Since the previous article on blue chip Singapore REITs, the general market has recovered considerably. The iEdge S-REIT index, which tracks the performance of Singapore’s largest and most liquid REITs, reflects this.

The REIT index has recovered 9.6% since its October low. All of this comes as there is growing speculation that the US Federal Reserve may slow rate hikes as CPI figures indicate a slowdown in inflation.

Investor sentiment was lifted due to this news, driving the broader market higher as they anticipated recovery from here on out.

Interestingly, throughout this period, several REITs outperformed the rest. While these Singapore REITs have risen significantly, they still have a long way to go before fully recovering. As a result, let’s take a look at six of these REITs that made a significant recovery in November and determine whether you should add them to your list.

Top 6 Best-Performing SREITs

| Singapore REIT | Type | Nov 2022 returns (%) | Dividend Yield (%) |

| Digital Core Reit | Data Centre | 18.1 | 4.8 |

| CapitaLand China Trust | Diversified | 16.5 | 8.9 |

| Daiwa House Logistics Trust | Industrial | 16.1 | 6.3 |

| OUE Commercial Reit | Diversified | 12.3 | 7.4 |

| SPH Reit | Retail | 10.4 | 6.7 |

| CapitaLand Integrated Commercial Trust | Diversified | 10.1 | 5.5 |

The top performing subcategories for this recovery were data centres, diversified, and industrial REITs. This push has come primarily from retail investors, who have a net inflow of $54 million, while institutional investors have a net outflow of $95.6 million.

Is there something that retail investors are missing? Find out below.

No time to read now? Download this as a PDF report here and read it at your own convenience.

1) Digital Core Reit (SGX: DCRU)

Digital Core REIT is a pure data centre REIT listed in Singapore and sponsored by Digital Realty, the world’s largest data centre owner and operator. Currently, the REIT has 10 portfolios scattered across the United States and Canada.

Digital Core REIT debuted on the SGX exchange in December 2021, drawing a great deal of interest from retail investors.

However, since then, the REIT’s share price has plummeted by nearly 50%. This may be attributed to various variables, including the high-interest environment, high valuation, and the bankruptcy filing of its fifth-largest tenant.

Based on its most recent business updates, Digital Core REIT recorded a net property income of US$53 million in 9M 2022, 5.7% more than the IPO projection. However, the distributable income of US$34 million fell short of the expectation by 3.4%.

The management, however, is highly optimistic about the REITs prospects, even though its business is not entirely immune to broader macroeconomic trends. According to datacenterHawk, market vacancy has tightened, resulting in significantly improved pricing for the third quarter.

An update on its customer’s bankruptcy: an agreement has been reached to amend the lease, allowing for an orderly exit by the end of this year. Digital Core REIT sponsor will also cover the cashflow gap caused by this event through the end of 2023, giving Digital Core REIT a 12-month runway to fill the vacant premises with a new tenant. If all goes as planned, there should be no effect on the Digital Core DPU.

Looking ahead, given that the REIT has a relatively low gearing of 26% (less impacted by rising interest rates) and that all of its debt is unsecured, there will be opportunities for yield-accretive acquisitions arising from its $15 billion Sponsor pipeline. All of this points to a promising recovery for the REIT.

2) CapitaLand China Trust (SGX: AU8U)

CapitaLand China Trust (CLCT) is Singapore’s largest real estate investment trust focusing on China. Following an expansion of the investment mandate in 2020, it was renamed CapitaLand Retail China Trust (CLCT) on 26 January 2021.

The REIT’s portfolio, which includes 11 shopping malls and five business parks distributed across China, Hong Kong, and Macau, can be seen as a proxy for growth in China’s future economy.

CLCT reported 1.4 billion yuan in gross revenue for the first nine months ending 30 September 2022, up 7% from the previous year, and 970.8 million yuan in net property income, up 7.5% from the previous year.

This is a result of positive rental reversions, notably in CLCT’s new economy segment (Logistics parks and business park portfolio). Nonetheless, its retail portfolio has fared admirably, achieving its first positive reversion of 4.9% since the start of Covid19. With the recent relaxation of Covid restrictions in China, we may see a further boost to the retail sector as locals and tourists patronise malls more frequently.

3) Daiwa House Logistics Trust (SGX: DHLU)

Daiwa House Logistics Trust (DHLT), like Digital Core REIT, debuted a year ago.

DHLT’s portfolio presently consists of 16 logistics properties spread across Asia but predominantly in Japan. The portfolio has a strong occupancy rate, supported by a diverse blue-chip tenant base in various industries, including third-party logistics and e-commerce.

DHLT’s share price has been falling since its blockbuster IPO, as it has done for Digital Core REIT. The prime causes for this are undoubtedly rising interest rates and concerns about the macroeconomic situation, both of which have impacted all REITs in general. The fluctuation in foreign exchange rates is what makes DHLT different. Given that SGD has appreciated by about 20% against the Japanese Yen, there may have been some impact, particularly during dividend distributions in SGD.

The good news is that DHLT has a hedging policy in place. Considering DHLT’s borrowings are in JPY, it already provides a natural hedge. Aside from that, 100% of DHLT borrowings are fixed. Therefore, the current interest rate hike does not jack up the interest expense on DHLT’s existing loans.

According to its most recent report, while the weaker Japanese yen resulted in lower Net profit Income for YTD FY2022 compared to the forecast, lower financing charges helped absorb the impact, and so distributable income for YTD FY2022 was in line with the forecasts.

Leasing activity is also strong, as all leases that were set to expire during YTD FY2022 were renewed. However, the average rent increase for leases was only 2.9%. While this is acceptable, keep in mind that the recent inflation figures in Japan are close to 4%. Thus, the rent increase may be inadequate to cover the increase in overhead costs.

Moving forward, while considerable new supply is anticipated to enter the market, demand for logistics space is expected to remain strong, fueled by the e-commerce and third-party logistics sectors. The share of e-commerce sales as a percentage of total retail sales in Japan is just 8.1%, which is significantly lower than in the more mature e-commerce markets of China (44.0%) and the United States (14.5%), signalling that the e-commerce industry in Japan has room to grow.

4) OUE Commercial Reit (SGX:TS0U)

OUE Commercial Real Estate Investment Trust is one of the largest diversified Singapore REITs with seven properties in Singapore and Shanghai spanning the commercial and hotel sectors.

Net property income for the most recent quarter was $48.3 million, a 4.4% increase year on year. This improved profitability was primarily attributed to decreased property costs. After accounting for decreased revenue support for the OUE Downtown Office and higher interest expenses, the amount available for distribution was S$26.2 million, a 13.3% decrease year on year.

Moving forward, with the continued improvement of its operational metrics, particularly the increase in committed occupancies and positive rental reversions for the Singapore office properties, as well as higher RevPARs for both of its hotels, we may well see further improvement in its revenue in the coming quarters.

5) SPH REIT (SGX: SK6U)

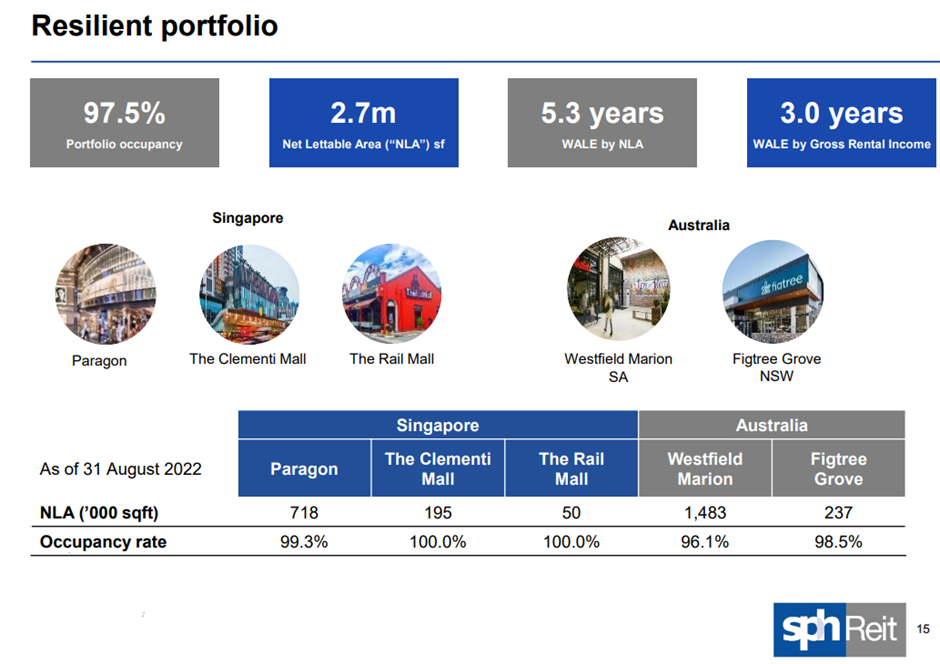

SPH REIT invests in a real estate portfolio primarily for retail purposes. It currently has 5 properties, three of which are in Singapore and two in Australia.

This REIT has also benefited from improving retail sentiments in both Singapore and Australia, as seen by increases in both traffic and tenant sales.

The yearly gross revenue of SPH REIT climbed 1.7% year on year to S$281.9 million, while net property income increased 3.5% to S$209.7 million.

SPH REIT maintained a solid portfolio occupancy rate of 97.5%, which is underpinned by a high tenant retention ratio of 82.9%. As a result, the 12-month rental reversion rate for FY2022 was -2.8%, compared to -8.4% in FY2021. While this is an improvement, it is still negative, which is not ideal, especially considering the current inflationary climate. In this aspect, more should be done to uncover why this is happening when other Retail REITs have a positive rental reversion.

6) CapitaLand Integrated Commercial Trust (SGX: C38U)

CICT was already mentioned in an earlier post. To recap, CICT owns and invests in high-quality income-generating assets primarily used for retail and office applications, particularly in Singapore. CICT’s portfolio consists of 21 properties in Singapore, 2 in Frankfurt, Germany, and 3 in Sydney, Australia.

In the recent quarter, the REIT’s gross revenue increased by 13.7% as it’s retail and office properties improved, while net profit income increased by 12.7%. This growth was expedited for CICT, owing to a stronger comeback in downtown malls due to border easing and an increase in office workers around downtown.

With 80% of its borrowing at fixed interest rates, CICT has successfully controlled the impact of rising interest rates, with an average debt cost of around 2.5%.

Finally, CICT has shown strength in its latest earnings with a high committed occupancy of 96.8% for retail and 94.1% for office, as well as further potential growth in the future.

2023 could be tricky for REITs

While most of the REITs mentioned above could maintain their momentum, here is something to consider if you plan on investing in REITs going into 2023.

As you’ve seen, REITs are heavily influenced by changes in interest rate expectations. While recent news may indicate peak inflation, Powell’s last address on 30 November suggests that interest rates are unlikely to be cut anytime soon.

The report begins by acknowledging that inflation remains far too high, while there is some consolation in the fact that inflation is starting to fall. Aside from that, the labour market remains hot, with demand for workers outstripping supply. An overheated labour market is bad because to attract people, salaries must be raised, and if this amount is more than inflation (as it is currently), we might well expect continued inflation in the foreseeable future.

So, if we truly want to see inflation fall to the 2% target, we need to see a slowdown in the labour market, which may necessitate a protracted period of high-interest rates since such transitions take time.

As a result, despite hopeful developments, interest rates may stay high for the time being to control inflation, which may influence the performance of REITs in 2023.

Conclusion

Overall, the rebound is mainly attributable to a change in the macroeconomic environment, as investors anticipate the Fed slowing or maybe cutting interest rates shortly. Of course, there are certain contrasts, such as how China’s opening might offer an additional push to CLCT.

However, in the grand scheme of things, this dip may not be over just yet. With a high-interest environment extending beyond 2023, certain REITs may struggle, particularly if they have higher floating loans and gearing ratios.

As such, if you still want to invest in REITs in 2023, you need to be pickier.