Following a tumultuous restructuring and recapitalisation process that began in late 2020 and was completed in May of this year, First REIT has revealed the next phase of its growth strategy. The management intends to revitalise First REIT through this growth strategy, with the first step being the acquisition of a nursing home in Japan. Let us examine this deal to see if it is a turning point for First REIT or just another ruse.

Intro to First REIT

First REIT is a healthcare real estate investment trust (REIT) with a portfolio that includes hospitals, nursing homes, rehab centres, and other healthcare-related properties. The trust has a diverse portfolio of 19 properties, 16 of which are in Indonesia and three in Singapore. It has a total value of about S$939.7 million as of 31 December 2020.

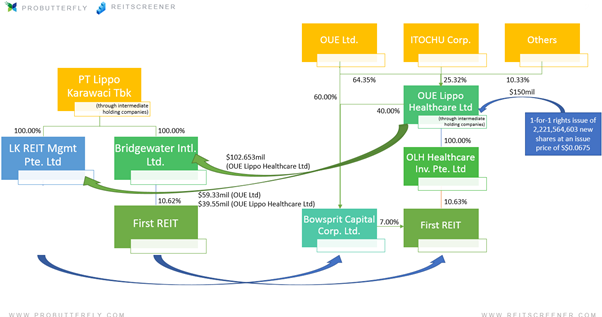

First REIT Management Limited currently manages the REIT, which is 60% owned by OUE Limited and 40% by OUE Lippo Healthcare Limited (OUELH). Both of these are controlled by the Indonesian Riady family and also have stakes in First REIT.

The Riady family also owns PT Lippo Karawaci, Indonesia’s largest listed property company. It likewise has a stake in First REIT, giving it the right-of-first-refusal on healthcare facilities pipelines from PT Lippo Karawaci Tbk and OUELH.

So, what has happened so far?

Before we go any further, let’s review what’s happened so far. Doing so would be necessary to understand why First REIT has been hammered so badly:

Announcing the restructuring of leases

This all began in June 2020, when PT Lippo Karawaci (IDX: LPKR) announced in a press release that it would undertake discussions with First REIT. It sought to restructure its leases since the rents were unsustainable due to Covid-19, causing hospital revenues to drop by 40 to 50%.

To emphasise, Lippo Karawaci also owns a position in First REIT. This added to the confusion of the announcement, given that LPKR had not approached First REIT before the press release.

The market was not pleased with this news, and First REIT was down 21% by the end of the trading day.

The drop and volatility

On November 29, First REIT announced restructuring on the master lease agreements for 14 Indonesian hospital assets.

There was some positive reception to this new agreement, as basic rent escalation will increase from 2% to 4.5%, and greater variable rent will be paid if the tenant performs well, offering additional upside. However, the bad news overshadowed this as the base rent plummeted from S$80.9 million to S$50.9 million.

This rent would now be payable in Indonesia Rupiah, which had higher volatility relative to the Singapore Dollars. Hence, First REIT plunged a further 20% in November.

First REIT 2.0 Growth Strategy

With all of that behind it, First REIT is ready to move on to the next phase of its revitalisation.

The REIT intends to reduce its reliance on Indonesia as part of its 2.0 development strategy. This will be done by diversifying into developed markets like Japan, Europe, the United Kingdom, and Australia. Other goals include reorganising its portfolio, strengthening its capital structure, and pivoting to take advantage of megatrends.

Acquisition of Japan Assets

In conjunction with this announcement, the REIT has stated its plan to purchase 12 nursing homes in Japan from OUE Lippo Healthcare (OUELH), one of its sponsors, for JPY24,213 million.

Currently, it is priced at a 2.9% discount to the average of the two independent appraisals of Japan Nursing Home, which stands at JPY24,926 million as of 29 October 2021. The total purchase consideration for the planned acquisition is expected to be around S$163.5 million. It would cost a total of S$168 million after stamp taxes, professional fees, and other costs.

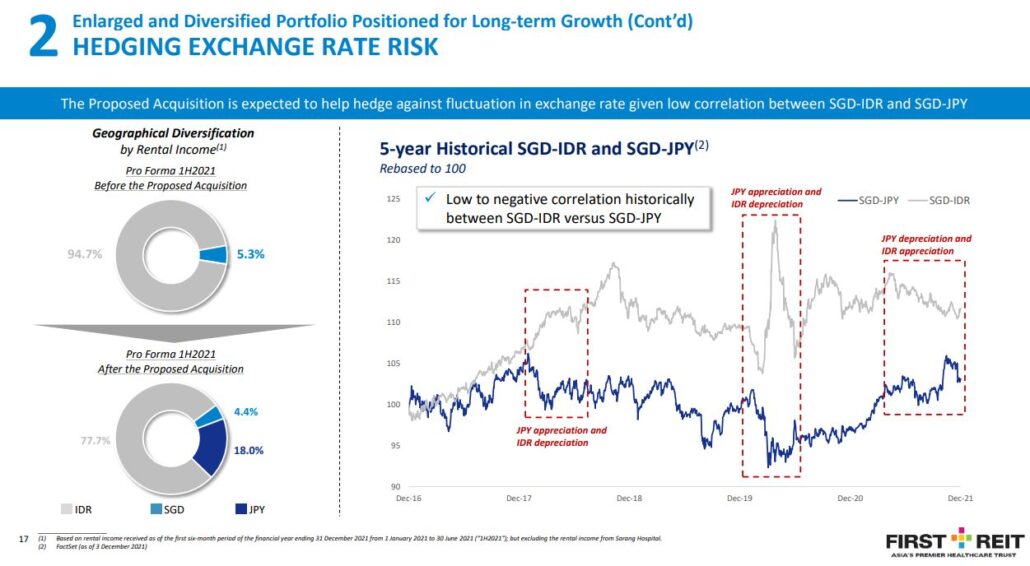

Post-acquisition, First REIT Indonesia assets will account for 77.7% of the portfolio rental income, down from 94.7%. The assets in the developed markets of Japan and Singapore would then make up 18% and 4.4% of the portfolio, respectively.

Upon completing the proposed transaction, OUELH, which currently holds a 40% stake in First REIT manager, would increase its ownership of First REIT from 15.3% to 33.2%.

Rationales for the acquisition

According to the manager, there are several reasons why this acquisition is taking place.

1. Growing demand driven by an ageing population

The acquisitions would give First REIT a strategic foothold into the Japanese nursing home market, characterised by solid market fundamentals, limited supply, and highly defensive attributes. This is proven by the COVID-19 pandemic’s minuscule impact on the market.

Rapidly Ageing Population Driving Surge in Demand for Nursing Home

Japan’s population is ageing faster than any other country, with an average life expectancy of 85 years. By 2040, Japan’s population will consist of around 35.3% seniors above 65, making it the world’s first “super-aged” nation.

The number of individuals requiring long-term senior care is rising in unison with the ageing population, which has climbed 1.5 times from March 2008 to March 2021. At the same time, the occupant rate (ratio of residents to maximum capacity) has risen from 74% in 2002 to 87% in 2019.

As a result, the market for fee-based senior housing is also likely to rise.

Inadequate Supply of Fee-based Nursing Homes for Elderly

Despite the existing and anticipated increase in demand for senior care services, Japan’s senior housing supply has lagged. The government limits on developing more eldercare public facilities contribute to this.

Defensiveness and Quality of the Nursing Home Market in Japan

From April 2020 to March 2021, the Welfare and Medical Service Agency surveyed 434 social welfare corporations operating special nursing homes. Many have been doing well, with 81% reporting either growth or stability in their revenue.

Aside from the overall market attributes, Japanese nursing homes are located in regions with very favourable characteristics and demographics, which promote and sustain nursing home demand growth.

2. Enlarged and Diversified Portfolio Positioned for Long-term Growth

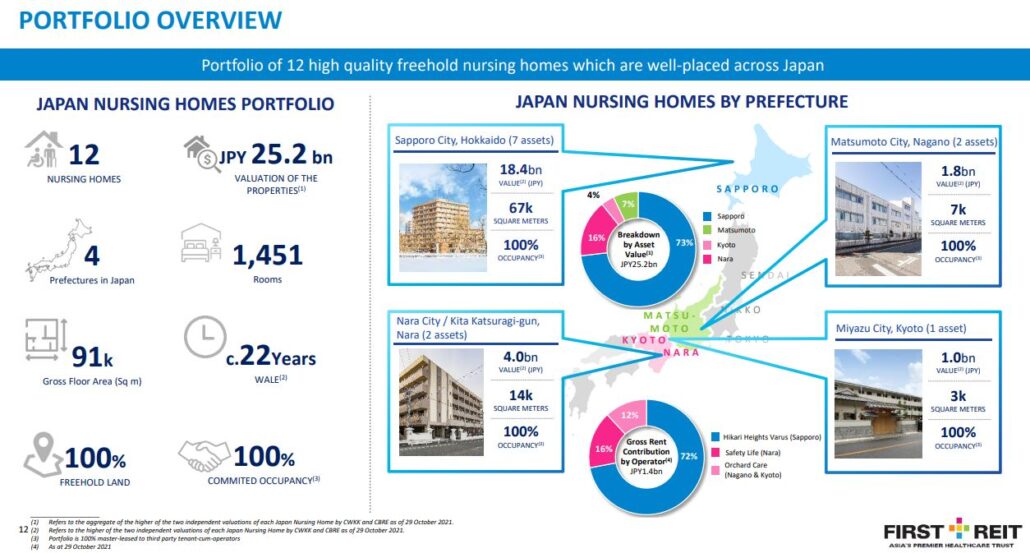

The Japan Nursing Homes consists of 12 freehold nursing homes in Hokkaido, Nagano, Nara, and Kyoto. They have a total gross floor area (GFA) of 90,989 square meters and 1,451 rooms with a weighted average lease expiration (WALE) by GFA of 22 years.

As seen below, this would boost First REIT’s portfolio diversification and lower its risk profile.

High-quality Defensive Portfolio with Strong Operators

The Japan Nursing Homes are 100% master-leased to well-established, independent local nursing home operators. These provide stability in tenancy and rental income for First REIT.

They have fixed rentals over the tenure and the option of negotiating a rental increment every two or three years, depending on changes in the Japanese consumer price index and interest rates.

To mitigate disruption, each of the Master Lease Agreements has a backup operator clause. This will ensure a smooth transition of operations to the backup operator in the event of a lease cancellation or termination.

Enlarged Portfolio

After the Proposed Acquisition, the value of First REIT’s deposited property will increase by 29.1%, from S$1,016.5 million to S$1,312.1 million.

First REIT’s enlarged portfolio allows for larger transactions and greater capital management flexibility. The larger scale also offers First REIT more flexibility when rebalancing its portfolio as it implements its First REIT 2.0 plan.

Enhanced Diversification

- Market exposure

The Proposed Acquisition will increase First REIT’s geographic, lease, and property tenure diversification and defensiveness. After the acquisition, First REIT’s exposure to developed markets will rise from 3.6% to 27.1% of its asset value.

- Third-party tenants

The Japan Nursing Homes are also directly leased to third-party tenants on a master lease. As a result, rental income from third parties will rise by 16.6%, from 7.9% to 24.4%, reducing the concentration risk of First REIT’s rental income sources.

- Freehold properties

Finally, Japan Nursing Homes are freehold properties. Following completion of the proposed acquisition, freehold assets will account for 88.9% of First REIT’s portfolio, significantly increasing the portfolio’s land tenure quality.

Reduced Rental Income Volatility from Exchange Rate Fluctuation

After the proposed acquisition, First REIT’s exposure to the Japanese Yen will rise to 18.0% of its rental income. Given the poor correlation between SGD-IDR and SGD-JPY, the proposed transaction should effectively hedge First REIT’s rental income fluctuation in the exchange rate.

Improved Rental Stability and Weighted Average Lease Expiry

First REIT is also projected to benefit from the proposed transaction in terms of income stability.

The Japan Nursing Homes had an aggregate WALE of 22 years as of June 30, 2021, with each Nursing Home having a long-term Master Lease Agreement with its master tenant until April 24, 2043. The WALE by GFA of First REIT will improve from about 12 years as of 30 June 2021 to approximately 14 years after the proposed transaction is completed.

3. DPU Accretive to Unitholders

On a pro forma basis, the proposed purchase is estimated to be distribution per unit (DPU) accretive. The DPU is estimated to increase from 1.30 Singapore cents to 1.31 Singapore cents, or roughly 0.8%. This is based on the pro forma financial effects of the Proposed Acquisition on the DPU for 1H2021.

This is pretty impressive, especially considering that the current yield is based on its Indonesian property, which generally has a greater yield than its Japanese counterpart.

Nonetheless, this isn’t without some financial engineering on the part of its sponsor, who helped boost its yield by discounting the valuation, taking on units at a premium to the market price, and waiving acquisition fees.

4. Other Reasons

The manager commented that the proposed acquisition is in line with First REIT’s 2.0 strategy and that it will help the company position itself among its peers. The first reason felt like the manager was rehashing its goals, whereas the second reason pointed out some benefit in terms of First REIT’s greater appeal than its peers after it diversifies.

Conflict of Interest?

First REIT’s growth strategy sounds attractive. It might help the REIT return to its previous glory days. However, there is one key concern that we must consider: the conflict of interest.

First REIT’s complicated ownership structure

First REIT has one of the most convoluted webs of ownership among sponsors and managers I’ve ever seen. First REIT Management Limited currently manages the REIT, 60% owned by OUE Limited and 40% by OUE Lippo Healthcare Limited (OUELH). The Indonesian Riady family controls both entities, and both have a stake in First REIT.

Apart from that, PT Lippo Karawaci, Indonesia’s largest broad-based listed property company (also controlled by the Riady Family), also has ownership in First REIT.

Isn’t it complicated? Yeah, but just take note of the fact that they’re all connected in some manner.

With such a complicated ownership structure, it may be difficult for investors to spot potential conflicts of interest. In truth, such a factor could be at play with this latest transaction.

The sponsor’s commitment and intentions

The manager cited the sponsor’s commitment to the First REIT 2.0 plan in the proposed transaction (Point 4 to its rationale for acquisition). They agreed on the acquisition at a discount of 2.9% to the aggregate of the average valuation. They even settled to undertake the complete issuance of units at a premium and waive acquisition fees in support of this.

All of the sponsor’s actions appear noble. On the surface, they seem to demonstrate their commitment to the First REIT shareholder. Is this, however, actually the case?

Don’t get me wrong: this is a win-win situation for First REIT shareholders. (It has to be, or the shareholders would not approve the deal.) This acquisition would give a more predictable income stream and diversify the portfolio. Though the increase is modest, a greater DPU would also benefit retail investors.

However, I have a feeling that the sponsor will benefit far more than ordinary investors from this transaction. By moving its assets to First REIT, OUELH could continue to pursue its asset-light strategy.

The backdoor workarounds

What about OUELH paying a premium for the new units, isn’t that good for retail investors?

While the issue price is higher than First REIT’s current market price, considering how the bad news has pushed down its valuation, the issue price is still below its net asset value (NAV). Therefore, the sponsor is still receiving a decent bargain. However, First REIT’s NAV per unit will drop 4.1% to 33.68 cents after the acquisition, from 35.12 cents. Not that noble after all, isn’t it?

To top it off, this transaction will be financed mostly by the issuance of new shares to the sponsor, which would dilute existing shareholders who will be unable to participate.

How dilutive is it? Well, First REIT will issue 431,147,541 additional units at S$0.305 per unit. With 1.61 billion shares outstanding, the issue represents around 26.7% of all shares outstanding. This is a significant amount, especially since it is below the NAV.

The sponsor is effectively ‘purchasing’ First REIT (raising their ownership) at a low price in exchange for some of the company’s assets that it had already planned to get rid of.

If you look at the Lippo group as a whole, it appears to be a smart move. They essentially transfer property ownership from the sponsor to the REIT that it also owns. By simply moving the properties around, the Lippo group still owns them while generating new shares, which ONLY they would receive.

The predicament of retail investors

Wait, don’t other REITs also issue additional shares when acquiring assets from their sponsor? Yes, but there is a distinction in that this acquisition is accomplished solely by issuing additional shares to OUELH, the sponsor.

Other REITs, such as CapitaLand Integrated Commercial Trust, use a mix of debt and equity. They allow all shareholders, including you and me, to participate in such acquisitions through rights issues. This is especially true for large acquisitions like this one.

When such steps are taken, it will reduce the effect of dilution on retail shareholders during acquisition, which doesn’t seem to be the case for this deal.

So, why weren’t retail investors entitled to take part? We don’t really know. With that, we need to call into question the true motive of the sponsor. I can only speculate, so I may be wrong, but only the management knows for sure. As a result, you must use your critical thinking skills and make your own decisions.

Conclusion

Healthcare needs will only grow in the coming years, as many economies face an ageing population. Healthcare REITs like First REIT would undoubtedly benefit from such trends, and with an 8.92% dividend, it could be appealing to some.

Nonetheless, for the reasons stated above, I personally would not touch this REIT. I’m not sure what the management’s real intentions are, and given the company’s recent history of poor management, I’m not convinced this is a good investment for me.

I could be mistaken about the management’s motivation, and the sponsor’s willingness to buy at a higher price could indicate that First REIT is now undervalued. However, I do not want to take the risk of being wrong. Therefore I would rather invest in a REIT with a better sponsor, albeit at a lower return.

Hi Zhi Rong,

Thanks for the detailed write up!

My personal view would be that the Sponsor after owning so many First’s share, what do you think would be their next move? Maybe to push up the share price ya?

Joe.

Hi Joseph!

I believe their next action will be to regain investor confidence and try to restore the REIT to its former glory. The recent management’s actions can be interpreted in this light, and it could be a hint that change is on the way. In regards to pushing the price up, yes, that is one way the sponsor can benefit seeing how they own stake in the company. This is the best scenario where retail stakeholders can also benefit from the price increase. However, there are also ways in which companies can benefit other than pushing the share price up. With more voting power, the sponsor has more influence over retail shareholders and could potentially benefit from different ways detrimental to retail holders. As such, the alignment of interest between you as a shareholder and the management is very important. I hope this helps!