One out of 10 Singaporean is a millionaire. Singapore is a rich country indeed.

Despite living in such a wealthy country, many people are still living paycheck-to-paycheck without proper financial planning in Singapore.

Many working adults are simply too busy with work that they have no time to take care of their own finances.

They only think about their finances at certain stages of life – marriage, having a child, purchasing property. Some only start to be concerned as they approach retirement age. At other times, they remain blissfully unaware of the need to plan.

Although Singapore has one of the lowest unemployment rates, one cannot assume that they will continue to remain employed forever. No one will ever care more about your money than yourself.

In this article, I share the top 7 questions that you need to ask yourself constantly in your financial planning journey.

1. Are you under-insured or over-insured?

It is common for many to relate financial planning to ‘buying insurance’. This is because there are financial advisors in Singapore who push for insurance purchases without a proper financial review.

Insurance is an important part of financial planning. However, insurance alone is not enough.

A comprehensive financial plan will also involve other aspects which I will discuss subsequently in this article.

However, before we can even talk about other aspects, we need to constantly ensure that we are well protected.

An insurance review should be done on a yearly basis.

This is because your insurance needs change throughout your lifetime. At certain life stages, you may have new liabilities or new dependents.

Thus the insurance coverage that you need will increase accordingly.

On the other hand, when you have already accumulated sufficient cash savings, you may opt to reduce your insurance coverage.

Insurance companies are constantly pushing out new insurance products. Typically, new types of insurance tend to be an improvement over existing ones, offering lower premium or better coverage.

Hence, we should always review our policies on a yearly basis. For more information on the roles of insurance in your life journey, please read about The Roles of Insurance in your Journey to Financial Freedom.

2. Is your money working hard enough?

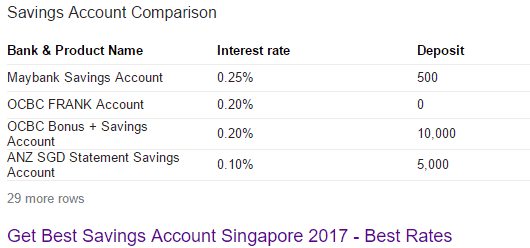

While you are working hard to get a bigger salary increment, you should not leave our savings idling in the bank. Current interest rates are almost negligible and you ought to make your money work harder for you.

Especially since there are so many ways to invest your money today.

They range from relatively risk free investments to high risk investments. You can either invest actively on your own or invest passively with a fund. There should be no reason not to invest your money.

To find out more about various investment instruments, read The Expected Risk and Return for Various Investments.

3. Do you know how much you can get from your CPF?

It is mandatory to contribute 20% of your gross salary to CPF.

The CPF Board is constantly tweaking the CPF scheme to ensure Singaporeans have adequate resources during retirement.

There are many options available and it pays to understand which ones work best for you.

One of the latest initiative is the new CPF LIFE payout structure. You can now choose to postpone the age to begin receiving your CPF payouts and in return receive higher payouts from your CPF LIFE.

Most importantly, CPF serves as a basic but crucial component of your retirement planning.

You should know how much you will eventually receive from your CPF and factor this into your retirement planning. For more information on CPF LIFE, read this.

4. Do you know how much you need to retire comfortably?

As mentioned in point 3, CPF only forms the basic part of your retirement.

If you rely solely on CPF payouts, you would most likely receive only between $1200 to $1900 per month from age 65.

Many would cringe at the amount, claiming that it is hardly sufficient to keep up with retirement needs.

But do you truly know exactly how much you need to retire comfortably?

It requires some forward thinking but it is not rocket science. To make it even simpler, you can download my retirement calculator:

5. Are you paying too much interest for your loan?

For most people, a housing loan is one of the biggest loans they will have in their life.

The market is highly competitive, and there are so many loan packages out there that have various interest structures.

Most of these loan generally come with a lock in period and a step up interest rate structure.

You should always review your loan package regularly and check for refinancing eligibility.

You may be able to save few thousand dollars on interest expenses if you refinance your loan to a new loan package.

To check on whether you can save on interest payments, you can get in touch with a mortgage broker, or you can download my refinancing calculator:

6. Are you paying too much tax?

Is it good to pay too much tax? Well, yes and no.

If your tax payments are bothering you, you are probably earning a significant income. It is a happy problem and your fellow Singaporeans will be grateful for your contributions towards nation building.

However, in financial terms, tax is categorized as an expense item. To achieve financial freedom earlier, you should cut down on your expenses so that you can save and invest more for our retirement.

There are various ways you can pay less tax (legally).

One option is through contribution to the Supplement Retirement Scheme (SRS). By contributing to the SRS account, you can save your income tax expense and at the same time use the SRS money to invest. To learn more, you can read about Everything You Need to Know about the Supplementary Retirement Scheme.

7. Are you ready to buy a big ticket item?

Are you planning to have a baby? Are you on the verge of buying a car? Is your first (or second or third) property in the works?

Most importantly, do you have sufficient savings for all these items?

We should always plan ahead and allocate our savings more prudently. A simple calculator can indicate how much and for how long we need to save in order to afford these big ticket items.

Let’s sum it up

Financial planning is a must for everyone.

With proper financial planning and sound decision making, one can really save on expenses and achieve higher returns on investments. To find out more about making your money work harder for you, attend this half day workshop about personal finance. I am confident that you will gain knowledge which will benefit you for life.

1 thought on “7 Essential Financial Planning Questions That You Need An Answer To”