BNPL (Buy Now, Pay Later) is gaining popularity in Singapore right now. The program’s innovative mode of payment allows consumers to pay for their purchases in instalments over a short period without incurring any interest or fees.

However, some caution is needed because there is truth in the saying: “anything that seems too good to be true, generally is.”

Credit Card vs. BNPL

1 – Smaller ticket items

Although BNPL appears to work the same way as a credit card instalment plan, there are some key differences. First, BNPL programs are typically used for smaller ticket items as compared to credit cards, which are often used for instalments of large purchases, such as home renovations and vacations.

2 – User Demographics

Another distinction is the level of accessibility. While most working adults have access to credit cards, the younger generation (those above 18 but aren’t old enough or aren’t earning enough to obtain one) do not, and this is the main demographic that the BNPL services are targeting.

BNPL providers

So what are the different BNPL services offered in Singapore?

Let’s take a look at some available providers, their instalment plans, credit restrictions, as well as the catch.

GRAB

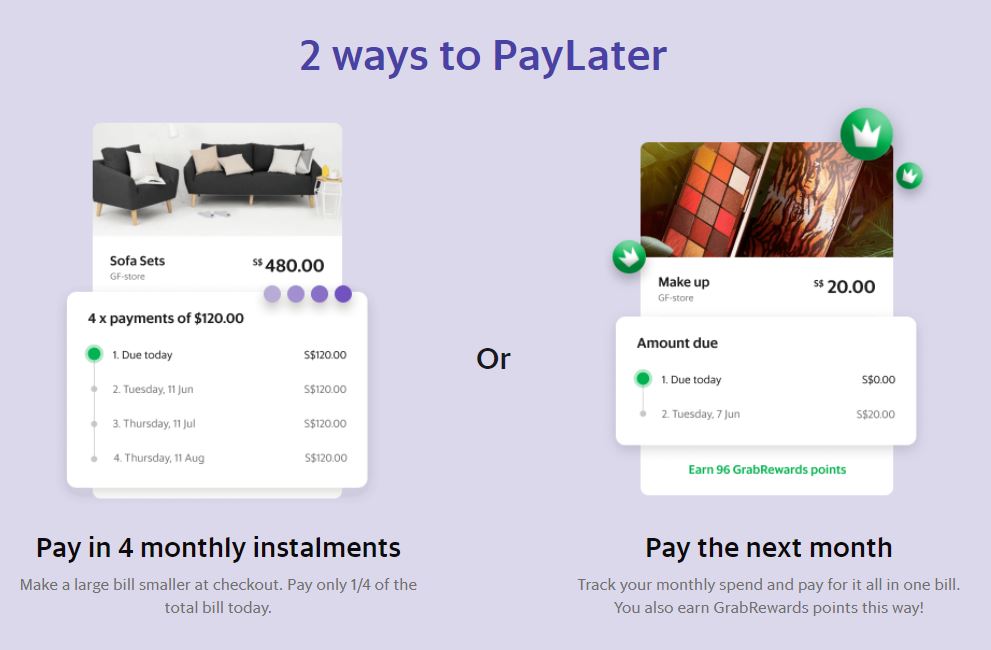

GRAB currently offers two types of BNPL services:

- PayLater Instalments,

- PayLater Postpaid.

PayLater Instalments allow customers to spread their payments over four months. On the other hand, PayLater Postpaid lets customers make monthly payments for Grab services (such as rides, food orders, and deliveries) and purchases made through its online partners.

These transactions will be merged into a single bill at the end of the month which must be paid before the due date.

In my opinion, Grab has the broadest selection of partners, including brands like Dyson, Prism+, ISTUDIO, Shein, Secretlab, Sennheiser, and many others.

Charges and Rewards

According to the company’s website, there are no interest or hidden fees unless you miss a scheduled payment. When that happens, you must pay an admin fee of $10 flat to restore your suspended PayLater account.

In addition, GrabRewards points will be awarded for every payment made using PayLater Postpaid (only for Pay the next month)

Sign up criteria

To sign up for Grab PayLater, one needs to be:

- 21 years old and above

- A Platinum, Gold, or Silver GrabRewards tier member

- Have used a credit or debit card for at least 3 Grab transactions in the recent month

Spending Limits

Spending limits differ from one user to another. Your user profile and purchase patterns, which may vary from time to time, will determine your spending limits. GRAB claims that the longer you use the service and the more orders you successfully repay, the more likely you will be granted a larger amount to spend. This sounds exactly like a credit card.

You may be wondering what the spending limit is. As I currently don’t use this service, I can only share with you the amount GRAB used in their example, which is roughly $1500 for PayLater Installment and PayLater Postpaid.

Rely

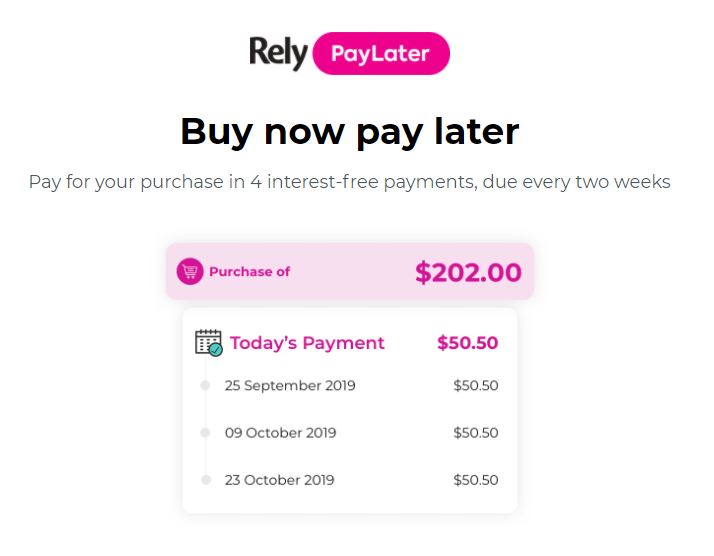

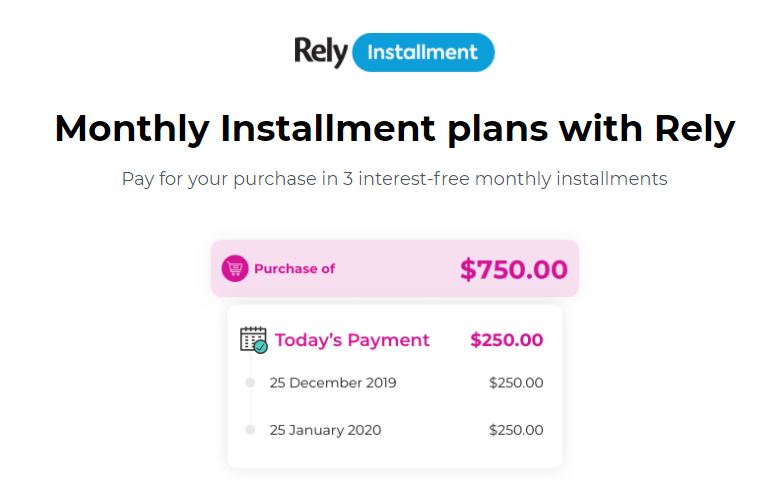

Rely offers two payment options:

- Rely Pay Later,

- Rely Installment.

Rely Pay Later allows customers to pay for their products in four instalments at two-week intervals. Meanwhile, Rely Instalment divides the total amount into three monthly instalments.

Below are some of Rely’s prominent partners.

Charges and Rewards

Rely claims to offer no interest or hidden costs, similar to GRAB. However, it’s worth noting that the website says that a late fee ‘may’ be imposed for late payments. There isn’t much information on their website on how much the fee is, but after searching online, I found that it can range from $1 to $40 depending on the size of your purchase.

Sign up criteria

To sign up for Rely, one needs to be:

- 21 years old and above

- Has a Singapore residential address

- Has a Singapore issued credit or debit card

Spending Limits

Spending limits vary per user, and it will be determined by your user profile and payment patterns, which may vary from time to time.

Hoolah

Hoolah only offers one service at the moment: three interest-free instalments.

Charges and Rewards

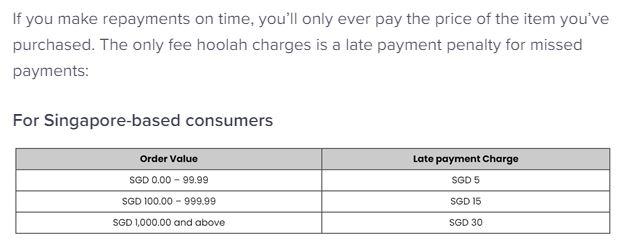

Similar to GRAB and Rely, Hoolah has no hidden fees or interest. But if you miss a payment, you will be charged a late payment fee that ranges between $5 to $30, depending on the value of your purchase.

Sign up criteria

To sign up for Rely, one needs to be:

- 18 years old and above

- Has a Singapore residential address

- Has a Singapore issued credit or debit card

Spending Limits

Spending restrictions also vary per user and is determined by the system. The more you use the site, the more you will likely be able to spend more money. What perplexes me is that their website stated “there may be a limit on the amount you can spend” but did not provide further details.

Concerns

So, what are my reservations about BNPL?

Well, the ease with which credit may be obtained, the lower initial cost of buying, and the lack of interest fees are concerning as it may encourage impulsive buying. These services make a product that is currently beyond reach due to its price, appear more ‘affordable’ to consumers. I have observed that this perceived affordability can cause overspending.

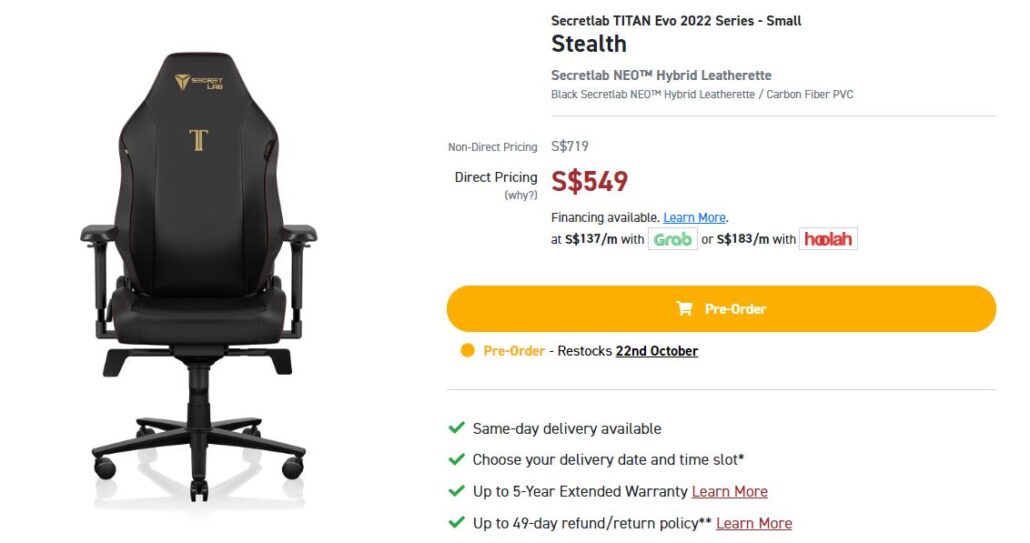

When I was shopping online for a chair to relieve my backache, I came across SecretLab. In case you didn’t know, SecretLab is a Singaporean company that sells gaming chairs and their chairs are pricey, costing more than $500 each.

When I mentioned this to my friends, they all suggested I could buy it in instalments. I knew they were referring to the BNPL partnership between SecretLab and providers like Grab, Rely and Hoolah.

See how a $549 chair easily became $137 and $183 after being split into 4 and 3 instalments, respectively? This certainly makes the chair feel much more ‘affordable’ instantly, doesn’t it? (P.S. Guess if I purchased the chair in the end).

This concerns me since based on their advice, my friends seem to have fallen victim to BNPL schemes just like many other Singaporeans.

The Rise of BNPL

Buy Now Pay Later seems like a fresh concept but it has been widely used in many North American countries. One of the possible reasons it has arrived on our shores today is because it is a highly profitable industry.

According to Coherent Market Insights, the global BNPL platforms market is expected to grow by 21.2% CAGR between 2020 and 2027. With a market value of US$7,320.6 million in 2019, it is expected to reach US$33,638.3 million in 2027.

While North America had the majority market share in 2019, the report mentioned that the Asia Pacific is expected to grow faster due to the increase in mobile internet infiltration and the rise of emerging economies.

Worrying Spending Trend?

Regarding Singapore specifically, a report by Finder found that 38% of Singaporeans have used a BNPL service. The data also suggests that the likelihood of the unemployed using BNPL is higher than average at 54%.

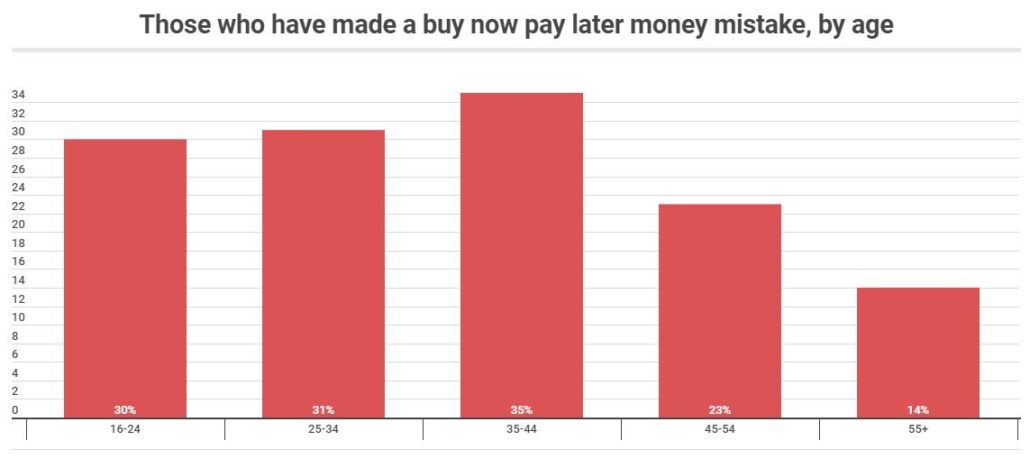

Approximately 783,000 persons or 27% of those surveyed admitted to being worse off financially due to BNPL mistakes. The report showed that people aged 35-44 are the most likely to have made BNPL money blunders, followed by those aged 25-34 (31%) and those aged 16-24 (30%).

I was honestly surprised because I expected younger people to make more BNPL mistakes than those who are older and more mature. I guess the problem isn’t limited to individuals in their twenties. Nonetheless, the percentage is high across all age categories, indicating a concerning trend.

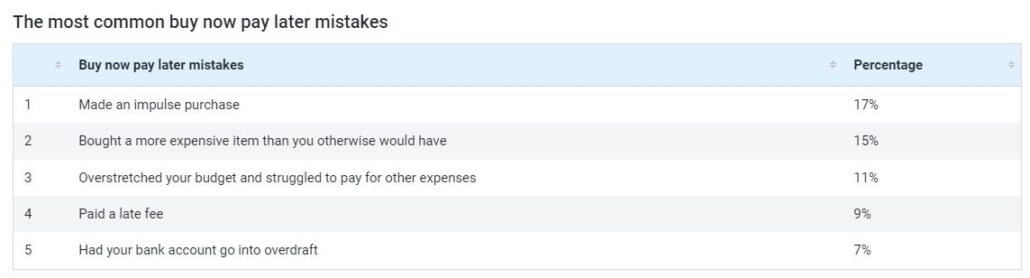

When broken down into the various ‘mistakes’, impulse buying accounts for the highest number (17%). I’m not surprised since such services are designed to get you to buy products you were previously hesitant to acquire because of the price.

Another thing worth noting is that 7% of people had their bank account go into overdraft, which means their account was depleted to nothing. We can assume that some people just neglected to top up their accounts, but it could also mean others experienced financial hardships.

Regulations on BNPL

Regulators worldwide are taking notice of this trend and are now reviewing or strengthening the rules governing the BNPL industry. For example, the UK government enacted regulations requiring BNPL lenders to conduct affordability tests before lending to consumers.

Singapore is no exception. Based on the response to parliamentary queries on BNPL schemes, the MAS and other government agencies appreciate the concerns raised and are now investigating whether regulations should be put into place.

When regulations are implemented correctly, I believe it will not kill the industry but rather foster a healthy economy that will benefit both consumers and businesses. Moreover, rules are necessary to safeguard consumers and ensure they do not take on more debt than they can afford.

The credit limit is one issue that regulators must address. Yes, each BNPL service sets a credit limit, but it doesn’t prevent a consumer from opening several accounts with different BNPL providers, does it?

Summary

I’m not suggesting that BNPL services are terrible. BNPL is a double-edged sword, similar to leverage in investing.

I believe that if you have a comprehensive view of your finances, are financially responsible and are able to pay off your instalments on time, such a system could allow you to improve your cash flow and enjoy double dips on benefits.

These businesses are profit-driven, and who in their right mind would turn down the opportunity to make money, especially in a fast-growing market? Nevertheless, companies like GRAB can only offer you BNPL and make it attractive. It is ultimately up to you to decide whether or not to use it.

I did buy the SecretLab chair in the end, but not through the BNPL scheme. That does not mean that I will never use such services in the future. But if ever I do, I would double-check if I have the appropriate funds before purchasing through BNPL.

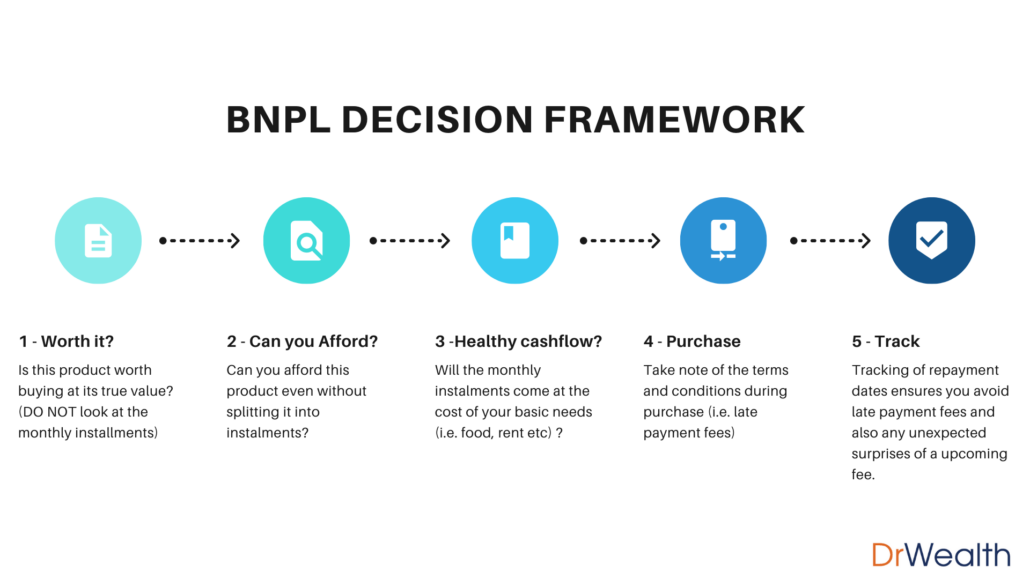

As a financial website, we promote prudent spending and we want you to be aware of the risks when using BNPL services. Here’s a framework you can utilize before deciding to use these types of services:

The framework is quite simple. As long as you successfully pass all of the stages, you should be fine. If you don’t meet all of the conditions, I don’t think it’s wise for you to use BNPL.

I’d want to emphasize the final point. It’s crucial to keep track of your expenses because it’s normal for people to forget how much they owe at the end of the month. As such, it is highly probable they would have spent the money instead of reserving it for repayment, which might cause further cash flow problems.

That’s all I’ve got for now. Please stay safe!