China is expected to overtake the US to become the biggest economy in the world but we don’t know when that would happen exactly.

Also, China was the first country to recover from Covid-19 and posted a positive GDP growth in 2020. This means that businesses in China should post better results than anywhere else.

Hence, investors can stand to benefit from China recovery stocks either for short term or long term horizons.

REITs with China exposure fit these themes – they can be used to ride the growth of China while enjoying high dividend payouts; and REITs have been heavily affected by Covid-19 and recovery is in progress.

China does not have REITs except private property funds at the time of writing. But they are in the midst of establishing the governance and ecosystem to enable listing of REITs in the Chinese stock markets in the near future.

But we don’t need to look far when it comes to REITs. SGX offers one of the best REIT markets in the world. We can get access to REITs with properties in various parts of the world, including China.

There are 5 REITs with significant China exposure and here’s the rundown.

#1 CapitaRChina (SGX:AU8U)

CapitaRChina Trust (CRCT) is one of Capitaland’s numerous REITs and it is often more assuring to see a Singapore blue chip’s brand when investing in a foreign country.

It prided itself as the first and largest China focused REIT listed in Singapore. It started off with retail malls but has recently expanded the mandate to include industrial, logistics, data centres and office properties. That’s almost every kind of properties (except residential) you can imagine. I see this as a positive development and provide more growth areas for the REIT.

Capitaland has the largest real estate assets under management in Asia Pacific and it will have a lot of China properties for CRCT to acquire. Usually the sponsor would offer its REIT the Right of First Refusal (ROFR) for its properties.

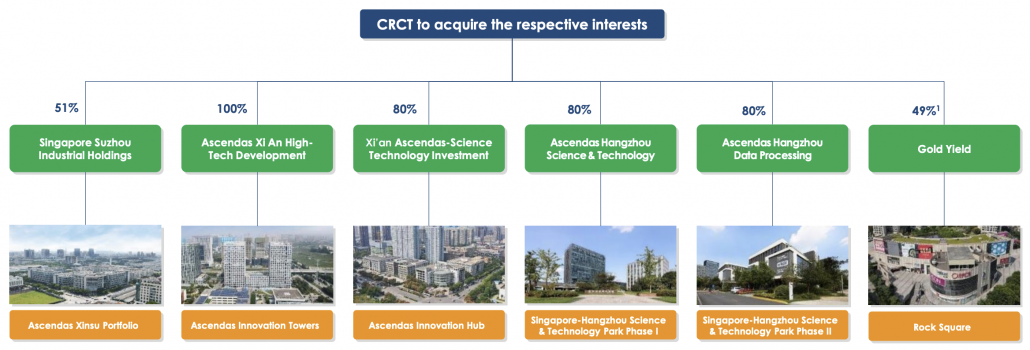

In fact, CRCT acquired 6 Chinese properties shortly after the expanded mandate was approved – most of which were industrial properties except for Rock Square which is a retail mall.

#2 Mapletree NAC (SGX:RW0U)

Mapletree NAC (MNACT) has about 23% of its asset value in China, the remaining properties are in Hong Kong and Japan. That said, the combined value of its Chinese properties is about S$1,800 million, which is larger than 3 other China-focused REITs mentioned below. Hence I have decided to include in this list given its size.

It has two Chinese office properties and Gateway Plaza is more valuable with a S$1,368 million valuation.

Its current mandate focuses on commercial properties in Greater China, Japan and South Korea. Of which, tier-1 cities, key tier-2 cities and Hong Kong SAR are the focused areas in Greater China. MNACT’s latest acquisition is an office property located in Seoul, South Korea.

Note that MNACT would not give you a pure China play.

#3 Sasseur REIT (SGX:CRPU)

Sassuer REIT (Sasseur) has a niche in outlet malls. The sponsor of the REIT, Sasseur Group, is one of the largest operators of outlet malls in China – it has 13 malls and over 12 years of experience.

Currently, Sasseur owns 4 outlet malls in China. Most are in tier 2 cities except the one in Chongqing which is a tier 1 city.

There are 9 potential outlet malls (in Nanjing, Hangzhou, Changchun, Changsha, Lanzhou, Yangzhou, Xiamen, Shanghai and Shenzhen) in the acquisition pipeline and 2 ROFR properties (in Xi’an and Guiyang) from the parent.

I think retail malls would coexist with e-commerce and not going anywhere soon. Everyone still needs a place to hangout. Moreover, outlet malls can often be a draw because consumers are able to buy branded goods at lower prices.

#4 EC World REIT (SGX:BWCU)

EC World is the only non-commercial REIT in this list. It owns logistic properties in China which includes a port.

Forchn is the sponsor of the REIT and is in the construction and logistics business. But it has kept up with times by expanding into the growing e-commerce market with the launch of Ruyicang, an integrated smart warehouse logistics services platform. It has also invested in Alibaba’s supply chain subsidiary, Cainiao. The boom in e-commerce should lead to greater utilisation of these warehouses.

So I suppose EC now stands for e-commerce and this is a REIT to invest in if you want a part of the supply chain network in China.

#5 BHG Retail REIT (BMGU)

BHG stands for Beijing Hualian Group and not some other Hokkien renditions you have heard from fellow Singaporeans.

The sponsor is Beijing Hualian Department Store (SZSE:000882) and it is listed in Shanghai Stock Exchange. The sponsor is in turn part of the larger BHG Group, which has supermarkets, luxury stores and franchises (e.g. Costa Coffee) operations.

BHG Mall REIT owns 6 malls currently. Beijing Wanliu is the only one in a tier 1 city while the rest are in tier 2 and 3.

Which is best?

Most of the China-focused REITs hold commercial properties. CRCT stood out to me as it has a sponsor with good track record and the expanded mandate means it would hold more diversified properties. It would be my first choice and I have actually invested in it.

MNACT has a good brand name too but has little exposure to China properties for my liking. Sasseur and BHG Retail have small portfolios. Between the two, Sassuer is at least differentiated with its focus on outlet malls.

Lastly, EC World REIT would be suitable if you want an exposure to the e-commerce supply chain network in China.

I have tabulated some financial data for the REITs mentioned in this article and have linked them to the respective stock pages should you need more information. In general, these REITs don’t look expensive and the yields remain attractive as they have not fully recovered to the share prices prior to Covid-19. (Please note that the P/B and Dividend Yield figures are derived from 8 Jan 2021 share prices and their respective annual reports.)

| Name | Ticker | Type | PRC exposure by asset value | Market Cap (S$ millions) | P/B | Dividend Yield |

| CapitaRChina | AU8U | Retail | 100% | 1,890 | 0.8 | 8.0% |

| Mapletree NAC | RW0U | Retail + Office | 23% | 3,350 | 0.6 | 7.8% |

| Sasseur | CRPU | Retail | 100% | 1,010 | 0.9 | 8.0% |

| EC World | BWCU | Logistics | 100% | 580 | 0.8 | 8.4% |

| BHG Retail | BMGU | Retail | 100% | 281 | 0.7 | 6.6% |

Thanks for sharing. Insightful article.