Christopher Ng Wai Chung, CFA

Trainer of Early Retirement Masterclass and All Weather Portfolio Masterclass

- Retired at age 39. Now pursuing a 2nd career in law.

- Financially Independent.

- Straits Times Best Selling Author.

- CFA, CAIA, FRM

- NUS Bachelor of Engineering (1st Class).

- NUS Masters of Applied Finance.

- SMU Juris Doctor (Cum Laude). Since retiring, I went to study law, completed my Juris Doctor and have been called to the Singapore Bar.

- Owner and Writer of popular financial site; ‘Growing Your Tree of Prosperity‘

- I wrote three books on Personal Finance explaining the processes by which I attained my financial independence. The first in the series, “Growing your Tree of Prosperity” was a local Straits Times bestseller in 2005.

- I was featured in Me and My Money sections in the Sunday Times twice as well as:

Why do I Invest?

I resolved to taking my personal finances and investments into my own hands after a horrible experience with an insurance policy in my teenage years.

Long story short, my mom and I were mis-sold an plan and I had to cut losses and watch years of savings evaporate into thin air.

Thankfully, that painful experience took plan just after I graduated. It drove me to start learning about finance and investment from scratch (I was an engineering graduate, working in IT then).

By 2008, I had amassed a sizeable portfolio that was growing well. Then the financial crisis hit.

I became the butt of the jokes in 2008 financial crisis.

As an engineer, I rely heavily on data and statistics. My studies told me that all market crashes will recover…eventually.

Hence, I invested my entire paycheck every month while the market dropped. My colleagues heard about it, and I became the butt of all jokes.

In 2009, my portfolio value ballooned as the markets recovered. The growth of my dividend income started to outpace that of my salary too. Soon, I earned my financial independence at age 39 after my investment income started to exceed my monthly take home pay, and decided to retire officially.

One of my first acts upon retirement is to go back to Law School to reinvent myself as a legal professional.

Fast forward today, my portfolio has survived several “market crashes” since then, even the latest 2020 Covid crash. The good news? My dividend income remained rather consistent during the crash! And a better news? My students report similar performance.

Why do I Teach?

I want to turn the tables on “investing gurus”.

There’s a fundamental conflict of interest in the private finance education space: “A trainer CANNOT guarantee good returns on knowledge shared.” There are both legal and practical reasons which I will not delve into here.

But I believe I can reduce that conflict of interest. This is the unique selling proposition I’ve designed for my ERM program which I don’t expect my competitors to match:

I’ll teach and equip my students to pick dividend stocks during our actual class. They’ll get their hands dirty and design an actual portfolio that can be invested in, based on current live prices. I’ll then invest at least $10,000 into that portfolio.

Doing so allows me to keep my personal promises to students:

- They will graduate with applicable skills – they can immediately invest in the portfolio that was designed. There is no need for an additional ‘advanced’ course.

- They will become independent, confident investors who are able to pick stocks and design a dividend portfolio.

- They will have direct support should any stock turn bad. I provide support and updates of all the newest portfolios to my graduates.

So far, there have been encouraging results. Here’s one:

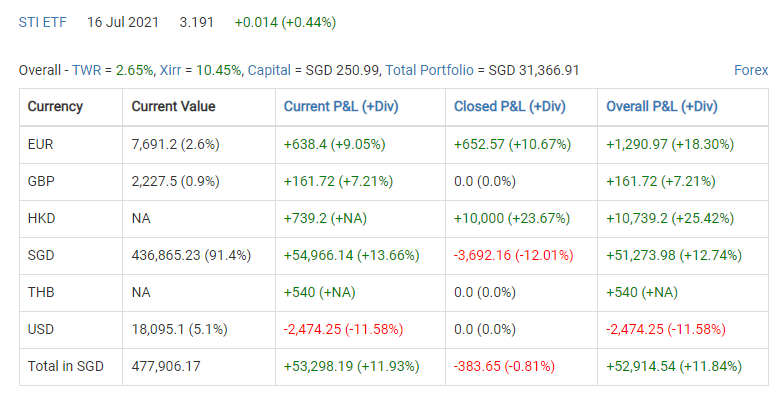

In less than two years after attending the ERM course, one graduate had accumulated almost half a million worth of stocks in his account with an internal rate of return of 10.45%:

He has allowed me to share some of his results, which I’ve compiled it in this article.

How do I invest?

I focus mainly on dividend paying stocks in Singapore. I share more in my videos which you can find on my Early Retirement YouTube Channel.

I also share my investing insights:

As an investor who is able to retire thanks to my investment income, I am constantly looking to improve my returns and futureproof my portfolio.

I share my investing insights, backtests and simple strategies that aspiring investors can use in my articles (see full list here).

I hold live webinars and workshops with Dr Wealth periodically, you’re welcome to join me to learn or have a discussion. See you there!