Investors, especially Singaporeans, are probably more familiar with Exchange Traded Funds (ETFs) than Index Funds.

Both are known to track the indices and try to mimic the returns by investing into the index constituents closely.

If they do the same job, why do they have different names?

Let’s find out the differences…

#1 The Index Fund is the mother of ETFs

Vanguard is the champion of index funds and the brainchild behind it was John Bogle. He successfully revolutionalised the financial industry and made a lot more investors adopt index investing.

He launched the first index fund on 31 December 1975. It tracks the S&P 500 Index.

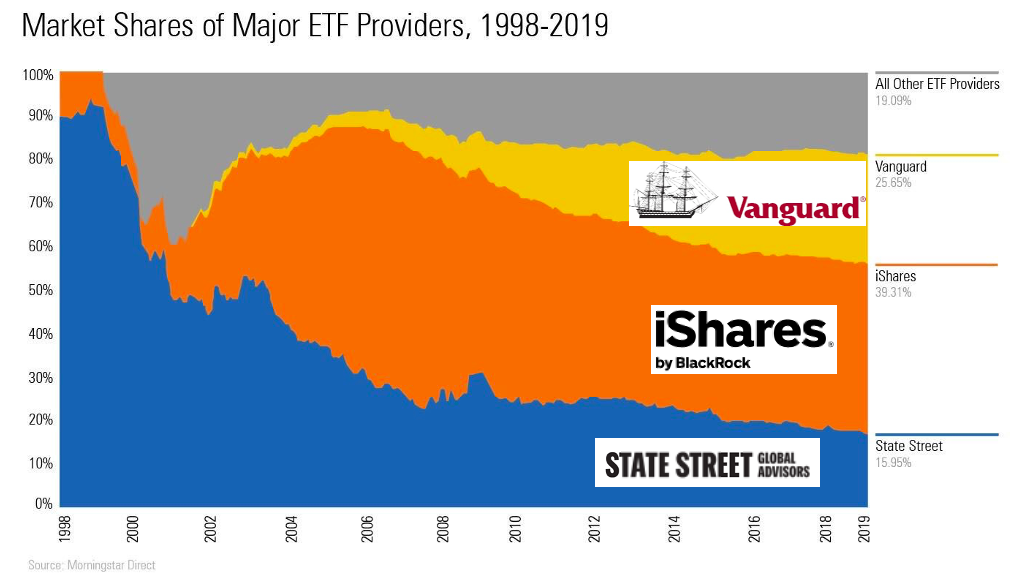

The first ETF was only launched on 22 January 1993, about 18 years later. The manager was State Street Global Investors and there’s no surprise that tracks the S&P 500 Index too.

Today, BlackRock is the largest ETF manager by assets with their iShares brand of ETFs.

Vanguard came to the ETF business later in early 2000s but has gained more market share in recent years.

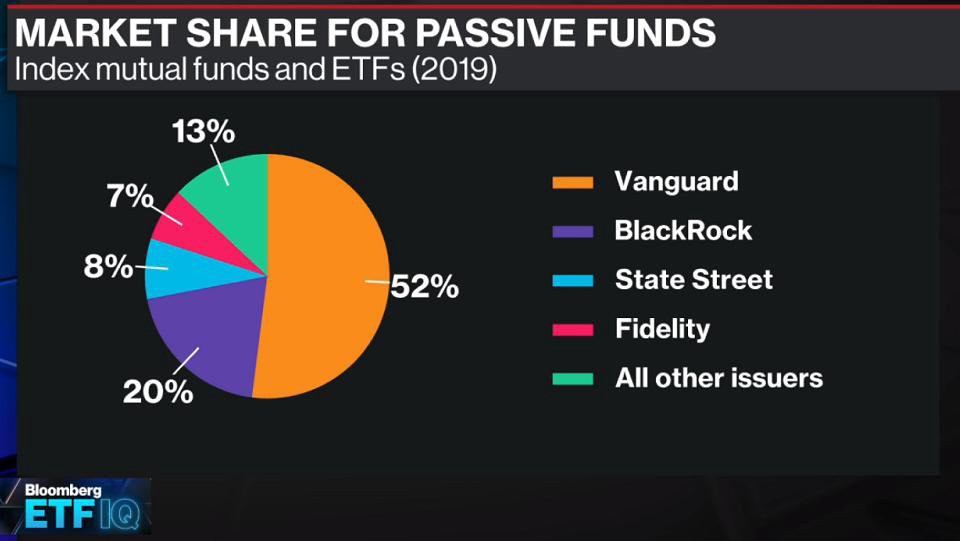

However, if we take both index funds and ETFs into consideration, Vanguard held more than 50% market share in 2019.

#2 ETFs are listed on the exchange while index funds are not

As the name suggests, an Exchange Traded Fund is traded on a stock exchange.

The advantage is that you can buy or sell the ETF like a stock and it is subjected to supply and demand between the buyers and sellers.

ETFs have an underlying value known as the Net Asset Value (NAV), however ETF prices may deviate from this value, if the supply and demand goes out of whack. Most of the time, the prices are very close to the NAV.

The trading mechanism also means that the ETFs do not need to create or redeem units all the time. A seller can transfer his units to the buyers and hence, the Assets Under Management (AUM) can remain the same.

But this is not the case for the index funds.

They are not traded on the exchange and are sold by financial advisors or directly via the managers’ platforms. Units are often created when someone wants to buy and redeemed when another is selling.

Of course, these transactions can net off each other such that there isn’t much changes to the AUM too. The price is usually based on the NAV with a tight bid and ask spread.

There’s only one price a day unlike the ETFs which can trade at different prices within a day. There may be sales charges depending on the intermediaries (e.g. financial advisors) who sold the index funds.

#3 ETFs are more accessible than Index Funds

Unless you live in the US, index funds are not that accessible for most investors.

Even in Singapore, you can only count on Lion Global Investors to offer you these 6 index funds:

Unfortunately, these index funds have higher expense ratios than the ETF equivalent. For example, the US 500 Stock Index Fund charges 0.71% annually while the SPDR S&P 500 ETF listed in the US charges 0.095%. That’s about 7x more expensive.

Alternatively, if you’re really interested in index funds, you can consider some of the local roboadvisors (such as Money Owl and Endowus) who distribute index funds from Dimensional Fund Advisors. The expense ratios are estimated to be around 0.4%.

Vanguard does not offer their index funds to retail investors but they will entertain you if you are an accredited investor in Singapore and are planning to buy in at large amounts.

Comparatively, you can buy ETFs via exchanges anywhere around the world, at your convenience, as long as your broker provides you with the access.

#4 Fees differ because they are distributed differently

ETFs are traded on the exchanges so they will attract the usual brokerage fees.

In the US, some brokers have started to offer zero commissions for trading ETFs. For SGX-listed ETFs, most brokers still charge a minimum commission of around S$25, but it is getting cheaper with a few offering to do away with the minimum commission.

This would make it more cost effective for investors with smaller investment amounts and make dollar cost averaging possible. It is also important to note that some brokers may charge a custodian fee if the ETF is listed in foreign exchanges – about $2 per month per counter but could be waived if you hit the minimum commission spend.

Index funds can be purchased from financial advisors or directly via DIY platforms such as FSMOne.

Financial advisors may include at least 1% sales charge to for their recommendation or charge an annual wrap fee for as long as you continue to use their services. You can reduce the 1% advisory fee, if you used roboadvisors to manage your portfolio of index funds on your behalf.

There are no sales charges on FSMOne but you pay a platform fee of 0.0875% per quarter.

#5 Not all ETFs are passive but all index funds are passive

Although ETFs are almost synonymous with passive index investing, there are actively managed ETFs. ARK comes to mind as they have achieved superb performance lately – the ARK Innovation ETF achieved an annual return of 29.09% between 2015 to 2020.

That said, majority of the ETFs are passively managed so you aren’t wrong to make a broad assumption that ETFs is equivalent to index investing.

Index funds on the other hand are all about passive index investing. Otherwise, they will be called mutual funds in the US or unit trusts in Singapore – these are active investing funds where fund managers will handpick securities and try to do better than the indices they are benchmarked against.

ETFs or Index Funds for you?

There you are, I have explained the 5 differences between ETFs and Index Funds and you should have a better idea about them.

It is quite obvious to me that ETFs is a better choice, if you are a Singaporean investor because of their accessibility and the cost effectiveness.

That said, if you do not want to have to think too much about investing and prefer to have someone else handle it for you, going with roboadvisors may be a good solution, if you don’t mind paying a bit more fees.

Regardless, index investing is for the long term and you should not disrupt the compounding process prematurely. Stick with it, regardless if you have chosen ETFs or Index Funds.

Hi,

Many thanks for the continuous great work for helping layman investors understand the investments concepts and jargon.

There was a helpful article recently on stock index ETF. I wonder if the bond ETF work the same way.

I noted that there was a recent listing (in mid Sep 2020) on SGX of the China government bonds ETF, managed by CSOP (CYC.SI).

Will be great if you can briefly comment on the suitability of investing in this China govt bond ETF for layman investors, in particular the potential for capital gains in the event that the Reminbi strengthen against SGD in the future.

Thanks in advance

Regards

Ernest Kee