I first published this piece back in 2010, since then the markets have evolved tremendously. Although Gold’s position as an investment asset has constantly been challenged, we see that it remains the investor’s choice of investment when hedging against uncertainty and inflation.

This was particularly significant in the early Covid years of 2020 and 2021 as well as early 2022 when fear of inflation started to creep in. Today, as the world grapples with rising rates and the potential of bank failures, gold shines once again:

If you’re looking to gain exposure to gold as a hedge, I present the best ways to buy Gold in Singapore:

6 ways to Buy Gold in Singapore

1) Gold Exchange Traded Fund (ETF)

There is an ETF which tracks Gold prices – SPDR Gold Shares. It is available in the US (NYSE), Singapore (SGX), and several other exchanges.

When I first published this article, Singapore investors only had the option to invest in ETFs using USD (SGX:O87), however as of Jun 2021, you now have the option to invest in SGD under the secondary listing (SGX:GSD).

This is how it had performed in the past 5 years (in USD):

From the prospectus – “The investment objective of the Trust is for the Shares to reflect the performance of gold bullion, less the Trust’s expenses.”

The Trust will buy real gold bullion bars collectively and issue gold ETF shares to investors who want to own a portion of it. The gold purchased are kept “in the form of allocated 400 oz. London Good Delivery Bars in the London vaults of HSBC Bank USA.” You can view the list of Gold Bars in the vault here.

You can purchase these gold ETF shares throughout a trading day, via your usual broker.

They claimed that the expenses of carrying, storing, insuring the gold is lowered and the savings can be passed on to the investors.

Although inspections of the gold bullion stock are conducted twice a year, there were claims that Gold ETFs may not possess the actual amount of gold to back the funds it holds.

If it is true, in times of crisis, a shortage of gold may cause the fund to collapse and you not getting your money back.

- Listed on SGX

- Expense ratio – 0.40%

- Minimum Order Size – 5 shares

- Available under CPF Investment Scheme (CPFIS)

| Advantages of Gold ETFs | Disadvantages of Gold ETFs |

|---|---|

| Highly liquid: buying and selling is easy and convenient from the stock market. | May not be backed by the actual amount of gold. |

| No need to own and store physical gold. | Remember to account for expense ratio and commission fees when you buy Gold ETFs. |

| Low cost with board size of 5 shares. |

The Gold ETF is a simple way to buy gold, but at the point of writing, the minimum trading size costs about SGD$1,200 before commission fees. If you wish to invest in smaller quantities, then consider:

2 – Gold Savings Accounts

The two common ones are UOB’s Gold savings account and OCBC’s precious metals account.

These work like the Gold ETFs, except that they are usually offered by banks and you ‘own’ your vault – you pay to buy a certain amount of gold and are issued with paper bullion that holds the same value as the physical gold, so you don’t need to hold or store the actual gold.

The bank doesn’t charge custody or storage fees, however nothing is free, there’ll be a monthly service charge. For UOB, its 0.25%pa, or a minimum that equates to 0.12g of gold. OCBC doesn’t state their fees but their T&Cs mentions ” Bank’s fees, commissions and other charges for the Services”.

For UOB, you can start buying gold with ~$422 while with OCBC, you can buy gold with just S$25. Prices were accurate at point of writing, do check with the banks for their latest pricing.

| Advantages of Gold Saving Accounts | Disadvantages of Gold Saving Accounts |

|---|---|

| Low cost of entry | Fees may be higher than ETF for smaller investments. |

| Ease of purchase: you can buy gold from your banking app |

3 – Gold Bullions: Coins or Bars

In case you’re wondering, bullion refers to high purity physical gold (or silver) kept in the form of coins, ingots or bars. Their weight is usually denoted in troy ounce where 1 troy oz is about 31.1g.

Depending on your investment objectives, you may prefer to own physical gold – some believe that these are easy to carry around and will be a good asset in times of unrest or conflict, others think its the most cost efficient way to own gold, without all the middlemen.

If you’re in this camp, gold bars or gold coins are right up your alley.

Gold coins

In Singapore, you can purchase gold coins or gold bullions from gold dealers like BullionStar, GoldSilver Central and Silver Bullion.

Gold coins are usually sold in 0.5 troy oz (15.6g) or 1 troy oz (31.1g) denomination and their retail price would usually include a premium on top of the international gold price.

If you walk into any of the dealers, you’ll find a range of gold coins from different makers, with varying prices. They are priced differently mainly due to their purity and fineness – the purer and finer a gold coin is, the more expensive it is.

The Canada Maple Leaf Gold coins are known for their high purity and fineness. As they are generally preferred by investors, you’ll also find that they are the most liquid coins in the market – almost any dealer would accept them if you can produce a certification of authenticity.

Gold coins sold by Singapore Mint tend to be decorative coins featuring various themes.

The advantage of gold coins is their portability – you can carry them anywhere you go.

Gold Bars

You can also buy gold bars from the gold dealers, however these are more expensive and difficult to store.

How heavy are gold bars?

The standard gold bars you see in movies weigh 12.4kg or 400 troy ounces or 27.4 pounds.

For comparison, the SAR 21 rifle is about 4kg. If you plan to own portable gold, these gold bars are not for you. Also, the gold bar costs about S$1.05m at the point of writing.

However, gold bars are also commonly sold in 1 troy oz, 50g, 100g and 1kg variance, and their prices vary according to the international gold price as well as their purity and fineness.

Most people would not be comfortable storing their gold bullions at home, especially once you’ve built up a sizeable holding. Hence, many would choose to keep their gold bullions in safety deposit boxes and these come with a storage cost.

| Advantages of Gold Bullions | Disadvantages of Gold Bullions |

|---|---|

| Portability: You own the actual gold in your hands, you can take it wherever you want. | Additional cost of storage for peace of mind. |

| Bullion coins may include a premium on top of international gold price. |

4 – Gold Futures

Another method to buy gold that requires more sophisticated investment knowledge is futures.

Futures is a form of derivatives and as all derivatives, they are complicated and if you do not understand or have not traded futures before, it is advisable to stay away.

Those who engaged in gold futures are more speculative in nature as all futures have expiry dates, and usually traders have no intention to exercise the contracts and receive the delivery of the physical gold. They just want to profit from the change in price over the period of the contract.

To buy gold futures, you would need to open a futures account with the local brokers. Futures accounts would require a higher capital outlay than a stock account as each contract size is as big as tens to hundreds of thousand dollars. They are highly leveraged which means your losses and profits are amplified.

| Advantages of Gold Bullions | Disadvantages of Gold Bullions |

|---|---|

| Big transaction window (stays open longer than stock exchange) | Requires more product knowledge |

| Leverage | Leverage |

5 – Gold Mining Companies

Besides owning gold directly, you can consider buying shares of gold mining companies. Companies like Barrick Gold (NYSE:GOLD), Newmont (NYSE:NEM) and Franco-Nevada (NYSE:FNV) are some examples.

However, the risk is that the stock price may not move in tandem with the international gold price.

If you don’t know which to pick, fret not because there’s a Gold Mining ETF too. The VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) invests in a basket of large gold mining stocks

| Advantages of Gold Bullions | Disadvantages of Gold Bullions |

|---|---|

| Easy to buy and sell in the stock market | May not have a direct correlation with the rise in gold price |

6 – Gold Jewelleries

I guess most of us own a piece or two of gold jewelleries. Although you (or your grandparents) might think that they are a good way to own gold, the truth is jewelleries are not considered good investment.

This is because the price that you paid includes design and fabrication cost, which are in addition to the gold material itself. These additional costs do not retain their value over time.

| Advantages of Gold Bullions | Disadvantages of Gold Bullions |

|---|---|

| You have it already! | Design and fabrication costs included |

| Relatively easy to purchase. |

If you’re a millennial or a gen z, you might be wondering why anyone would still invest in gold today when there’re more exciting options like Bitcoin. Here’re three reasons why it remains a desirable asset class for most investors:

3 Reasons to Buy Gold

1. Negative correlation with USD

Gold is known for its inverse correlation to major currencies, such as the US Dollar. Here’s its performance against the US dollar over the past 10 years:

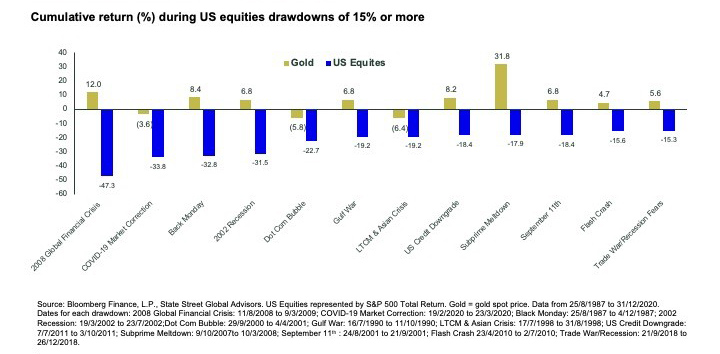

2. Low correlation with the stock market

Gold also has a low correlation to the stock market and it could protect your portfolio from significant drops during a market crash.

3. Hedge your portfolio against inflation

If you have been reading the news, you might know that the gold market can be perceived as “volatile”, with hard-to-predict price movements.

However, gold is also often considered as a good hedge against inflation. Over the long term, gold has been able to deliver higher-than-inflation returns. In fact, gold has delivered a 7.7% compound annual growth rate in USD terms since gold was unpegged to the U.S. dollar in 1971.

As a smart investor, rather than finding the “best” time to buy gold, you may find it easy to dollar cost average your gold purchases over time.

Would you buy gold?

I’ve shared 6 ways you can buy gold in Singapore and 3 reasons why it is remains viable as an asset class today.

That said, you should only invest in gold or any other precious metals if it is in line with your investment objectives. Would you be adding gold to your portfolio soon?

Hi Alvin,

I’m interested in investing in Gold due to the currrent fluctuating USD. I’m looking into the savings account for Gold. Now, i.e. if I’m putting 1k per month for 24 months, how much can I earn?

As you can see, I’m quite clueless on how it works actually and I hope you can give me some insights on it.

Thx in advance. =)

Hi Jun, maybe you can try asking yourself some questions first:

– what is your purpose of investing in gold?

– what is your expectation?

– why gold and not other asset classes?

– what if you the gold investment does not turn out well or to your expectation, will you be financially ok?

– when will you exit? either for loss or profit.

Sometimes by asking yourself questions, you would be able to understand better and make a wiser decision.

Hi Alvin

What do you think of using CPF-IS to buy gold under the UOB Gold savings a/c?

Hi Ruttger, it is possible if you are looking for a hedge against inflation. There should be more upside for silver than gold though. You must look at your overall portfolio, if you have no precious metal at the current moment, you may consider getting some gold.

I am not offering you advice. I am just giving my opinion. If you are still unsure, pls consult a qualified financial planner to assist you.

I was browsing for some gold information when I chance upon your site. Good information.

On a personal note, how do you know it’s the right time to sell gold? Would love to hear your views on it. 🙂

I would when US stop printing money and flooding the market with liquidity. Which would also mean the risk of high inflation is reduced. Then I would sell my silver.

If you are a Singaporean, the best way to invest in gold is to invest in gold certificates. When you invest in gold certificates, you can lock in the price for XAU/SGD. That means the price of gold against SGD.

Many times gold price rises but it benefits little to Singaporeans. Because our SGD is so strong. So when you see gold price rising in CNBC or Channel News Asia, that is gold price against USD. That does not necessary means that gold against SGD is rising.

So if you want to invest in gold, look at XAU/SGD chart instead of the traditional gold chart.

Alvin, I attended your session last night at the 11th investment mentoring session. It was a very good session and I particularly like the pp. Just wish to share my approach about US$ denominated investments. I normally keep US$ if I sell the asset. I would sell my gold ETF after US$ depreciates and buy back when it moves up. This is on condition that it has reach my target price and I am taking profit. Any comment?

It is fine and good if u understand what u are doing. I won’t take the risk to hold USD and trade gold in and out though.

Hi can we trade in physical gold in singapore ?

Do we need special license or permission or conduct gold trading ?

If you are talking about opening up a shop in Singapore to trade physical gold, then yes.

Hi Alvin, thank you for your article. I was planning to buy the GSD gold ETF to diversify my risk from my stocks, but my order was rejected. The reason was because my order volume was above 60% of the average daily volume, which makes me concerned – why is the volume so low? I would have imagined gold to be a relatively actively traded commodity, but my total order was not even $20k. Am I missing something here?

The SGX-listed one is a feeder to the bigger GLD ETF traded in the US. There are usually market makers who will buy and sell with customers so the liquidity isn’t the concern, as long as the price is right. To confirm, you can contact their IR and ask if this is the case. If you want to buy big amounts, I think they can even create the units for you.