ComfortDelGro Taxi CEO, Ang Wei Neng, recently announced that the company is projected to make a loss for the year ending 31 Dec 2020 and it will be the “first time Singapore’s largest taxi operator will post full-year losses”.

He added that “the dramatic drop in tourist arrivals, the increased number of people working from home, the enhanced measures to restrict crowd at shopping malls and eateries as well as the closure of nightspots, are having a massive impact on our cabbies.”

The Singapore Government has dedicated S$55 billion or 11% of GDP to support the economy. The stimulus package ensures businesses can survive and the people are able to have some form of support to meet their daily expenses.

As a large company, ComfortDelGro is expected to dish out not only the amounts received as a passthrough but also additional amounts from their reserves. This is evident from their recent announcements:

[13 Feb 2020] COMFORTDELGRO CABBIES TO GET MORE THAN $18M RELIEF PACKAGE TO COMBAT FALLING DEMAND

[20 Feb 2020] COMFORTDELGRO TO INCREASE TAXI RENTAL REBATES BY ANOTHER $10M

[25 Mar 2020] COMFORTDELGRO INCREASES DAILY TAXI RENTAL RELIEF

[30 Mar 2020] COMFORTDELGRO TAXI EXTENDS RENTAL RELIEF TILL SEPTEMBER, GOES INTO THE RED

Large companies are aware that they need to support its customers and suppliers as any permanent cessation will cause even bigger economic impact and massive job losses. This would mean that a severe hit to the ComfortDelGro’s bottomline, arising from not only lower demand but also assistance to its business partners.

Given that ComfortDelGro is trading at its 5-year low, we wanted to do an analysis and determine if there’s any buy case for the company.

Background

ComfortDelGro (CDG) is one of the largest land transport companies in the world. CDG’s businesses include bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving centres, non-emergency patient transport services, insurance broking services and outdoor advertising.

CDG has a significant overseas presence. The Group’s operations currently extend from the United Kingdom and Ireland to Australia, Vietnam, Malaysia, as well as across 11 cities in China, including Beijing, Shanghai, Guangzhou, Shenyang and Chengdu. Based on its geographical revenue, we can see that the 3 core markets are Singapore, United Kingdom and Australia.

In Singapore, CDG owns the biggest and likely most well-known taxi franchise and also SBS Transit, the biggest bus operator in Singapore.

CDG also manages 2 MRT train lines and 2 LRT train lines through SBS Transit.

Financials

Looking at the summary financials, we can see that CDG has been able to grow its revenue, which is mainly via acquisitions. CDG has not been able to maintain margins and ROE. This is due to rising costs and also competition in the key taxi segment with Grab and Go-Jek in the scene (previously Uber as well). The public transport fare hikes in 2018 and 2019 helped with the revenue and allowed CDG to maintain operating profit levels.

Capital expenditure and Free Cash Flow (FCF) has also been maintained within a range. We can also see that CDG tries to ensure that FCF after dividend is positive so they are able to maintain their debt levels. Debt level only increases with an acquisition which leads to accretive earnings.

Focusing on the operating margins of the 2 largest revenue segment, we can see that the operating margins of the Public transport segment was constant after the fare hikes, without which it would have fallen significantly. The taxi segment recorded declines in line with expectations due to competition from Grab and Go-Jek (including Uber previously).

Looking in detail across all segments, we note that the remaining 4 segments have largely maintained its contribution share but is immaterial to the larger CDG Group. This is why the share price movement of CDG is still largely linked to news arising from the 2 largest segments.

In the recent announcement on 30 March 2020, CDG also provided a profit warning for the financial year ending 31 Dec 2020. This means that instead of recording a $200+m profit on average years, they will now make a loss. This is a significant gap. It is likely that all segments will be severely affected, especially the Public transport and Taxi segment.

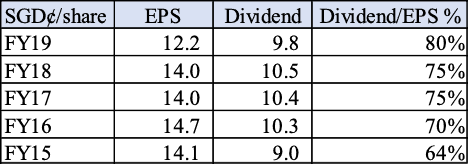

CDG enacted its first dividend cut in recent times due to the declining profits and cashflow. In a declining profit environment, we expect CDG to maintain dividend as a % of EPS and also to ensure FCF after dividend is positive so as to maintain debt levels as mentioned above. As we can see that CDG tries to maintain dividend as a % of EPS, with the profit warning, we expect significant cuts to dividend.

The 2 factors determining dividend payout is the timing of recovery from Covid and also its available cash and loan facilities. Where CDG has inadequate loan facilities, they may not be able to draw down to fund dividends even if they have the intention to do so.

Positive Factor #1 – Room for Organic Expansion

SMRT currently operates 4 MRT lines while SBS Transit operates 2. We noticed a historical trend where SBS Transit tend to have 1 fewer line than SMRT. Therefore we think SBS Transit has an opportunity to be awarded an additional MRT line to manage. This also allows the government to reduce risk and spread the lines across the 2 major operators.

Ridership of new train lines tend to start slow and take a few years to ramp up as the new estates near the new train stations increase in population. As the Singapore population gradually increase, overall ridership will increase too. Therefore the ridership for the Downtown line will increase over time and lead to higher profits.

The government has a policy of reducing cars on the road and encouraging public transport ridership to reduce road congestion and pollution. We expect this trend to continue as we move towards Smart Cities.

Positive Factor #2 – Opportunistic Acquisitions

We note that the current gearing ratio is about 10%. However, as CDG has substantial cash of about $594m, it means CDG is in a net cash position. In addition, we note that an acquisition of $540m would theoretically increase the gearing by 10% and could contribute about $54m or 2.4 cents per share. In our opinion this is the biggest and strongest lever that CDG has.

The challenge is to carry out a sizeable acquisition and also integrate them into the business and obtaining efficiencies. We have seen CDG carry out multiple acquisitions below $30m to gradually expand its fleet size and exposure in UK and Australia.

An acquisition during a crisis brings about greater opportunities but also higher levels of risk. While there may be an opportunity to acquire assets cheaply, we think CDG may opt to conserve its cash as they have an implicit obligation to fund the public transport and taxi segments.

Postive Factor #3 – Strong Player in a Defensive Industry

CDG is the largest transport operator and part of a duopoly of public transport operators in Singapore. With their size, CDG is also able to negotiate better deals relating to capital expenditures (e.g. buying new taxis or buses in bulk and being able to negotiate the delivery period).

As a transport operator, CDG can also be viewed as a defensive play as a substantial portion of their revenue are demand inelastic. There are of course situations where demand is impacted such as the current Covid-19 outbreak pandemic where traveling is reduced significantly. Currently, more than half the world is under some form of reduced movement arising from either forced quarantine, closures or a change in their daily habits, as a transport operator.

With the finalisation of Brexit helping stabilise the GBP and a low AUD due to low commodity prices, CDG has been acquiring assets both in the UK and Australia. The assets tend to be in mature townships or cities where ridership has also stabilised and thus provides CDG with a certain level of consistency in revenue. These are also developed countries with a stable market and low levels of unemployment, thus ensuring public transport utilisation.

Positive Factor #4 – Price Hikes

Follows three consecutive years of fare reductions totalling 8.3 per cent, the Public Transport Council (PTC) of Singapore allowed two consecutive years of fare hikes compounding to 11.6%. As the Public transport segment contributes about 74% of revenue to CDG, the fare hikes would lead to 8.6% higher revenue to CDG. Market watchers think it is unlikely for a fare hike with an upcoming election, we think the fare hike serves to offset rising operating costs as should be viewed as a floor/put option provided by the government rather than an opportunity for CDG to make outsized profits.

In addition, the PTC informed that Singapore’s public transport fares continue to be one of the cheapest as compared to other major cities. This indicates that the PTC has ample headroom to hike fares to mitigate against any future rising costs.

Risk Factor #1 – Macroeconomic headwinds due to Covid-19

CDG’s CEO noted the following “we are now faced with new challenges brought on by the 2019 novel coronavirus (COVID-19) outbreak that first started in Wuhan, China. Our taxi, driving centre and bus station operations in China have been hit amidst measures to try and contain the spread. In Singapore, we have started seeing some negative impact on our taxi operations as tourist arrivals fall and residents avoid crowded places. I think things will get worse before they get better.”

Ministry of Trade and Industry (MTI) forecasted an economic contraction in a range of -4.0 to -1.0 per cent.

The Singapore Tourism Board (STB) also guided the following statement on 11 Feb 2020: “Singapore tourism to take ‘significant hit’ in 2020 due to coronavirus, up to 30% fewer visitors expected” CDG is at the core of transport in Singapore, where both local and tourist consumption declines, it is inevitable that CDG will take a hit.

Risk Factor #2 – Government’s population policies

In Singapore, the level of population has always been a constant bugbear for the locals who have complained that Singapore is overcrowded, leading to strained infrastructure, and issues which generated outrage such as the MRT disruptions of 2011.

It also led to the Singapore ruling party losing its first Group election seat ever and the consequence was a major rethink of Singapore’s public transportation system, as well as major commitments from the government to improve the strained infrastructure.

In January 2013, the Government released the Population White Paper, projecting Singapore’s population as 6.9 million by the year 2030 (current population is 5.6 million). sparking protests, both online and real-world ones.

The White Paper said that in order to achieve an average of 3 to 5 per cent gross domestic product growth up to 2020, Singapore will need 2 to 3 per cent annual productivity growth, whilst maintaining 1 to 2 per cent workforce growth.

Since 2013, the Singapore Government has rolled back immigration and tightened the inflow of foreign labour, for all intents and purposes, it seems that the Population White Paper is on ice and few politicians now mention it in public.

With Singapore recording a GDP growth of 0.7% in 2019, providing a 2020 economic growth forecast to between -4% and 1% due to the Covid-19 impact, there is now a risk of a recession occurring in 2020. As such, the government may decide to increase the population after the next election which is required to be held by April 2021.

As Singapore accounts for nearly 60% of CDG’s revenue, the GDP and population growth of the country impacts CDG significantly. Where policies tighten, CDG will be severely impacted.

As CDG is not huge in UK and Australia, it is not a structurally important transport operator in both countries. While macro level government policies may not impact CDG as much, the population, price of transportation and strength of currency will still weigh in on CDG’s revenue and bottomline.

Risk Factor #3 – Competition

Before the advent of tech companies, CDG pretty much operated in an oligopoly, however it has now changed with competitors such as Grab and Go-Jek.

CDG who is the market leader has seen its fleet size tumbled to 13,244 – 22 per cent down from its December 2015 fleet size. Its Comfort-branded cab numbers stood at 9,825, while its CityCab taxis numbered 3,419.

We can see that the rise in private hire cars is more than the decline in taxi fleet which means that on a net basis, there are more private transport drives for hire in the market. One of the fundamental reasons is due to fewer private owner cars on the road. The 2 main private hire car operators are Grab and Go-Jek. As these tech companies are in the revenue acquisition phase, they have provided generous rebates to both customers and drivers. These rebates have lessened significantly in all aspects, therefore we expect some drivers to exit the market, leading to fewer private hire cars on the road.

To mitigate this risk, CDG is eyeing opportunities beyond its core passenger transport business, and has made strategic investments into startups involved in mobility tech and ancillary services.

The early-stage investments are made out of ComfortDelGro Ventures, the US$100 million corporate venture capital fund which was set up in November 2018. CDG is also assessing other tech startup investments, these include opportunities in the core land transport business such as vehicle fleet electrification, automotive engineering technologies, autonomous vehicle fleet management systems, as well as adjacent disciplines such as smart logistics, artificial intelligence, cybersecurity and robotics.

In addition to startup investments, CDG will be involved in incubating new mobility business concepts and technologies.

Risk Factor #4 – Conglomerate Underperformance

This is a summary point pulling together the risk factors mentioned above, with this many segments and products, there is a risk that CDG may not be able to deliver a respectable performance on all its segments. CDG has seen operating margins decline from 12.7% to 10.6% and ROE decline from 13.3% to 8.8%. While CDG expects to make losses in FY20, we expect CDG to bounce back to this range after the Covid situation blows over.

The Covid-19 pandemic is now widespread and we expect to see underperformance of the entire group in FY20, drag down the performance of the 2 main revenue segments – Public transport & Taxi. While it seemed for awhile that the Taxi segment was beginning to turnaround after the exit of Uber, the number of private hire cars on the road increased due to the onset of the gig economy and also Go-Jek entering the market.

A Group-wide underperformance may have significant flow on effect on its operating cashflow, current net-cash balance sheet and ability to maintain future dividends.

Conclusion

With the current macroeconomic headwinds and COVID-19 virus, we think an opportunity has surfaced to purchase this stock. There are differing views and expectations in the market now (which is in a constant state of flux), ranging from green shoots of a turnaround in late Q2 to a prolonged depression spanning a year or two.

As a transport conglomerate, we believe in investing in this company that grows both organically and via acquisitions and also improve its cost base.

Looking at a longer time frame, we believe a good entry price would be around S$1.40 (Yield of 6.9%) (P/E of 12) while an exit at S$2.80 would be desirable.

Disclosure: The author has no position in ComfortDelGro at the time of writing.

Hi

I ever read one of your article, that the free cash flow should bemore than the dividend. Yes, this one do, but compare to say YZJ. or bank is a far cry.

Good point is that this is a defensive stock like ST eng.

Will you do a analysis on ST Engineering,

God bless you. Thanks

victor

Compare it with AEM whose free cash flow is like a mighty river. In 2019, the FCF was 22 cents per share. Why so high? Cos capex in this business is consistently low. Thus, AEM can pay dividends assuredly. For 2019, the dividend is 5.1 cents/share.