Ant Financial has flirted with the IPO idea a few times in the past. It did so again recently. We get an unusual interest in it and have received questions about how to subscribe to the IPO. It isn’t confirmed yet! For all we know, they may delay the IPO again.

We do not have the financials and an IPO price to determine the deal is a reasonable one but we can conduct some qualitative analysis by looking at the history and the business model of Ant Financial.

How it started

The story was that eBay entered China and dominated the C2C e-commerce market after acquiring Eachnet in 2003. Jack Ma wanted to compete and win. Alibaba was focused on B2B and Taobao was launched to move into the C2C space. But it wasn’t easy to get the transactions going because the buyers and sellers were not familiar with this new way of commerce. The lack of trust was an issue. This led to the creation of the first version of Alipay, which was an escrow service. The buyer’s funds would be custodised by Alipay and would only be released to the seller after the buyer has received the item. This was crucial in increasing the transactions on Taobao in the early days and beat eBay eventually.

But the challenges didn’t stop there. The online payment system was non-existent and many Chinese did not have bank accounts. Alipay co-developed the online payment infrastructure with a bank so that it could get on the banking network. This legitimised Alipay as a payment solution provider and coupled with the technology, it revolutionalised the way people make payments in China – including the enablement of cashless payments in the stores.

Alipay grew in popularity and its app has been a mainstay in many smartphones because of its utility – the user could pay for almost everything in life – QR code payment in the stores, bills payment, money transfer, prepay mobile phone top-up, bus and train ticket purchase, food order, ride hailing, insurance selection and of course, pay for items on Taobao and Tmall.

After finding success in mobile payment, Alipay found itself in a world of possibilities – technology can do a lot more to improve the state of the financial industry. Alipay was rebranded as Ant Financial Services in 2014 as their financial services went beyond payments.

The world’s largest mobile payment platform

Alipay’s main mobile payment competitor would be WeChat Pay.

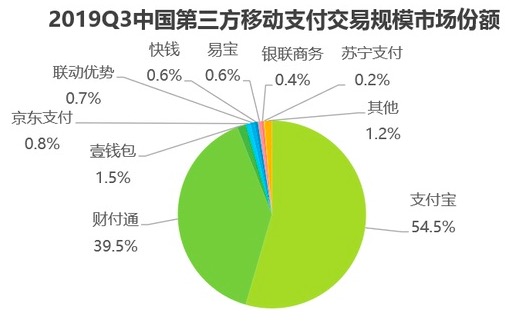

Alipay 支付宝 held more than 50% market share in China while Tenpay 财付通 (the company powering WeChat Pay) had close to 40% in 3Q2019.

China has the high adoption of cashless mobile payments and most countries are just playing catch up. In 2019, both Alipay and WeChat Pay led the world by the number of active users on their mobile payment platforms.

Alipay has moved beyond China and offered its mobile payment to other countries such as Singapore, Japan, South Korea, U.S., Canada, U.K, Italy, Iceland, Norway, Australia and New Zealand. Merchants in foreign countries have an incentive to accept Alipay as they could attract Chinese tourists to spend at their stores.

The world’s largest money market fund (previously)

Yu’e Bao 余额宝 was launched in 2013 as a money market fund and it became wildly popular. I have mentioned in previous occasions that the biggest threat to finance isn’t coming from a fintech company but more likely from a popular mass market product / service company. Taobao has a massive customer base and the users are comfortable transacting via Alipay. The resistance is very low to adopt the money market fund when it was offered to them – high interest deposits with a few clicks – why not?

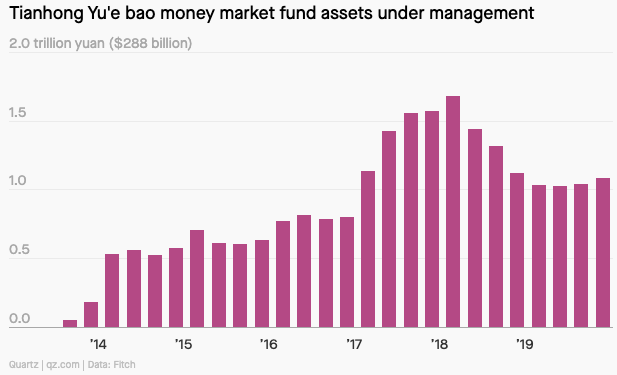

Yu’e Bao quickly became the world’s largest money market in 2017, with assets peaking above ¥1.5 trillion in 2018.

The Chinese government started tightening the regulations and a state-run television attacked online money market funds like Yu’e Bao. The assets dipped and Yu’e Bao lost its throne to two other money market funds – JP Morgan US Government Money Market Fund and Fidelity Government Cash Reserves.

Moving into micro-lending

Ant Financial is not resting on the laurels even after conquering the markets with mobile payment and the money market fund – it launched Sesame Credit in 2015.

You might think this just another credit or lending facility. You have to understand that most individuals do not qualify for credit with the banks because they lack data needed for proper credit rating. Alibaba has enough transaction records of their customers and could analyse their purchasing behaviour on their platforms. It can extend a credit to purchase an item before you check out if you are credit worthy according to Sesame Credit – bypass the need for a credit card.

Sesame Credit assigns Sesame Scores to users based on creditworthiness, which is based on the following five factors:

- Credit History reflects a user’s past payment history and indebtedness, for example credit card repayment and utility bill payments.

- Behaviour and Preference reveals a user’s online behaviour on the websites they visit, the product categories they shop, etc.

- Fulfilment Capacity shows a user’s ability to fulfil his/her contract obligations. Indicators include use of financial products and services and Alipay account balances.

- Personal Characteristics examine the extent and accuracy of personal information, for example home address and length of time of residence, mobile phone numbers, etc.

- Interpersonal Relationships reflect the online characteristics of a user’s friends and the interactions between the user and his/her friends.

This is an application of big data in finance and Alibaba being the largest e-commerce company will have more data points than any other banks. Ant Financial is really a force to be reckoned with and revolutionising finance in so many aspects.

Who owns Ant Financial?

Most people would think that Alibaba owns Ant Financial. The history was more complicated than this.

Alibaba was partly owned by Softbank and Yahoo when Alipay was operating. Jack Ma knew that the Chinese government will never grant a license to Alipay because of its foreign ownership. He also knew that the board will never allow him to spin off Alipay into a separate company in order to get the license. But Jack just went ahead without consulting the board.

The shareholders naturally felt unfair especially when Alipay has turned into a success. They definitely want a piece of it. Jack arrived with an agreement with the shareholders in 2011 – if Alipay goes public, Alibaba will be paid at least $2 billion but no more than $6 billion, plus 37.5 per cent of Ant Financial’s pre-tax earnings before the IPO. But this arrangement was superseded after Alibaba acquired 33% stake in Ant Financial in 2019. Hence, Alibaba should have some upside when Ant Financial is spun off through an IPO eventually.

Conclusion

Ant Financial has disrupted the financial industry more than anyone else. I have only covered the mobile payment, money market fund and micro-lending. But Ant has made an impact in insurance too, signing up 100 million users under Xiang Hu Bao 相互保 within the first year of its launch. Mybank has lent ¥2 trillion to 16 million small companies in 4 years. Ant Financial seems unstoppable and would probably continue to be a trailblazer in the finance industry. Coupled with Alibaba’s strong e-commerce presence, Ant Financial will have access to a mass customer base and fuel its adoption of all its products.