As a follow-up to our 2022 S-REITs outlook, we have identified a few S-REITs that we could potentially invest in as they are poised to outperform in 2022. (NB: the list below is in no particular order)

To identify potential Singapore REITs candidates that would outperform, we looked at S-REITs that have a track record of providing value to shareholders, such as through accretive acquisitions or asset enhancement initiatives (AEI). They could also either be in growth segments or have relatively favourable valuations.

Here’re the best S-REITs to invest in 2022:

1) Mapletree Commercial Trust (“MCT”)

We start off with the biggest merger in 2021 which we previously covered.

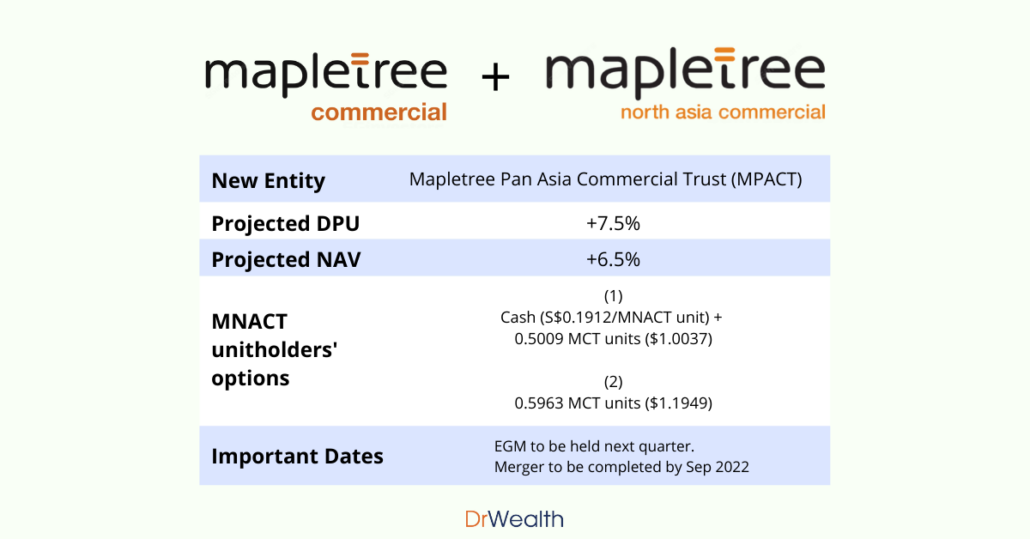

On 31st December 2021, MCT proposed a merger with MNACT to form MPACT. The merger will allow MCT to expand its investment mandate from a Singapore-only to a Pan Asia REIT.

Despite the acquisition providing accretion both from a DPU and NAV perspective, MCT’s share price declined from S$2 to S$1.84 on 6th January 2022.

On 5th January 2022, the credit rating agency Moody’s placed MCT on review for downgrade, which showed a potential weakening of MCT’s credit metrics and uncertainty around its financial policy, following its merger with MNACT as the deal would raise MCT’s leverage. A downgrade will increase MCT’s cost of debt and reduce the merger’s projected DPU accretion for shareholders.

On top of the merger, another potential upside is that MCT could be a turnaround play for its retail assets should the pandemic situation improve, allowing for relaxation of existing movement restrictions. Once returning to the office becomes a trend, it may result in a number of companies keeping their office space instead of downsizing.

MCT also has a strong track record of carrying out AEI in its retail assets such as its revitalisation of a segment of the VivoCity shopping mall in September 2020, as shown below. This allowed the company to obtain return on investments through higher rental income.

MCT’s post-merger NAV and DPU is projected to be around S$1.80 and S$0.095, respectively. At a share price of S$1.84, investing in MCT at a valuation that is close to NAV would provide for a yield of around 5.2%.

2) AIMS APAC REIT (“AA REIT”)

In September 2021, AA REIT went through a management change and also entered the business park segment in Australia through a large acquisition, which we previously shared here.

AA REIT entered Australia’s business park market by acquiring Woolworths’ Sydney HQ and data centre. Woolworths is the biggest supermarket chain in Australia, with a market share of more than 30%. It also owns Big W, which is one of the country’s largest discount department stores.

This acquisition significantly enlarged AA REIT’s portfolio size, from S$1.7 billion to S$2.2 billion, and enhanced its portfolio quality through geographical and segmental diversification. Other metrics, such as its portfolio’s WALE and tenant diversification, also improved.

On top of the Woolworths acquisition, another potential upside could come from positive rental reversions as the overall industrial property market in Singapore is improving. With a new management team and an aggregate leverage ratio of 38.6% after the acquisition, AA REIT also has the headroom to carry out accretive bite-sized acquisitions very quickly.

The share price decreased from S$1.60 before the news, to S$1.44 as of 6 January 2022. With a NAV and projected DPU of S$1.40 and S$0.0937 respectively, investing in AA REIT at a valuation that is close to NAV would provide for a yield of around 6.5%.

3) Digital Core REIT (“DC REIT”)

DC REIT was one of the most popular IPOs in the Singapore market in 2021, listing in December 2021 at US$0.88 and trading at US$1.18 as of 6th January 2022.

DC REIT has been one of the best performers, with more than 30% share price increase from its initial IPO price. Based on the share price of US$1.18, the P/B and yield are 1.41x and 3.5% respectively.

While the P/B is still lower than its peers, such as Mapletree Industrial Trust and Keppel DC REIT, its yield is also much lower than its peers. This could imply that the market is pricing in potential acquisitions by DC REIT, which would allow the yield to catch up. DC REIT, being in the high-growth data centre segment, has industry tailwinds from increasing data centre demand.

DC REIT also has a low aggregate leverage ratio of 27.0%, hence there are market expectations of acquisitions.

4) ESR-REIT (“ESR”)/ ARA LOGOS Logistics Trust (“ALog”)

ESR is currently pursuing a proposed merger with ALog to form ESR-LOGOS REIT (E-Log). E-Log will hold a diversified portfolio of logistics, industrial and business park assets, with a total AUM of S$5.4 billion. It will also be one of the Top 10 S-REIT by market capitalisation and have greater representation and potential for inclusion in many indices.

The merger was proposed because ESR Cayman, the majority shareholder of ESR, acquired ARA Asset management, the majority shareholder of ALog. In addition, the merger will accord not only scale but also potential synergies as ESR & ALog have many overlapping value propositions. The scale will also allow for cross-selling of asset spaces and improve E-Log’s cost of debt.

Potential upsides to look out for would be sizeable acquisitions from its Sponsor at a favourable cost of debt and development. The larger asset base will allow E-Log more AEI opportunities to unlock value from underutilised spaces, as it can now target more assets for AEIs without adversely affecting its earning performance.

The larger AUM would also increase weightage in indices, which would lead to increasing institutional demand and higher share valuations.

E-Log is also well-positioned with multiple industry tailwinds arising from its sizeable portfolio of logistics and business park assets.

The merger’s illustrated FY20 DPU would increase by 4.8% to 2.935 cents. At a current share price of S$0.48, it represents a yield of 6.1%.

5) Parkway Life REIT (“PLife”)

PLife has been one of the best performing REIT in the last 10 years with a ten-year compounded CAGR total return of 15.9% as of November 2021. PLife owns assets that are defensive in nature, with a long-term lease structure and downside protection in place. It is well-positioned in a fast growing healthcare sector in the Asia Pacific region.

PLife has a track record of countless accretive acquisitions, underpinned by favourable funding costs. Thus, it is scaling up tremendously, with its DPU increasing by 118% since IPO as shown in the chart below.

PLife is trading at S$5.05, which represents a P/B of 2.5x and a yield of 3.6%. Since PLife is trading at such high valuations, it can ensure that every acquisition is accretive.

PLife’s potential upside will come from its low aggregate leverage ratio of 34.9% and ability to undertake up to S$705 million of acquisitions, thus potentially increasing its portfolio size by 23% and substantially increasing its DPU.

Closing statement

Investors might be concerned that a higher interest rate environment in 2022 may affect S-REITs’ returns. However, there are some S-REITs that have set themselves up to outperform as they are in favourable industries with strong tailwinds or have a high potential to grow its DPU, resulting in further increase in share price.

That said, conditions may change as the year unfolds. You should do your own research, for starters, I’ve shared how you can pick the best REITs for your portfolio.

If you aspire to build a sustainable income from a REITs portfolio and wish to learn from someone who has done it successfully, join Chris Ng at his live webinar* to learn how you can get started and what you should take note of in order to build a resilient REIT portfolio. (*this will be the last run for 1Q22)