(this guide was first published in 2018. latest update was done on 2 Apr 2024)

We hope this would become the most comprehensive guide to Singapore Savings Bonds (SSB) you can ever find on the web.

You'll find reviews, latest SSB interest rate, investment strategies and step-by-step walkthrough on how to buy SSBs. We hope that you will find it useful.

The Singapore Savings Bonds were launched in 2015. Back then, interest rates were around 3-4%, but dropped to below 1.5% in 2020. Last year, the interest rate environment is back up, and SSBs started to gain the recognition they deserve.

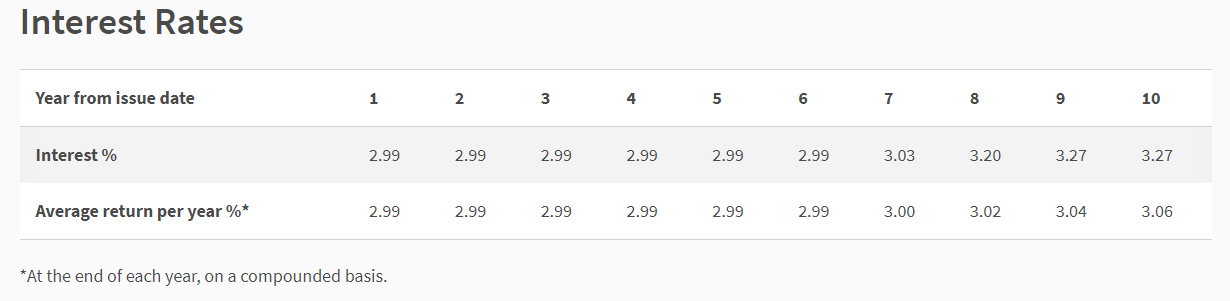

Interest rates for the upcoming May 2024 tranche are as follows:

Interest rates offered by SSBs is up slightly this month! The upcoming tranche offers an average return of 3.06% per year.

The application for May 2024 tranche closes on 25 Apr 2024.

What Are Singapore Savings Bonds?

Specially structured government securities that were designed to be accessible and suitable for the individual investors.

That sounds complicated.

What are they exactly?

Every time the government issues a bond - and when you buy one - it means you're lending the government money. In return, they give you a small interest rate (more on this later) on the money you've lent to them.

Think of it being like a one man bank to the Singapore Government. Except in this case, you're not the only 'bank'. Everyone with money can chip in.

Launched by the Monetary Authority of Singapore (MAS) in October 2015, a new Singapore Savings Bond will be issued every month for at least the 5 years after its launch. You can refer to MAS' issuance calendar for upcoming tranches.

The aim of the Government is to give investors access to long-term interest rate returns with maximum flexibility at zero risk.

The good thing about SSB is that it always trade at par value and that means your capital is protected regardless of how the interest rate moves. You put in $1000 and you will get back $1000 anytime plus interest due to you. There's no interest rate risk.

Here are three quick-facts to learn about SSB:

#1 A government bond designed to help Singaporean investors to save and invest for the long term | #2 They are safe, principal-guaranteed investments backed by the triple A credit rating of the Singapore Government. That means zero risk. Unless the government goes bankrupt overnight. | #3 The SSB have two unique features:

|

|---|

Here's a quick video summary of the key features of Singapore Savings Bonds:

Should You Invest in Singapore Savings Bonds?

SSBs are a great tool for you to lock in long term, guaranteed returns when interest rates are high. When interest rates are low as they were from 2020 to early 2022, investors might not have found them enticing.

However, as rates increased in recent months, you may be wondering if SSBs deserve a place in your portfolio. Read ValueChampion's analysis of whether SSB is a worthwhile investment currently.

The unique selling point about the SSB is its flexibility. Unlike conventional bonds where investors receive the short end of the stick if they redeem the bonds early, the SSB has no lock-in restrictions.

Although each SSB has a maturity term of 10 years, you can redeem your bonds at any time before maturity.

And even if you redeem the bond early, you still get to keep the interest paid out at six-monthly intervals.

Another advantage of investing in SSB is that the returns are tax-exempted.

How Long Should You Invest?

That’s really up to you.

The bond tenor is 10 years, but because you can get your money back at any time with no penalty, you do not have to decide about the duration of your investment upfront.

Obviously, the longer you invest, the better the yield. The question is, do you have the patience to sit on your SSB for the full 10 years?

SSB Interest Rate: How Much Can You Earn?

[Illustration Credit: MAS]

Interest rates on the SSB will be linked to long-term SGS rates.

This means that the average interest you receive over the period you hold the SSB will match what you would have received had you bought an SGS bond of equivalent tenor.

The key difference is, while SGS bonds pay the same interest every year, the SSB offer “step-up” rates, meaning that interest payment will increase the longer you hold your bonds.

Just to give you an idea of how much to expect: the 10-year SGS has mostly yielded between to 2 to 3% over the past 10 years (before 2022), with the current yield being 3%.

Assuming a S$10,000 investment, this gives an average interest of $300 a year or $30 a month, over 10 years.

Illustration Credit:: MAS

Financial adviser Wilfred Ling has done an interesting analysis on the projected yield percentages, arguing that the realised return for the SSB is actually slightly lower than that for the SGS.

If we go according to his figures, here’s how much your investments would work out to over the long run.

If you think about it, the SSB’s interest rates aren’t bad for conservative investors.

Sure, they were lower than that of long-term CPF funds, but at least they’re higher than that of short-term fixed deposits and savings accounts.

If you’re looking for somewhere to park your savings (under $100,000), forget about the banks and go for the SSB instead.

How to find the latest SSB rates?

You can refer to this guide (we aim to keep it updated).

Or, go to MAS's website for the latest information.

How To Buy & Invest In SSB?

Before you apply

You will need the following to start applying for the Singapore Savings Bonds:

- A bank account and ATM card (or online banking) with one of the participating banks – currently DBS/POSB, OCBC or UOB. (More banks may be included in future)

- An individual (not joint) CDP Securities account with Direct Crediting Service activated. Note that you must be at least 18 years old to open an individual CDP Securities account.

A new SSB will be issued every month for at least the next five years. The application window for each SSB issue will open on the first business day of each months and close four business days before the end of the months.

You can apply through any participating bank’s ATMs, or via internet banking platforms. Application requests must be made in multiples of $500. A $2 transaction fee (non-refundable) is applicable for each application.

Note that you can purchase SSB using cash or your Supplementary Retirement Scheme (SRS) funds, for the time being. In future, the Government may consider allowing people to use their CPF savings to buy SSB.

How Will I Know If My Application Is Successful?

The success of your application depends on the demand for the SSB in that particular tranche.

The issuance size for each SSB tranche will be announced before application opens. If the demand exceeds the amount on offer in a particular month, MAS will allocate the bonds to maximise the number of successful applicants.

If you read between the lines, you’ll realise this means smaller applications stand a higher chance of being fully allotted.

But fret not – if you did not receive your full allotment, you can always apply again for the next issue. (Although there is little reason to worry about not getting your full allocation…)

If your application is successful, you will be notified by CDP via mail of the amount of SSB credited to your account. Application results will also be announced three business days before the end of the month.

How To Redeem?

The redemption process is similar to the application process – submit your request through any participating bank’s ATMs, or via DBS/POSB’s internet banking channels. You will get your cash (along with any accrued interest) back in the bank account linked to your CDP Securities account.

Do note, however, that redemption proceeds will only be processed by the second business day of the next month.

So don’t invest your entire nest egg in the SSB; you should still keep a portion of emergency funds separately in case you need them urgently.

How Much Can I Invest In The Singapore Savings Bonds?

The minimum sum is $500 and the maximum sum is $200,000.

In other words, you can only hold up to $200,000 worth of SSB at any one time. You can top-up in multiples of $500 and apply for up to $50,000 on any single bond issue.

(Note: These figures may be revised in future, pending MAS’s review after the programme has been in place for some time.)

Yes, there is a quota imposed, but it’s a far more generous cap than what many of us were expecting.

This cap should be sufficient to meet the needs of most Singaporeans, as more than 90% of individual bank deposit accounts have balances of $100,000 or lower.

Should you go all into SSB?

We wouldn’t know about your financial situations or goals, so here’re 3 questions to ask yourself instead:

1) What’s your time horizon?

The SSB’s return increases the longer you hold it. To unlock the full 3.26% for the Jan 2023 issuance, you’ll need to hold it for 10 years till Jan 2033.

That said, the advantage of investing in Singapore Savings Bonds is that you can choose to withdraw your capital plus earned interest at no penalty, whenever you decide to. i.e. if you were to decide to withdraw your funds at year 3, you would have earned 2.95% interest on average.

Here are the historical average returns on SSB if you were to withdraw your capital within 1 year, 5 year and 10 year:

Historical average returns on SSB (Yearly). Data Source: MAS

It's interesting to observe that the gap between the average returns across 1-, 5-, and 10- year have narrowed in 2022.

Now, the question to answer is; are you willing to save your money in the SSB for 10 years? Or, would you be okay with a lower average return if you were to withdraw earlier?

2) Can you get better yields elsewhere?

Let’s face it, 3.21% is enticing no, especially since everything else is falling and the risk of investing anywhere else feels high risk.

What other options should you consider then?

Here’s a comparison of the SSB rates against other yield generation options:

Potential returns (Dec 2022) | Duration | Minimum Amount Required | Risk | Liquidity | |

| Singapore Savings Bonds | 3.07% | 10 years | S$500 | Low | Can sell at par value when you need to. |

| Fixed Deposits | 3-4% | 1 year | S$5,000 | Low | May have charges for early termination |

| Bank Savings Accounts | ~3-4% | flexi | S$1,000 | Low | Can withdraw whenever, but may need to keep a minimum amount. |

Across the yield generation vehicles listed in the table above, SSBs do provide higher returns as compared to fixed deposits and savings accounts.

3) Can you invest and grow your money faster?

You do not even have to pick individual stocks to do this. As of Dec 2023, the 5-year returns of the S&P 500 is at 73.24%, even as the markets are down.

And the good news is that you can invest in it easily through ETFs. There are even regular saving plans that allow you to put in a fixed amount on a monthly basis.

If you’re new, here’re some guides that could help:

- Beginner’s Guide to ETF investing in Singapore

- How to invest in S&P 500 ETFs in Singapore

- Everything you need to know about the STI ETF

Or if you’re like us, you may want to pick your own stocks to beat the market indices. You may want to pick stocks that could deliver greater returns in the next 10 years. This is especially true if you do not believe that interest rates will keep rising for the next decade.

4) Will the rates continue going up in the next tranche?

This is anyone’s guess.

However, if we were to look at the historical returns as shown in the "Historical average returns" chart above, the SSB rates are already at an all time high.

Will it go even higher? Nobody knows.

But you should stay tuned to the Fed’s movement as that would give us a better inclination.

Conclusion

In our opinion, the Singapore Government has created the most perfect financial product ever (for the lazy investor and the non-investor who wants to build their investment portfolio). Such an instrument will never exist in the free market.

Unless you consider the need to activate the Direct Crediting Service in your CDP account as 'work', its like having the option to unlock free returns.

Unfortunately, bonds tend to be highly misunderstood and hence shunned by many investors. Because of that, the take up rate for the Singapore Savings Bond will likely remain low among retail investors in Singapore.

We hope that by changing your perspective, you are able to see that despite the name, the Singapore Savings Bond has more features of a Fixed Deposit rather than a Bond.

And that it isn't as intimidating as it's name.

With that in mind, we hope more will explore and subscribe to the offering.

Which other countries offer a product similar to SSB? Comparatively, what’s their interest rates & exit t&c ?

SSB is quite unique to Singapore. I am not aware any countries offer that. It is a hybrid between a bond and fixed deposit.

When is a good time to buy the bonds? is it when it is first offered at the start of the month? will the price of bonds increase thereafter for the remainder of the month?

The price of the Singapore Savings Bonds will not change.

Can Malaysian buy Singapore Savings Bonds? Thank you

Hi,

I may be asking a silly question, but when redemptions are made, is it only allowed in full? Or partial redemptions are also allowed?

Thanks in advance!

You can. In multiples of S$500.

Hi, may I know what’s the difference btw interest n average returns?

Thks

For e.g., the interest rate you see, say 2% for a Singapore Savings Bonds, it is an average number if you hold it for 10 years.

But year 1 you don’t get 2%. Maybe 0.1%. Then year 2 is 0.5%. for e.g. The Singapore Savings Bonds stop up its interest each year. So your average returns over 10 years is 2%.

But if you sell it earlier, your average returns would be lower, not 2%.

The article mentions that the higher amount I apply, the lower the chance of my SSB application being accepted?

So if I were to apply $50,000 for the SSB application, what are the odds of my application being accepted? And if my application got accepted but with the “cut-off” amount of eg. $2500, what happens to the remaining amount?

Thank you!

The supply is currently more than demand. Hence you should not have a problem not filling. If indeed you can’t be filled, the remaining funds would be returned to your bank account.

just read r reply. funny if the int is stated at 2%pa at time of application why doesnt an investor of $10k get $200/- at the end of yr 1? If it’s only 0.1% for yr 1, might as well put in FD at 1%pa?

also asssuming ssb is allotted in aug, will investor be paid 6 mos int in feb the following yr n every 6 monthly?

If the SSB is issued in Aug, yes, you’ll receive the first payout 6 months later, in Feb.

“Interest is paid every 6 months, on the 1st business day of the month. The first interest payment will be made 6 months after you receive your Savings Bonds” (Source)

However, if you sell before the 6 months, you’ll get back your your principal and any accrued interest.

Yes, there’s technically no diff from a FD if you only want to put your money in for a year for 1% rates. The key difference for SSB comes in the step up interest rate over the 10 years.

I want to change my tranche due to higher rates in the latest tranche. My limit is full already. Can I redeem first my older tranche then apply back 15 mins later on the same day for new tranche in order not to lose one month interest ? Thanks in advance.

a) How to find out the amount of interest rate of each month ?

b) What is the interest rate if I start to subscribe SSB for Feb 2018 ?

Kindly advise.

Apart from waiting for the mail from CDP on the successful allotments to me, is there any way to find out via phone calls or another enquiry centre . Thanks

I’m not sure but you can try this contact list: http://www.sgs.gov.sg/savingsbonds/Contact-Us.aspx

Should we only apply for bonds at the end of the month instead of the start of the month? Since the bonds only issued in the start of next month. No point applying at start of month and lose 1 month of interest in bank account? Correct? Or is it the time start when you pay the money?

That’s just a bit higher than the abysmal fixed deposit rate in Singapore, somewhere around 1.5%. This SSB stuff goes from an equally un-impressive 1.98% to 2.X% depending on year. Invest in Vanguard funds and get much, much better rates than this crap. I don’t see the point. What am I missing?