I bet you can find a lot of Japanese products in your house. Although we use many of these products every day, we may not have thought of investing in their stocks. You can blame it on home bias, whereby investors have the tendency to invest in stocks based on where we live.

Here, I picked 10 familiar Japanese brands that have been increasing their dividends in the past 5 years! You might even have these brands in your home or office!

Keep in mind that not all of them are doing well because familiar brands may be matured and lack growth areas that can increase their sales and earnings further.

Use this list as a starting point to generate your initial ideas but you need to analyse them on a case-by-case basis to evaluate their investment merits.

p.s. this list was first curated in 2020 and have been updated for 2023!

#1 – Nintendo (TSE:7974)

I have a Nintendo Switch and I love it. This product has singlehandedly driven the growth for Nintendo in the past few years. It is a testament of the company’s innovation and prior to Switch, the Nintendo Wii was also an avant-garde product in the gaming world.

Nintendo Switch contributed 94% of the total revenue in 2023. While the Nintendo Switch had been a growth drive in the past few years, Nintendo would need another blockbuster product to replace Switch eventually, as every console has a lifespan. Rumors of a new blockbuster product have been in the air, now Nintendo executes its next move could affect its stock price in the near future.

But I digress. Let’s take a look at Nintendo’s dividend growth!

The dividends per share has grown an annual growth rate of 66.4%!

We should note that Nintendo underwent a stock split (1:10) in Oct 2022, hence the dividends per share would be lower from 2023 onwards.

Nintendo’s share price has also done very well, gaining 140% over the past 5 years!

#2 – Meiji (TSE:2269)

Hello Panda and Yan Yan are popular childhood snacks. They are also comfort food for adults. Admit it. Besides food products, Meiji produces pharmaceutical products such as antibiotics and anti-depressants. The pharmaceutical segment contributed about 19% to the revenue.

Meiji has been rising dividend in the past 9 years consecutively. Currently, dividends per share has grown at a compounded annual growth rate of 16.2% per year, in the past 5 years.

However, the share price wasn’t that inspiring with a decline of 18% in the past 5 years. One of the possible reasons was that the earnings have been flat and that means that Meiji gave out a larger proportion of the earnings as dividends over the years with payout ratio rising from 13% in 2016 to 35% in 2023!

#3 – Kikkoman (TSE:2801)

Kikkoman is a soy sauce producer which uses a unique dispenser. In fact, the bottle design is a registered trademark. The bottle perhaps enjoys more fame that the soy sauce. I wouldn’t be able to identify the sauce in a blind test but I can associate the bottle shape to Kikkoman even without the label.

It was amazing to know that Kikkoman sells more soy sauce to the rest of the world than in Japan.

Kikkoman has grown the dividends at a 14.9% compounded annual growth rate in the past 5 years.

The share price has gained 69%, pretty in line with the growth in dividends per share.

#4 – Asahi (TSE:2502)

Touted as Japan’s number 1 beer. I admit I do like the ‘dryness’ aftertaste feel.

But Asahi doesn’t just sell beer. They have soft drinks, food products and some international brands such as Peroni and Pilsner Urquell (good stuff!) which they have acquired over the years.

Below is the breakdown of the Asahi’s revenue based on their 5 key global brands:

Asahi has raised dividends for 16 consecutive years, and in the past 5 years, dividends per share has grown at a 8.5% compounded annual growth rate.

The share price has grown 27.8% over the past 5 years.

#5 – Lion Corp (TSE:4912)

Lion Corp invaded our bathrooms and kitchens with its Shokubutsu and mama Lemon brands.

But you’d be surprise to find that beauty care and living care products only contributed 19% of the total revenue. Lion Corp made most of the money from fabric care (detergents – Softlan, TOP, etc) and oral care products (toothpaste – Systema, Dent, etc).

Lion Corp has increased dividends for the past 8 years and in the past 5 years it has grown dividend per share at a compounded annual growth rate of 8%.

However, Lion Corp’s earnings hasn’t been very consistent and its revenue growth is rather flat. Its share price has fallen -40% in the past 5 years.

#6 – Pilot (TSE:7846)

I believe every school goer would know the Pilot brand. From markers to pens to mechanical pencils, they have dominated the stationery market for decades.

Pilot Corp has sold stationery to the entire world, with more than half of the revenue comes from Europe and the Americas. A truly global company!

Pilot has raised dividends for 7 consecutive years. Dividends per share has grown at a 30.8% compounded annual growth rate.

But the share price didn’t do well with a 20% loss in a 5-year period. This is surprising since the dividends have grown. Despite the journaling trend during the pandemic period, Pilot seems to be struggling with poor sales. They had reported a decline of operating profits in the first 9 months of 2023 as well.

#7 – Yamaha Corp (TSE:7951)

What products comes to mind when someone mentions Yamaha? Depends on who you ask. You would either get music instruments or motorcycles. I am not sure where’s the synergy between the two and it is pretty unusual for a company to be doing both seemingly unrelated businesses. Maybe that’s the reason why Yamaha Motor was spun off from Yamaha Corp in 1955. Hence this Yamaha Corp’s main business is related to music and nothing about bikes.

Besides music instruments, audio equipment contributed about 23.7% of the revenue. The audio equipment segment includes products such as digital mixing systems and speakers.

Yamaha Corp increased the dividends at a compounded annual growth rate of 3.3%.

Yamaha’s sales have been hit during the pandemic and they are still struggling to recover since. They had reduced their profit forecast in the latest earnings as sales in China slumps. The share price is down 30% over the past 5 years. However, the company has been actively buying back shares.

#8 – Suntory Food and Beverages (TSE:2587)

Japanese whisky has made a mark in an otherwise Scot-dominated industry. Yamazaki and Hibiki are the top Japanese whisky brands and prices have shot through the roof due to a lack of supply. Both brands are under Suntory.

But Suntory made most of the money from non-alcoholic beverage and food, which constituted 56% of the total revenue. This is a diverse segment ranging from soft drinks to even tonics such as Brands’ essence of chicken.

As of 3Q23, Suntory managed to grow its revenue by 10% on a year on year basis.

Suntory grew its dividends per share at a compounded annual growth rate of 1.3%.

Suntory share price has declined 0.37% over the past five years, largely due to its rather flat earnings.

#9 – Tokio Marine (TSE:8766)

My family is holding some Tokio Marine policies for years and I believe some of you might have it as well. I just learned that they are part of the giant Mitsubishi Group.

Tokio Marine derives more revenue from non-life insurance and majority sales are done internationally.

The company didn’t manage to keep increasing its payouts during the pandemic, which was expected due to the possible increase in claims. However, Tokio Marine did increased its dividends at a compounded annual growth rate of 30.3%. Hence, it still deserves a mention on this list.

The share price was up 108.6% in the past 5 years!

#10 – Nissin Foods (TSE:2897)

I visited the CupNoodles Museum at Osaka, Japan and learned about the history of instant noodles. It was invented by Momofuku Ando post-World War II when Japan was suffering from food shortage. Ando wanted to invent noodles with long shelf life to help alleviate the situation. He succeeded and commercialised the first instant noodles in 1958.

Nissin Foods’ 2019 annual report looks like a manga, at least for the first few pages.

Reading their annual report continues to be a joy in 2023.

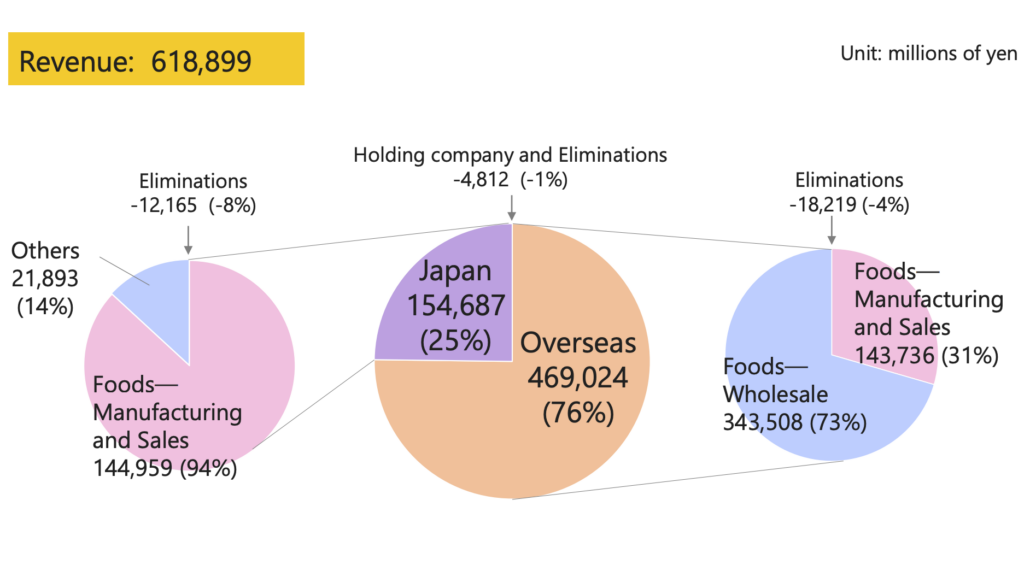

Nissin Foods have businesses all around the world with the Americas contributing the largest revenue outside Japan.

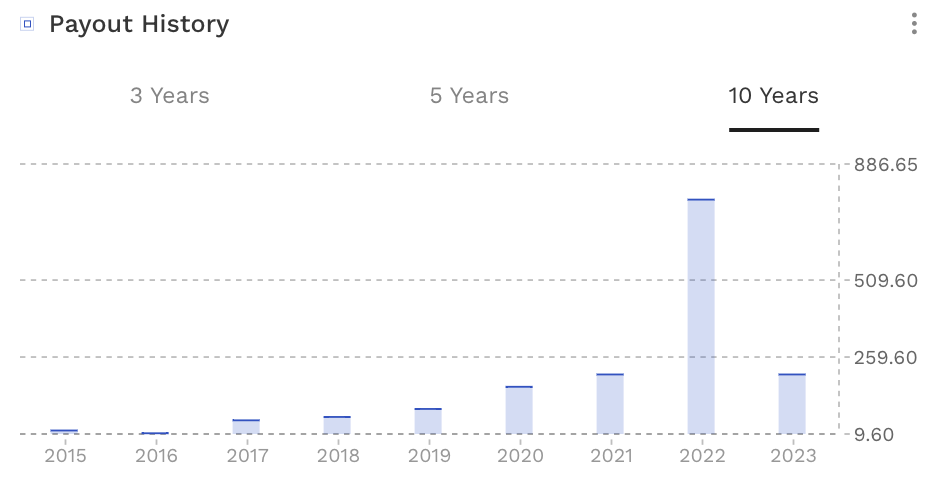

Nissin Foods have been paying dividends for 33 consecutive years, and its dividend had been growing at an average of ~9.2% per year in the past 5 years, despite a dip in the bear markets of 2022:

Despite the dip in dividend in 2022, I think Nissin Food still deserves a spot on this list due to its steady revenue growth post-pandemic. Its share price performance was a good 116% gain in the past 5 years.

Conclusion

You should find these brands familiar.

Despite growing their dividends, not all of these stocks have done well. Those that didn’t performed have seen a dip in their earnings. The companies had to distribute a bigger proportion of the earnings as dividends to keep increasing the payout.

As the Japan markets recover, you may be thinking of finding some potential investments there. I hope this list provides a good starting point for you to start exploring!