There was a big hoo-ha regarding a Daily Leverage Certificate (DLC) that’s tracking Singapore Airlines (SIA) (SGX:C6L) shares as it has gone to $0.

Our trainer, Robin Ho, wrote about this issue on his Facebook Group:

SIA – How traders lost all their money in DLC through a bizarre price movement

Singapore Airlines (SIA) shares went ex-rights on 6 May 2020 and there was some unusual and bizarre movement in its share price wiping out the total value of SIA Daily Leverage Certificate (DLC) 5 X Short, which has been suspended as the underlying price has appreciated more than 20% from their theoretical ex-rights price (TERP) of S$3.71. This means that losses are now in excess of 100% for this leverage product.

The value of TERP was derived by Soc Gen, the market maker for DLC using a methodology which includes the rights share component based on the issuance of approx. 1.78bn shares and the conversion of Mandatory Convertible Bond (MCB).

The retail investors who bought the SIA 5XShort DLC were the amongst the worst casualties, they lost all their investments. They are crying foul because they had bought the SIA 5XShort DLC based on the TERP that was derived by SIA which amounted to $4.16 as at Thursday closing price of $5.91.

Investors who bought the 5Xshort DLC had bet that SIA could continue to be weak given the poor fundamentals as a result of COVID 19. SIA shares traded in a weird fashion yesterday from a low of 4.15 to a high of 5.05 before closing at 4.40. It actually closed at 4.62 at 5 pm only to be bashed down to 4.40 by a big block order that was matched during trade-at-close hours. These weird price actions left traders scratching their heads.

Investors are complaining that there is no transparency and no level playing field when there was an official SIA derived TERP at 4.16 that differs from a TERP derived by Soc Gen at 3.71. This was not published and retail investors have no privy to the information. Investors content that big gap in the TERP potentially opens the door to market manipulation because if someone had information that the TERP is at 3.71 and the markets perceives it at 4.16, it is obvious that the airbags for the DLC will easily burst resulting in the DLC being delisted. Fuelling more discontent , if Soc Gen had used the same official TERP at 4.16 investors will have sufficient time to exit their position and perhaps the airbags wouldn’t have burst.

One investor actually wrote to SIA Investor Relation and got this reply:

“With regards to your query, it would not be relevant to calculate the TERP based on MCBs prior to maturity given the nature and trading characteristics of both types of securities (e.g. no market quote/price for MCB prior to issuance compared to ordinary shares traded on an exchange)”

Soc Gen adjusted TERP 3.71 is significantly different from the announced TERP by SIA at 4.16 . Being a material difference, this should be communicated clearly to traders of DLCs on a timely basis before the ex-rights date. The significant difference in the adjusted price create a huge price disadvantage for those who are holding on the SIA DLC shorts while huge advantage to SIA DLC long.

What’s going here… its bizarre . At S$4.77 SIA is even higher than the TERP price of S$4.16 base on a pre-ex-rights price of S$5.91. The S$4.77 price would indicate a pre-ex-rights price of S$7.44! WoW! . Overnight, SIA’s price/share has increased from S$5.91 to S$7.44 which is an appreciation of 26%!

Many traders are asking me whether there was any conspiracy behind this weird price movement to flush out all the traders holding the shorts from the people who had privy information of the adjusted TERP at 3.71. Frankly after having being involved in promoting DLC with Soc Gen and SGX since its inception, I don’t think there is any malaise but someone must be held accountable for this confusion which has resulted in huge losses and loss of confidence for derivative products listed on the SGX.

MCB Should Not Have Impact To TERP

I think the main issue here was about Soc Gen using a Theoretical Ex-Right Price (TERP) that was different from what most people understood to be. This is because they included the MCB conversion to shares to calculate the TERP of $3.71.

But MCBs are only convertible at the 10th year and it has no immediate dilutive effect to the SIA shares. Hence, Rights MCBs should not be considered in calculating the TERP.

The TERP should only consider the conversion of the Rights Shares which would be $4.16 based on SIA share price of $5.91.

This was confirmed by the SIA investor relations,

With regards to your query, it would not be relevant to calculate the theoretical ex-rights price (“TERP”) based on MCBs prior to its maturity given the different nature and trading characteristics of both types of securities (e.g. no market quote/price for MCB prior to its issuance, compared to ordinary shares traded on an exchange).

Traders had little reaction time to adjust their trades

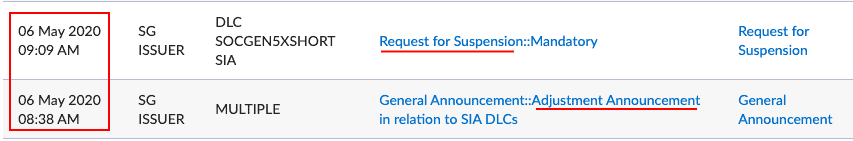

To be fair, Soc Gen did inform the market participants about the TERP they used in an announcement prior to the market open.

For the purpose of the calculations under the terms and conditions of the Certificates on 6 May 2020, the closing price of the Shares on the SGX-ST on 5 May 2020 will be adjusted to S$3.71025415

The only issue was that the adjustment was announced 22 minutes before the market open and the DLC was suspended from trading within 9 minutes of trading.

I agree that the reaction time was too short for the traders to even cut their losses.

Conclusion

I am not involved in the trades and only learned about it through Robin.

Personally I think that the TERP used by Soc Gen could be communicated earlier to the traders. The reaction time was indeed too short to do anything to protect their capital.

I don’t fully blame Soc Gen as the rights issue by SIA was a complex one and most people find it hard to understand it. We realised we had to do a walkthrough and an explanation of it and yet, we still received a lot of questions.

It has been a domino effect: COVID-19 has led to borders closure. Airlines like SIA couldn’t generate business and needs cash to survive. Borrowing would increase debt levels by much. Temasek was able to help but couldn’t make drastic moves such as privatising immediately or resorting to a huge private placement which would be unfair to the other shareholders. Hence, issuing renounceable rights would be fairer. But a pure rights issue would also cause too much dilution. Rights MCBs would balance against the excessive increase in equity. It resulted in a complex offering that few understands it which might have caused wide swings in SIA prices on ex-rights trading day. Derivatives that track SIA with leverage amplified the price movements and unfortunately, one of them blew up.

I would say it has been an unfortunate event and there’s no way to rewind things that have happened. Let’s just try to make good with whatever we can.

Hi Alvin,

am an affected investor. Was wondering if you could guide me to other affected investors where we discuss our options.

Thanks,

You can look for Robin Ho on Facebook.

Don’t waste ur time. Nothing gonna be done. If it’s zero on paper it’ll stay like that. Take ur loss and move on.

Your explanation that soc gen adjusted for MCB is in correct.

1. Before ex right you have 1 share of SIA.

2. Ex right it is split into 3 parts 1 share 1.5 rights share and 2.95 MCB rights. When you total these you should get back the price of 1 share before ex rights.

3 The MCB rights has zero value as seen from the FAQ below published from your website.

4. Hence the ex right 1 share and 1.5 rights share has to total to be $5.92 …this gives us fair value of $4.17 for one share and $1.17 for each right share $4.17+1.5x.17=$5.92.

5. Soc Gen has arbitrarily given a value to MCB rights…there is no financial basis for doing so since they will trade near 0

—–FAQ on ex Rights valuation—-

.Q: What prices should the rights shares and rights MCBs trade at?

Price of the Rights Shares should trade close to SIA share price – $3.

Price of the Rights MCBs should trade close to $0.