Singaporeans have one of the most comprehensive social security mechanisms in the world called the Central Provident Fund (CPF).

Not only that, Singaporean employees also have the CPF Special Account (SA).

If you are one of those who are not familiar with either CPF or the CPF Special Account, then this article is for you.

This is a a comprehensive guide on CPF Special Account (SA) to help you understand this extremely helpful system. But before we jump into it, let us first cover the basics of its foundation, the CPF and why it’s so important that YOU as the reader understand it.

What is CPF?

CPF, otherwise known as the Central Provident Fund (Board), is a mandatory investment scheme for all employed Singaporeans. It is a comprehensive social security system that allows working Singapore Citizens and Permanent Residents to appropriate funds for retirement.

CPF Funds are split into the following accounts:

- Ordinary Account (OA) – This is meant for housing, insurance, investment and education

- Special Account (SA) – This is meant for old age and investment in retirement-related financial products

- Medisave Account (MA) – This is meant for health expenses in hospitalisation and other approved medical insurances.

- Retirement Account (RA) – This is created on your 55th birthday, and will be for your retirement.

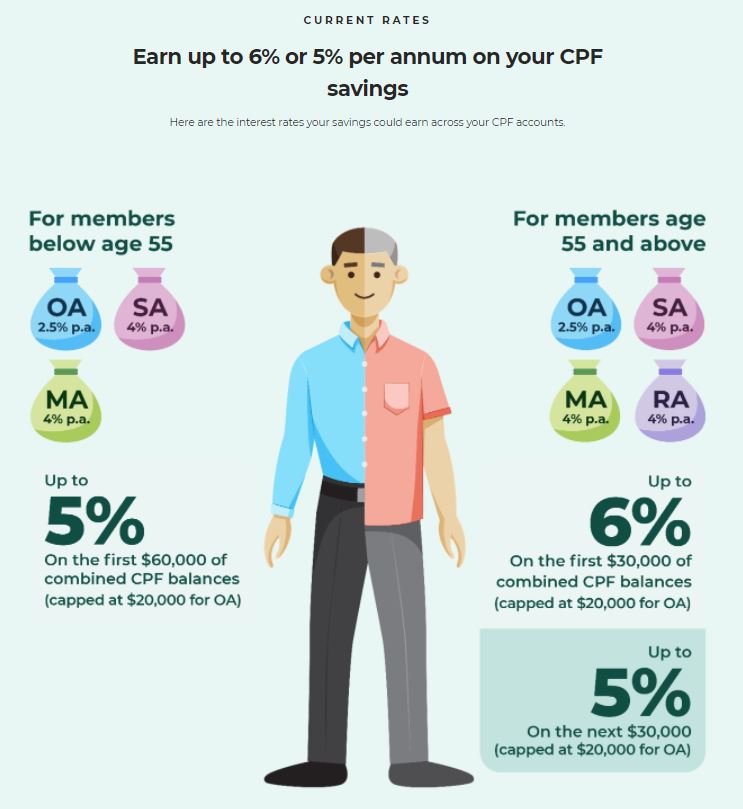

Interest Rates – INTEREST EARNED BY MEMBERS

Your CPF Savings account can earn a guaranteed interest rate each year. Initially, your OA’s interest rate is 2.5%, while the Special Account and Medisave Account give you 4%.

However, there will be an additional one percent added to all of the accounts, only for the first $60,000 of your CPF balances, of which $20,000 is limited to your OA.

In other words, if you have a balance of $70,000 you will be earning 1% more from the $60,000 (the 1% extra in OA is limited to $20,000), and the remaining $10,000 will grow at the guaranteed rate.

Savings in your CPF accounts earn what is called a “floor interest rate” since these are invested under Singapore Government Securities. This are guaranteed by the Singapore Government, so you don’t have to worry.

What is the CPF Special Account (SA)?

Now that we’ve familiarized ourselves with the basics of CPF, let us now head on to one of its specific usage: CPF Special Account.

We mentioned above that the CPF Special Account is meant for financial needs after retirement, and can be used for investments in retirement-related financial products.

It primarily exists to help Singaporeans to save for future retirement needs, hence it enjoys a higher interest rate of 4%.

What are the features of CPF Special Account?

The CPF Special Account features the following:

- Savings will be for regular income after retirement and for investing in approved investment products. The latest list of approved investment products can be found here.

- Savings in Special Account will be guaranteed absolute, reliable returns, at a floor rate of 4% and up to 5%.

- CPF Special Account’s interest rate will not be affected by inflation. People would consider this as a better alternative of investing money than stock-related instruments and those offered by insurance policies.

- CPF Special Accounts savings cannot be withdrawn before the age of retirement.

- From Early 2025, the CPF Special Account will be closed for those aged 55 and above. The amounts in the Special Account would be transferred to the Retirement Account, up to the Full Retirement Sum. Any Special Account savings that remain will go to the Ordinary Account.

What are the uses of CPF Special Account?

The savings in CPF Special Account beyond its minimum amount of S$40,000 can be invested in any of the approved investment schemes. It could also be invested in the following financial instruments:

- Unit trusts

- Investment-linked insurance products

Note that you will not be able to invest in high risk financial instruments using the monies available in your CPF Special Accounts since the primary goal of the CPF Board is to ensure you have sufficient funds for your twilight years.

Risking your capital is in direct conflict with the directive that the CPF Board wishes to go in as well in order to take care of Singaporean Citizens in their later years.

The following financial products also cannot use the savings from CPF special account:

- Shares

- Corporate bonds

- Property funds

- Gold ETFs

- Physical gold

If a person reaches the age of 55, the savings from the special and/or ordinary account will be transferred to the retirement account. This can then be used to join CPF Life which offers lifelong monthly payouts to CPF members.

Once the retirement sum is settled, the rest of the total amount left in both the ordinary and special accounts can be withdrawn or kept in the CPF account to earn attractive interest rates.

How to get the most out of Singapore CPF?

Did you know that you can actually earn a million dollars with your CPF accounts? If your answer is no, then we’ll tell you how.

In its most basic sense, getting a million dollars would entail moving the money from your OA into your SA. The reason for this is that the OA only gets you a guaranteed interest rate of 2.5%. Compare that to the SA which gets 4%.

As a result, the combined effect of 4% per annum can build up your cash reserves faster.

It must also be noted that there is a cap to your Medisave Contribution (which is up to $63,000 as of 2021) and Special Account (which is up to S$186,000 as of 2021).

Finally, getting a million dollars is not time specific. It will take everyone a different amount time to actually get the amount. This depends, of course, on how much a person earns.

3 Advantages of Placing More Money in CPF Special Account

1. Guaranteed Absolute Return

As stated above, in the features of Special Account, CPF Special Account beats inflation. It does not get affected nor fluctuates according to the index it is pegged to. This sets it apart from mutual funds or Exchange Traded Funds.

Usually, when you invest in something, your returns can be volatile and often times beyond your control. You may have to weather a long period of ‘bad’ days before seeing any good returns.

However, with CPF, you are guaranteed that the returns are absolute. You will get the allocated percentage presented to you. In relation of SA, you will get up to five percent (on your 1st $60,000.

2. Inflation-proof Interest Rate

Since the CPF Special Account is like a retirement fund, the interest rate must beat inflation for it to be useful. It can’t just go down until you are left with is nothing. What use would it be if that happened to our old folks?

Fortunately, CPF does none of that. Strategically designed by the Singapore government, CPF Special Account interest rate cannot be affected by inflation. It is unlikely to change.

Your five percent return will remain as five percent. No matter the financial situation of Singapore, you will definitely get the absolute and guaranteed rate.

This is by far the only investment option where you get around five percent return, just by placing your monies in. With Singapore Savings Bonds, you will get between two or three percent.

Therefore, CPF Special Account does not only beat inflation, it also beats many other investment options.

3. Away from Creditors

If you are an active investor, then you might find this third advantage tempting. Being involved in Forex trading and other business could get you in risky situations—one with creditors who are willing to line up to get from you.

But with CPF, you can find a refuge from all of that. No one can take money from your CPF. Even if you go bankrupt, your CPF savings will remain safe.

3 Disadvantages of Transferring Money from Ordinary Account to Special Account

As everything goes, with advantages come disadvantages. Same goes for the CPF SA account. No matter how safe it is, it could still have its own negative side. These are the disadvantages of using your CPF Special Account:

1. No Tax Relief

Transferring money from Ordinary account to your Special account does not exempt you from tax relief. You will still be subject to it typical tax reliefs unless you top up your account with cash. You can learn more here.

2. Transfers are Permanent

While transferring cash into your CPF Special Account to earn a higher interest rate might sound positive, things can take a turn for the worse if you have a sudden need for cash .

The process of transferring your savings from Ordinary account to Special account is irreversible. You can’t undo it. Be sure to have enough money on hand for your current and future needs prior to plunking money into your special account.

3. Withdrawal Requirement

As mentioned above, savings in CPF Special Account cannot be withdrawn before the age of 55.

It also cannot be withdrawn and utilize for other purposes like paying off mortgages of housing.

From Early 2025, the CPF Special Account will be closed for those aged 55 and above. The amounts in the Special Account would be transferred to the Retirement Account, up to the Full Retirement Sum. Any Special Account savings that remain will go to the Ordinary Account.

Ordinary Account to Special Account Savings Transfer Calculator

Before you go and spontaneously transfer your OA savings to SA, it helps to know the estimates of the amount to be transferred.

With the online calculator provided by CPF, you can find the estimate to the additional interest that you might earn when you do transfer your savings from Ordinary Account to Special Account.

To do that, simply go to this website and fill in the required fields: https://www.cpf.gov.sg/esvc/web/schemes/oatosatransfer/oatosatransferGood luck and remember to always tweak things in a way that maximizes your benefits while mitigating your downsides!

If you need trusted financial advice based on your personal situation, you can indicate your interest here.

Hi, the additional 1% interest is only for the first 60k in the combined accounts (up to 20k from OA; the additional $200 in interest from OA will go into SA and MA) and not from the 60k onwards amount as stated in your article.

See below for the information from the cpf website:

These interest rates include an extra 1% interest paid on the first $60,000 of a member’s combined balances (with up to $20,000 from the OA). Extra interest received on monies in the OA will go into the member’s SA or RA to enhance his or her retirement savings. If a member is above 55 years old and participates in the CPF LIFE scheme, the extra interest will still be earned on his combined balances, which includes the savings used for CPF LIFE.

CPF members aged 55 and above will also earn an additional 1% extra interest on the first $30,000 of their combined balances (with up to $20,000 from the OA). As a result, CPF members aged 55 and above will earn up to 6% interest per year on their retirement balances.

Thanks for informing us, we have corrected it.

Hi,

You made a mistake. Excess of your Special Account (which is up to S$166,000 as of 2017) does not go to your OA. The S$166,000 is the limit to enjoy tax relief for cash top-up to your SA.

We meant that there is a cap. for the transfer of O.A to S.A, and have corrected for clarity. Thanks for informing us!

Hi, can i know, what will happen if my special account has reach $166k when i was 45 yrs old,

what will happen to my interest yearly??

just curious to ask, Thank u

Hi Ah Fai,

Your SA account interest will continue to add to SA account.

Regards

Louis

If you hit 166k for Sa already, will it be still having interest payment ? and also when u work, will it still be contributing to it ? If

If you wish to top up more than 166k. If you top up to 250k, will it be still incurring interest or just max total is 166k and not more interest or top up even if you work?

Hi Ho,

Yes. interest will be added to the same account. you will still able to contribute based on the mandatory contribution to your CPF account. even if you hit 250k, interest and contribution will still be the same

Regards

Louis Koay

Hi Ho,

yes. you will still get the interest that will be paid to your CPF respective account. your CPF contribution will still be the same as that will follow mandatory contribution allocation rate.

Regards

Louis Koay

This is a very informative article, thanks!

Can i clarify what it means for the below point extracted from Special Account (SA) Advantages:

“This is far from other investment options where you only get around four percent. Furthermore, with Singapore Savings Bonds, you will get between two or three percent.”

Does it mean we can invest say $10K from SA and the total interest received will be 5%(from CPF SA interest) + 2%(from Singapore Savings Bonds interest) = total of $700 interest a year?

Or when SA is used to pay the bond premium, that amount is no longer calculated for SA interest, ie total of $200 interest a year? If so, it is better to leave the monies in SA rather than buying the bond?

Hi Michelle,

You cannot use SA to invest in SSB. even if you can, you are giving up 4% or 5% interest for 2% interest. not worth it

Regards

Louis Koay

Hi, at age 55 if your OA+SA balance exceeds the FRS/ERS etc., what % of OA and SA is transferred out to create the RA? Or is it in sequence (e.g. OA used up first, then SA)?

Would be good to know in order to estimate how much OA is left for mortgage payments, or in SA gaining the 5%+ interest.

Thank you!

Hi Shaun,

CPF will transfer all SA to RA first, then only transfer OA to RA if SA amount is below FRS

Regards

Louis Koay

What is maximum amount can one transfer from his ordinary account to the special account before reaching 55 yrs old

Hi Eddie,

can transfer from OA to SA if you have less than Full Retirement Sum at SA.

Read more here:

https://www.cpf.gov.sg/members/FAQ/schemes/retirement/retirement-sum-topping-up-scheme/FAQDetails?category=Retirement&group=Retirement+Sum+Topping-Up+Scheme&ajfaqid=2188830&folderid=19860

Can someone (63 years old) with a full Retirement Sum transfer from ordinary account to own special account or top up cash into own special account

Hi SH,

cannot transfer from OA to SA after age 55. top up or contribution to both OA and SA still possible

What happen when we hit the special account ceiling? Does it mean that the monthly CPF contribution will now goes only to OS and MSA?

Hi Tom,

The contribution will still go to OA, SA and MA with the allocation % based on your age:

https://www.areyouready.sg/YourInfoHub/Pages/News-How-your-CPF-contributions-and-allocation-rates-change-as-you-grow-older.aspx

Regards

Louis Koay

Hi bro..

AGE :55 (AUG 2020)

SA : 135K

SA : 5K

MA :57K

Can I draw cash 30K from the above account? in August 2020…

Hi RJ,

Yes. you can pledge your property and withdraw the amount above basic retirement sum ($88k)

https://www.cpf.gov.sg/members/FAQ/schemes/Retirement/Retirement-Sum-Scheme/FAQDetails?category=Retirement&group=Retirement%20Sum%20Scheme&folderid=12567&ajfaqid=2188693

Regards

Louis Koay

i need to withdraw 200k from CPF to tide over January month urgently, but I want to shield my SA for the highinterest it earns. Should I buy a annuities using the SA ,current bal is 51k, the (51k-40k)11 k and withdraw the 200k from SA and OA

if there are sufficient bal in the combine oa and sa accounts.

Hi Lily,

Assuming that your combined balance of OA and SA is above minimum sum, you can consider to use SA to invest in a fund to shield your SA for higher interest after age 55. At age 55, balance from OA will be transferred to RA for minimum sum. Once the transfer is done, you can choose to sell your SA investment and park it back to SA account.

Regards

Louis Koay

Hi,

Can I use my medisave for my sister? She is recently hospitalised in Philippines due to haemoragic outburst aneurysm. Due to financial burden, hospital bills shoot up very high.

Hi Joce,

Please write to CPF. Read this FAQ from CPF website:

https://www.cpf.gov.sg/members/FAQ/schemes/healthcare/medisave/FAQDetails?category=healthcare&group=MediSave&ajfaqid=2189409&folderid=12935

Regards

Louis Koay

Age :52

SA : 230K

OA :100K

MA:57K

Want to take new housing bank loan now and do a deferred payment. for the bank loan after 55 yo… can I use the OA and SA to pay for the bank loan after setting aside the FRS/MRS after 55yo….?

Hi Micheri,

My understanding is after age 55 and assuming you have set aside MS, your cash in OA and SA can withdraw anytime as cash. You can then use the cash to pay for your bank loan.

Regards

Louis Koay

Hi,

I am wondering if I can transfer from OA to SA through mail or phone. I am not eligible to have an electronic account due to ex-PR issue. I have left Singapore for many years. Thanks!

Hi WL,

Please check with CPF as this is administrative issue. I believe there should be a way to do it.

Regards

Louis Koay

Hi,

thank you very much for sharing this useful information.

May I ask one question which really confusing me. as we know the CPF capped $37,740 annually. if I reached 37,740 by work contribution, am I still able to top-up $7,000 to my SA? or this top-up amount will be caculated into cap amount (for example, my current work contribution is $35,423, and I can only top-up $2,317)? in this case, if I already top-up $7,000, and lateron my work contribution will over the cap amount, will I still able to get the CPF contribution from my employer?

Many thanks for your kindly reply

Hi Cathy,

yes. you can still top up 7k even though you have reached $37,740 contribution cap. In fact, you can top up more than 7k, this top up is under retirement top up scheme.

The maximum top up is shown in this article. Do note that only $7k top up can be under tax relief

https://www.areyouready.sg/YourInfoHub/Pages/Views-A-beginners-guide-to-the-Retirement-Sum-ToppingUp-Scheme-InTouch.aspx

Regards

Louis Koay

SA=240k

OA=300k

1. Turning 55, should I opt for ERS ($271k) when I reach 55 or just opt for FRS and top up to ERS later?

2. I was advised to invest from SA and let the FRS taking from OA, so that when my investment is returned to SA, I have higher SA which earn a higher interest. Is it advisable?

Hi OK,

1. if you opt for ERS at age 55, your CPF LIFE payout will be higher as compared to the other option

2. Yes. this is possible. this is call SA shielding. your SA will be temporary invested. when reach age 55, your OA will be transferred to RA. You can then sell your SA investment and return the money back to SA.

By the time of 65 yrs old will hit over 1 million in RA account, do you advise opt for ERS ( the highest scheme)? What about the balance sum in RA can be cash out anytime? What is your advise if you have over 1M inside your RA account and how would you plan?

Hi Eileen,

It is really depending on how much you want to park in CPF LIFE. if you opt for ERS, you will receive higher payout for lifetime but you lose out on the liquidity as you cannot withdraw all ERS in lump sum.

If I have 1M in CPF. I will opt for ERS as I believe that the balance will be more than enough for liquidity purpose. this is for me, you may have different preference.

Regards

Louis Koay

Hi, I am above 55 of age and has some cash to invest. I do not have high risk appetite. Can I put my cash into my SA (assuming I already set aside ERS)? How much interest will I earn from my SA and can I withdraw cash from my SA account?

Hi Kamal,

If you are above 55, you cannot transfer from OA to SA. when you withdraw, you have to withdraw from SA first. 4% interest for SA.

Regards

Louis Koay

Hi Bowen,

As of 7 Mar 2020, I just checked CPF’s website, there are no suitable ETF for investment using the CPFIS-SA.

You are right based on the Jan 2020 update. ETFs, Fixed Deposits and Stat Board bonds are still allowed just that there are no products available right now. We have amended it. Thanks for highlighting!

Hi Bowen,

SA:200K

Special account: What interest rate does the excess above the 2020 Full Retirement Sum of S$181,000 earn?

Thank you.

Hi Mark,

Same as SA account balance above minimum sum, 4% interest

From Louis Koay

Age : 56

OA : 102K

SA : 42k

RA : FRS+interest

Should I do CPF transfer to RA to reach ERS or draw cash (from OA) then top up to RA ? To preserve SA balance and get 7K tax relief ?

Hi Andy,

transfer to RA has to be from SA first

cash withdrawal has to be from SA first.

cash top up relief is only for FRS and below:

https://www.iras.gov.sg/IRASHome/Individuals/Locals/Working-Out-Your-Taxes/Deductions-for-Individuals/CPF-Cash-Top-up-Relief/

Regards

Louis

Just to clarify, if RA exceeded ERS amount, the excess amount will still enjoy 4% interest?

Hi Soheng,

Yes. 4% for RA savings. RA maximum amount is ERS, the excess will be in SA which you will be getting 4% interest as well

Hi Lous,

if my SA now hit the FRS $181k, where will my monthly contribution to SA go to, SA or OA?

Then my SA end of year interests will go to OA or SA?

Thanks.

Hi Andrew,

Your CPF monthly contribution is still to OA, SA, MA based on CPF board allocation rate:

https://www.cpf.gov.sg/Employers/EmployerGuides/employer-guides/paying-cpf-contributions/cpf-contribution-and-allocation-rates

interest in SA still go to SA, interest in OA still go to OA

Regards

Louis Koay

I m age 55 and intend to pledge my property (full paid up) to meet FRS

OA= $ 100,000

SA= $ 40,000

1) am I right this will be the balance after meeting my FRS?

OA= $50,500

SA = $0

RA = $90,500

2) can I transfer my OA money ($50,500) to RA to earn the 4%?

3) if (2) is yes, am I allowed to withdraw that $50,000 and interest earned when I reach 64 or anytime?

Hi KK,

1) yes.

2) cannot. you cannot transfer OA to SA after age 55.

3) you can withdraw CPF balance anytime after age 55 and set aside minimum sum.

Regards

Louis Koay

l am 56, I have ERS, can my wife or children top up my RA? If they can do so, will it does to my RA or SA?

Hi Eric,

cannot. for age 55 and above, maximum top up is ERS – RA balance. you already have ERS, then top up is not allowed

Louis Koay

l am 56, I have ERS, can my wife or children top up my RA? If they can do so, will it does to my RA or SA?

Hi Eric,

Cannot. as answered above

Louis Koay

Hi, Since one cannot transfer from OA to SA to earn higher interest after age 55, could the person do it in 2 steps 1/ withdraw excess in OA, then 2/ top up SA? Wouldn’t the result be the same?

Hi Lily,

Maximum that you can top up to RA is ERS – RA balance. Yes. you can transfer from OA to RA to hit ERS or withdraw from OA and top up cash to RA to hit ERS. the result will be the same

Regards

Louis Koay

Hi,

Is there a ceiling of limit for Medisave Account? If so what is the ceiling? What happens to the contribution to MA beyond the ceiling?

Hi Kumareson,

Yes. maximum amount that you can have in MA account is call basic healthcare sum (BHS). any contribution beyond BHS will flow to SA or RA.

you can refer to this link for the BHS details:

https://www.cpf.gov.sg/members/FAQ/schemes/healthcare/medisave/FAQDetails?category=healthcare&group=MediSave&ajfaqid=2189345&folderid=12917

Regards

Louis Koay

Hi. I am 59 years old and a retiree. I have fulfilled the maximum amount required in my RA. I have some spare cash of $100k which i am earning from bank fixed deposit account which the interest is very low. Can I transfer from my bank deposit account of $100k into my SA instead to earn the 4% interest? If yes, can I withdraw the $100k plus interest accumulated after 1 year from my SA? Tks.

Hi Lisa,

Can you trf frm your bank deposit into your SA directly? NO.

There are two ways you can transfer your funds from your bank to your CPF to enjoy the higher rates though;

1) If you have used your CPF OA previously to fund for your property (assuming it is already fully paid) you may ‘return’ your CPF OA along with the additional accrued interest rates by making a lump sum transfer. All the money will go to your OA though and will not be possible to transfer them from OA to SA but its still better than banks rates.

2) You can make a voluntary contribution to your CPF up to the maximum annual limit and the funds wil be deposited to your OA, SA and MA according to the allocation rates for your age. Ideal case would be if your MA has already reached the BHS so all your contributions will go to your OA & SA.

And yes, since you have already met the ERS and you are above 55 you are free to withdraw the money in your CPF OA SA as and when you like!

Hi there

Susan here.I am 60 years of age. My RA is already maximum and currently I still have a balance of $350,000 in my OA. Should I transfer my balance in my OA to SA to earn more interest?Also need to know if the interest earned in my SA can be withdrawn as and when I need it. My friend told me that interest earned in our SA will be automatically transferred to RA even if my RA has already hit the maximum. Is this true?

Hi Susan,

I dont think you can transfer OA to SA after age 55. interest in SA will be in SA, will not transfer to RA unless you manually transfer to RA. but since your RA is already at the maximum, you cannot transfer SA to RA

Regards

Louis koay

hi,

I am about to turn 55.

OA: $500k

SA: $218k

MA : $58k

Can I empty OA via investment, and SA (left aside $40k) before 55, and fund the short fall of FRS with cash upon creation of RA?

In short, I would like to take advantage of RA/SA high interest.

What are ways I can do?

Hi AK,

there is a cap on cash top up to SA account.

the maximum top up is FRS – SA – investment amount drawn from SA for age 55 and below

https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/retirement-sum-topping-up-scheme

based on your scenario, you are unlikely be able to top up to SA

However, you can still shield your SA, invest in a short term fund for few months before age 55, RA will take from balance SA and OA. you can then liquidate your SA investment to put in back to SA

let me know if you need help in executing this

louis@drwealth.com

Hello, I am 56. Is it true that once my minimum sums are satisfied, I can withdraw from the SA as well as the OA? If so, apart from interest, what advantage is there in keeping funds in SA? Thank you for your time.

Hi ML,

yes. you can withdraw once you hit minimum sum and above age 55.

Apart from the interest, you can choose to transfer SA to RA to ERS for higher CPF LIFE payout if you want to

Hi ML,

yes. you can withdraw once you hit minimum sum and above age 55.

Apart from the interest, you can choose to transfer SA to RA to ERS for higher CPF LIFE payout if you want to

Hi, if I set aside FRS for my RA at age 55, can I continue to top it up using cash to ERS before I turn 65? Thanks.

Hi Thomas,

yes. you can continue to top up to ERS before age 65.

Regards

Louis Koay

Hi, is there a ceiling to my SA account? I’m 37 this year and my SA account has around 135k.

Thank you.

Hi Joe,

there is no ceiling to your SA account.

Regards

Louis Koay

Can I check if I have already hit the FRS in SA and BHS in MA before 55, does it flow to my OA?

Hi Lionel,

no. the CPF contribution will still follow the age bracket to flow to the 3 accounts. overflow in MA will go to OA if SA reaches FRS

Regards

Louis Koay

Wish to check that my understanding is correct.

Below age 55, maxed MA (the current year’s BHS) and SA (the current year’s FRS).

For MA

1) Monthly contribution and annual interest to MA will continue to overflow to SA instead of OA. MA will only overflow to OA once a person reached age 55 with FRS met.

For SA

2) Monthly contribution and annual interest to SA will continue forever. At age 55, SA first follow by OA to RA. If FRS met, contributions and interest to SA will continue as per normal. If FRS not met, contributions and interest to SA will be allocated to RA.

I am 56. FRS in RA. Still have 80K in SA.

Question: should I transfer the remaining 80K in SA to RA, or leave it in SA ? I hesitate since SA and RA both have 4% interest rate.

Thanks in advance !

Hi J.S,

if you transfer to RA account, you will join CPF LIFE with higher amount of payout from your higher amount in RA. whether you should transfer from SA to RA is depending on whether you want to have flexibility to withdraw from SA or to have higher payout from CPF LIFE

Regards

Louis Koay

I am 49yrs, OA 150k, SA 152k, what goes into FRS? I understand SA and OA forms the RA towards FRS. I have been topping up cash $7k to my SA, and also OA SA account have earn interest, will the top.up amount and interest earned count into part of the FRS at age 55?

After age 55, does it still make sense to make cash top up to RA? Considering the cpf monthly pay out is pooled interest that i may not received if I passed on earlier.

Thanks,

You can wait until you are 64. You will have same interest in SA and RA anyway. On the next year’s if you need a lumpsum up to 80k you can withdraw. Otherwise at 64 just move all to RA for better LIFE pay outs

Hi Oh,

At your 55th birthday, RA account will be created and CPF SA will first transfer to RA to meet FRS. if CPF SA has less than FRS, CPF OA will then be transferred to RA to meet FRS.

after age 55, whether you should top up to RA is depending on whether you want to park more fund in RA and for CPF LIFE. There will be bequest payout to your beneficiary should you passed on earlier. You can check out the CPF LIFE payout and bequest here:

https://www.cpf.gov.sg/eSvc/Web/Schemes/LifeEstimator/LifeEstimator

Regards

Louis Koay

Can I transfer OA to SA after 55 yo??

I don’t want it to be in RA due to liquity concern.

I have already hit FRS.

Hi,

I want to invest my CPF SA fund before it is transferred to my RA. Can you advise the following:

(1) Is a good idea to invest the fund in the Singapore Government Bond?

(2) If so, which Singapore Government bond is recommended?

(3) How much of my CPF SA fund can I use to invest in the bond and how can I invest in it?

(3) Can I sell Singapore Government bond easily?

Thank you.

I don’t think it is a good idea to buy SG govt bonds with your CPF as the interest is even lower than CPFSA interest.

He is looking for CPF SA shielding, just short term holding

Hi Lawrence,

I shall not give recommendation on investment in public domain, here are my takes:

1) find a fund that is stable for short term holding. you can find ETF that invest in good investment grade bond. Government bond may not has liquidity for you to buy and sell in short term

2) suggest to look for ETF that invest in bond.

3) first 40k in SA cannot be invested. the rest you can invest. You just have to find a platform that can invest with your CPF SA, traditional brokers and banks should allow you to invest with your CPF SA.

4) liquidity might not be there for you to do short term buy and sell.

Regards

Louis Koay

I am 51yrs, OA 350k, SA 200k (stop working). Wife (not working-living abroad) OA 5k, SA 2k. What would be the best options to maximize our CPF for 55yrs and beyond? Thank you

Hi Ah Tee,

There are too many options available and all have different pros and cons.

I suggest you make an appointment with CPF board and discuss with the officer on the available options

Regards

Louis Koay

Hi,

My husband just passed away and left me with 200K. I was born in 1956 and wish to put this 200K in my RA. My house mortgage is covered under Home Protection Scheme, thus no longer need to pay monthly mortgage.

1. Can I choose to as and when to withdraw the 200K if the need arises ?

2. Can I opt out from CPF Life ?

3. Will the RA still attract 4% interest?

Hi Tan,

Sorry to hear that your husband passed away. take care.

1) if you put in RA, you cannot withdraw all if need arises

2) according to CPF website, born before 1958 is not automatically included in CPF LIFE, please check with CPF board on your scheme.

https://www.cpf.gov.sg/members/schemes/schemes/retirement/cpf-life

3) Yes. SA and RA gets 4% interest

Regards

Louis Koay

Transfer from your OA to your wife SA for better interests.

Hi,

Can you advise if I will still enjoy income tax saving if I continue to top up my SRS every year? Is there a situation when I do not enjoy anymore income tax saving even if I top up my SRS?

Thanks.

If at age 33:

OA: 0

SA: 181k (FRS reached)

MA: 20k

Can you still do cash top to go beyond FRS?

This is on top of the normal contributions by the employer

Hi Wes,

https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/retirement-sum-topping-up-scheme

refer to the above, you can only top up to FRS balance for age 55 and below.

this is retirement scheme top up, not the normal contribution by the employer

Regards

Louis Koay

Hi, if I have already reached current full retirement sum in my 40s, do you recommend investing some of these funds in SA account so that I can do further top-up into the SA account?

Hi,

if after 55 my RA already hit ERS, can i still top-up my free cash into my SA to earn 4% (better than put in bank) and withdraw anytime i want?

Thank you

Hi GT,

no, you cannot top up to SA once your RA has hit ERS after age 55.

https://www.cpf.gov.sg/Members/Schemes/schemes/retirement/retirement-sum-topping-up-scheme

Regards

Louis Koay

Hi I’m 47 this year and if I transfer my monies from OA to SA, if by 55 let’s say my FRS is 235k but I have 300k in SA due to the earlier years transfer, can I cash out the remaining $65k in excess? Or will it just form the rest of the RA

Hi Eric,

yes. you can withdrawal any amount above FRS. Based on your example, you can withdraw 65k.

Regards|

Louis Koay

Hi Eric,

Yes. You can withdraw any amount above FRS when you reach age 55. Based on your example, you can withdraw 65k from SA anytime after age 65.

Regards

Louis Koay

Hi I have hit the max SA contribution as indicated in this article. May I know if I am still eligible for tax relief by doing cash top to my SA or love ones?

yes. so long as the recipient SA has less than minimum sum, you will still eligible for the tax relief of up to 7k/yr.

https://www.iras.gov.sg/taxes/individual-income-tax/employees/deductions-for-individuals/personal-reliefs-and-tax-rebates/cpf-cash-top-up-relief

After 55, i have built substantial savings in SA and OA after RA has hit the ERS. I want to withdraw from OA but do not want to touch my SA. What should do ? Can i invest all my SA in short term bonds and then withdraw from OA in cash. AFTER that I sell all my Bonds to return back to SA. This is SA shielding after 55.. is this ok?

Yes, the first 40k in SA cannot invest. you have to “shield” your SA amount then you can withdraw from OA

This April i turning 55 .

SA :173K

OA:65K

I meet my FRS but i want to leave my CPF to BRS it is possible, if i pledge what the consequences i need to know?

you can pledge your property for you to keep BRS only in RA. you need to take note that:

1) your property need to have enough property charge (principal amount used+ accrued interest) is higher than the BRS amount

2) when you sell your property, you need to return the BRS back to RA

3) you will receive lower payout for CPF LIFE as you only set aside BRS, you need to ensure that you can have sufficient income for your retirement

as you are turning age 55 soon, best is to make a trip down to CPF board to understand your various scenario before taking any actions

Hi Louis

OA: 0 (paid for property)

SA: 0 (withdrew all after I turned 55)

My question: can I top back to my SA the amount which I previously withdrawn?

If you are below 55, you may top up your SA up to the current FRS.

If you are 55 or above, you may top up your RA up to the current Enhanced Retirement Sum.

You can check your top-up limit in your Retirement Dashboard: https://www.cpf.gov.sg/member/ds/dashboards/retirement