There are two stocks by the name of Playmates listed on the Stock Exchange of Hong Kong.

Playmates Toys (HKEX:0869) manufactures physical toys of popular cartoons such as Frozen and Teenage Mutant Ninja Turtles (TMNT). Their toys are sold in Walmart, Target and Amazon with the U.S. being their biggest market.

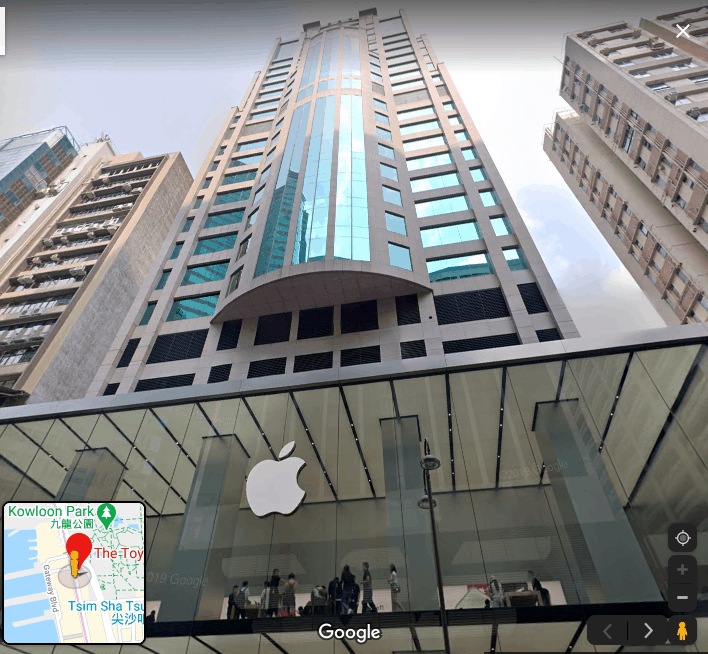

Playmates Holdings (HKEX:0635) is the parent company of Playmates Toys (HKEX:0869). The former has a 50.85% stake in the latter. Besides taking a share of profits from the toy business, Playmates Holdings has a property investment business and its most prestigious property would be The Toy House. This building houses one of Apple’s flagship stores is Hong Kong.

We bought shares in Playmates Holdings in Jan 2017, where it was trading way below the value of their investment properties and the cash that they have. Essentially we got the toy business for ‘free’. At that time, its subsidiary, Playmates Toys, was not undervalued. Buying Playmates Holdings would indirectly get us the toy business and our investment dollars would be backed by properties in Hong Kong.

We were using the FY15 annual report when we made the decision. Playmates Holdings had 75% and 15% of its assets in properties and cash respectively. Taking these two good assets to less off the total liabilities, we ended up with a Conservative Net Asset Value (CNAV) of $2.55 per share. The shares were trading at $1.034.

This means that we can get the cash and properties at 59% off! What a mispricing!

Moreover the business was profitable and generating positive cash flows.

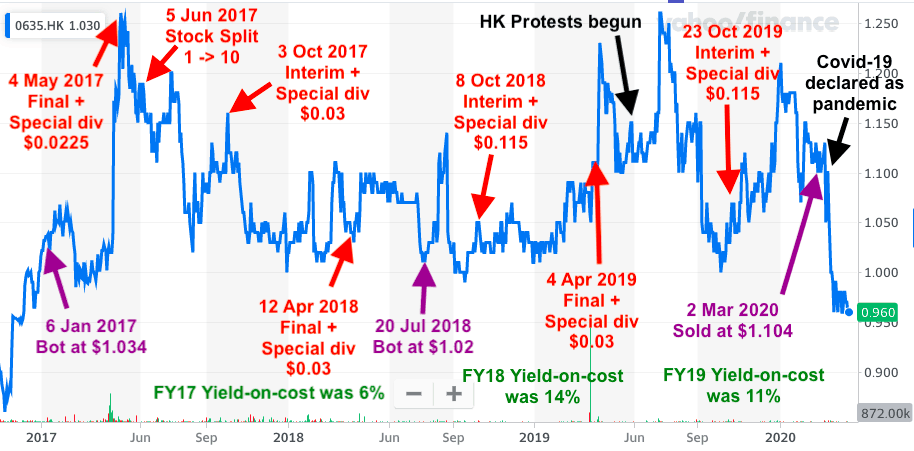

We happily bought it on 6 Jan 2017 at $1.034. Actually it was $10.34 (and the CNAV per share would be $25.50) because the shares were subsequently subdivided by a factor of 10 on 5 Jun 2017.

Playmates Holdings pays regular dividends. The management was also generous with the special dividends, giving extra money during every interim and final dividend payouts. Our dividend yields (based on our costs) were particularly high at 14% and 11% in FY18 and FY19 respectively.

The stock prices gyrated and our capital gain on paper ranged from 0% to 25%. Hong Kong was rocked by the protest in 2019 but it didn’t affect Playmates Holdings share price by much. Eventually we sold it at $1.104 on 2 Mar 2020 because we have a 3-year holding period for our value stocks and the time was up. It was a 36% gain with most of it being contributed by dividends.

We were lucky to have sold before the Covid-19 turned serious and the stock market started its selldown.

The current price has even gone below our original buy price while the value of the company has gone up. The CNAV per share is $2.97 based on FY19 report.

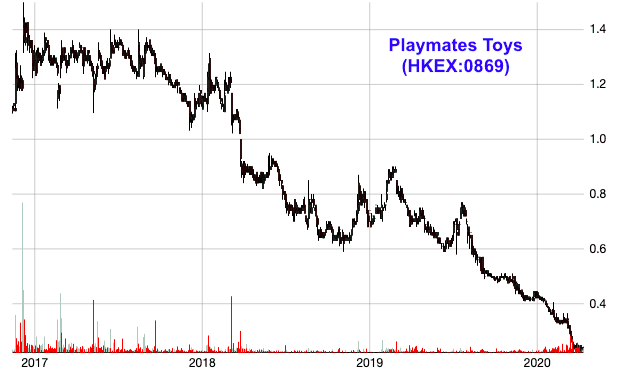

Its subsidiary, Playmates Toys, had it rough. Recalled that we said earlier we didn’t buy because it didn’t pass the CNAV criteria. Luckily we didn’t buy it because the share price kept dropping over the past 3 years due to falling revenue and profits.

The price has declined so much that Playmates Toys has become an undervalued stock now.

Playmates Toys has 86% of its assets in cash, which is over HK$1 billion. It is unlikely they will run out of money even if this Covid-19 situation persists.

The CNAV per share is $0.69 while the share price is at $0.24.

Both Playmates Holdings and Playmates Toys are undervalued now. Their businesses are definitely affected by Covid-19 and the decline in their share prices is warranted due to poorer business performance being expected in future reports. But they are also likely to survive it because of the cash they have. We can also expect the dividends to be cut if they are still giving out.

What’s your view? Would you buy Playmates Holdings or Playmates Toys? Yes or No, and why?

Like to know more in investing in undervalued stock with fundamentally strong business & healthy cash flow post market crash, and dividend income for early retirement

why is there is a 3 year limit on value stocks?

undervalued stocks can stay undervalued indefinitely. So we have a time stop to get out of a position. Give it enough time for a catalyst to happen. If not, move on.