It has been an eventful week. Besides the US election and Ant‘s failed IPO, we saw the 160-year old Robinsons closed the two remaining outlets at The Heeren and Raffles City. The departmental store is undergoing a liquidation procedure currently.

The younger generation has no recollection or attachment to Robinsons. But my parents’ generation does. Departmental stores used to be the favourite place for shopping and hanging out because there was no internet, no indie shops, and no e-commerce. Departmental stores were among the most glamorous places you can be, and where you can see novel imported items.

At least Robinsons survived longer than the others in Singapore – Daimaru, Sogo, Yaohan, Oriental Emporium and John Little (if you remember).

If you dug into the history of Robinsons, it showed great resilience surviving a bombing, World War II and a ravaging fire. But eventually, no one escapes what evolution would do unto you – adapt or die.

We all can agree that departmental stores are a passé. The earliest writing on the wall was not e-commerce but shopping malls. Think about this, departmental stores are aggregators. They curate a variety of brands in the store so that shoppers can buy what they want under one roof. But increasingly, shopping malls started to offer the same aggregation, soon the power and allure were taken away from the departmental stores. Coupled with rising affluence and brands going more direct to consumers with their own branded stores, departmental stores were slowly being taken apart.

With Robinsons gone, the question now is who’s next. There are a handful of departmental stores that are still operating in Singapore. The departures would also affect retail malls as the footprint of departmental stores are huge.

Here are listed companies that may be affected (I have excluded locations in privately held properties):

- Metro (SGX:M01)

- Paragon (SPH REIT – SGX:SK6U)

- Causeway Point (Frasers Centrepoint Trust – SGX:J69U)

- Isetan (SGX:I15)

- Tampines Mall (CapitaLand Integrated Commercial Trust – SGX:C38U)

- Takashimaya

- Ngee Ann City (Starhill Global – SGX:P40U)

- Tangs

- Vivocity (Mapletree Commercial Trust – SGX:N2IU)

Metro (SGX:M01)

Based on FY20 results, the retail segment took in $109 million in revenue and $9 million in net profits, reversing a loss of $6m from the previous year.

It ain’t that bad after all.

Another good thing about Metro is that they have a property segment which generated $24 million net profits in FY20. Metro can easily switch to its property business and give up its retail segment, if the industry prospects worsen.

Metro currently has two outlets in Singapore – Paragon and Causeway Point. The outlet at The Centrepoint was closed since Oct 2019. All its Indonesian outlets have been divested as well.

Paragon belongs to SPH REIT (SGX:SK6U) and Metro was listed as one of the top 10 tenants by rental in the REIT’s FY20 annual report. But SPH didn’t explicitly mention how much Metro contributed to its rental income.

Based on the table below, my estimate is that Metro would contribute between 1.1% to 3.2% of SPH REIT’s rental income. It is substantial for a single tenant but not a big damage to SPH REIT if Metro leaves Paragon.

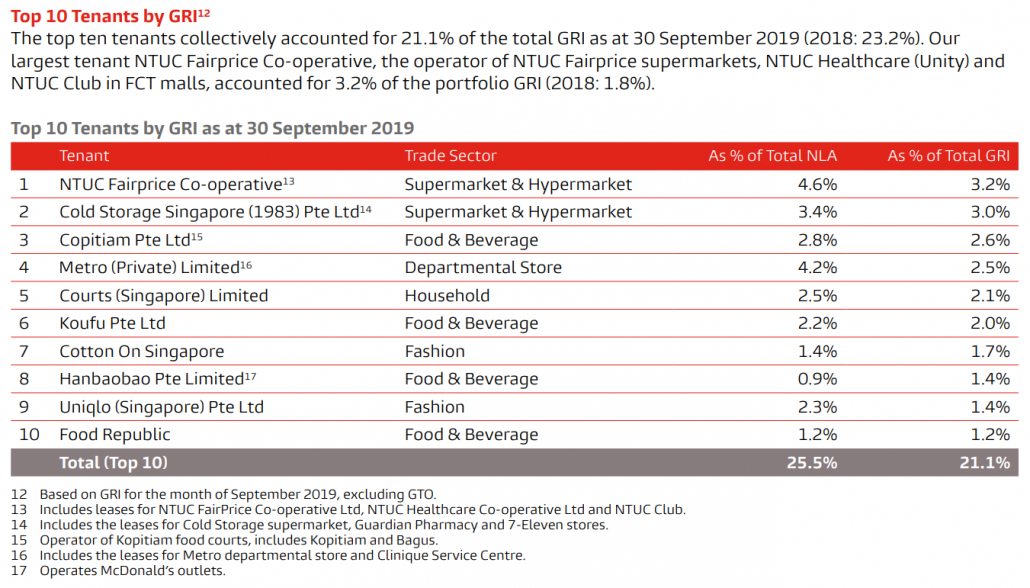

Similarly, Metro is one of the top 10 tenants for Frasers Centrepoint Trust (SGX:J69U), contributing 2.5% of the gross rental income.

I don’t see any problems for Metro.

Although the retail segment has shrunk, it was still profitable in FY20. Even if they have to close all retail stores, Metro still has its properties to rely upon. SPH REIT and Frasers Centrepoint Trust would suffer a drop in rental but they are capable of recovering from it after a while.

Isetan (SGX:I15)

Isetan is another SGX-listed departmental store. It generated $101 million revenue but made operating losses of $36 million in FY19. The results were relatively worse than Metro’s.

Isetan has two investment properties:

- Part of Wisma Atria (Isetan used to have an outlet but has since rented it out)

- 5 Kallang Pudding Road (previously a warehouse but now has been rented out for income)

But the rents were not sufficient to defray the losses in retail and Isetan ended FY19 with a $27 million net loss.

Isetan has stores in several locations but only the one at Tampines belong to a listed REIT – Capitaland Integrated Commercial Trust (CICT) (SGX:C38U).

Isetan was listed as one of the top 10 tenants with a 1.2% contribution to the gross rental income (note: the table below was from CapitaMall Trust and before the merger to form CICT).

Isetan is in a bad shape – its losses are mounting and its investment property portfolio remains unimpressive.

However, the impact to CICT would be small even if Isetan decides to close the outlet at Tampines Mall.

Takashimaya

Takashimaya is not a listed company and it is operated by Toshin Development Singapore. We all know that it occupies a big space spanning several floors in Ngee Ann City.

Just this tenant alone contributed 22.1% of Starhill Global REIT’s gross rent in FY19. It would be a huge impact to the REIT is Takashimaya decided to shut its door. In fact, the two parties had a rent dispute few years ago.

Tangs

The Tangs building in Orchard belongs to Tangs itself. The company used to be listed on SGX but has been privatized since 2009. Tangs has another outlet at Vivocity which the property is owned by Mapletree Commercial Trust (MCT) – SGX:N2IU.

The REIT has a good mix of office and retail tenants and Tangs is not one of the top ten tenants. MCT has the least exposure to departmental stores.

Conclusion

Starhill Global REIT has the greatest exposure to departmental store apocalypse while Mapletree Commercial Trust – SGX:N2IU would experience the least impact. Capitaland Integrated Commercial Trust, Frasers Centrepoint Trust and SPH REIT have moderate exposure but could easily recover should the departmental stores exit from the malls.

Metro and Isetan are two listed departmental stores with operations in Singapore. Both have seen dwindling retail sales and have reduced the number of stores over the years. Metro is in a better shape between the two as the retail segment was profitable in FY20 and its property segment is driving more profits than its stores. Isetan is mired in losses and has little investment properties to cushion the poor retail business.

In fact, Parkson Retail Asia (SGX:O9E) is also a listed departmental store on the SGX. But it has no presence in Singapore. The auditor opined that the company may have problems continuing its operations.

It seems like the end of departmental stores is already here.

Hi, thanks for the article. Could you elaborate further on your point on Takashimaya?

Managed to get some info on Toshin financial performance (see below). Looks like not all departmental store are the same in Singapore and looks like it has done well.

https://www.takashimaya.co.jp/base/corp/english/200413c.pdf

see page 25… the figures are reported in yen… FY19, Taka made an operating profit of Yen 3.1bn and Toshin S’pore made a profit of Yen 2.2bn…. combined its Yen 5.3bn or about SGD 50m… also its the most profitable outlet outside Japan and contributes a quarter of the group’s operating income.

Good stuff. Btw you can find Takashimaya’s financial results here. It has revenue and operating profit breakdown for its Sgp entity. https://www.takashimaya.co.jp/base/corp/english/200718a.pdf

With regards to starhill global, starhill owns 27.23% of ngee ann city strata lots and 74.23% of wisma atria. I believed starhill global reit doesnt own the strata lots for the department store. So if the department store shut door it will not have a direct impact to starhill global dpu unless toshin tenant also its shut door (means starhill global have to directly managed the tenants) or shopper traffic affected from department store closure.

Ah. you are right. I had the impression Starhill owns the whole Ngee Ann City but I am wrong. In this case, Starhill doesn’t have much impact even if Taka is gone.

Taka group makes about S$76mil in operating profits from its S’pore operation? Why would they close down?

Traditionally these department stores are anchor tenants that brings traffic to the shopping malls. While the older generation may still trust the brand, it probably has less impact on the younger shoppers. Taka’s market positioning is still strong in Singapore and the overall “Japanese” experience is still relevant, better than Isetan. Thus, the indirect impact to the REIT may still be strong if Taka closes. Ngee Ann City other anchor is Kino.

This is a good article and timely too.