Singapore Depository Receipts (SDRs) like ADRs are exchange-traded instruments issued based on underlying foreign securities.

The Singapore Exchange (SGX) launched Singapore Depository Receipts (SDRs) on 30 May 2023. SDRs present a unique opportunity for Singapore investors to broaden their investment horizons and tap into the potential of companies from other countries.

In this comprehensive guide, we will explore the intricacies of investing in Singapore Depository Receipts (SDRs), and everything you need to know.

What are Singapore Depository Receipts (SDRs)?

Singapore Depository Receipts (SDRs) work like the more popular American Depository Receipts aka ADRs. SDRs are an exchange-traded instrument that is issued based on underlying foreign securities.

They provide a convenient investment avenue for investors to participate in companies listed on overseas exchanges, without the complexities of navigating unfamiliar markets or complying with additional regulatory requirements.

Acting as a bridge between Singapore investors and foreign companies, SDRs provide a convenient and simplified method for accessing international markets.

For instance, let’s consider the initial SDRs introduced for Thai stocks. Instead of the need to directly invest in Thailand, which typically involves opening accounts with specific brokers providing access to Thai stocks and potentially incurring higher commission fees, Singapore investors can conveniently purchase the same underlying securities through the SGX. By offering this accessibility and convenience, SDRs empower Singapore investors to seize opportunities presented by foreign companies while eliminating potential hurdles.

SDRs should not be mistaken for actual stocks; instead, they function as exchange-traded instruments. These instruments are issued by a financial institution or better known as a “SDR Issuer” specifically for trading purposes.

SDRs are backed by the underlying securities of the foreign companies but these foreign companies are not involved in creating the SDRs. Should investors choose to do so, they have the flexibility to convert their SDR holdings into the actual securities they represent, thereby exercising their ownership rights in the underlying companies or securities.

Benefits of Singapore Depository Receipts (SDRs)

There are several benefits to trading SDRs:

1) Access to global securities

SDRs enable local investors to participate in overseas markets through the familiar SGX ecosystem. By aligning with the trading rules and the lot sizes of 100 on the SGX, SDRs provide a standardized and familiar trading experience. Investors can navigate the market more efficiently, leveraging their existing brokerage accounts without the need for separate accounts or incurring overseas trading fees. This streamlines the investment process and allows investors to manage their SDR investments within their familiar brokerage setup.

2) Similar to stock trading

SDRs are classified as Excluded Investment Products (EIP) as they are viewed similar to stocks. This means that there are no restrictions on buying and selling SDRs, and any investor with a brokerage account to trade SGX securities can easily trade SDRs.

3) Trading in SGD

Trading SDRs in SGD eliminates the need for investors to convert to foreign currencies. Moreover, it ensures price transparency and certainty when executing the trades in SGD, as oppose to not knowing the foreign exchange rate at the time of trade execution for foreign securities. Additionally, investors receive dividends in SGD, enhancing convenience even further.

4) Lower fees

Trading SDRs generally incurs lower costs compared to directly trading Thai stocks. Investors can enjoy cost savings by opting for SDRs instead.

5) CDP Custody

SDRs are held in custody by the Central Depository (CDP) of Singapore, providing investors with a secure and reliable system for the storage and management of their SDR holdings.

6) Convertibility

SDRs offer the advantage of convertibility. Investors have the option to convert their SDR holdings into the actual securities of the foreign companies represented by the SDRs. This flexibility allows investors to exercise their rights as shareholders and potentially benefit from any corporate actions or events.

7) Transparency

Corporate actions related to SDRs are made in English and published on the SDR Issuer’s website. The underlying companies also publish annual reports, presentations and announcements in English on the SET website. The availability of information in English enhances transparency and facilitates informed decision-making.

How do Singapore Depository Receipts (SDRs) work?

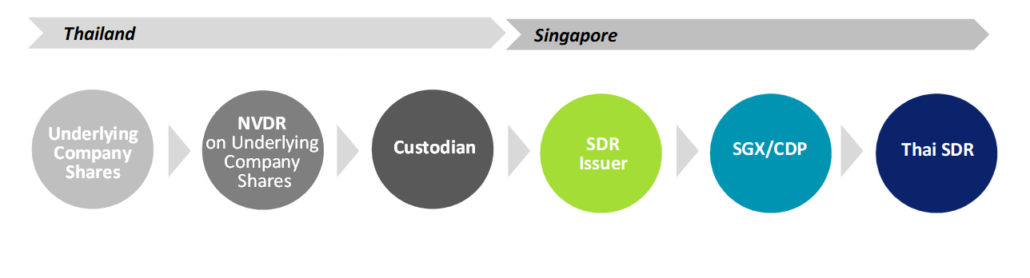

The SDR ecosystem relies on the involvement of six key parties. These parties include the custodian for the overseas securities, the SDR issuer, SGX, market makers, CDP (Central Depository), and brokers.

1) Overseas Custodian: safeguard the underlying securities

To facilitate the creation of Singapore Depository Receipts (SDRs), a custodian based overseas plays a crucial role by holding the actual securities that serve as the underlying assets for the SDRs.

In Thailand, a specific class of securities known as non-voting depository receipts (NVDRs) is utilized for this purpose. NVDRs, as the name suggests, do not carry voting rights and are designed to cater to foreign investors, ensuring they are not restricted by foreign ownership limitations imposed by Thai law. Consequently, the underlying securities for the Thai SDRs consist of these NVDRs. Although NVDRs lack voting rights, investors can still benefit from the financial aspects of the companies, such as receiving dividends.

The custodian responsible for holding these securities plays a critical role in maintaining their security and integrity throughout the entire process. This means that investors are not exposed to issuer risk. Even in the event that the SDR issuer ceases to exist for any reason, investors can rest assured that their securities held on trust by the custodian will remain intact, ensuring the continuity of their investment. The custodian’s role provides a layer of assurance and safeguards the interests of SDR investors, reinforcing the overall integrity of the SDR ecosystem.

2) SDR Issuer: Issues the SDRs and handle corporate actions

The SDR issuer creates the SDRs based on the underlying securities held in custody by the Thai custodian.

The SDR Issuer also facilitates the conversion between SDR and the underlying securities upon request from the SDR investors. That said, conversion is not necessary if investors want to trade on SGX only.

A crucial role of the SDR issuer is to handle various corporate actions, such as cash dividends, script dividends, distribution-in-specie, bonus issues, stock splits, consolidations, rights issues, and delisting offers. Notably, cash dividends are distributed in Singapore Dollars (SGD), ensuring convenience for SDR investors.

The SDR issuer also assumes the role of publishing important corporate announcements regarding the underlying companies. These announcements, which include details about corporate actions, can be accessed through SGX’s Company Announcements webpage or the designated platform provided by the SDR issuer.

However, it is important to note that not all announcements will be published on the SDR Issuer’s. Investors should monitor the websites of the respective companies or the Stock Exchange of Thailand (SET) to stay updated on the latest developments and business activities of the underlying companies.

3) SGX: Trading of the SDRs

Once created, SDRs are quoted and traded on the Singapore Exchange (SGX). This provides investors with transparent, fair, and efficient pricing of the SDRs, in contrast to over-the-counter transactions. This enhances investor trust in the pricing mechanism, ensuring that they receive accurate and reliable pricing information.

Trading of SDRs on the SGX follows the trading rules and trading hours set by the exchange. The SGX trading hours are longer than the trading hours of the Stock Exchange of Thailand (SET). For instance, SGX operates between 9:00 am and 5:16 pm, with a lunch break from 12:00 pm to 1:00 pm. On the other hand, SET trades between 10:00 am and 5:00 pm, with a longer lunch break from 12:30 pm to 2:30 pm (Bangkok Time). Consequently, the extended trading hours provide investors with more time to engage in buying and selling activities for SDRs.

SDRs are traded in SGD and the trading prices of SDRs are reflected on the SGX website, providing investors with information on the market prices of SDRs. Additionally, the SGX monitors the trading of SDRs and takes appropriate action, such as halting or suspending trading, if the underlying securities are halted or suspended on the overseas exchange. This ensures the integrity and reliability of the trading process for SDRs.

SDRs can be easily identified through a naming convention that includes the company name, market, and SDR designation. The first three Thai SDRs introduced are as follows:

| Trading Name | Trading Code |

| AOT TH SDR | TATD |

| CP ALL TH SDR | TCPD |

| PTTEP TH SDR | TPED |

4) Market Makers: Providing liquidity to SDRs

Market makers play a crucial role in ensuring the liquidity of SDRs, enabling investors to buy and sell these securities easily. When investors wish to purchase SDRs, they can acquire them from market makers at the ask price. Conversely, if investors want to sell their SDRs, they can sell them to market makers at the bid price. This two-sided quoting mechanism allows investors to trade with market makers regardless of the immediate availability of other buyers or sellers in the market.

Additionally, market makers help maintain price parity between SDRs and their underlying securities listed on the Stock Exchange of Thailand (SET). Generally, prices of SDRs quoted by market makers may be influenced by the prices of the underlying securities on SET, foreign exchange rates and the supply and demand of SDRs on SGX.

By actively participating in the market, market makers foster a liquid trading environment that facilitates seamless transactions for investors. Their presence improves bid-ask spreads, which refers to the difference between the buying and selling prices, making it more cost-effective for investors to trade. Moreover, market makers contribute to reducing price volatility, as they are willing to provide liquidity even during periods of uncertainty or lower market activity.

Overall, market makers play a vital role in enhancing the liquidity and stability of the SDR market. Their continuous participation ensures that investors can readily buy or sell SDRs at fair prices, promoting a more efficient and accessible trading experience.

5) Brokers: Executing trading orders for SDRs

To trade SDRs, investors can rely on their existing brokers who facilitate their buy and sell orders on SGX. The advantage is that there is no need to engage a specialized broker specifically for SDRs.

When it comes to brokerage fees, investors can expect the usual broker commissions and SGX trading fees to apply when trading SDRs. However, it’s important to note that fee structures may vary among different brokers.

First, there are limited brokers in Singapore that offer direct access to Thai stocks listed on the SET. Second, the fees associated with buying SDRs to buying Thai stocks listed on the SET directly are also different. One notable exception is POEMS.

In terms of costs, purchasing Thai stocks directly typically incurs a fee of 0.18% with a minimum commission of THB500 (~S$19.51) on the POEMS platform. On the other hand, buying the equivalent Thai SDRs can cost as low as 0.08% with no minimum commission. Even when factoring in the exchange fees, the overall cost for Thai stocks would be around 0.181%, while for SDRs it would be approximately 0.12% (+S$0.35).

However, it is essential to be aware of additional fees associated with SDRs. For dividend distribution, there is a 1% charge, which applies not only to SDRs but also to foreign stocks in general. Therefore, there is no difference in terms of this fee. Similarly, there is a 0.25% charge on cash distribution resulting from the sale of securities related to a corporate action.

Furthermore, if investors wish to convert their SDRs to the underlying overseas securities, a conversion fee is applicable. This fee amounts to S$5 for every 1,000 SDRs, with a minimum fee of S$50 and a maximum fee of S$1,000. It is important to note that frequent conversions are not expected, and an alternative, potentially more cost-effective approach, is to sell the SDRs and purchase the underlying Thai stocks.

Considering the cost comparison, it is evident that purchasing SDRs is generally more cost-effective than buying Thai stocks directly. The lower fees associated with SDRs make them a more attractive option for investors seeking exposure to Thai companies listed on the SGX.

6) CDP: Holding SDRs in custody

Finally, the custody of SDRs will be held by the Central Depository (CDP). Unlike custodizing foreign shares with brokers, there are no custody fees associated with holding SDRs in CDP. This is a significant advantage for investors, as it eliminates additional costs typically incurred when holding foreign shares over a long period. However, this applies only to investors who possess CDP accounts. In case the connection with CDP has not been established, the broker may hold the SDRs on behalf of the investor.

Investors can conveniently view their SDR holdings within their CDP accounts via the SGX Investor Portal, even if the SDRs represent securities of foreign companies. This provides a seamless and consolidated overview of their investment portfolio.

Moreover, the custody arrangement with CDP provides the added advantage of direct dividend payments to investors’ bank accounts. This eliminates the need for investors to go through the process of withdrawing dividends from their stock brokerage accounts.

Furthermore, CDP plays a crucial role in processing corporate actions related to SDRs, based on the decisions made by the SDR issuer. For instance, if the SDR issuer chooses to facilitate rights subscription for SDR holders, CDP will efficiently handle the necessary processing and ensure a smooth execution of such corporate actions.

By leveraging the services of the SGX Investor Portal, investors can enjoy the convenience, reliability, and cost-efficiency associated with the custody and management of their SDR investments, contributing to a seamless and efficient investing experience.

Risks of Singapore Depository Receipts (SDRs)

There are inherent risks associated with trading SDRs that investors should be aware of:

1) Overseas market risks

Investing in SDRs exposes investors to the risks associated with foreign markets where the underlying securities are listed. Factors such as geopolitical events, regulatory changes, and economic conditions specific to those markets can impact the performance and value of SDR investments.

2) Forex risk

Although SDRs trade in SGD, investors should recognize that forex risks still exist. Fluctuations in exchange rates between SGD and the foreign currencies of the underlying securities can affect the returns and value of SDR investments.

3) Liquidity and pricing risks

The liquidity of SDRs is dependent on trading activity and market demand. In some cases, SDRs may have lower liquidity compared to the actual securities listed on foreign exchanges. This can result in wider bid-ask spreads and potential challenges in executing buy or sell orders at desired prices.

4) No voting rights

SDR holders do not possess voting rights in the underlying companies. While SDRs provide financial benefits such as dividends, investors do not have the right to vote on major matters. This lack of voting rights may limit investors’ influence over corporate actions and strategic decisions.

5) Trading hours and market holidays

Differences in trading hours and market holidays between the SGX and the foreign stock exchanges where the underlying securities are listed can create disparities in price movements and trading activities.

Three Thai SDRs for the launch

The introduction of SDRs brings forth three prominent Thai SDRs: CP All, AOT, and PTTEP.

These companies hold a strong position as blue-chip stocks in the Thai market and are notably included among the top 10 stocks in the SET 50 Index.

1) CP ALL Thai SDR

CP All, a prominent retail conglomerate in Thailand, operates a diverse range of convenience stores, discount stores, and supermarkets. The company boasts an extensive network of convenience stores throughout Thailand, capturing a remarkable 64 percent market share in this sector. In the supermarket space, CP All holds a significant market dominance with a share of 76 percent. Notably, CP All is substantially owned by the wealthiest family in Thailand.

Investors seeking to explore CP All as an investment option can refer to our previous coverage on the company for a comprehensive analysis.

2) Airports of Thailand (AOT) Thai SDR

Another SDR available for investment is AOT, which stands for Airports of Thailand. AOT is responsible for the management and operation of several major airports in Thailand, including the bustling Suvarnabhumi Airport in Bangkok. As Thailand’s tourism industry continues to thrive, AOT plays a critical role in facilitating the country’s air travel infrastructure.

3) PTT Exploration and Production Public (PTTEP) Thai SDR

PTTEP, which stands for PTT Exploration and Production Public Company Limited, is actively involved in the exploration, development, and production of oil and gas resources. With a proven track record and extensive expertise in the energy sector, PTTEP presents a compelling opportunity for investors looking to gain exposure to a prominent upstream player in the oil and gas industry.

These Thai SDRs provide Singapore investors with an opportunity to diversify their investment portfolios and tap into the growth potential of the Thai market. By investing in blue-chip companies like CP All, AOT, and PTTEP through SDRs, investors can gain exposure to the performance and success of these prominent Thai businesses.

FAQs you may have around Singapore Depository Receipts

Is an SDR equivalent to a stock?

No, a Singapore Depository Receipt (SDR) is not a stock itself. It is an exchange-traded instrument that is issued based on underlying foreign securities. While SDRs can be bought and sold like stocks, they are not individual stocks.

Are SDRs considered a secondary listing?

No, SDRs are not considered a secondary listing. Unlike a secondary listing where a company’s securities are made available for trading on another stock exchange, SDRs are financial instruments created for trading purposes and do not involve the listing of the underlying companies themselves.

Who issues the SDRs?

The SDRs are typically issued by financial institutions, often referred to as SDR issuers. These financial institutions play a crucial role in creating and facilitating the trading of SDRs. They work with custodians to hold the underlying securities and create the SDRs that represent ownership of those securities. The SDR issuers are responsible for ensuring the availability of SDRs in the market and managing the conversion between SDRs and the underlying securities upon investor request.

Are SDRs safe?

The underlying securities are held on trust for SDRs and ring fenced from the performance of the SDR issuer.

However, there is always a risk (as with every instrument issued) that the underlying securities could potentially be deemed as assets of the SDR issuer or its custodian and that SDR holders may lose their entire investment.

Nevertheless, it’s important to be aware of other risks associated with SDRs, including risks related to overseas markets, foreign exchange fluctuations, liquidity, and pricing.

Do SDRs represent ownership in the companies?

Yes, when investors purchase SDRs, they are effectively buying an instrument that represents a certain number of securities in the foreign company. While SDRs are not direct ownership of the underlying securities, they entitle investors to financial benefits such as dividends and capital appreciation based on the performance of the underlying company.

How are SDRs traded and who determines the price?

SDRs are traded on the SGX. The price of SDRs is determined through the interaction of supply and demand in the market. Similar to stocks, the price of SDRs can fluctuate throughout the trading session based on various factors such as market conditions, investor sentiment, and the performance of the underlying foreign securities.

Market participants, including investors, traders, and market makers, contribute to the price discovery process by placing buy and sell orders for SDRs. The continuous buying and selling activity in the market helps establish an equilibrium price at which trades are executed.

It’s important to note that the pricing of SDRs is influenced by the underlying securities’ prices on the foreign exchange where they are listed. Changes in the value of the underlying securities can impact the price of SDRs on the SGX.

Which brokers to use to invest in SDRs?

The brokers that offer SDR trading include CGS-CIMB, DBS Vickers, iFAST, KGI Securities, Lim & Tan, Maybank Securities, moomoo, OCBC Securities, Phillip Securities, Tiger Brokers and UOB Kay Hian.

What are the trading fees for SDRs?

The trading fees for SDRs can vary depending on the brokerage firm, but they generally follow the same fee structure as trading any other SGX-listed stocks. The usual trading fees such as the SGX Access fee, Clearing fee, and SGX Settlement Instruction fee will apply when trading SDRs too.

Where will the SDRs be held?

The SDRs will be custodized in the Central Depository (CDP) of Singapore. CDP is the national securities depository in Singapore and provides a secure and reliable system for the custody and settlement of various securities, including SDRs.

Do SDR holders receive dividends?

Yes, SDR holders are entitled to receive dividends based on the dividend distribution policies of the underlying companies. These dividends are paid in SGD, which may be subject to potential forex differences. It’s worth noting that a 1% fee is applied to cover the administrative costs associated with the distribution of dividends to SDR holders.

Is there any dividend tax?

Yes, dividends are subjected to 10% tax.

Can I participate in corporate actions in the underlying companies?

As an investor holding Singapore Depository Receipts (SDRs), you can participate in certain corporate actions depending on the decision of the SDR Issuer and the specific terms and conditions associated with the SDRs. Corporate actions can include events such as stock splits, rights issues, bonus issues, or other actions that impact the underlying companies.

It’s worth noting that while SDRs represent ownership in the underlying companies in terms of financial benefits, such as dividends, SDR holders may not have the same level of voting rights or influence over corporate decisions as shareholders of the underlying companies.

To find out your eligibility to corporate actions relating to SDR and to stay informed about upcoming events, it is advisable to regularly check for announcements relating to the SDRs on SGX website or the SDR Issuer’s website, monitor announcements related to the SDRs, and consult with your broker or the SDR Issuer for any specific instructions or procedures for participation.

Can I attend AGMs?

As an SDR holder, you do not have the right to attend the Annual General Meetings (AGMs) of the underlying companies. AGMs are typically reserved for shareholders who hold the actual securities of the company. Since SDRs represent a separate instrument issued by a financial institution, they do not grant you the same rights and privileges as direct shareholders.

Where do I get updates for the SDR’s underlying companies?

To stay updated on the SDR underlying companies, you can refer to the following sources:

- SGX Company Announcements Page: This is where you can get up-to-date information about latest developments relating to SDRs.

- SDR Issuer’s Website: Visit the website of the SDR Issuer to find information about corporate actions related to the SDRs.

- SET’s Website: For general announcements and updates about the underlying companies, you can visit the website of the Stock Exchange of Thailand (SET). The SET’s website provides a platform for companies to publish announcements and disclosures that may impact the stocks.

- Company Websites: Check the official websites of the individual underlying companies. These websites often provide access to important information, including annual reports, investor presentations, financial statements, and news releases. By visiting the company websites, you can gain insights into the company’s operations, financial performance, and future plans.

- Brokerage Research Reports: Some brokerages publish research reports that analyze the performance and prospects of the underlying companies. These reports can provide valuable insights, analysis, and recommendations based on in-depth research and market trends. SGX consolidates analyst research reports and are made available on https://www.sgx.com/research-education/analyst-research.

How to convert my Thai SDRs to the underlying Thai NVDRs? What are the costs?

When you buy a Thai SDR, an overseas custodian will help to hold the actual securities which are the Thai non-voting depository receipts (NVDRs).

You have the option to convert your Thai SDRs into the actual stock (or NVDR). Here’s how:

You can either submit a request via your broker or directly to the SDR Issuer. A conversion fee is applicable. This fee amounts to S$5 for every 1,000 SDRs, with a minimum fee of S$50 and a maximum fee of S$1,000. The minimum fee is waived till 31 Dec 2023.

Note: This article has been prepared in partnership with SGX.

Apart from dealing with illiquid share tradings, we also can’t check the valuations of these 3 SDR. How to check whether current price is fair, over or under-priced, in term of PE or PB ratio etc?

as mentioned, there are market makers to buy and sell with investors, so liquidity isn’t a concern. Valuation wise is the same as with other stocks. They have English annual reports and slides available on the Thai stock exchange.