China’s rapid economic growth is one that cannot be ignored. In the past decade, more domestic or institutional investors have added Chinese securities in their portfolios – Temasek has a huge China exposure and Charlie Munger is known to have invested in China for over 15 years.

China’s Global IPO Dominance

In 2020, the initial public offerings (IPO) size and volume in the domestic China market have hit a historical high in the past 10 years. Chinese firms are dominating the IPO chart and even took the top 3 spots, according to research from EY. China is also the first Asia Pacific country to enter the top 10 spots.

According to Noah Holdings’ Willam Ma, he expects the demand in China IPO to remain strong in 2021.

Fast forward today, many Chinese companies are queuing for their IPOs. A well-known company would be BtyeDance’s Chinese short video platform Douyin.

In a Bloomberg Television interview in March 2021, Bonnie Chan, Hong Kong’s head of listings mentioned that it “will be as busy, if not more busy this year” based on the pipeline of companies queuing up to float their shares in the city.

In the first quarter of 2021 alone, 143 Chinese companies have completed an IPO and have raised up to US$23.6 billion, according to Refinitiv. This is by far the highest volume in the first quarter:

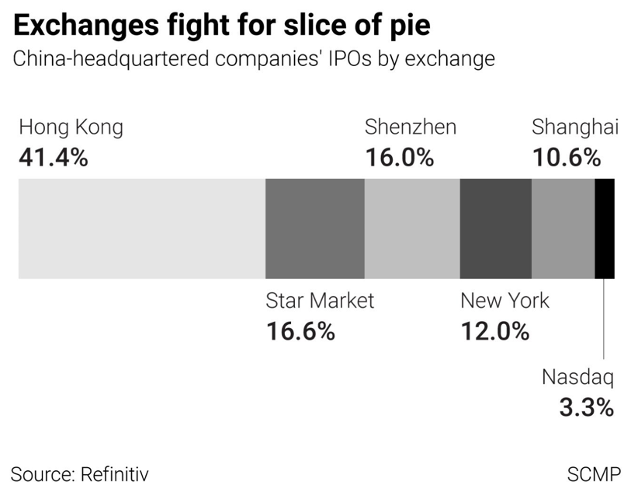

In the past 2 months, many Chinese technology companies are flooding into the New York exchange despite high tensions between China and the US.

Why do Chinese companies flock to list in the US?

The US exchange is the home to the largest technology companies in the world and investors there tend to be able to understand the business model better, enabling companies to have higher valuations.

Therefore, more tech startups/ companies choose to do IPOs in the US first before going back to Hong Kong for a secondary listing.

In comparison, Chinese companies which choose to list in Shanghai’s STAR Market have to face stricter criteria. According to Reuters review of Exchange filing, more than 100 companies were withdrawn from its application.

Tightening scrutiny on US listed Chinese companies

The urge for Chinese companies to list in the U.S. has triggered the Chinese government to step up its scrutiny.

Didi Chuxing saga was telling. The Chinese government asked Didi to hold on to the listing three months ago but Didi went ahead. The government resorted to banning the app from the app stores in China and Didi’s share price tanked, drawing lawsuits in the U.S. currently.

You can read our analysis on Didi Chuxing’s IPO, or scroll through our summary on IG:

The Chinese government wants to pile on the pressure by enacting new rules to remove a loophole Chinese companies used to list overseas. Foreigners are not allowed to own China’s sensitive technology but Chinese companies created Variable Interest Entities (VIEs) to circumvent the law. This has happened for years until the government decided to step in now.

This could strongly discourage or even disable Chinese companies from listing in the U.S.

But I believe it would not douse the interest to go public. Chinese companies can still opt for Shanghai, Shenzhen and Hong Kong listings.

Top 3 Chinese technology companies that could IPO in 2021

Here are the top 3 largest Chinese technology companies that investors are eagerly waiting for IPO in 2021 and I think it would happen despite the ongoing clampdown:

Megvii

Megvii is a technology company that designs image recognition and deep learning software. They are one of the China’s largest facial recognition companies which often provides technologies to chinese government and enterprise like Alibaba. They are also the world’s largest open-source computer vision platform, Face ++ who has more than 2 billion people’s facial features in the database.

This will be their second attempt to IPO as the 2019 Hong Kong IPO filing lapsed.

The company was last valued at more than US$4 billion post-money after raising US$750 million in 2019.

Currently, they plan to be listed on the Shanghai Stock Exchange’s STAR board.

SenseTime

SenseTime, together with Megvii, Yitu and CloudWalk, are known as the four artificial intelligence dragons in China.

SenseTime is known for their facial recognition software and was alleged by the U.S. that the technology was used to identify Uyghurs and other ethnic and religious minorities.

The IPO plan was deferred after the U.S. blacklisted it. But the IPO plan is back on the table, where it could raise as much as $2 billion in a Hong Kong listing happening in the second half of 2021.

Douyin

ByteDance, the developer of Douyin and Tiktok, may consider listing Douyin in the New York or Hong Kong Exchange. Founded by Zhang Yiming, Douyin has been China’s most valuable unicorn. They are one of the fastest-growing companies in the world.

Douyin is a platform where users can post short videos of themselves. It was launched in 2016 and has been downloaded more than 1 billion times. Douyin reported 600 million daily active users as of August 2020. According to 36Kr, a Chinese online technology news outlet, Douyin also been contributing two-thirds of the advertising revenue at ByteDance.

Bytedance denied the rumour and said that they are not ready to IPO. I believed they have been preparing otherwise the rumour mill wouldn’t have been ongoing. Probably they are waiting for a more opportune time or at least avoid the heat of government clampdown.

Conclusion

The world’s exposure to China has increased over the years.

Will China ever be the world largest economy in future, we do not know. But even if they do not become the largest, they would definitely be a sizeable market to be looking in.

In the short term, the Chinese government is reining in foreign IPO listings. No one knows how this will eventually turn out, although we remain bullish on China’s growth.

P.S. if you’re interested to invest in China stocks, read our complete guide to Investing in China