I reached my financial independence at age 35.

Career? No. I didn’t work hard in the office or climb the corporate ladder.

Savings? No. I couldn’t be bothered to scrimp and save 50% -70% of my salary. I spent freely and foolishly.

Investing? Not exactly. I wasn’t a genius investor.

I have been investing since I was 16 years old. Since I was too young for my own account, my mum would help me buy the stocks I wanted. I had early success in counters like Keppel, Cosco, Singtel, Starhub, and Cerebos. The excitement of making money helped to grow an obsession with personal finance. I devoured books on investing, including classics like the Intelligent Investor and One Up on Wall Street. I even earned a degree in Finance.

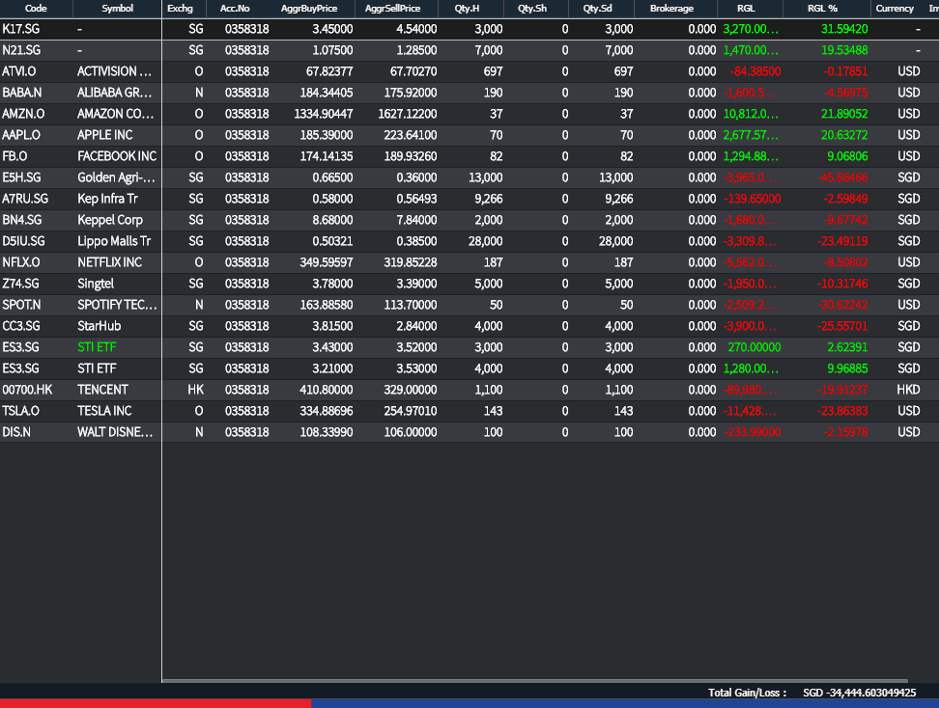

But my timing is and always has been, horrible. All those names above, with the exception of Cerebos, have crashed. I sold out of them all in 2018, disgusted with the returns from the STI.

I have put my funds into US equities, with slightly better results. But again, bad timing and emotional selling have led me to buy high and sell low, and my realised returns have been lacklustre. After almost 20 years of investing, my returns are a negative $35,000. I would have been better off putting it into CPF and never touching it.

I was doing well up till Feb 2020, where everything looked increasingly expensive, and good returns were hard to find. Everyone was chasing yields and driving up bond and stock prices.

How things have changed in just a few short weeks. We are now in the greatest buying opportunity in a decade and I find all my spare cash being used in the margin account to protect me from a loss. Since my bonds are in European banks and they are in trouble, there is risk of it being converted to equity and me then taking a huge loss. I’m looking to get out, but the bid prices being offered are ridiculous, with spreads about 8%-10%.

I used to look forward to the next crash, reasoning I had enough cash to seize opportunities. I had about $250k in cash and cash-equivalents by my estimates, about 30% of my portfolio. But the bonds on margin have fallen lower than anyone’s expectations, and I had to put up nearly $100k to support my margin. That goes my ammunition for buying good companies at incredible prices.

Even safe assets like gold and US treasuries have been falling. The only haven has been US dollars. Worst, the Temasek bond I hold has been dropping. This is an AAA bond, guaranteed by the Singapore Government. It is rock solid. Very soon I will be forced to sell it too. It was a good bond, with a great leveraged return of 10%, and grew from 102 to about 112 now. It’s a profit of about $30,000. It is a great shame to part with it.

Timing is so difficult. I could have cashed out about 20% 2 weeks ago, and redeployed. But once you see your stock go up to 30%, you won’t want to accept 20% for it. But I have also sold and seen the stock zoom up to unbelievable heights. Take a look at what price I sold Tesla at.

I can’t seem to settle on a strategy and stick to it. Too often I hesitate, and due to FOMO, go in and buy at the wrong price and time.

So, no. I didn’t get my financial independence through investing.

The sad and hard truth is… I got stage 3 cancer and received a $700,000 pay out from my insurance. I invested the proceeds in bonds and stocks. The income generated exceeded my expenses, hence I didn’t need to work if I don’t want to.

I would not recommend this as a way to get financial independence and to retire early. Crime would be way more fun. If you can, don’t get cancer. But really, it’s not up to you.

But it is up to you to buy adequate insurance coverage, and I can recommend that.

Before you think this is some sales pitch, I must declare that I’m not a guru or salesman, just a simple man who wishes to contribute.

At least let me walk through what I have to go through financially during my cancer treatment so you can be more well prepared. Not that I wish it to happen to anyone, but just in case the information comes in handy.

I was fortunate to have prepared for this unfortunate event

Cancer is an expensive disease to treat, with surgery, chemotherapy, and radiotherapy all costing a lot of money. All in all, my medical bills have been about $120,000. This is actually on the lower side, since I had some of the treatment in a public hospital.

Fortunately for me, this was mostly covered by insurance. I wanted to share my real-life experience so that people know how important insurance is and how unexpectedly disasters can happen. There isn’t a lot of real first- hand information out there, and I had to stumble along myself. I hope this helps.

How it started

I was feeling great. Things were looking up for me, both in career and my family.

The first sign was a dull ache in my leg. When it didn’t go away within a few days, I walked into my local private hospital to check it out. What followed was a series of scans, where a large tumour was accidentally discovered. I underwent surgery to remove the tumour, and then radiotherapy. Chemotherapy wasn’t effective for my particular cancer, so I didn’t get to do that. The biopsy post-surgery confirmed it was a stage 3 cancer.

A private shield plan is worth it

The benefits of a private shield plan are beyond just getting a nicer bed in a nicer hospital. It expands your options for treatment drastically. This means you can get treatment from all the best doctors in Singapore, not just those in the public hospitals. This is especially crucial if you get hit by a rare disease.

Treatment is also a lot faster. Because I had private health insurance, I was able to get a scan which discovered the tumour and a specialist in the space of a few hours. This would normally take up to 6 months in the public health ecosystem in Singapore. You have to wait for the polyclinic to refer you to a specialist (1-4 months wait), wait for the scan (about 3 months), and 2-3 weeks for the results to come in.

In addition, I could walk across the road to my private hospital to get radiotherapy treatment which lasted for 6 weeks. Given the fatigue and damage that radiotherapy caused, this was much better than the 1.5 hour commute back and forth to the nearest public hospital.

I advise people to go for the new shield plans which allow for up to 12 months post-hospitalisation outpatient visits. As a cancer survivor, I will have to do scans up to 4 times a year for the foreseeable future. Each of this is about $2,000. As it is no longer within three months from my hospitalisation date, I need to pay for this out of my own pocket.

A word of warning: you need to have large cash stash, even with a shield plan. A lot of my bills weren’t covered by a letter of guarantee and I had to pay first and be reimbursed later. This is especially true for private hospital bills, which tend to be much larger than those from the public hospitals.

You should choose a shield plan that doesn’t cause you financial hardship. Any shield plan is preferable to none at all. However, the difference in costs between a private and “A” class ward shield plan is less than $300 a year if you are below 40 years old. It’s disheartening that most Singaporeans won’t blink at an expensive vacation or their daily coffee, but hesitate at spending another dollar a day for a better medical care.

Get the riders

Cancer is an especially expensive illness to have, given the long treatment period and years of follow-up.

When you buy a shield plan, get the rider which limits your deductible and co-payment. For me, I had a payment cap of 10% of my claimable amount, with a maximum co-payment of $3,000. Without the rider, my out-of-pocket including the deductible and co-payment, would have been about $15,000 ($3,500 deductible and 10% of remaining amount). Instead I paid $3,000, a much more affordable amount.

The daily cash rider was surprisingly helpful. A daily cash rider pays you a cash benefit for each day you were in hospital, typically $100 – $200 a day. The great advantage of this rider as compared with other policies, such as critical illness or disability income claims, is that the claim is fast and easy. You don’t need to fill out long forms or get a doctor’s statement (takes 4-6 weeks) to get the claim. This claim is automatic, easily verifiable with the discharge summary. Given that this can be used for both accidents and illnesses, and long hospital stays are not uncommon, this is something I would recommend most people to have. A daily cash rider shouldn’t be tied to your critical illness plans, as these plans end once you have contacted a critical illness.

Know what your shield plan covers

Read your policy terms and conditions carefully. Some people get upset or surprised when they learn that not all their medical bills are covered, but it is all there in black and white. Don’t rely on your agent to tell you, because if they are wrong, you are liable for the bills, not your agent.

For example, outpatient charges aren’t part of your shield plan, unless it is within a set period from your hospitalisation. Outpatient charges can be very expensive, usually ranging from $100 – $200 a visit if you have been in an “A” class ward and above. This also doesn’t include scans and medicine, may not subsidised. This is why many people opt to downgrade to a “B” ward and below, despite being qualified for a higher class, because they will continue to get subsided outpatient visits and medicine.

Some other treatments you won’t usually have under your shield plan are hospice, home nursing, and overseas treatments. This is also why your critical illness, disability income plans, and cash stash are all important to keeping you and your family protected.

I would like to tell a story that stuck with me. A nurse told me how a guy a few years younger than me was found to have stage 4 colorectal cancer. He had no symptoms before, and just found blood in his stools 2 weeks before. That young man didn’t have insurance, and was sobbing in the room, facing a mountain of bills and no good options. Don’t be that guy.

I was fortunate enough to have been well – covered and gotten top treatment, but not all are as lucky as I am. I hope you can get yourself covered well too, for your sake and your family’s.

Retiring Early in Singapore is very much within reach

You may be surprised by this, but Singapore is a decent place to work towards financial independence.

Despite the headlines of being one of the cities with the highest cost of living in the world, it really is quite possible to retire comfortably. . And it is achievable on a $3,000 a month salary.

Here is the simple math.

Save 10% of your income. Assume its $300 per month, or $3,600 a year.

- Invest it in the S&P 500 ETF.

- Average return of 8% a year

- Do this for 30 years.

You should have about $407,819 at the end of it

This sum can translate to about $37,440 a year, or $1,700 a month, assuming a lower risk 5% annual return. This exceeds the basic monthly income of about $1,400 needed in Singapore for a single elderly person. See here.

And remember, this assumes that your salary is stagnant at $3,000 a month for 30 years. During this whole time, there isn’t any salary or bonus. For most this should be unrealistic.

Most people should be able to increase the monthly savings of $300 illustrated in the above scenario. If you can’t do it, you need to look at yourself in the mirror and think about who’s fault it is.

I know that I don’t have real experience in saving that amount over that many years. I got my FIRE money in the worst way.

But this isn’t about me, it’s about you. You have different circumstances from me, and you need to find what works for you. But you will get old, you will need to stop working at some point, and its best that you have something to look forward to.

Fortunately or unfortunately, I have reached my FIRE number already. You have to figure out how to reach yours.

We were touched by FI35’s story and wanted to share his story with you. He was kind enough to agree to publish it here. You can visit his website for more updates.

There will not be a stock bond market left. Capitalism as we know it is done. Time to even up the world and maybe people will find out money isn’t everything.

Good luck

You must living in a very sad world

Why

1) What is a good investing platform for S&P 500 ETF? Saxo, poems or DBS Vickers?

2) S&P500 ETF refers to SPDR S&P500 or vanguard S&P500?

Appreciate if Dr wealth could advise.

If let’s say every month buy $300. A shares cost $200USD. Buy 1 share. The transaction fee cost $20-25 for buying/ selling on platform on DBS or poems. SAXO have custodian fee, etc. The transaction cost gonna eat into dividends. How does 8% dividends vs expense cost still make a gain out of it? Can enlighten?

if you want to buy small amounts without incurring large cost, you probably have to look at discounted brokers from the US. Otherwise roboadvisor is another possibility.