No, we did not short the stock.

Instead, we chanced upon a small, strange little company using our Conservative Net Asset Valuation method. And it went on to reward us with a 100% gain, even though its business was failing:

It’s revenue was falling steadily

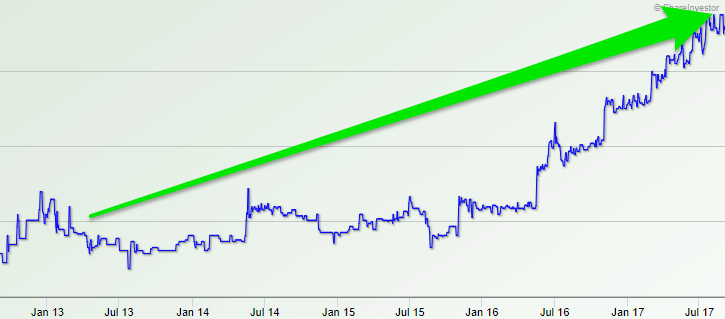

But it’s price chart was a stark contrast. It’s stock price was climbing despite of the losses!?

On the surface, this seems illogical. But our investment criteria told us otherwise.

It takes guts (and balls) to stick to your decisions at times. But if you have a sound strategy to picking undervalued stocks, these decisions are often easier.

We bare it all in this case study, and you’ll discover:

- How to analyse the value of a company’s assets using items from its annual report (and Google Maps)…and why we decided to invest in this strange business

- Why you should stick to your quantitative criteria despite negative news.

- 3 uncomfortable lessons that a value investor must understand in order to profit from stocks

Chemical Industries (SGX:C05): How They Got Started By Singapore’s Finance Minister In 1962

It is a small company with a market capitalisation of less than $100 million.

We discovered this stock in 2014 while performing a value screen via our Conservative Net Asset Value (CNAV) stocks database.

You’ve probably never heard of this company because stocks like Chemical Industries are unlikely to be covered by big analysts or the media. Thus, we have to rely on our quantitative criteria to fish them out.

This company has a deep history. It goes way back to the days of the Singapore Industrialisation Programme. In 1962, Lim Soo Peng was tasked by then Finance Minister; Hon Sui Sen to run Chemical Industries. Lim (now 89 years old) has continued to manage the company ever since. He had also served as a Member of Parliament for Havelock in Singapore’s first and second parliaments (1967-70).

Under Lim, Chemical Industries became a prime supplier of chlorine, caustic soda and chlor-alkaline products to the petro-chemical, pharmaceutical, electronics, polycarbonate and water-treatment industries.

Lim and Chemical Industries have played crucial roles in the building of Singapore. But as we move away from manufacturing and into technology, the stock has been forgotten by most Singaporeans today.

25% Conservative Net Asset Value Discount. And Here’s The Assets Breakdown

When we first chanced upon this humble company, Chemical Industries was trading at $0.54 while her conservative book value was $0.72. This presented a 25% discount which we could pocket.

This means that we get to own Chemical Industries’ assets below their real value. On top of that, we get the business for free by not paying anything for her future earnings.

Here are 3 of the considerations we made before we invested:

Plant and Equipment & Investment Properties

There were 2 desirable assets that caught our attention when we look at the composition of Chemical Industries’ assets:

Plant and Equipment

37% of the total assets are in investments in her production plants and machinery. These are necessities for her core business of chemical production.

The plant is located at 91 Sakra Ave, Jurong Island, in proximity to the clients she serves. Below is a satellite image of the plant. Google Street View is unavailable since Jurong Island is a protected area.

Plants and Equipment follows a depreciation schedule and each year they are valued based on their remaining productive lifespan.

The CNAV strategy requires investors to be more conservative. Hence, only half of the ‘Plants and Equipment’ value quoted in the balance sheet is considered as part of its value.

Investment Properties

Chemical Industries owns two investment properties which are shop houses along Carpenter Street and Upper Circular Road. They represented 35% of the total assets of Chemical Industries.

These properties are rented out but the income was not significant. But, these properties are valuable as they are located in Singapore’s city area.

Current Share Price (at point of analysis in 2014)

The share price was trading below the discounted value of these assets while generating profits and positive cash flow.

PE ratio and Debt-to-Equity

The PE ratio was low at 4 and the debt-to-equity was acceptable at 63% in 2014.

[thrive_leads id=’30461′]

The Share Price Dropped By 21% Right After We Bought It!

We took a position on 30 Jul 2014 at a price of $0.54…and it floundered.

The share price began to decline after we have invested as a string of bad news surfaced.

First Major Business Loss

On 11 Nov 2014, Chemical Industries announced that a major customer who contributed significant revenue would be ceasing business in Singapore. The share price dropped 21% from our buy price.

Further Business Loss

Another major customer who contributed 10% of the revenue was lost in a separate announcement on 18 May 2015. Counter-intuitively the share price has risen after the announcement (sometimes, price movements cannot be explained logically????).

Investors were generally losing confidence, and started to worry about the company.

No Satisfactory Answers From The Management During The AGM

One of the local investors, Mano, posed a few questions during Chemical Industries’ Annual General Meeting on 2 Jul 2015. The most pertinent point was about succession planning. Lim Soo Peng was in his eighties and there was no clear successor communicated to the shareholders.

Mano also asked about the management’s response to the loss of major customers, and if the company could pivot to other businesses to recover the revenue. He felt the management could have been more proactive, and could also consider unlocking the value of the two shop houses that the Company owns.

There were no resolutions to these issues.

After that, the management declared a dividend and we have got a 2.8% yield based on our buy price.

[thrive_leads id=’30461′]

How We Ended Up Earning 22% Dividend Yield On Cost In 2016

After a string of bad news, the situation turned for the better. Chemical Industries was able to claw back some cash through a settlement with one of its customers which decided to cease business prematurely.

First Special Dividend At 15% Yield

The management decided to return some of that cash to the shareholders with a special dividend for Financial Year 2016. We have achieved a 15% yield. The market reacted positively to the large dividend distribution and the share price rose significantly!

The management was also able to reduce operating costs as their clientele and revenue dropped, maintaining their profit margins. The bad news weren’t as impactful after all.

Good news begets good news.

Second Interim Dividend At 7% Yield

The management announced an interim dividend following the release of half-yearly report on Nov 2016. Our dividend yield was a whopping 22%!

The Revenue Dropped Further. But Share Price Continued To Rise

The market loved it and the share price continued to rise despite a 25% drop in revenue in the year end results for FY17. We pocketed another 6% dividend yield in May 2017.

Exited At $0.915 With A 100% Total Gain (Capital + Dividends)

We decided to sell the stock at $0.915 as we have held it to our pre-determined 3-year exit point.

We realised a total gain of 100%, inclusive of the dividends collected and the capital gain on the stock price.

– Key Takeaways –

#1 The Unexpected Can Happen

Before the investment, we had no idea if the management would be generous with their dividends. We also had no idea about the actual impact of the lost customers to Chemical Industries’ business.

But we knew for sure that the share price was significantly lower than the value of its’ assets. And when we buy stocks this cheap, all we need is a single piece of good news for the share price to gain significantly.

A 100% gain in slightly 3 years is a good result for us.

#2 Without Pessimism, There is No Opportunity

This shows that investors might have been overly pessimistic about this stock, which created an opportunity for us to capitalize on. We can only profit when some investors are wrong in their judgement.

It is true that this kind of value investing often surface companies which have problems. But it is precisely the presence of problems that would create undervalued opportunities.

#3 Share Prices Revert To Its Fundamental Value Over Time

It makes no sense that for a stock with only good news, and positive outlook to trade at a discount, because every other investor in the market would have already bought it and bumped up its price.

One must be able to appreciate the contrarian way of investing in order to adopt this approach.

[thrive_leads id=’30461′]

Disclaimer: This is NOT a stock recommendation, we have profited but no longer own the stock. This article was written to show that undervalued stocks do exist in our market, it is up to you to do your due diligence to find them.

Hi Alvin, thank you for this post! May I know why did you set a 3 year exit point? I have attended the CNAV course and I don’t remember that there is anything on setting a pre determined exit point based on years. Also, if the share price has dropped lower than your entry point, may i know if you will still sell It when the 3 years exit point is met?

yes, we have a 3 year time stop for CNAV stocks if the take profit and cut loss criteria are not met.

Hi Alvin, at this point is chemical industries still considered a net net stock?

nope

Hi Alvin and team,

Thank you for sharing your analysis, It was refreshing to read this from your usual posts…

I have a few questions i wasn’t able to come to an answer about this counter, and i was hoping you could share more of your insights with us.

1) In my opinion, I feel it’s a value trap, especially when you’ve pointed out that the counter had consistently incurred losses over the years.

Other than the quantitative basis that it was undervalued according to CNAV, It doesn’t answer the question of why should we invest in Chemical Industries when we could find other companies/industries that are undervalued as well.

2) 2) As mentioned , management only declared a dividend yield through a settlement with one of their customers. You’ve also pointed out the trade could have very easily gone in the opposite direction as well.

The dividend yield would only be very profitable for retail investors who took a concentrated initial position.

Without knowing the management would return a dividend at all at the time of your analysis, It wouldn’t make rational sense to devote a huge chunk of capital to this position.

I would argue in term of position sizing,you guys took a very risky position with such a concentrated size.

Thanks again for sharing your insights and perspectives with your readers, it was really a very insightful post and gave me some thoughts to dig further into.

1) Research have shown that certain metrics give us higher returns. We often doubt the robustness of such quantitative methods and we believe humans can do better. But history has shown us that it isn’t true and humans make poorer investment decisions due to the biases we have. It is widely known that most investors do not beat the index returns in the long run. And index components are selected quantitatively without human judgement. Math beats humans most of the time.

2) Yes, it could have gone the opposite direction. But buying a stock with good news and prospects isn’t foolproof. In fact, a ‘good’ stock is very vulnerable to bad news. Whereas a stock that has been beaten down in price by bad news just need a slightly positive event to unlock the value. An A student cannot afford to get a B while an F student would be seen differently when he gets a D. I would argue that buying good news and outlook might be a worse approach.

We didn’t invest in Chem Ind more than any other stock. Our stocks are equally weighted in the portfolio. There are winners and losers in the portfolio but the wins are much bigger than the losses such that we get a good return overall