’s status as the world’s reserve currency. You see, the U.S. dollar is unique in the way that it is the global reserve currency. Many companies including foreign governments around the world hold U.S. dollars in their reserve and uses them for business transactions daily. Nearly 40% of the world’s debt is denominated in U.S. dollars and it also makes up 60% of central bank foreign exchange reserves. This essentially removes the ‘currency risk’ of U.S. dollars. In another word, large-scale printing by the Fed does not affect the USD value much because there is a high demand for it.

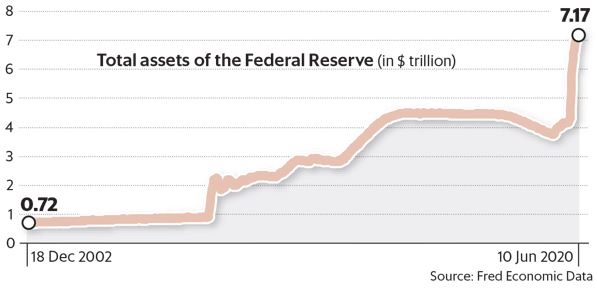

As such, apart from borrowing more debt to repay the previous debt, the U.S. could print money literally out of thin air to repay its debt. This is not a one-off thing. The Fed has been doing it for years with the latest being done during the COVID-19 crisis which pumped $3 trillions of printed money into the economy.

So, what is the problem?

Well, the U.S. was and is still able to print money without accountability as a result of the reserve status of its currency.

But what if this reserve status is challenged? Will this cause the US economy and market to crash?

Well, when the time comes, the United Stated would have 2 choices, either they default all the debts or cause inflation in its economy by printing money to repay its debt as in the case of Zimbabwe. Both are equally bad and could decrease Americans’ standards of living by a big margin.

Will it happen? I don’t know but I have listed some factors that could challenge the US reserve currency status.

Factors that threaten U.S. dollar reserve status

- Loss of confidence in the USD

If one day the world were to wake up and realize the USD is worth less than it is, we could see the collapse of USD. This is an unlikely scenario as the U.S. dollar still sits in many countries’ reserves. By devaluing the USD, it is akin to shooting oneself on the leg.

- Central Bank Digital Currency

A more realistic threat would be the adoption of Central Bank Digital Currency (CBDC) based monetary policy. CBDC is a digital form of fiat currency and unlike decentralized cryptocurrency like Bitcoin, a CBDC is centralized and regulated by the country’s monetary authority. Several countries like China, UK, Japan, and the US are looking into its viability.

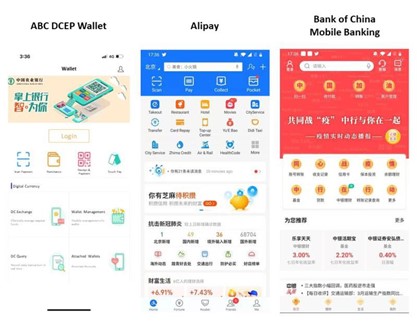

We will focus on China’s implementations of CBDC which is one of the fastest in this field. The DCEP (Digital Currency Electronic Payment) which would become the digital version of the RMB has been undergoing development and testing since 2014. If successful, the Chinese government could better monitor the flow of currency transaction, potentially allow them to better manage its economy, reduce counterfeiting, stop tax evasion, and many more.

These benefits are immense which is why China is actively pushing for them.

Here is a video that summarises China’s digital currency. Alternatively, you can have a read of this article.

So how does this affect the U.S. dollar reserve currency status?

As you see, China’s DCEP has great potential, for its country. Apart from that, China also aims to get Asia and Africa to take the digital yuan for cross-border transactions instead of the current US dollar, which is possible with the help of trade deals like the RCEP and Belt and Road Initiative.

If successful, China’s DCEP could be widely used in these regions and thereby be held in significant quantities by the regions’ central bank in replacement of the U.S. dollar. It could weaken the U.S. dollar as the global reserve currency and effectively end the U.S. economic advantage of printing unlimited money as and when they like.

My takeaway

While I have painted a gloomy outlook of the U.S., I am not saying we should avoid the U.S. market completely. There have been many claims over the years which say the US market is going to crash. But what happened? The US market continues to increase consistently over the years.

What I would like to recommend is to diversify your portfolio. If your portfolio is currently concentrated with U.S. stocks, why not allocate a portion of it elsewhere like China. It is undeniable that the Chinese economy will surpass the US and we should ride along with the growth.