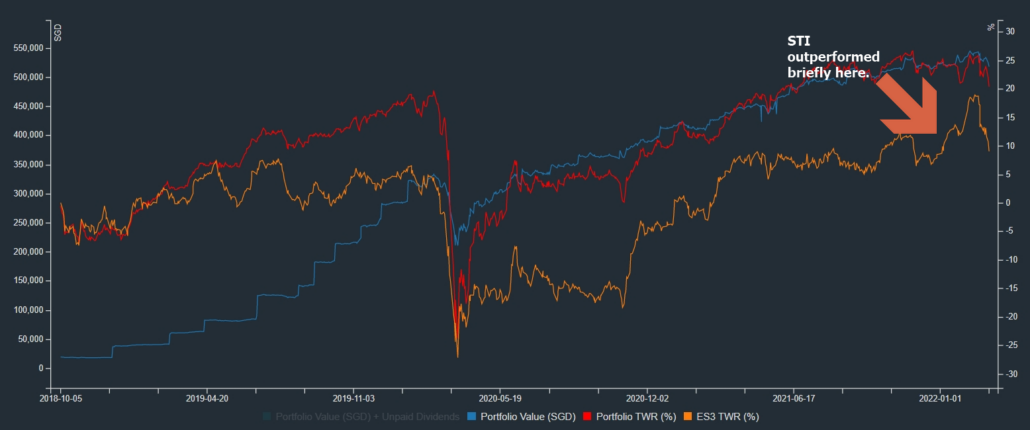

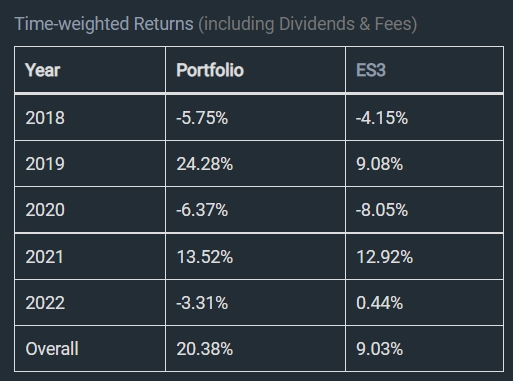

The Early Retirement Masterclass (ERM) portfolio is a diversified mix of local dividend stocks that currently yields about 5.5%. It has been built progressively by 24 batches of students and still outperformed the benchmark STI index by a factor of 2.

2022 would have begun with ERM portfolios severely underperforming the STI index as bank stocks started a meteoric rise due to expectations of rising interest rates. As bank stocks rose, the ERM portfolio began to lag behind the STI because it is still diversified across 15-19 counters per batch of students, whereas 40% of the STI was invested in bank stocks.

Initially, we were prepared to accept underperformance as that may be the small price to pay for diversification – the return to outperformance can happen some other time in the future and things may return to normal in 2H2022.

Fortunately, or unfortunately, no one predicted that Russia would invade Ukraine in 2022 and the rise of STI relative to ERM seems to be unsustainable. The likely reason for this is that chaos in Eastern Europe may push the US Fed to raise interest rates slower and reduce the probability of local banks earning more interest on their loans.

ERM narrowed the previous performance gap of about 8% to about 3% today, but sadly is still losing money year to date, but it remains a single-digit loss. Readers are free to compare the performance against their favourite technology counters.

Here are a couple of points about dividends investing in a time of crisis:

1. Dividend stocks generally experience a slower decline in a crash.

Growth counters tend to outperform when markets are doing well but will suffer a more comprehensive loss when markets tumble. Dividend counters tend to earn less when markets are trending up but can partially value when markets fall.

You can observe the rightmost trend on the chart attached above.

As the STI begins to slump, the ERM portfolio goes down less.

2. Dividends spun off can be used to bargain hunt.

A local portfolio of dividend stocks can be designed to pay every quarter, and this provides a basis to buy counters trading at a discount when dividends are received. Reinvesting dividends at a discount is a slow but sure way of rewarding you for your patience, and further downturns may lead to even better deals.

There is also nothing stopping you from buying battered growth counters with dividend payouts.

3. Dividends counters tend to mean revert due to increasing yield as it drops in price.

The logic is quite apparent. Backtests have shown that mean-reverting strategies that buy on a downturn are profitable for most REITs and Business trusts counters. If you have buildings in Singapore and parts of Asia, rental collections are primarily stable due to rental contracts that already lock in a price.

When there is a war in Europe, the price of these real estate investment trusts drops, resulting in higher yields making them more attractive to older buyers who are always on the lookout for more passive income. The pressure to return to the original price will always come from folks who prefer stable revenues.

There are things to be glad about in these markets

While the Ukraine War does not seem likely to meet its resolution soon, investors still have good news. In Singapore, COVID-19 numbers are trending downwards, and we should see some restrictions soon, which would be a boon for local businesses.

Whoever invests in dividends stocks over the next few months should be able to buy some yields at a reasonable price and subsequently be able to benefit from a market recovery in the future. Once investors have assimilated all the bad news, any light at the end of the tunnel should result in a sudden recovery.