Investing in China evokes a wide range of reactions. Today, we will focus on what you should do if you wish to invest in them rather than whether you should or should not.

You should already be aware that there are a number of ways to participate in the China narrative – from ADRs listed in the US to A shares in China, investors have many options. So, which option is best for investors, and which should you choose?

A-shares vs H-shares vs ADRs

China A-shares

A-share represents publicly listed Chinese companies traded on either the Shanghai or Shenzhen stock exchange. These shares are generally only available to Chinese citizens on the mainland, and they are traded in Chinese yuan (RMB). However, in 2014, the stock connect programme opened up the market to international investors, allowing them to purchase A shares via the Hong Kong Exchange.

To be honest, this is one of the most underappreciated share classes, as most investors focus on ADR and H shares because most of the big names, such as Alibaba and Tencent, are listed. However, if one digs deeper, there are numerous hidden gems to be found here.

Investors can purchase A shares by opening a brokerage account with access to the Shanghai, Shenzhen, or Hong Kong stock exchanges. Interactive Brokers and Tiger Brokers are two well-known brokers.

A-shares Trading Hours

- Trading hours for SSE are 9.30am to 3.00pm (Singapore Time), with a lunch break from 11.30am to 1.00 pm.

- Trading hours for the SZSE are 9.30am to 3.00pm (Singapore Time), with a lunch break between 12.30pm to 1.00pm.

China H-shares

H shares represent publicly listed Chinese companies traded on the Hong Kong exchange using the Hong Kong dollar (HKD). An example would be Alibaba (HKSE:9988) which is listed on HKEX instead of SSE or SZSE.

H shares, unlike A shares, are open to all investors to trade.

Another thing to keep in mind is that a company, such as Bank of China, can have both A and H shares. If this is the case, the one listed in mainland China will typically trade at a premium compared to the one listed on the Hong Kong exchange.

You can also buy H shares through Interactive Brokers, Tiger Brokers, and other brokers with Hong Kong access.

H-shares Trading Hours

Trading hours for HKEX are 9.30am to 4pm (Singapore Time), with a lunch break from 12pm to 1pm.

Chinese ADR

The Chinese American Depositary Receipt (ADR) is a certificate issued by a US bank that represents Chinese company shares. These shares are priced in US dollars and traded on US markets.

Some notable companies we have include Alibaba (NYSE: BABA) and JD.com (NASDAQ: JD). However, investors should be aware that these ADRs are not stocks in which owners do not have the same voting rights as traditional shareholders.

Furthermore, due to the strained relationship between the United States and China in recent years, there have been many talks of companies delisting (case in point Didi). Should investors choose to invest in ADR, I would highly advise them to stay away from companies that deal with a lot of sensitive data about Chinese citizens since they are more likely to be delisted given the security concerns.

To purchase ADRs, all you need is a broker with access to the US market.

ADR Trading Hours

Trading hours for the United States are 10.30 p.m. to 5.00 a.m. (Singapore Time) or 9.30 p.m. to 4.00 a.m. (Singapore Time during daylight savings)

A-shares, H Shares or ADRs: which one should you buy?

Well, that depends on the investors and their circumstances.

Let me illustrate several circumstances.

1) Where is the stock listed?

Alibaba, for example, is only traded on the New York Stock Exchange (NYSE: BABA) and in Hong Kong (HKG:9988). Bank of China, on the other hand, is only available in Hong Kong (HKG: 3988) and Shanghai (SHA: 901988).

As a result, you would have already been limited in some aspects.

2) Forex risk

Investing in China entails a certain level of Forex (FX) risk, which varies based on the type of stock chosen.

For example, ADR is denominated in USD; thus, we must factor in USD/SGD rates.

H shares are similar to this. While H shares are traded in HKD, the Hong Kong dollar is pegged to the US dollar; thus, the currency risk is identical to that of buying an ADR.

When you choose to buy A shares that are traded on the Chinese stock exchange, you will notice a difference. Because these stocks are denominated in CNY, your FX risk will be CNY/SGD rather than USD/SGD.

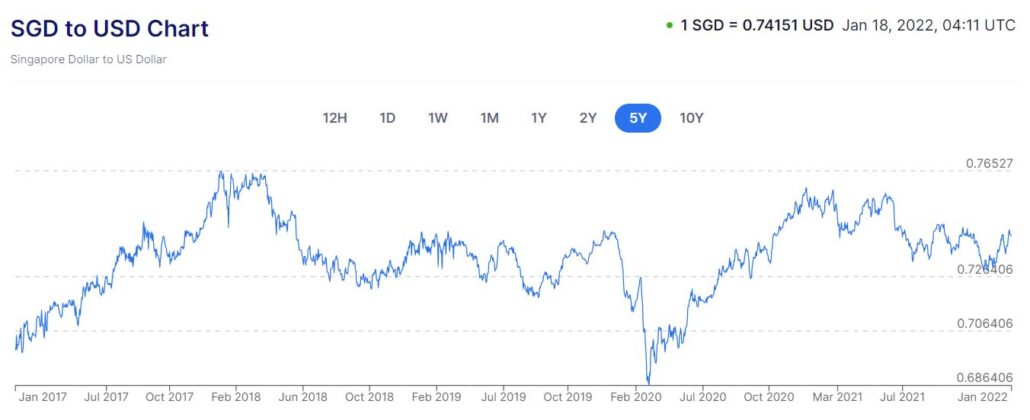

In the long run, forex’s impact may be negligible, especially if you can generate strong returns from stocks. However, if we look at the short term, i.e. two year time frame, we may notice a difference between the forex pairs.

SGD has risen against the US dollar, whereas the RMB has fallen. There are advantages and disadvantages to this. When purchasing stocks, it is preferable if your home currency is ‘stronger’ so that you have more purchasing power. However, having a ‘strong’ native currency may not be advantageous when it comes to realising your gains because you can convert less back.

3) Minimum lot sizes

The minimum amount of shares you need to purchase in each transaction varies between exchanges. The most straightforward is the US exchange, which has a trading unit minimum of 1.

The minimum trading unit in Hong Kong is 1 lot, which might be 100 shares, 500 shares, 1,000 shares, etc. Tencent, for example, classifies one lot as 100 shares, allowing investors to buy in 100 share increments. However, for Bank of China (HK:3988), 1 lot equals 1000 shares and thus if you wish to buy Bank of China shares, you must do it in 1000 share increments.

Finally, a minimum of 100 shares are required in mainland China. We can see the differences here: Bank of China, which is listed on both the SSE and the HKEX, has a different entry price, which could be a significant consideration for new investors. If you choose to buy the share on the Hong Kong market, with a minimum share of 1000, you need to cough out a minimum of 3010 HKD (taking the current price of 3.01 HKD per share) which is roughly S$520. On the other hand, if you buy on the Shanghai market, with a minimum share of 100, you only need to cough out 312 CNY (Taking the current price of 3.12 CNY per share), which is roughly S$66.

$520 may seem fine, but not all stocks would be at such a price. Furthermore, being able to buy a position in the S$66 interval would be significantly easier than in the S$520 interval.

4) Different holidays and market timing

This is not a big deal, but keep in mind that some markets may be open while others are closed due to different public holidays.

In terms of market timing, being in Singapore makes trading HK or CNY equities considerably more convenient. However, if you are a long-term investor, it doesn’t matter because it is only a few clicks before you head to bed.

5) Tax rate

Different countries have different taxes even though they are all Chinese stocks.

As a Singapore investor, you will be liable for a 30% withholding tax if you buy an ADR. This dividend tax is only 10% if you buy from Hong Kong or Mainland China.

Whether or not this is a cause for concern is dependent on the type of stock you own and the duration you are planning to hold it. If you intend to hold the stock for a short period or if the stock gives out minimal dividend, then investing in either market makes little difference.

Choose the best for your investing needs

So there you have it.

These are the factors to consider before deciding which type of stock to purchase. If possible, I would prefer to invest in Hong Kong or mainland China stocks. However, we should not dismiss ADRs. ADRs can be attractive, especially if you are already invested in the US market. This allows you to effortlessly balance your portfolio without having to convert between USD and CNY, and with no minimum share size, it allows investors with limited cash to invest in China while diversifying their portfolio.

Nevertheless, companies that are more likely to be delisted should be avoided. If you want to buy ADR, stay away from ‘sensitive’ companies which China may regard as a threat to their national security.

Another piece of advice for investors is to look for more A-shares companies, as they are rarely discussed among investors, even though most of China’s greatest companies are listed there.