I think this is a great case study for REIT investors.

I have had the privilege to know investors from both camps – the deep value investor and the majority from the bear camps.

So the million-dollar question is this – is there a bottom for Manulife US REIT (SGX: BTOU)?

What is happening to Manulife US REIT?

Since I mentioned it’s going to be a case study, let’s keep even those who are totally oblivious up to date to what is happening.

Manulife US REIT (MUST) is trading at a dirt cheap discount. “Dumpster level”; as my deep value investing acquaintance says.

It is trading at a trailing dividend yield as of writing, of 33.2%.

Yes, 33%. You can get back your capital in the form of dividends in 3 years’ time and still have a 33% yield.

Price to book ratio wise, it is at 0.25x. That means you are forking out $0.25 to buy $1.

Is this a fraud like Eagle Hospitality Trust?

Far from it. Eagle Hospitality Trust was too fishy even from the beginning.

Manulife US REIT’s current debacle is a cumulation of events and probabilities that have unexpectedly led it to its current state.

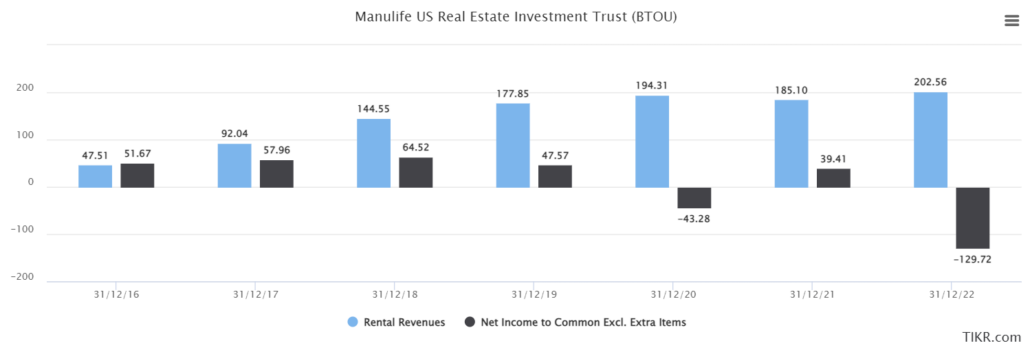

To summarize everything, when MUST first IPOed, it was an aggressively growing REIT. They were doing aggressive asset acquisitions. Their rental revenues were growing by leaps and bounds.

However, smart-eye investors would have noticed something.

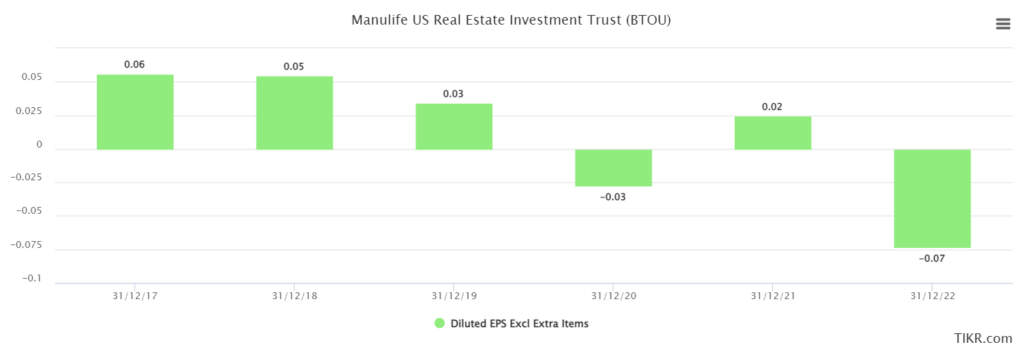

Why isn’t net income catching up or tending along with revenue growth? And why isn’t also the earnings per unit growing?

Expansion came with a cost. Not only did expenses in terms of operations and financing wipe out any accretive earnings improvements, but the severe unit dilution also stunted the EPU growth.

The REIT might be growing, but it was not creating value for the retail unitholders.

MUST had bitten off more than it can chew

There is nothing wrong with a REIT being hungry for acquisition and growth. But inorganic acquisitions utilizing a mixture of debt and rights is really an art.

Ensuring that rental income not only covers the operational and financing expense but also minimizes potential dilutions so that earnings and distribution per unit are accretive.

MUST went on a shopping spree to build its investment property portfolio via rights and debt. In FY 2019 just before COVID, it already had a gearing ratio close to 40%.

When COVID came, it started off with mandatory work-from-home (WFH). The valuation of its investment properties in the commercial space got written down as the cash flow generability of its properties was severely impaired.

Post COVID and reopening, as WFH became an acceptance of the new way to work, employers scrambled to downsize their rental leases.

What was supposed to be sunshine after a thunderstorm didn’t happen.

In FY 2020, gearing grew to more than 40%, and close to 50% in 2022.

MUST is now stuck in a sticky situation as it is close to breaching the gearing limit set for REITs to prevent overleveraging.

Small steps to deleverage but insufficient

MUST must deleverage (pun intended). It can do so by asset disposition and/or capital injection.

MUST sold Tanasbourne (located in Oregon) to its sponsor for USD 33.5 million. It did plan to sell more, but 3 asset disposition attempts were halted due to interest rate hikes and a lack of financing available for buyers.

US commercial properties are currently in a death spiral, where most employers are choosing to downsize their leases as well. Higher interest rates not only tighten liquidity but also shredded the valuation of properties.

The gearing of 49.5% is so high that it might even impact MUST to draw down debt for fund leasing costs.

Imagine, a REIT not being able to sign new leases as it busted its leverage ratio.

The sponsor, Manulife, already has its hands tight with a maximum 9.8% unitholding limit.

And as each day pass by, the REIT draws closer to the expiry dates of some of its loan tranche. Refinancing will be challenging, not only from a rising interest rate point of view but also from the financial institution’s scrutinization.

In essence, MUST is on the brink of dysfunction.

And the only hope of resuscitating MUST is by voting FOR Mirae to become a strategic partner by subscription of more than 9.8% of new units.

More dilution!

So, how low can MUST go?

There are currently a weighted average number of MUST units of 1.767 billion units of MUST.

Assuming a 9.8% dilution as the best-case scenario, that will bring us to a total of 173.175 million units to be issued and subscribed by Mirae.

And assuming that Mirae is so kind as to subscribe these 173.175 million units at the settlement price as of writing, which is USD 0.14 per unit, Mirae will only pump in USD 24 million.

USD 24 million is hardly a significant amount to bring down the leverage ratio.

Mirae is brought in more on the asset disposition aid rather than miraculously bringing down leverage by 10 pts.

Whether Mirae will turn out to be a white knight or a grey knight is still a question mark.

Asset sales to Mirae will no doubt help MUST to deleverage and survive this onslaught.

But post-deleveraging and what prospects MUST hold with lesser properties and also lesser rental revenue is actually the elephant in the room to determine the fair price valuation of the REIT.

My thoughts and verdict

I am not a deep-value person, although I really enjoy exchanging ideas and simulating the intrinsic value of deep-value stocks.

A deep-value case like the SPH privatization was far more straightforward. If I were Mirae and think like a fund manager, the 10% stake would just be a pacifier. Helping MUST deleverage its properties at an advantageous price is a greater reward than getting 10% of MUST at dirt cheap price.

However, the other side of the coin my deep-value investor pal provides is this – so what if rental income, earnings, and distribution drop on a YoY basis? The operating fundamentals of MUST are still relatively intact.

The business is not broken. It was just bad management and a string of bad luck.

If earnings and distribution drop by 50% YoY (a theoretical assumption) due to a smaller portfolio, and MUST manage to deleverage by doing a large asset disposition spree.

At the current price, isn’t a 15% dividend yield (half of its current trailing 30% yield) still a deal too good to be true? And a potential re-rating post-stormy weather could see a huge upside…right?

This could be a well-calculated punt for those who are looking at this case study from a deep-value point of view.

However, for the long-term MUST holders who held on to the REIT at USD 0.60 per unit, even if this does play out, you would need to triple or quadruple down on your current holdings to really save that floating loss.

But, will the uncertain economic outlook throw a wrench in this potential grand turnaround, even the wise cannot forsee.

173.175 units can’t at US$ 0.14/ unit it is not a fair value

What is fair to unitholders and Mirae then? It was just an assumption to simulate that the rights will not bring down the gearing.

I disagree. Workers will be returning to work as employers realise that WFH is not a feasible option. Office rental is just a small part of the cost.

If that is the case, why are we seeing most of the US commercial REITs struggling?