After the abandoned plans to take Budweiser Brewing Corporation APAC (“Budweiser” in short) to the public market just 2 months ago, Budweiser is once again making an attempt at listing it’s shares on the Hong Kong stock exchange.

According to Reuters, the listing comes at an important time for the Hong Kong Stock Exchange when China’s flagship e-commerce giant Alibaba Group Holding Ltd (BABA.N) intends to shelve aside a Hong Kong listing worth up to US$15 billion amid ongoing protests there.

As such, Budweiser’s IPO listing is being watched with a keen eye in the investment community around the world.

For your convenience, we have distilled the prospectus into 6 top things you need to know:

#1 – IPO Details

Based on the listing price of HKD 27 per share (or around US$3.45 per share), Budweiser’s IPO is expected to raise up to HKD 39.2 Billion (~US$5 Billion) for the Asia-Pacific arm of the AB Inbev brewing empire.

Below is a quick comparison of the 5 largest IPOs worldwide and Budweiser comes in at the top 2nd spot. In addition, its IPO also includes an over-allotment option and if this option is exercised, Budweiser could be looking at gross proceeds of up to US$5.75 billion.

The IPO proceeds is set to help the parent company – Anheuser-Busch, reduce the US$100 billion debt load it accumulated after it acquired SABMiller in 2016.

Budweiser APAC will begin trading on the Hong Kong Stock Exchange on 30 September 2019. Investors keen to read up on the IPO prospectus can also take a look at it here.

#2 – Company Background & Business Model

According to its IPO prospectus, Budweiser is the largest and a fast-growing beer company based in Asia Pacific.

According to data analytics and consulting company GlobalData, Asia Pacific is the largest beer consumption region by volume and value and one of the fastest-growing beer consumption regions globally as of 2018, which is poised for further growth (4.9% CAGR by beer value over the next five years).

In addition, Budweiser has gained a strong foothold in this region and holds:

- the number 1 position by beer value in China, and the number one position in the fast-growing premium and super-premium categories collectively by beer value and beer volume in 2018;

- the number 1 position by beer value and by beer volume in South Korea in 2018;

- a top 3 position by beer value and by beer volume in India, and the number one position in the fast growing premium and super premium categories collectively by beer value and beer volume in 2018;

- and a top 3 position in the fast-growing premium and super-premium categories collectively by beer value and by beer volume in Vietnam in 2018.

The chart above illustrates Budweiser’s market maturity model and the positioning of their markets in Asia Pacific.

Budweiser owns a broad diversified portfolio of more than 50 brands (owned or licensed) to cater to evolving consumer preferences.

Examples of different beer categories include classic, easy-drinking, flavoured beer, wheat and ales. Their products are spread out in the price spectrum, ranging from premium (i.e. Budweiser, Corona) to value (i.e. Double Beer, FilGood).

In short, leveraging on their extensive range of brands, Budweiser can then cater to countries with different maturity levels and their corresponding levels of income (i.e. India and Vietnam versus South Korea).

Furthermore, it can be observed in Asia Pacific’s beer markets that consumer preferences are shifting towards premium brands (known as “premiumization”) and consumers are making higher price point choices within the same brand family and/or same price segment (known as “trading-up”).

Hence, Budweiser is well-positioned to benefit from the increased affluence in their markets and looks to continue doing so by product innovation as shown from the picture below:

Last but not least, apart from organic growth in their current markets, Budweiser is also looking to expand its market share through the form of attractive M&A deals that will give them access to new and rapidly growing markets.

#3 – Financials

Budweiser’s revenue growth from FY2017 to FY2018 was promising, up 10.5% on a year-to-year basis. Net profits surged even higher, up 67.6% during the same period.

However, when we look at its revenue growth between 1QFY2018 and 1QFY2019, we saw that it trickled down to only 1.4%. Net profits still managed to grow at a decent 12.7% from US$213 mil to US$240 mil.

One notable point was how Budweiser is able to secure 50% gross margins across the various financial periods, indicating a strong competitive advantage there.

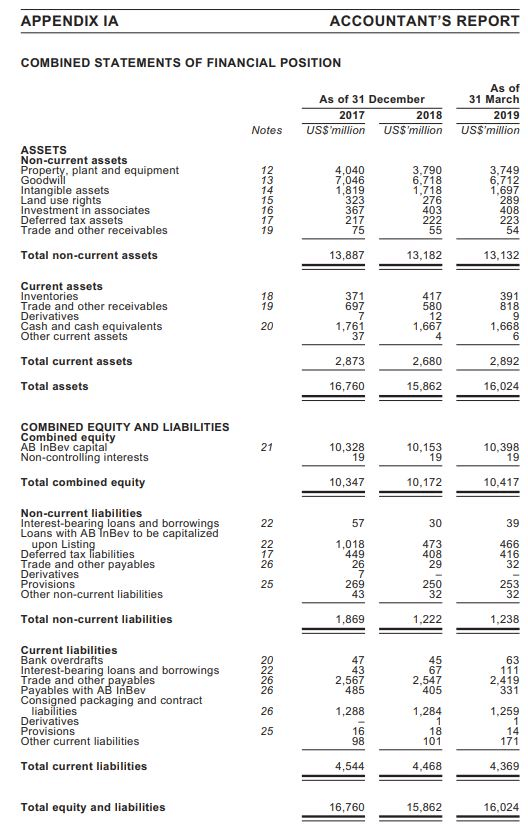

Moving on, we delved into its financial position as of 31 March 2019. One particular line stood out in the statement – Goodwill which stands at a good 42% of the group’s total assets.

When we dig in deeper to the IPO prospectus for the goodwill portion, we are unable to find out more information other than that South Korea and China constitutes to a huge bulk of the Goodwill.

No further information was given except that the group has completed its annual impairment test for goodwill in FY2018 and no impairment charge was warranted. Given that these 2 countries are part of their growth plans, we reckoned that it is for past acquisitions that warranted the Goodwill involved.

In addition, we also see that Budweiser carries a significantly high level of Trade Payables at US$2.4 bil as of 31 Mar 2019.

The management is aware of it and explained that this is a common working capital management strategy in the FMCG sector. It works in a way where they fund their working capital through their trade payables, with whom they have exceptionally favourable terms of 120 days and is not a cause for concern.

In addition, we observed that Budweiser’s debt profile is also manageable with a cash and cash equivalents of US$1.67 billion as of 31 March 2019 with only US$679 million in the same period.

With massive cash outflows limited to only dividend pay-outs or acquisitions, we opined that Budweiser has a solid financial position given its highly cash generative business model.

Last but not least, Budweiser also faces significant fluctuations in FX rates in the various territories where their operations are based.

We can see from above that the group ‘earns’ a currency profit of US$43 mil from FY2017 to FY2018 and subsequently made a translation loss of $22 million on their normalized EBIT for the three months ended 31 March 2019.

#4 – Management Team

Having joined the group in 2002, CEO Jan Craps has a long history of experience within the brewing industry and within AB Inbev itself.

Prior to this, he reached was a fellow at McKinsey & Company in Belgium, providing him with a range of strategic international experiences in a number of senior marketing, sales and logistics executive positions in France and Belgium.

With his extensive experience in the brewing industry, Jan Craps looks like a good candidate to lead Budweiser APAC forward in its post-IPO future. A quick glance at the rest of the management team shows that all of them have strong track records within their respective areas of speciality and can bring across a diverse set of skills and qualifications to the table.

To sum up, CEO Jan Craps is backed up by a team of people that have the necessary attributes to deliver value to Budweiser’s shareholders.

#5 – Growth Outlook and Use of IPO Proceeds

The IPO proceeds will be primarily used by the parent company AB Inbev to reduce its debt burden after their 2016 acquisition of SABMiller, which has been a cause for concern of both ratings agencies and investors alike.

Although the IPO funds are earmarked for paring down of debt, Budweiser’s post-IPO growth outlook still looks positive as it capitalizes on the strong organic growth in the developing and high-growth markets of the Asia-Pacific region.

As previously mentioned, Budweiser is also gunning for more product innovation to tap on the growth in this region.

#6 – Peer Comparison

When we take into account the FY2018 net profits of US$959 mil and total issued shares of 13.054 billion, we derive an Earnings per share of US$0.073.

Taking its HKD27 listing price (~US$3.45), Budweiser’s P/E ratio comes up to around 47.26x. Taking into account its 25% dividend pay-out ratio policy, Budweiser would also dish out dividends per share of US$0.018, which translates to a dividend yield of merely 0.5%.

We have compiled some of the world’s largest brewers and did a simple peer comparison in the table above.

From what we can see, Budweiser isn’t particularly debuting at a cheap valuation (Heineken and Carlsberg Malaysia trades at lower P/E ratios) even though it has priced its IPO at the bottom of the expected IPO price range.

Conclusion

With Chinese e-commerce behemoth Alibaba shelving its IPO, all the limelight is now on Budweiser to deliver a successful listing. Furthermore, it will serve as a good gauge of the investors’ appetite amid the political unrest in Hong Kong.

All in all, Budweiser APAC looks set to grow from strength to strength in the long run due to several positive traits including an easy-to-scale business model, solid financial position and extensive variety of portfolio brands. On the flip side, investors would have to determine if they are willing to stomach a relatively high valuation right now to partake in Budweiser’s growth story.

Editor’s Note: This article was delivered pre-IPO. Due to scheduling and some conflict of content timelines, I couldn’t get it out pre-IPO. Future measures have been taken to prevent this.

Budweiser has since climbed 4.4% on their first day of trading.

I would like at this point in time to advise readers that missing out on minor gains should not encourage you to jump in headfirst.

We have noted in the article that valuations of the company is just not that cheap. And it pays to be cheap when it comes to shopping for stocks.

You could buy google at $1 million per share and stand to lose a lot of money, and you could OKP Holdings at $0.20 and stand to make a lot of money.

Price is what you Pay. Price is also what you Risk.

Overpay for anything, anything (even the best companies in the world) and you’ll end up losing money. Always pay attention to the price you pay.