No doubt that living in a condominium feels a whole lot different compared to staying in a HDB flat. There is security, luxury fittings and an array of facilities available at your convenience (swimming pool, gym, etc). All perks of a high-end living.

You must take time to carefully consider all the facts before committing to what is likely to be the biggest investment you’ll ever make.

Take it slow and do your sums carefully.

An over-eager homeowner may run into financial difficulties by rushing to buy a condominium apartment without thoroughly doing the proper background checks on the developer.

And as for older establishments, some fail to examine the intended unit and its common areas for potential problems. I am pretty sure you would have come across a Singaporean couple or two who are in huge debt because of their impulse purchase.

If the property is well within your means, then go ahead with the purchase. Otherwise, the developers or real-estate agents, driven by commission-based sales target, may persuade you to make a hasty decision and commit.

Buyers who rush to buy a condo unit, often succumb to these factors:

- The promise of luxurious and carefree living

- The anticipation of owning their first private property

- Failure to educate themselves to the essential facts of communal ownership

As with the innate tendency to follow the crowd, some buyers might also be enticed to buy in the perceived high take-up rate broadcast during the first week of condo launches. Note that percentage sold figure is always misleading.

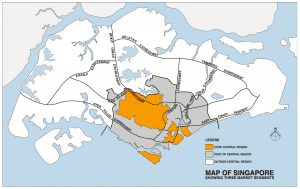

Naturally, how much you pay for your condo unit also depends on where it is located. The Singapore private residential property market is divided into 3 geographical market segments namely; Core Central Region (CCR), Outside Central Region (OCR), and Rest of Central Region (RCR). You can refer to the map below for an overview of the three market regions.

Source: Urban Redevelopment Authority

Source: Urban Redevelopment Authority

CCR Condominiums

CCR Condominiums are located in the most prime area – districts 1, 2, 9, 10 and 11, which includes the regions of Singapore CBD (Central Business District), Sentosa Island, Bukit Timah, Tanglin, Orchard Road, River Valley and Newton. Condos in these areas are most sought after due to its central location and are also priced among the highest.

RCR condominiums

RCR condominiums, on the other hand, are well liked for being in the city fringe. Projects in this region are priced mid-range and consist of developments in Bukit Merah, Bishan, Queenstown, Toa Payoh, Geylang, Kallang and Marine Parade.

Meanwhile, the OCR is known as the neighbourhood areas where most of our population resides in. Majority of the mass-market condos, including the Executive Condominiums, are located here. Typically, many buyers in this region are HDB upgrades, as the price in this region can be quite affordable.

Most Singaporean couples and small-sized families would go for a 2-bedroom or a 3-bedroom apartment. Let’s take an average price of $850,000 (assuming the average of $1,000 PSF) for easier calculations. These are the considerations to see if you can afford to buy such a condominium in Singapore.

The first thing you need to look out for is the Loan to Value (LTV) ratio. The maximum bank loan tenure you can take is 35 years, with a maximum of 80% of the house market value. But this loan is only for tenure up to 30 years. If your loan is more than 30 years, you can only borrow 60% of the house market value.

Another thing to take note of is the Total Debt Servicing Ratio (TDSR), which is 60% at the current moment. This means you can only use a maximum 60% of your gross monthly income to pay for all loans. Yes, that includes all your other loans like car loans, student loans, credit card debts, personal overdrafts and the likes.

Let’s assume that you do not have any other outstanding loans, so you can use the full 60% ratio and the maximum LTV ratio at 80% with the loan tenure of 30 years.

- Property Price: $850,000

- Loan tenure: 30 years

- Loan amount: $680,000 (80%)

- Down payment: $170,000 (20%)

The monthly repayment when calculated based on a 2% interest will be $2513/month.

You can only use 60% of your gross income to pay the loans*. This means you need a monthly gross income of $4435. However, MAS requires financial institutions to use a higher interest rate of 3.5% when calculating monthly loan repayments. That comes up to a figure of $3,054/month. Therefore, you are required to have a gross monthly income of $5090 to qualify for a $680,000 loan for 30 years**.

Now, having an income of $5,100 sounds quite reasonable, especially if you are a degree holder working at the managerial level. But don’t forget, you still need to make 20% down payment ($170,000). Furthermore, you can only pay 75% of the down payment using CPF and you’ll need to pay the rest by cash – which gives you the additional $42,500 to be paid in cash.

In any case, even if you can afford the down payment, it is dangerous to have such high ratios of debt to income. You need to consider setting aside some of your income to pay the monthly maintenance fees. They range between $250 for a 2-bedroom apartment to $350 for a 3-bedroom in the mass-market development. Maintenance fees for luxury developments can reach up to $1,000 a month.

By the end of every month, you’ll be left with nothing much. We encourage you to keep some of your income for savings. In the event that you lose your job, you’ll be strapped for cash. That’s what happened to so many investors and homeowners alike, especially now with the looming economic recession.

So How Much Do I Need To Buy A Condo In Singapore?

A safer gauge to see if you can afford a condominium that costs $850K, would be if you have a monthly income of approximately $6,100 to $7,600. Conservatively, you’ll be using only 40%-50% of your income to finance the property.

*Do take note that buyers are subjected to a Mortgage Servicing Ratio (MSR) of 30% for Executive Condominiums (EC) bought directly from developers. This means you can only use 30% of your gross monthly income to pay for EC housing loan installments.

**Disclaimer: The above calculations are used for simple illustrations only. It does not reflect the actual loan amount that you qualify for.

Condo used to be exclusive but not anymore. Often these so called exclusive projects are build close to the road side some with bus stop nearby. What is the use of having a balcony facing a noisy road and pedestrians can even caught a glimpse of the living room. Near where I am staying there is one which is build next to a flated factory so near that one suspect it can be touch with a bamboo pole ! To make matter worse its supposed to be the ” only” project in that area but at later stage another condo project sprung up just beside it together with other new BTO flat costing a fraction of the price. The maintenance fee is often overlooked when one concentrate on the price alone. It can add up to a significant sum say over 20-30 years. With jobs so fleeting nowadays its better to have a fat bank account than to stretch one’s finance just to leave in an ” exclusive” neighbourhood.

would it make sense to buy the condo and rent it out?

Hi Danessa,

Great article. Can you elaborate and give a breakdown of how you reached $2513/month for 2% interest and $3,054/month for 3.5%?