Intelligent Investors Immersive (i3)

For those who are laser focused on massive capital appreciation. We use a combination of Deep Value & Growth Strategies employed by Benjamin Graham, updated with modern research and backed by data. All taught by our CEO who got to his first million using what he’s teaching.

Turbo Stocks Trading

Long term investing exposes our portfolio to market volatility which could prove devastating, and put a hard pause on your financial plans.

Turbo Stocks Trading is a faster, market-tested strategy for the highly motivated DIY investor to reach their goals faster.

Early Retirement Masterclass (ERM)

Do you believe that it’s possible to retire early in Singapore? Chris Ng, who retired at 39 did it. He reveals how you can hack the system to an early retirement, even if you have a small capital.

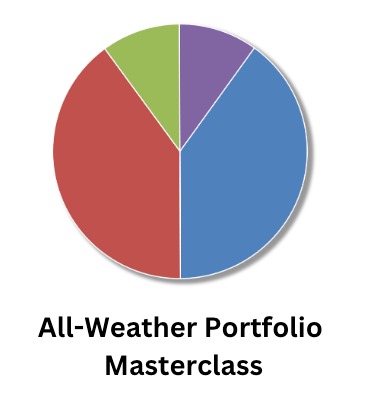

All-Weather Portfolio Masterclass

What if you could invest and grow your money, without having the deal with the stress and volatility of bear markets? Wouldn’t investing be way easier?

This is how you can build an all-weather portfolio (+how you can immediately determine what you should buy to maintain it, in a couple of mouse-clicks)

Cryptocurrency Investing Masterclass

AK bought his first crypto in 2017, and never looked back. Together with his mentor, Chris Long, they now help hundreds of aspiring Cryptocurrency Millionaires to get into crypto safely and profitably: