For the uninitiated, the Metaverse is broadly defined as the next iteration of the internet. It is visualised as an immersive and interactive digital environment populated by virtual avatars representing actual people. It is a virtual world focused on social interactions.

Since the Metaverse attempts to integrate the virtual space with the physical space, software and relevant hardware devices are required for access.

The future of the Metaverse

The excitement over the Metaverse caught on in late 2021. It is expected to be the next big trend and the future of the internet.

These high hopes could stem from the fact that for the first time in history, the technology is nearly there. With the advancements in VR gaming and connectivity, our generation may have the capacity to develop the Metaverse.

The companies of the Metaverse

There are seven layers needed to build the Metaverse ecosystem. Many tech companies jumped on the Metaverse-themed bandwagon, signalling their intent to join the virtual race. They plan to build up their capabilities and provide use cases for one or more layers of the Metaverse.

In identifying Metaverse-themed companies for outperformance, we look for ones with a strong track record of product development. We also consider those with an innovative culture. After all, we need companies that will continue designing and developing exceptional products.

Best Metaverse Stocks

These companies should also be able to fund the sizable investment required to capture market share. Do keep in mind that write-up focuses on the metaverse growth opportunities for such companies.

1) Apple (NASDAQ: AAPL)

When it comes to unprecedented development, innovative culture, and excellent products, Apple would likely be the first company that comes to mind. Apple’s most famous slogan was “Think Different,” the company’s core belief. Accordingly, it constantly reinvests profits into research and development.

While Apple does not currently have a device for the Metaverse, it is reportedly working on an augmented reality/virtual reality (AR/VR) headset that may launch in 2022.

We may not see big waves at every Apple event, but when the company does come up with a new product, it almost always makes an impact.

2) Qualcomm (NASDAQ: QCOM)

Qualcomm is the market leader for semiconductor chip patents, with applications across many leading industries.

Qualcomm’s contribution to the Metaverse

i) Updated chips

Many tech companies are expanding into the Metaverse and require new chips to stay competitive. There is little doubt that Qualcomm will continue to adapt to the changes in the industry by designing chips with capabilities to support hardware in the Metaverse.

ii) Internet of Things (IoT)

Qualcomm provides Internet of Things (IoT) solutions.

IoT devices have multiple applications in consumer, industrial, enterprise, and edge networking services. They also have the potential of integrating with Metaverse applications.

Qualcomm already has a functioning product with its Qualcomm Snapdragon XR2 5G Platform. It is the world’s first extended reality (XR) platform to unite 5G and AI. Further, Facebook’s Oculus VR headset already uses Qualcomm’s chips.

iii) Augmented reality

At the 2022 Consumer Electronics Show, Qualcomm Technologies, Inc. announced its collaboration with Microsoft. Together, they seek to expand and accelerate the adoption of AR in both the consumer and enterprise sector.

The partnership covers several initiatives to drive the ecosystem. This includes the development of custom AR chips to enable a new wave of power-efficient, lightweight AR glasses. There are also plans to integrate software like Microsoft Mesh and Snapdragon Spaces™ XR Developer Platform.

Tech companies with hardware requiring semiconductor chips would likely consider Qualcomm as a supplier due to its position as a market leader.

3) Tencent (HKG: 0700)

Tencent’s pathways to the Metaverse

While Tencent is in the nascent stage of fleshing out its Metaverse vision, it has considered three pathways.

The first and most obvious path to the Metaverse is through video games, the firm’s most significant revenue driver. The second path is via a gamified social network that supports programmable experiences. The third path would be real-world experiences augmented by AR and VR.

Tencent already has an office software suite similar to Microsoft Office. Hence, it could build AR/VR capabilities on this platform.

Acquisition of Game Shark Technology

In addition to developing capabilities internally, Tencent has started acquiring capabilities in the Metaverse. It announced its plan to acquire Black Shark Technology, a gaming mobile phone company.

Tencent intends to integrate Black Shark into its Platform & Content business segment. In turn, Black Shark’s future focus will shift from gaming phones to virtual reality devices. Basically, Tencent will provide the content while Black Shark will provide the virtual reality devices.

Existing involvement

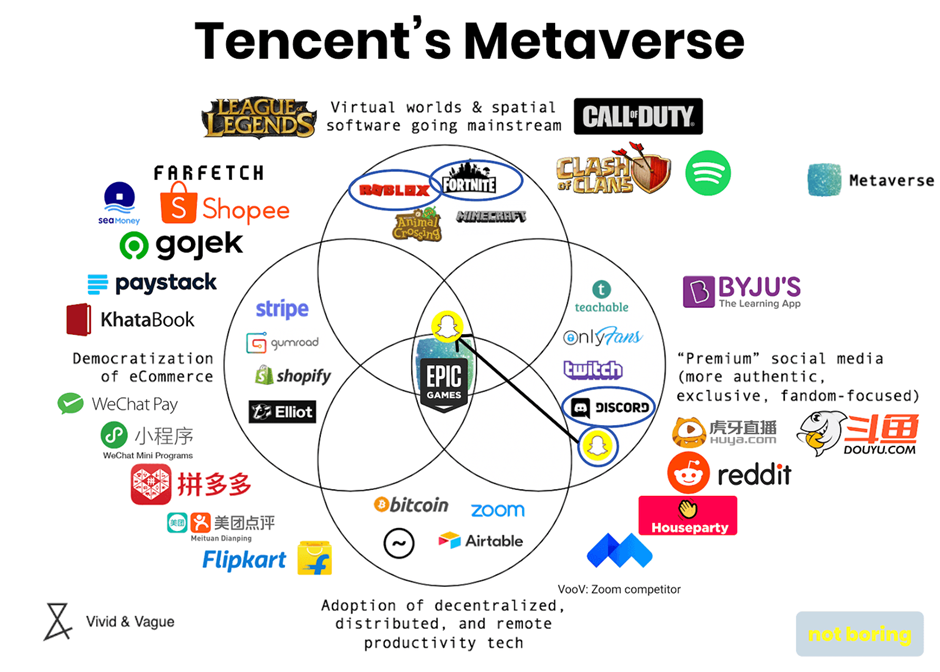

Tencent has a portfolio of hundreds of companies, including Epic Games, Discord, and Roblox. These companies are deeply involved in various segments of the Metaverse.

Thus, investors of Tencent will gain exposure to a spectrum of companies involved in the Metaverse.

4) Meta Platforms (NASDAQ: FB)

Commitment to the Metaverse

Facebook, now known as Meta, has made building the Metaverse one of its big priorities. It has gone so far as to emphasise its commitment by renaming itself.

The company now follows a new vision, that is, to help bring the Metaverse to life for both work and play.

Meta intends to spend about US$10 billion over the next year developing technologies to build the Metaverse. Mark Zuckerberg, Meta founder and CEO, hopes that the Metaverse will reach a billion people over the next decade.

Meta’s investments

i) Oculus headsets

Meta invested heavily in virtual reality with its Oculus headsets. The company seeks to make them accessible by pricing them lower than rivals – even at a loss, according to some analysts.

And as of 2021, Oculus has captured 80% of VR sales by volume, a massive lead ahead of other makers that include Microsoft, Sony, HP and HTC.

ii) VR apps

Meta is also building VR apps for social hangouts and the workplace. It is currently experimenting with a VR meetings app called Workplace, and a social space called Horizons. Both use Meta’s virtual avatar systems.

In Horizon, users of Facebook’s Oculus virtual reality headsets can create an avatar to wander in the animated virtual world. There, they can play games and interact with other avatars.

Meta is leading the paradigm shift. It is the stock to look out for due to its focus on the Metaverse.

In April 2022, Meta announced that creators can now sell things to make money in its metaverse. Many critics have bashed their 47.5% creator fees, Alvin shares an opposing view here.

5) Nintendo (TYO: 7974)

Nintendo is a video game company with popular titles such as Pokemon Go and Pikmin Bloom.

Making AR mainstream

Although Pokemon Go wasn’t the first AR game, it was arguably the first mainstream case of AR. It reached a mass audience with more than one billion total downloads.

Still, the company proved that it was no one-trick pony by following up with Pikmin Bloom.

Moving into a virtual world

Nintendo has its own game with a virtual world, Animal Crossing: New Horizons. It is also well-positioned to transform its franchises into AR experiences in the Metaverse.

The strong branding from its hit titles would allow Nintendo to explore the possibilities of AR/VR, virtual worlds, and non-fungible tokens (NFTs). The company is even able to cross-sell via physical outlets such as Super Nintendo World.

Best Metaverse Stocks to buy?

Investors looking for the next trend for 2022 and the decade ahead may find it in the Metaverse. However, as it is still in the nascent stage of development, there could be risks involved. After all, you’re looking at investing in a product from conceptualisation to production.

Although the companies mentioned above have started the race, there is no guarantee that they will be the first to cross the finish line.

Still, they are the current market leaders and are aware of the challenges ahead. Most importantly, they are willing to invest in what is shaping up to be the most significant theme of this decade.