You work hard and a portion of your pay goes into your CPF each month. You could leave them in there to grow at the nominal CPF interest rates or you could let your CPF monies work harder through investing.

How much CPF monies can you invest?

The purpose of CPF is to ensure you have savings to fall back on when you are old. Hence, you won’t be able to invest everything.

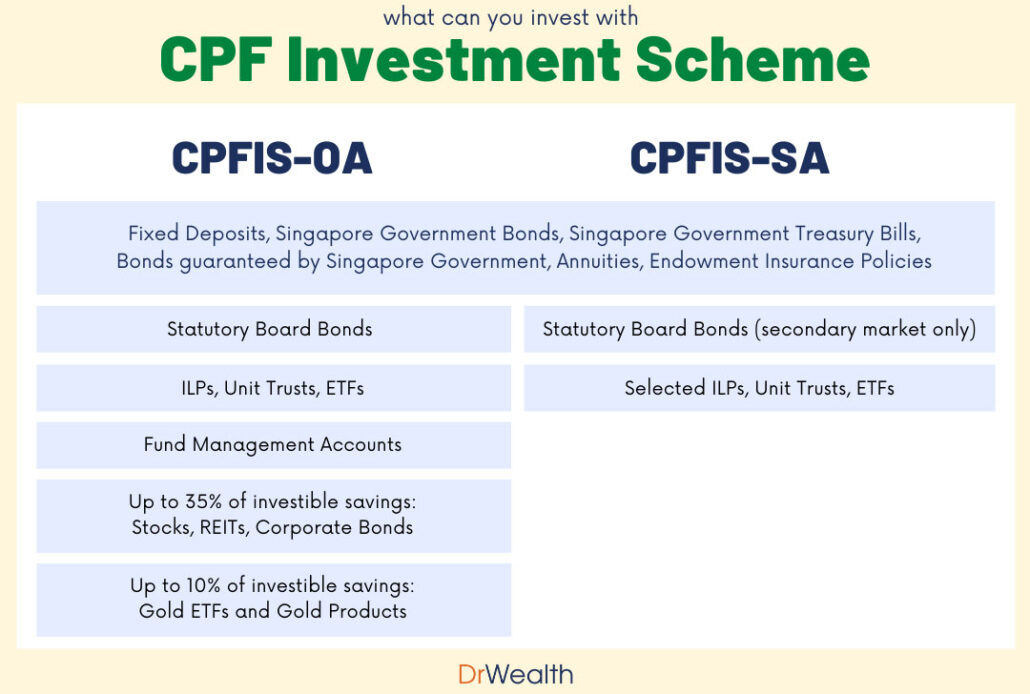

You can only invest in stocks using funds in your CPF Ordinary Account (CPF OA) after you have set aside $20,000 in it. Even after the $20k minimum, you won’t be able to invest everything but only 35% and 10% of your investible savings in stocks and gold respectively.

Before you invest in anything, login to your CPF account to check the actual investible savings. If there’s a shortfall for the investment, you will be forced to use cash during the settlement!

If you’re new to CPFIS and are not sure how to set it up, refer to our guide here.

Brokers that offer CPF Stock Investing

Unfortunately, not all brokers allow you to link your brokerage account to your CPFIS account.

Here is a list of brokers that offers CPF investing:

- CGS-CIMB

- DBS Vickers

- FSMOne

- Lim & Tan

- Maybank Kim Eng

- OCBC Securities

- POEMS

- UOB Kay-Hian

- KGI Securities (Singapore)

- RHB Securities Singapore (RHB’s Singapore brokerage has been sold to Phillip Securities)

Not all brokers are equal, some offer more products while others offer a more attractive trading fee. I compared all the CPFIS brokers in this table:

Best Brokers for CPF Stock Investing

| Broker | Trading Fee | Account Fee | What can you invest with your CPF monies? | My Picks |

|---|---|---|---|---|

| FSMOne | Flat S$8.80 | Nil | Stocks, ETF, Unit Trusts | Best low-cost broker + Comprehensive CPF investment selection |

| POEMS | 0.12% Min S$10 | S$15 per quarter. Waived if at least 1 trade is done in the quarter. | Stocks, ETF, Unit Trusts | Comprehensive CPF investment selection |

| DBS Vickers | Buy – 0.12% Min S$10 Sell – 0.28% Min S$25 | Nil | Stocks, ETF | |

| CGS-CIMB | 0.18% Min S$18 | Nil | Stocks, ETF | |

| Maybank Kim Eng | 0.275% Min S$25 | Nil | Stocks, ETF | |

| UOB Kay Hian | 0.275% Min S$25 | S$2 (account with no holdings) to S$15 (account with holdings) per quarter. | Stocks, ETF, Unit Trusts | |

| OCBC Securities | 0.275% Min S$25 | Nil | Stocks, ETF | Best for seamless CPF trading |

| Lim & Tan | 0.28% Min S$25 | Nil | Stocks, ETF | |

| KGI Securities | 0.275% Min S$25 | S$2.14 (account with no holdings) to S$16.05 (account with holdings) per quarter | Stocks, ETF |

If you’re still unsure who to go with, let me break them down further for you:

Best low-cost brokerage for CPF Investing: FSMOne

Investors have been enjoying lower trading fees over the years and that applies to investing in stocks using CPF funds.

However, it is not so easy to compare who has the lowest fees because it depends on the account type you have with the broker and the number of trades you make. The fees will vary.

For example, POEMS offers two account types – Cash Plus and Cash Management accounts with differing fees. Even within the Cash Plus account, the trading commission varies with the amount of funds you park in the account.

I took the account with the lowest fees and lowest capital requirement from each broker for comparison and found that FSMOne is the cheapest with a flat fee of S$8.80.

The flat fee will be attractive for investors with large capital. It would still cost the investor S$8.80 when he invests S$100,000 in a stock. This is a no-brainer compared to a fee of S$120 where commission rates are 0.12%.

Best brokerage for seamless CPF trading: OCBC

If you have linked your CPFIS account with your OCBC Securities account, you can use your OCBC banking app to buy and sell stocks directly, using your CPF funds. How convenient is that!

Moreover, OCBC is one of the agent banks for CPFIS account so you can get everything done with just one bank instead of having multiple accounts with different institutions which makes tracking a hassle.

In fact, you can open all three accounts online:

- OCBC bank account

- OCBC securities account

- OCBC CPFIS account

Once completed and approved, you will be able to see all these accounts on a single OCBC banking app and place trades on it. You don’t need many apps, just one:

Best brokerages for comprehensive CPF investments: FSMOne and POEMS

You can use your CPF OA to invest in unit trusts, on top of ETFs and stocks. However, unit trusts are not offered by every brokerage. FSMOne, POEMS and UOB Kay Hian are 3 brokerages that offer both stocks and unit trusts under one account. This will be convenient for investors who want to invest beyond stocks.

It makes sense to consider unit trusts because although you can only invest up to 35% of your CPF OA investible savings in stocks, you can invest the remainder or even 100% of your CPF OA investible savings in unit trusts! These brokerages provide you with the facilities to maximise your CPF OA investments and to make your money work harder.

Likewise, the fees vary for these accounts.

FSMOne and POEMS offer no additional charges when you invest in unit trusts under CPFIS. They make money by earning a trailer fee from the fund managers instead.

Brokerages that offer Unit Trust for CPF Investing

| Sales Charge | Switching Fee | Platform Fee | |

| FSMOne | Nil | Nil | Nil |

| POEMS | Nil | Nil | Nil |

| UOB Kay Hian | Yes | Yes | Nil |

How to choose the best broker for your CPF stock investing?

The choice of broker is dependent on which factor you value most.

If cost is a concern, FSMOne would be your best choice. But for investors who do not trade frequently but instead hold stocks for a long time, the cost isn’t the most important consideration.

Some investors prefer the convenience and having all financial transactions in one account. If so, OCBC will offer a seamless experience and even easier if you are already an OCBC bank customer.

If you want to buy stocks and unit trusts with your CPF funds, FSMOne and POEMS will be better choices as other brokerages may not offer unit trusts under the same account.

So what’s your choice?

P.S. CPFIS is not the same as your CPF Special Account, you can read more about the latter here.

i think the fees for UOB and Maybank are for prefunded accounts, not CPF trading.

thanks for pointing out. changes made

Commission for POEMS Cash Plus is 0.08% & no minimum commission.

If the contract value is above S$11,110.00 then switch to FSMOne.

Yet to try on CPF but it is workable for SRS settlement

It is promotional till 31 Dec 2021. So prefer to stick to the original fees for comparison.

POEMs having promotional (till 31 Dec 2021) pricing of 0.08%, down from the usual 0.12%, with no minimum commissions.

Yes. Not sure if the promotion will get extended so prefer to stick to the original fees for comparison.

Can I buy from one broker and sell with another? (e.g. buy on DBS Vickers, sell on Poems)

Yes, if both accounts are CPFIS linked.

For Stocks-

POEMs is good on brokerage but needs spare cash in trading account even if trade is settled via CPFOA.

FSM one brokerage is high but it doesn need cash collateral to settle CPF trades.

Worst is DBS – as CPFIS acct their charges are highest and settlement is less efficient than UOB.

DBS Vickers is probably the worst share trading platform in the world. Charges and execution ..