The HDB flat is probably one of the biggest investments most Singaporeans would make in their lives. We explore the important part of every shoebox purchase – the finances.

Last updated on 19 May 2015

—

It’s the rite of passage that almost every Singaporean not born with a silver spoon in his or her mouth goes through – purchasing an HDB flat. Whether you’re single and turning 35 (the age at which HDB finally allows singles to buy their own apartments) or married and looking to build a home, the money is probably the most important factor to take into consideration when you’re in the market for a flat. We’ve put together a comprehensive list of questions you should ask and financial guidelines we recommend you adhere to so that you’ll have worry-free nights in your new home for the next few decades.

Should I ballot for a new Build-to-Order flat or find one in the resale market?

According to PropertyGuru, the average price difference between BTO and HDB resale flats has increased in the past decade. Today, the price difference stands at 31%, as compared to 18% in 2004. Furthermore, HDB is only launching 16,900 new flats this year, down from 22,400 units last year. The Ministry of National Development expects “more buyers to return to the resale market rather than await the building of BTO flats…as resale prices continue to moderate”.

So, if you read in between the lines, the prices of resale flats should be experiencing a slight uptick in the next couple of years until 2016. That’s when the first batch of flats built during the three-year record construction programme from 2011 to 2013 will be eligible to enter the open market after fulfilling the five-year Minimum Occupation Period.

In any case, purchasing a BTO flat will, in almost all cases, be cheaper than a resale flat. In fact, the BTO flat has been likened to your first pot of gold by many folks and there’s no reason to turn down an asset that will only appreciate in the time it takes to build it. The only reason why you would go for a resale flat as your first purchase is if the market takes a severe beating and resale flat prices dive to the depths of the Mariana Trench. History has shown, however, that flat prices tend to be rather resilient even during an economic downturn.

What’s a good rule of thumb for the cost of the house?

Tan Kin Lian has suggested that the purchase price of your HDB house, after grants, should not exceed:

- Seven years of the breadwinner’s income, or

- Five years of the combined family’s income

So, if your monthly household income is S$4,500, that means you should be aiming for a flat that costs s$270,000 or lesser, after grants. Based on the latest BTO sales figures released in February this year, that should net you a decent 4-room flat in a non-mature estate such as Bukit Batok or Hougang.

You’ve probably heard of people saying that you can go for a flat that has a monthly loan payment amount not exceeding the combined CPF OA contributions of you and your partner. While that seems somewhat sound on paper and allows you to opt for a bigger flat in a “hotter” estate, it leaves you and your partner in a precarious position if something cataclysmic happens in the future, such as one of you losing your job. It also means that your main retirement fund i.e. your CPF, will be affected. It’s a decision that you’ll only experience the full brunt of much later in the future. By that time, it will be too late to repair the financial damage.

Also, here at DrWealth, we always recommend having an emergency fund of at least six months of your monthly income, so take that into account when you’re deciding on your flat.

Having said that, if you manage to spot an under-priced flat in a mature estate and your extensive research has told you that the price will go up in the future but you might need to take a calculated financial risk, by all means, go for it.

Should I go for a bank loan or an HDB loan?

It’s the age-old question and there is legitimately no right answer. Bank loans have been offering lower interest rates than the loans offered by HDB in the past few years, but at the same time, the fear that rates may rise has also prompted more flat buyers to opt for HDB’s fixed concessionary loans.

Currently, banks offer interest rates that start from 1.1% and go up to 2.38% while HDB’s interest rate – pegged at 0.1% above the prevailing interest CPF interest rate – is 2.6%.

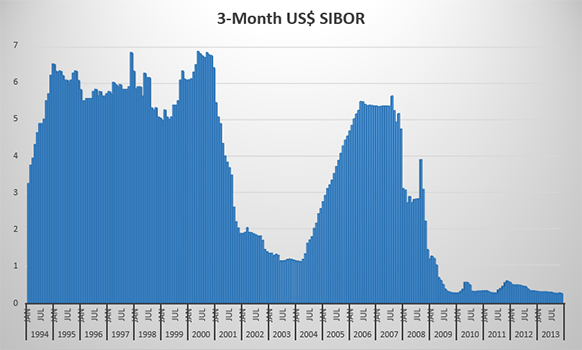

One of the main issues of a loan from the bank is that interest rates fluctuate up or down, depending on SIBOR (Singapore Interbank Offered Rate). If you’re wondering how much the SIBOR can increase or decrease, here’s a handy chart we’ve created that reflects the SIBOR movements for the past two decades.

Recently, many of the banks have been adjusting their fixed home loan rates to match that of the floating rates, in response to the SIBOR and SOR soaring to above 1% — a record level we have not seen since 2008. The DBS home loan package offer was one that caught our eye. For the first five years, the bank promises to cap the prevailing interest rate at a maximum of 2.5 percent per annum, 0.1 percent lower than the HDB loan rate. You pay the lower rate if the rate is below 2.5 percent.

The key thing that you need to ask yourself is whether you’re planning to upgrade, migrate out of the country or sell the house within a decade of moving in. If you are, it’s probably advisable to go for a bank loan at this time as the interest rates are lower. Then, negotiate for a lock-in period for your interest rate with the bank officer. The higher your loan quantum, the more leverage you have on the negotiating table, as the bank would rather keep your business than risk losing you to a competitor.

However, if you’re planning to stay in the house for the next few decades and are not planning to move out, then we would recommend opting for the HDB loan instead. Interest rates are locked in at the time of purchase and HDB is more lenient when it comes to late monthly payments.

So, how much cash should I set aside?

Generally, you’ll need anywhere between S$20,000 and S$50,000 at the point of purchase, depending on the flat you choose and the type of loan you go for. When you successfully apply for an HDB flat, you’ll also need to pay a variable option fee that will be refunded to you when you sign the sales agreement.

I heard that I need to pay the grants that were given to me when I sell my flat. Is that true?

Absolutely untrue. Yes, the grants you took are returned to your CPF but are not taken out of your pocket. That’s why your first HDB flat is a pot of gold. If the government gives you free money, why would you want to turn it down?

—

“The Ministry of National Development expects “more buyers to return to the resale market rather than await the building of BTO flats…as resale prices continue to moderate”.

So, if you read in between the lines, the prices of resale flats should be experiencing a slight uptick in the next couple of years until 2016.”

Thanks for the above article – it’s a great read. I am just a little confused with your statement (copied above). From what I read in the news, Minister Khaw Boon Wan has indicated his desire for a single digit fall in resale home prices this year. This runs contradictory to your statement. Care to elaborate?

Hi Melvin, I’m glad you enjoyed the article. As for your question, HDB resale prices went down in 2014 due to a combination of factors. I suspect the cooling measures and the glut of new BTO releases were the two main causes. I also read the news that you’re referring to and from what I understand, Minister Khaw hopes that the drop will continue this year. The keyword here is “hopes”. Reality, however, is a cruel mistress. Since supply of new flats will drop and with the MND expecting more buyers to return to the resale market, naturally, there will be more buyers, married or otherwise, in the market who cannot get their hands on a flat.

Also, the HDB is focusing on building 1- to 2-room flats for the next few years for low-income families, and from anecdotal evidence, the supposed shortfall is because many married couples want a minimum of a 4-room flat, of which there is limited supply, for their first home. So, I expect resale prices for 4-room flats and above to experience a slight uptick in the next few years. I hope this rather long-winded elaboration answers your question!