In the most recent Federal Open Market Committee (FOMC) meeting on 15th June 2022, the US Federal Reserve (Fed) raised interest rates by 75 basis points (bps) to 1.50% after a shocking CPI data was released on the previous Friday, showing that inflation surged by 8.6% on a YoY basis. This quickly led to investors pricing in a 75bps hike instead of earlier expectations of 50bps as expectations grew on the Fed to combat inflation.

The Fed is also projecting for interest rates to be between 3.1% to 3.6% in 2022, followed by a 50bps increase in 2023 before seeing interest rates come down in 2024. This means that there are expectations of roughly another 150bps of hikes in the 4 remaining FOMC meetings this year.

Higher interest rates dampen economic sentiments, consequently, the Fed has revised real GDP growth lower to 1.7% from its March 2022 projection of 2.8%.

Higher interest rates and lower economic growth are two of the main reasons why many stocks including REITs have performed poorly this year.

Before we go into detail as to why we think the Singapore REITs mentioned below are the safest as compared to other REITs, first and foremost we have to state that while it is obvious that rate hikes means higher interest costs for companies such as REITs who have significant levels of borrowings, it does not immediately have a significant impact to the bottom line of each REIT.

Other factors which we shall talk about in detail below matters more in assessing whether a REIT is safe and is able to ride out this uncertain environment.

For example, Capitaland Integrated Commercial Trust (“CICT”) disclosed in its capital management section of its presentation that every 0.1% p.a. increase to interest rates would reduce distribution per unit (DPU) by 0.02 cents. This means that a 3% p.a. increase to interest rates would reduce DPU by 0.6 cents. Using CICT’s 2021 DPU of 10.4 cents, this is an approximately 5.8% decrease to CICT’s DPU. While 5.8% is not a small figure, it is definitely not catastrophic.

5 Safest S-REITs to buy amidst rate hikes

| S REIT | Ticker | YTD Total Return (%) | 3 Year total return (%) | Dividend Yield (%) | Gearing Ratio (%) | Price to book ratio (times) |

| Capitaland Integrated Commercial Trust | SGX:C38U | 7.5 | 3.3 | 4.9 | 39.1 | 1.0 |

| Lendlease Global Commercial REIT | SGX:JYEU | -1.5 | 1.6 | 5.8 | 27.7 | 0.8 |

| Mapletree Logistics Trust | SGX:M44U | -12.2 | 28.8 | 5.4 | 36.8 | 1.2 |

| Ascendas REIT | SGX:A17U | -2.8 | 11.5 | 5.6 | 35.9 | 1.2 |

| Parkwaylife REIT | SGX:C2PU | -3.0 | 82.0 | 2.9 | 34.5 | 20 |

1. Capitaland Integrated Commercial Trust (SGX:C38U)

CICT is the 3rd largest REIT in Asia Pacific and the largest REIT in Singapore. It was formed after the merger of Capitaland Commercial Trust and CMT and is backed by its Sponsor, Capitaland Investment and has Temasek Holdings as a major shareholder.

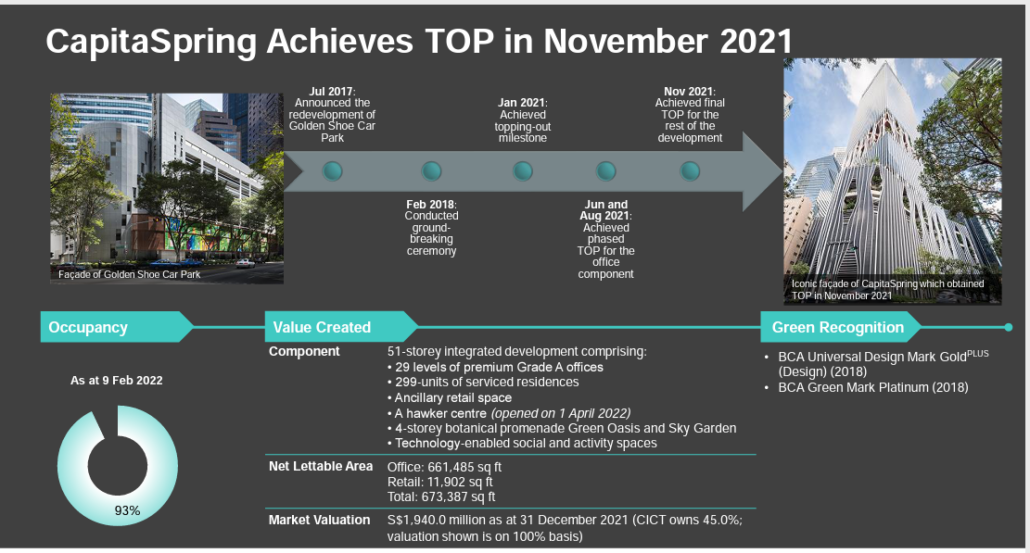

With the merger, It currently has a huge portfolio of $23.8 billion, diversified across retail and office assets as well as integrated assets such as CapitaSpring and Funan, two of the newest buildings for CICT and also in Singapore.

Although CICT’s portfolio is not well diversified by geography, its assets are mostly based in Singapore, one of the most stable economies, which enables CICT to have a strong committed portfolio occupancy of 93.9% and a portfolio weighted average lease expiry (WALE) of 3.2 years.

In March 2022, CICT acquired a 70% interest in 79 Robinson Road, an office building in the Tanjong Pagar area of Singapore for $882 million. The acquisition which is expected to provide DPU accretion of 2.9% significantly increases CICT’s presence in that area, allowing it to cross market its assets.

It also completed the redevelopment of CapitaSpring in November 2021 after 3.5 years, creating significant value as the site was redeveloped from a hawker centre and a carpark to a 51 story integrated development, adding 29 levels of Grade A offices, 299 units of service residences, ancillary retail space and even a 4 storey botanical promenade.

CICT’s steady and long term value creation strategy with a track record of increasing its DPU over time is the key reason why this is one of the safest REIT amidst a higher interest rate environment.

2. Lendlease Global Commercial REIT (JYEU)

Lendlease Global Commercial REIT (“LREIT”) is a relatively new REIT which commenced trading in Oct 2019 with just two assets, namely 313@Somerset, a retail mall in Singapore and Sky Complex, an office asset in Milan, Italy.

LREIT’s sponsor, Lendlease, which is an Australian property conglomerate listed on the Australian stock Exchange, with nearly $100 billion in development in its pipeline, provided LREIT with right of first refusal over JEM, an integrated development, enabling LREIT to acquire JEM in piecemeal until it was able to own 100% of the asset this year in February 2022.

The acquisition of JEM, with a property value of nearly $2.1 billion was highly accretive with a 1HFY22 DPU accretion of 10.5% and it allowed LREIT to quickly expand its portfolio size significantly to a total of $3.6 billion, thus staying relevant in a market that has seen REITs such as ESR REIT merging to scale up, sometimes at a disadvantage to unitholders.

Despite JEM being an integrated development with retail and office component, its tenants have a very high WALE of 9.5 years (by Net Leasable Area (“NLA”)), which meant that the acquisition of JEM increased LREIT’s existing high WALE of 8.4 years to 8.9 years. This is mainly due to its 30 year master lease of JEM’s office component to a government body with a built in rent review clause every 5 years.

With high quality assets in stable geographic regions such as Barangaroo South (Sydney, Australia), Melbourne Quarter (Melbourne, Australia), Paya Lebar Quarter (Singapore), The Exchange TRX (Kuala Lumpur, Malaysia) and Milano Santa Giulia (Milan, Italy) owned by Lendlease, LREIT has plenty of opportunities to carry out acquisitions should market conditions be favourable.

While LREIT has a relatively short track record as compared to other REITs mentioned here, being able to quickly more than double its portfolio size with a double digit percentage accretion to DPU, and at the same time increase its total portfolio WALE to nearly 9 years should attest to LREIT’s ability to secure shareholder return with a stable portfolio over a long timeframe, which is a key reason why this is one of the safest REIT amidst a higher interest rate environment.

3. Mapletree Logistics Trust (SGX:M44U)

Mapletree Logistics Trust (“MLT”) is the largest logistics REIT in Singapore with a portfolio value of $13.1 billion comprising 183 properties and 840 tenants. It is backed by its sponsor, Mapletree Investments, has Temasek Holdings as a major shareholder.

It is probably one of the most acquisitive REIT in recent times, with the most recent ones being a $1.4 billion acquisition of 17 properties in China, Vietnam and Japan which we covered here. It also acquired properties in Malaysia and South Korea to the tune of $120 million in February 2022.

Looking at how its acquisitions span across various countries, one may have realised that MLT is likely to be highly geographically diversified. MLT is indeed one of the most geographically diversified REIT in Singapore with assets across 9 countries and regions, with each accounting for not more than 22% of the portfolio.

For investors who are concerned that this may just be a management that is scaling up to earn larger fees, concerns may be allayed as not only are the acquisitions all accretive but as a logistics REIT with major customers such as China’s e-commerce giants JD.com and Alibaba’s Cainiao and Australia’s Coles Group, the number 2 supermarket group in Australia, having assets across these few countries means that MLT is able to offer warehouse space to the same tenant across a few geographic regions, thus playing a key role in supporting its tenant’s supply chain capabilities.

During uncertain times such as the present, investors look towards companies with a long and proven track record and with the ability to continue to maintain relevance. MLT, being a logistics REIT has positioned itself to capture longer term structural tailwinds such as e-commerce growth and also immediate short term needs from increased inventory build up by many companies in an uncertain macro environment characterised by disruptions.

MLT is clearly one of the safest REIT with a proven track record of providing strong returns to investors as presented in the table below, clearly outperforming benchmark indices such as the FTSE REIT Index and Straits Times Index by multiple folds on a longer timeframe.

4. Ascendas REIT (SGX:A17U)

Ascendas REIT (“AREIT”) is the second largest REIT in Singapore after CICT. While not as diversified geographically as compared to MLT, its asset base is very well diversified, with 95 properties in assets such as business parks, logistics, industrial, data centres and even a life science and innovation campus.

With its diverse asset base, with asset types such as the life science campus, logistics and data centres clearly more resilient than others, this enables AREIT to remain stable amidst economic uncertainty.

Similar to the other REITs mentioned above, AREIT also does not rest on its laurels as it has acquired/redeveloped 10 properties so far in 2022 with a total purchase cost of $262 million in Singapore, Australia and the US.

It growth journey is impressive as it has grown its portfolio size by 27 times from $0.6 billion in 2002 to $16.4 billion now. It also diversified from a single country industrial asset portfolio to a multi asset portfolio with a focus on developed markets for stable returns.

On top of reasons that are applicable to the other REITs mentioned thus far, what makes AREIT one of the safest REIT in this high interest rate environment is that it is keenly aware of structural tailwinds in sectors such as technology and logistics and has focused its growth strategy on these sectors with a total of $2.1 billion in investments in 2021 in logistics properties, data centres and business parks for tech companies as presented in the chart below.

5. Parkway Life REIT (SGX:C2PU)

Parkway Life REIT (“PLife”), one of Asia’s largest healthcare REIT, with Parkway Holdings Limited as its sponsor is the best performer of this list, not just across 3 years, but also across the last decade. We recently covered PLife REIT here in detail.

It also has a track record of growth, starting from merely 3 properties in 2007 to 56 properties today, nearly tripling its portfolio value. It also currently has 40.9% of its assets in Japan as compared to a 100% Singapore centric portfolio when it first started.

Being a healthcare REIT with hospital and nursing home assets means that it is structurally defensive. Its nursing homes are mainly situated in Japan, one country with a long term aging trend. As Japan is a mature and developed country with a low interest rate environment, this provides for low cost of funding and stable returns.

One risk that’s at the top of many investors mind recently for PLife is its high exposure to the Japanese Yen(JPY) which has declined by nearly 20% against the Singapore Dollar in the last twelve months. To enhance the stability of distributions to unitholders, PLife has a policy to put in place to hedge at least 50% of all financial risk for income derived in JPY. It has currently put in hedges till 3Q 2026 which indicates that it is gradually building up its hedges to the required levels over time rather than only executing its hedges on a just in time basis.

The reason PLife is one of the safest REIT is because it operates in developed countries with demographic tailwinds. With a significant portion of its assets in Japan, it is well positioned to benefit from the demographic trend and the low interest rate environment. It is also well aware of the risk of operating in Japan, putting in place income hedges to secure stable distributions to its unitholders.

Conclusion

Interest rate hikes have dampened sentiments in REITs as rate hikes leads to higher interest costs and slower economic growth. With REITs being leveraged real estate vehicles, should the REIT be unable to meet its interest liabilities or refinance its borrowings when due, it is likely that the REIT will default and may end up selling its assets in a fire sale situation which would likely leave unitholders with little or nothing at all.

With this, we have identified 5 REITs which we think are the safest among the 43 Singapore listed REITs and have provided a variety of reasons why so. While each REIT has its own strength, there are commonalities such as a well known sponsor, track record of growth and having its assets situated in fundamentally secure locations. As the saying goes, offence is the best defence, the ability to make value adding moves to secure and even grow its income in such times also makes these REITs safe.