Airbnb’s long-overdue plans to go public is finally a step closer to becoming reality as the company officially filed its S-1 on 16th November.

The popular vacation rental platform company originally planned a late 2019 or early 2020 IPO, but was thrown into an existential crisis when the global travel and tourism industry took a massive hit from the COVID-19 pandemic.

Reports now suggest that the IPO will likely happen somewhere between early to mid December.

What to make of this highly-anticipated IPO?

If you’re not inclined to read the over-349 pages of prospectus filing, I’ve provided a breakdown below as well as some of my own insights and analysis!

IPO Overview

Here are some notable details about the upcoming Airbnb IPO:

- Airbnb will list on the Nasdaq exchange, with ticker symbol “ABNB”

- Listing is via a traditional IPO, expected between early to mid December 2020

- Airbnb is expected to be a “hot IPO” – meaning the issue will be highly sought after. This is amidst a wave of recent popular listings including Snowflake, Palantir, and Unity, and renewed optimism for international travel on news of vaccine progress from Pfizer and Moderna

- Airbnb is expected to raise around US$3b, with an estimated valuation of US$30b. Airbnb’s valuation notably fell to US$18b at the peak of the pandemic when it rushed to raise additional capital. With renewed optimism, experts expect valuation levels to mostly recover by the IPO date

- Funds raised would be used for “general corporate purposes, including working capital, operating expenses, and capex”. While Airbnb does get a bump in its balance sheet with the IPO, one of the main reasons is to take advantage of this “hot period”. In fact, the filing explicitly states this – “the principal purposes of this offering are to… create a public market for our common stock”

- 4 classes of shares will be issued – A, B, C, H.

- Only Class A common shares will be available for trading in the secondary markets. Each A share represents 1 vote.

- B shares are mainly issued to insiders and core management and represent 20 votes.

- C and H shares have no voting rights, and are not publicly issued. H shares are fully issued to Airbnb’s wholly-owned Host Endowment Fund subsidiary

- Notable major shareholders include Temasek Holdings, Sequoia Capital (est. 4% of Class A), China Investment Corp, Andreessen Horowitz LLC, Silver Lake (est. 23.5% of Class A), Sixth Street (est. 18.5% of Class A)

Update: Alvin shares his latest analysis, as of 8 Dec 2020 (airbnb is slated to debut on 10 Dec 2020, at the point of recording):

Airbnb’s Business Model & Value Proposition

In simple terms, Airbnb operates an online/mobile platform that connects hosts who have available spaces with guests who are looking for short-term stays (ie. on leisure travels, business trips, etc.).

When bookings are made through the platform, Airbnb takes a cut out of the final booking value.

For the hosts, they can specify rates they want to charge and make additional income for renting out their property for short-term stays.

For the guests, they can compare across listings, rates, amenities provided, and read reviews on past experiences.

Typically, the cost for an Airbnb stay is much lower than a hotel due to lower overheads (no staff or land use costs versus hotels).

Moreover, with over 4m hosts and 7.4m available listings (as of 30 Sep 2020), guests have a wide selection of spaces apart from the traditional home, from “igloos to treehouses, and castles to boats”, that are allegedly only available on Airbnb.

With the large and varied number of spaces, it is no wonder many travelers use Airbnb to book their vacation stays.

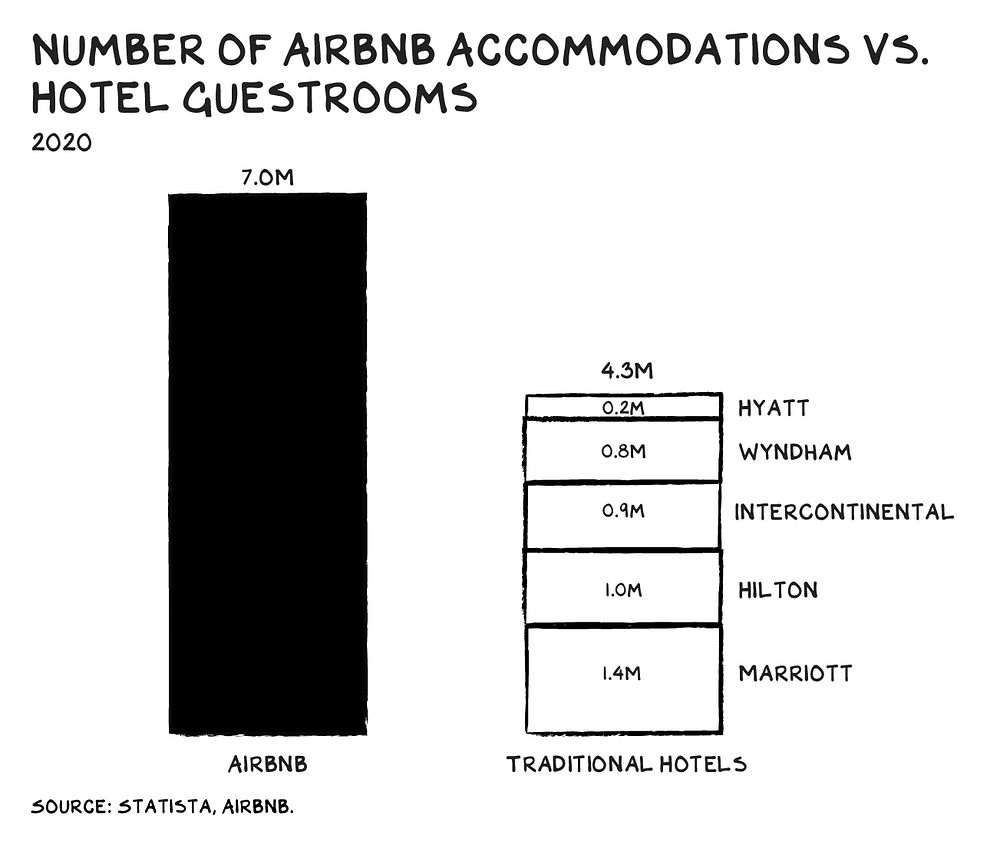

In fact, as Professor Scott Galloway points out in his blog, the number of spaces Airbnb offers exceed total rooms at the top 5 hotel chains in the world!

Such global scale and accessibility not only presents itself as a huge barrier to success for competitors, but has also created a strong network effect for Airbnb.

The more spaces listed, the more valuable the platform is for the guest as they get more distinct choices and can benefit from more reviews.

Meanwhile, the more users on Airbnb, the more opportunities for hosts to lease out their vacation spaces at any given point in time – which means more income and in turn incentivizes other hosts to list their spaces too.

In fact, being in more than 100,000 cities and 220 countries… Airbnb has become synonymous with vacationing.

Business Performance

According to the filings, no single city accounts for more than 1.5% of Airbnb’s listings or 2.5% of its revenues in 2019 and the first 9 months of 2020 (9M2020).

However, zooming out regionally, we see that slightly over 80% of revenues come from US and EMEA (mainly Europe).

Thus it seems like on a city level Airbnb’s revenues are well diversified – but it still relies heavily on US and Europe as its biggest markets… which are not doing too well at the moment with new waves of COVID-19 cases in those regions.

While disappointing results was to be expected this year, what’s interesting to me is the narrative surrounding the latest 3Q performance (the latest one as of the IPO filing).

This is just a taster:

Airbnb bulls and news reports alike highlighted that Airbnb had achieved profitability in 3Q2020 – a stark recovery from the first half of the year. Reports then state Airbnb’s resilience in the pandemic, echoing remarks made in the filing itself.

While Airbnb indeed reported profits of $219m for the three months ended 30 Sept 2020, such profits have been achieved through deep cost cuts – including laying off 25% of staff, cutting executive salaries in half, shedding 54% of marketing costs and raising US$2b in debt in April.

As an asset-light online platform business, I would think that cutting marketing budgets, product development and support staff would shrink Airbnb’s long-term business value even though it has enabled them to post a profit right now.

Furthermore, keen observers would notice that over the last few years the 3rd quarter has typically been a profitable one. Airbnb explains in its filing that its business is a seasonal one – with the peak season for travel in the third quarter for North America and EMEA.

However, zooming closer on a year-on-year basis, 3Q revenues have been already declining in 2019 despite higher YOY revenues.

A closer look at the income statement tells us that 3Q2019 operating costs and tax provisions grew disproportionately more – by 50% and 293% – despite revenues increasing 30% YOY. What this tells me is that from a financial standpoint, internal operating costs (not COVID, not competitors) has been and will increasingly be the biggest obstacle Airbnb will need to tackle as it grows and expands.

So, with all the reports talking about resilience and continued profits from growth via domestic travels… I’m not so sure that the narrative will hold moving forward.

To Airbnb’s credit, management has explicitly cautioned (under “Risk Factors”) that they may not achieve or sustain profitability, owing to the fact that they have incurred net losses every year since inception. For the near term, management also expects greater declines in revenues (ie. “Nights and Experiences” segment and Gross Booking Value) and more cancellations in Q42020 due to new waves of infections and lockdowns in Europe.

Looking at the credit side of things, I am actually surprised that Airbnb has not had any long-term debt since 2015 (earliest disclosed financials). Maybe it is because I am used to looking at more mature companies…

Anyway, Airbnb did chalk up ~US$2b of long-term loans in April 2020, during the peak of the COVID-19, to maintain liquidity and buffer against further unforeseen circumstances.

In hindsight, I would say this move has been a pretty costly one.

Airbnb holds two 5-year term loans of US$1b each – with payment terms at 7.5% and 10% above LIBOR respectively (or similar equivalents using the prime rate or fed funds rate). This brings Airbnb’s cost of debt to at least ~12%.

Coupled with an average cost of equity of ~10% for Internet software companies, investors would need to be confident that Airbnb can generate returns on capital upwards of ~10% per year in order to justify its expansion plans.

Can it do that within the next few years or so juggling growth expectations, operating cost pressures and COVID-19 uncertainty? I don’t know.

On a brighter note, Airbnb’s gross margins have been holding steady around 75%, not counting 9M2020. This is unsurprising for an asset-light marketplace business – and barring any other shocks to the business model, margins will likely recover moving forward.

Who is behind Airbnb?

Brian Chesky is the main man behind Airbnb, running the show today as CEO, Board Chairman, and Head of Community. Interestingly, the last Board review saw Mr. Chesky’s base compensation reduced from US$110k to US$1 with no target bonus.

His compensation will be in the form of equity incentives – with the Board granting him a long, multi-year stock award of 12 million restricted stock units (RSU). He also holds 15.4% of Class B shares, according to the IPO filing.

This compensation chess move closely resembles those made by big tech CEO-founders like Elon Musk (Tesla), Eric Schmidt (Google), Jack Dorsey (Twitter), and Mark Zuckerberg (Facebook). The premise is that the move signals Mr. Chesky’s belief in the long-term value of the business by aligning his interests with those of shareholders.

The other 2 co-founders, Nathan Blecharczyk and Joe Gebbia, do not have the same compensation treatment. Each hold 14.2% of Class B shares.

What are the Growth Prospects of Airbnb?

New Verticals and Offerings

Most users familiar with Airbnb will know that the company launched Airbnb Experiences back in 2016 – where instead of simply offering stays, hosts (or locals) can create “unique experiences [that] go beyond a typical tour or workshop”.

Hosts or locals can share their passions, bring guests to places not usually known, and offer a chance for guests to immerse themselves in true local culture.

To date, Airbnb offers around 40,000 handcrafted activities (“Experiences”) in over 1000 cities around the world.

With the halt of physical Experiences due to the pandemic, the company recently launched Online Experiences that function similarly but conducted via interactive sessions online.

With regard to its growth, the IPO filing does not break out number of bookings for Airbnb Experiences separately – so we would only have to hope that all is on the up and up in this area.

Besides Experiences, Airbnb has also launched Airbnb Plus (2018), Airbnb Luxe (2019), and Airbnb for Work (2014)… which all flow through to accommodation booking revenues.

Airbnb Plus promises only the best-in-class stays in design and quality with premium support functions.

Airbnb for Work allows business travellers to book short-term stays in homes or spaces supposedly conducive for meetings and brainstorming sessions. Oddly, there is no mention of this at all in the S-1, which implies revenues from this vertical are currently not significant.

On the other hand, Airbnb had recently acquired Gaest.com in 2019 – an online marketplace for listing and booking meeting spaces, workshops, photoshoots, etc. This could signal that Airbnb for Work may be re-positioned to target small-time home business owners, freelancers, event organizers which may attract better demand than business travellers who are indifferent to paying significantly higher sums for a more-professional hotel room stay.

Airbnb Luxe opens up the typical home-staying experience to include high-end stays in private villas, top-of-the-line hotels and resorts coupled with ancillary services like a butler, chef, and even childcare. This comes after Airbnb acquired high-end vacation rental platform Luxury Retreats back in 2017.

And yes – you read that right – hotels.

Airbnb acquired HotelTonight in March 2019 and this has opened Airbnb up to a database of hotel room rentals. CEO Brian Chesky had publicly stated that he wanted Airbnb to become an end-to-end travel platform (ie. “the Amazon of travel”) – expanding offerings to include flights and more. Hence it is likely investors will see hotels becoming more common on the platform in the near future.

Leaving the best for the last, the most recent unexpected demand came from an increase in near-distance domestic stays as a result of COVID-19 pandemic.

Amidst global lockdowns, the filing reflected that users who were bounded within their own countries took to the next best option to rent short stays in different neighborhoods and quieter spaces.

Airbnb aptly calls this “work-from-any-home”… and weaves this into its “resilience” narrative:

While I generally agree that domestic demand has held up well from this phenomenon, reports and bullish articles have hypothesized that this will continue to increase as such short-term stays allow for better social distancing for guests (vs hotels) and allow more hosts to come onboard and earn additional income during this economic slump.

Thus, these reports argue higher valuations should be warranted due to this listing growth.

I believe this may be pushing it a little.

Again, growth doesn’t come free. Assuming there’s indeed greater bookings demand over the next year, operating costs are still unhinged and will continue to knock out any profitability.

Investors who are expecting profitability to continue (if that’s what they were led to believe), will be sorely disappointed.

Rationally, that should drive down valuations, not increase it. (Then again, we’re dealing with irrational markets at the moment)

Total Addressable Market (TAM)

According to the filings, Airbnb sees a US$3.4 trillion market to capture.

It cites “$1.8 trillion for short-term stays, $1.4 trillion for travel experiences, and $210 billion for long-term stays”.

Now, I’m not too good when it comes to market sizing so I did a little fact-checking with some data providers.

Right off the bat, I found some odd discrepancies doing a search on Google.

In 2018 (or near the start of 2019), the alternative accommodation booking market was reported to be at US$150 billion with Airbnb leading the pack with a high-teens share of the pie.

Just almost two years later, the market has purportedly grown to US$2 trillion, combining long and short term stays, according to Airbnb.

This is a staggering 265% per year increase in market size, wow!

This is quite hard to believe, considering travel and tourism industry growth is only expected to grow at 3.6% from 2019-2029, according to the World Travel & Tourism Council (which Airbnb also cites in its estimate of SAM and TAM).

Anyway, I wanted to find out the real market size for Airbnb’s vacation accommodations market. Digging around Pitchbook, it seems like the maximum median market size estimate is only at US$1.09 trillion.

And this is after having factored in both short-term stays (Airbnb’s niche), the general lodging market (which includes longer-term stays), and the general market for online travel bookings.

This is almost half of the US$2 trillion TAM projected and so in reality, the market might not actually be that big…

Anyways, Airbnb duly notes that “to arrive at our short-term stays market size, we use our own estimates based on available regional data on overnight paid trips, nights per trip, and ADR”… so we’ll give them that.

Meanwhile, Airbnb’s “travel experiences” market estimate of US$1.4 trillion seems to be in the right ballpark according to Pitchbook.

With a considerably smaller actual market growing at a small 3+%, the long-term value of Airbnb now depends even more on whether Airbnb can sustain its key competitive advantages and whether competitors can successfully erode those advantages and take market share away from Airbnb.

What Are the Main Risks?

Increasing Competition

We’ve discussed briefly about competitors – but here’s who Airbnb officially considers to be their competitors:

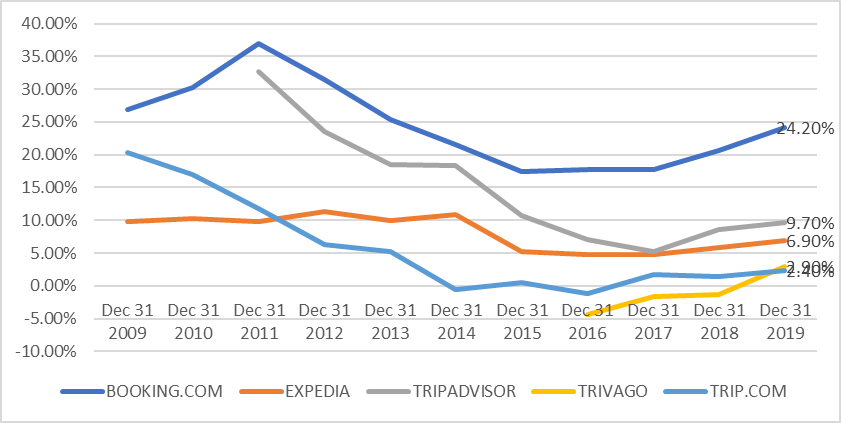

It seems like Online Travel Agencies (OTAs) are a big enough threat with many equally notable players that it takes up 3 lines of text compared to the other categories of competitors.

What’s also important to point out is that these are just the more well-known players – there are also many, many more smaller, niche OTAs such as FlipKey, InvitedHomes, SpotAHome.com, HundredRooms, UniPlaces.com, HouseTrip, TheHomeAlike.com, Roomorama, Wimdu, and Couchsurfing that populate the space over the years.

Additionally, as Airbnb starts to open up in underpenetrated markets like China and India, they face the threat of “super-apps” like WeChat where users (majority of the Chinese population) can already book for flights and accommodation without ever leaving the app…

With this much competition, eMarketer estimates that Airbnb will cede some share of users by 2022 but also notes they should retain their market advantage.

Regulation Restrictions

Airbnb is seen as a disruptive force to the hotel industry… and as such has gotten much pushback from them over the years via lobbying for greater regulations and taxes on short-term rentals.

There have been some wins for the hotel lobbyists.

For instance, “Occupancy Taxes” which were only previously applied to hotels now had to be levied on each Airbnb booking in certain jurisdictions.

Other things like increasing hosting disclosures were also put in place – and all this has led to some hosts leaving the platform from troublesome compliance and significantly lower incomes which make it not as worthwhile to open up their spaces to guests.

Additionally, threat of lawsuits is also a key risk. According to Airbnb, “the number and significance of these claims, disputes, and proceedings have increased as our company has grown larger… and we expect they will continue to increase”.

Of course, Airbnb has taken steps to address such regulatory concerns through a set of guiding principles known as the “Airbnb Community Compact”.

Did it work?

The evidence is not conclusive – but Airbnb has indeed scored some wins through partnerships with various local governments and emphasizing the positive externalities from increased tourism.

Reliance on Google for Search Visibility

As with any online business – web traffic is a key component to sustaining and growing revenues. It is what drives bookings and ultimately sales.

Airbnb states that in 2019, around 23% of traffic to its platform came from paid marketing channels (namely, Google paid ads). Looking at it another way, ~77% of Airbnb’s website visitors come from free, normal Google searches (aka. Organic traffic).

In 9M2020, this figure is even higher at ~91% as Airbnb cuts its marketing spend.

According to the filing, this poses a major threat to its business model, operations, and financial condition if they cannot sustain its organic traffic or they have to spend significantly more to get their usual numbers of web visitors.

This seems to be the weakest link for Airbnb (and most other OTAs) – and it is an important factor to consider when coming up with a valuation for Airbnb.

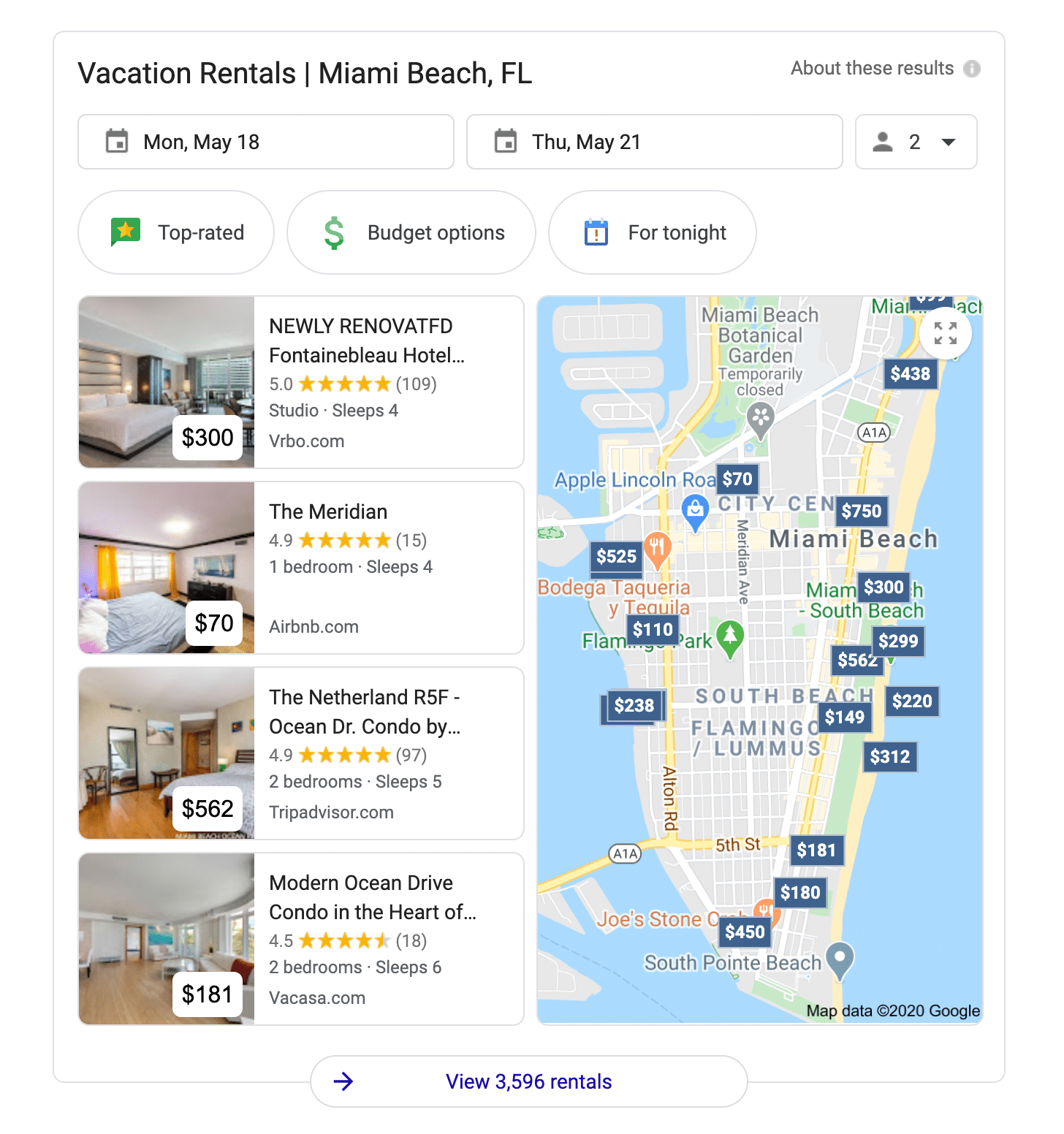

In fact, Google has in early 2020 launched Google Travel and Google Vacation Rental Ads which OTAs and Airbnb sees as a key threat to its business model. Reportedly, 34 travel companies have lodged complaints against Google for this alleged unfair predatory move.

While Google places listings from OTAs at no charge right now, Airbnb expects that this will change – as the service becomes popular. In similar fashion with Google Flights and Hotels, the expectation is that Google will require OTAs to pay for these listings on Google… or see their organic listings pushed further down.

The probable result for Airbnb here is either higher marketing costs (which further eats into already suffering profits), or experience a decline in new visitors which negatively impacts revenue growth.

Either way, not a good look for Airbnb’s resilience narrative.

Is Airbnb A Good Buy?

Prof. Galloway in his blog states that Airbnb’s valuation should be in excess of 20x multiple of revenues, citing global scale and brand equity similar to those of credit card companies (which are/were trading at those multiples).

Data from Capital IQ suggests a current EV/Revenue at 11.8x with a forward multiple at 14.15x revenues.

Thus, it seems as though Prof. Galloway’s valuation might be logically sound – and that Airbnb is a good buy at the expected valuation of US$30b.

However, using data from Public Comps tells a different story.

When benchmarked against OTA peers (including Google), the median multiple is between 6-7.3x… a long shot away from the 20x suggested.

Even if we benchmark against similar internet marketplace tech companies, the valuation multiples are still at single-digits.

It is important to note that Prof Galloway believes Airbnb’s moats are wide and its market leadership is sustainable far into the future where competitors fail to match up to Airbnb. If you believe this narrative, a 20x multiple is definitely sound.

If instead you doubt the “resilience” narrative (as I have) and believe Airbnb’s competitive advantages are not as strong as they seem… then market values should reflect the peer average.

If revenues for 2020 manage to match revenues in 2019 of ~US$5b, a US$30b listing valuation comes up to a 6.3x valuation multiple… which is still a fair price to pay for Airbnb per this valuation metric with the facts we know as of this filing.

Of course, only time will tell if investors have gotten a great deal from this issue or overpaid for its resilience story.